Berlaide's new vision mixed in 2022: The stock position increase and the net worth rebounded significantly

Author:Capital state Time:2022.07.19

On July 19, 2022, the Berlaide Fund announced that its product was reported in the second quarter of 2022. The performance of the first foreign public fund -Black China's new vision mixed performance was disclosed.

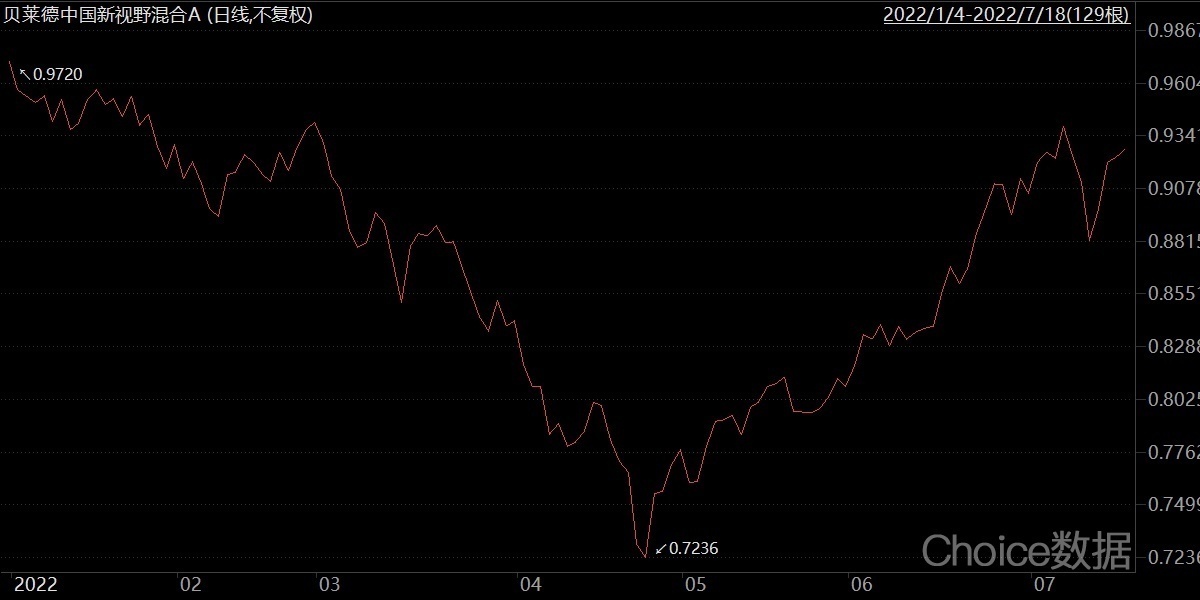

The financial report revealed that Berlaide's China New Perspective (Class A: 013426; Class C: 013427) is now jointly managed by Tang Hua and Shan Xiuli. As of the end of the second quarter of 2022, Berlaide's Chinese new vision hybrid scale was 5.256 billion yuan, a slight increase from 5.042 billion yuan at the end of the first quarter. The net value of the fund A fund share was 0.9135 yuan, and the net fund share growth rate of the fund's share in the second quarter was 8.79%; the net value of the Class C fund share was 0.9098 yuan, and the net fund share growth rate of the fund's share in the second quarter was 8.65%.

It can be seen that compared with the decline in the first quarter, the net value of Black China's new view in the second quarter rebounded significantly. As of July 18, 2022, the net value of Black China's new vision hybrid A year narrowed to -5.94%during the year.

Chart source: choice data

In terms of asset allocation, as of the end of the second quarter of 2022, the fund's stock position was 79.38%, an increase of 3.28 percentage points from the previous quarter, and the combined position was at a medium level. In terms of industry, compared with the end of the first quarter, the combination mainly reduced its holdings and some electronic sectors.

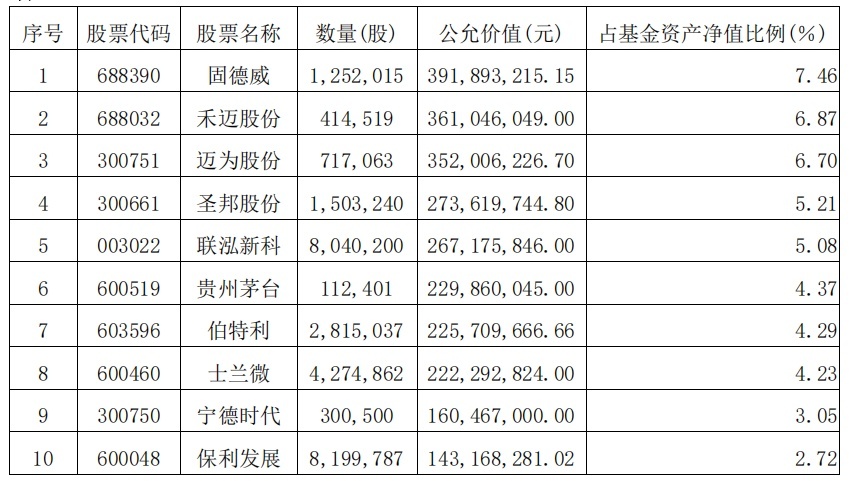

According to the financial report, as of the end of the second quarter of 2022, the top ten heavy stocks of the new vision of Belle Germany China were: Gudewei (7.46%), Homai shares (6.87%), Mai as shares (6.7%),, 6.7%),, 6.7%),, 6.7%). Shengbang (5.21), Lianhong New Science (5.08%), Guizhou Maotai (4.37%), Berteley (4.29%), Silan Weimi (4.23%), Ningde Times (3.05%), Poly Development (2.72% ), The top ten stocks accounted for 49.98%.

From the perspective of holding positions, the second quarter of Belle Germany's new vision of China has added positions to Gudewei, Hemai, Mai Weizhi, and Shengbang. Significantly reduced the holdings of 1.8088 million shares. In addition, compared with the first quarterly report in 2022, China Merchants Bank, Xingye Bank, Luzhou Laojiao, and Wentai Technology withdrew from the top ten heavy stocks, and added Lianhong New Science, Guizhou Moutai, Ningde Times, and Poly.

Chart source: choice data

In the fund investment strategy and operation analysis section, looking forward to the third quarter of 2022, fund managers Tang Hua and Shan Xiuli said that the A -share market will usher in the interim reporting and third quarter performance disclosure period, and the importance of the fundamentals of individual stocks will be prominent. According to the performance of the performance of the listed company, the combination of the combination of the combination, focusing on industries and stocks with strong definition of short -term performance and long -term development potential for a long time. In addition, you will also be cautious to find the opportunity to lay out the second- and third quarters of the second and third quarters. It will continue to tap new investment opportunities to achieve the combination of value preservation and appreciation, and strive to control the retracement on this basis.

- END -

Ministry of Finance: August and August issued electronic national debt

According to the website of the Ministry of Finance, the Treasury Bond issuance pl...

Helping the development of the service industry 丨 "Express Station Tax Story" Episode 9

SMEs are important forces to expand employment, improve people's livelihood, and p...