American confidence was severely damaged

Author:Global Times Time:2022.06.15

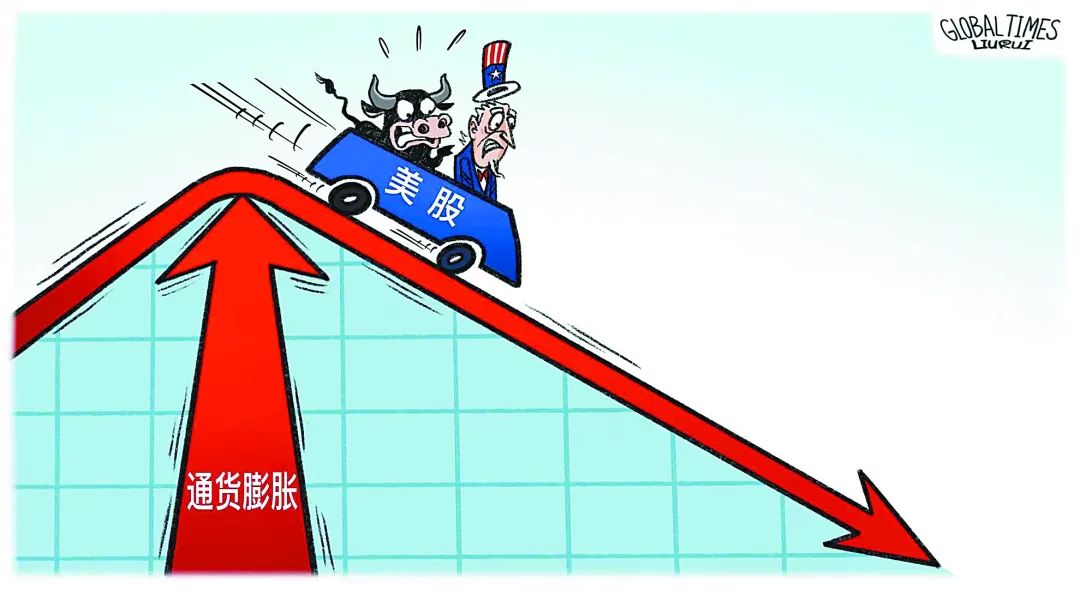

"The faint light has disappeared" and "welcome to the bear market" -A American media is full of depression on the 13th. On the same day, as the US stocks plummeted, the S & P 500 Index fell more than 20%from recent highs, marking that the "bear market" that the stock market is usually called officially started.

The inflation figures announced on Friday on Friday reached the highest value of more than 40 years, and the expectations of the Fed will announce a significant interest rate hike on the 15th, which is generally considered to be the main reason for the plunge of US stocks.

The New York Times said that from a historical point of view, "bear market" is often accompanied by economic recession. This is the seventh "bear market" of US stocks over the past 50 years. It is reported that the last time the US stocks entered the "bear market" after the outbreak of the new crown pneumonia in early 2020, but it only lasted for a relatively short 6 months. But analysts are worried that the "bear market" will last longer. After the opening of the local time on the 14th local time, the major indexes of the U.S. stocks rose slightly, but the soaring inflation rate will lead to 75 basis points in the Federal Reserve's interest rate hikes, which in turn causes the US economy to fall into a recession and still lingering in the market.

1

CNN: Welcome to "Bear Market"

"Three weeks ago, Wall Street barely got rid of the bear market. The stock market rebounded from a plunge in the last moment, bringing a line of hope to investors, that is, the most serious losses may be over. But now, that light is disappeared." "New York New York." "New York." "New York." "New York." Times reported on the 13th.

According to the National Broadcasting Corporation (ABC), as of the closing on the 13th, it was called the most widely used standard of the Wall Street market -the S & P 500 index fell 3.9%compared with the previous trading day Falling 22.18%, technically fell to the "bear market" area. On the same day, the average index of Dow Jones fell 2.8%, down more than 17%from recent highs, and fell to the lowest level since February 2021. The Nasdaq Composite Index fell 4.7%on the 13th and was already in the "bear market", a 32.7%peak from November 19 last year. The Washington Territory stated that the popular label of "Black Monday" on Twitter on the 13th, and the US economic decline appeared.

"Why did the stock market fall? In short: inflation, and the Fed's efforts to control its efforts." CNN said that investors' nerves have been very tight recently, and an inflation report released on June 10 shows that it shows that the inflation report released on June 10 shows The inflation rate in the United States in May reached 8.6%, the fastest increase since 1981. "Inflation is not a new problem, but all the hope of the inflation slowly slows down." The report said that for investors, this inflation data shows that the Fed will have to become more radical on the issue of interest rate hikes, and and more radical, and and more radicals, and more radicals, and more radicals, and more radicals, and more radicals, and the issue of interest rate hikes, it will become more radical on interest rate hikes, and Wall Street hated it.

