The Federal Reserve "corrected" anti -inflation strong US dollar testing emerging market financial stability

Author:21st Century Economic report Time:2022.07.19

21st Century Business Herald reporter Hu Tianzhengjia Junhui Shenzhen Guangzhou report

Affected by the market's concerns about the rise of global economic prospects and the increasingly toughness of the Federal Reserve's position, the US dollar index has jumped 13%since 2022, the highest rose in 20 years.

In this context, funds have accelerated to the United States. However, for many developing economies, this is a bit bad.

The Asia -Pacific economy is depreciating at the center of the "US dollar against global appreciation", and most of their currencies are depreciating. As the second largest economy in Southeast Asia, Thailand's currency exchange rate against the US dollar has fallen by more than 8%. In addition, since the beginning of April, Indonesia, Thailand and Malaysia have fallen by 4.4%, 8%, and 5.5%, respectively.

Fund has also continued to flow from emerging markets. According to JP Morgan Dagai, as of July 10, investors have withdrawn approximately 52 billion US dollars from emerging market bond funds, with the highest scale of 17 years.

The market expects that the US dollar will still be appreciated for a period of time. In June, the US Consumer Price Index (CPI) accelerated to 9.1%, which was the highest level of more than 40 years. As a result, the Federal Reserve has taken more active actions to slow down the pressure of rapid rise in prices in the economic field. The market is currently included, and the Federal Reserve has raised interest rates at least 75 basis