The Wall Street Journal stated that the Fed will make a rate hike decision on the 15th after the two -day meeting. The market is expected to change rapidly on Monday, and believes that the Fed "almost affirmed" announced the 75 basis points of interest rate hikes this week. Such a significant interest rate hike exceeded most of the previous market expectations. CNN said that the Federal Reserve ’s interest rate hike is not unheard of, but it is extremely rare. The last 75 -basis point of interest rate hikes was the Alan Greens Pan era in November 1994.

"U.S. stocks have risen after falling into a bear market." The Wall Street Journal said on the 14th that after the defeat of Monday, US stocks rebounded slightly on Tuesday. However, the report quoted analysts that the market will not have a "V" recovery, but will be repaired in a lower -key manner. Morgan Stanley CEO James Gorman said on the 13th that he believes that about 50%of the possibility of the US economy has entered a recession, and "no one can accurately predict the inflation rate after one year."

2

US media and White House confrontation: Who should be responsible for inflation?

U.S. stocks are considered an important standard for measuring the US economy, especially during the period of former President Trump. The New York Post stated on the 13th that before the recent plunge in the stock market, Biden also often touted the stock market well, saying that US stocks rose 20%during their term and set one after another.

On the 13th, at the White House press conference, Fox journalist Peter Duls took Bayeon's previous question, saying that "the stock market rising during President Bayeng has been wiped away." The White House press secretary Karina Jean-Pierre said that the Bayeon government "is closely concerned" the stock market and argued that the United States is not the only country that is facing inflation. The global epidemic is encountered. She went on to say that the United States has achieved historic economic achievements under President Biden, which is largely due to the US rescue bill that is largely attributed to the "only Democrats voting support", "it has led to historic economic prosperity."

"Doesn't this lead to historic inflation?" Dussi's interruption was denied. Pierre denyed it. She said: "No, that is not the way we look at the US rescue bill."

"Why is the inflation rate higher than other places?" Broadcasting Corporation (BBC) said on the 14th that since last year, the inflation rate of countries around the world has risen. However, in major economies, the United States has hit the most severe blow, and its inflation rate is the highest among major industrial countries. It is reported that many factors to promote inflation, such as the interruption of supply chain caused by the new crown pneumonia, and the rise in food prices caused by bad weather -not unique to the United States. However, the reason why the United States performed worse was promoted by the US government approved to protect the impact of families and enterprises from the impact of the epidemic. By sending money directly, demand and commodity prices are pushed up, and the Fed's response to this is slow. "As the money was spent, the situation changed, which brought serious political issues to Biden. Republicans accused him of being the culprit of rising prices. Biden in turn did the war to Ukraine." 3

Economist: US economy may be pushed to "hard landing"

CNN said that investors are worried that the Federal Reserve ’s interest rate hike may accidentally fall into a decline in the US economy, especially when companies have begun to lay off layoffs and the real estate market are facing collapse. Economist Neil Duta said that the oversized rate hike indicates that the Fed is losing confidence in prediction. "This implies that the Fed would push the economy to the situation of 'similar hard landing' in order to control inflation."

Michelle, a real estate agent of Wendmir, a well -known American real estate company, told the Global Times reporter on the 13th that the Fed ’s interest rate hike strategy in May has led to the continuous cooling of the real estate market. Unlike the previous spring and summer buying season, the price is needed to buy a house. The house's price reduction cannot be sold. Mr. Li, who was originally interested in buying a house but was "dismissed" by high interest rates, said that although the house prices have decreased from the beginning of the year, the repayment pressure is too high, and the price is high. Even if you have money in your hands, it is not a good time to buy a house.

The New York Times said on the 14th that despite a mild rebound on the same day of Wall Street, the global market was still unstable due to inflation problems, supply chain interruptions, and geopolitical tension on global economic growth. ▲

Special reporter in the United States Zheng Ke ● Our reporter Ni Hao ● Yu Wen

- END -

Send a service solution problem, Zhumadian Zhengyang Taxation Bureau empower the enterprise

What are the new combined tax support policies? Do the latest value -added tax ret...

100 -day online recruitment special operations to launch artificial intelligence, central enterprises, living services, textile clothing, trainer internships, chain operation special recruitment

From June 27th to July 3rd, the Ministry of Human Resources and Social Security wi...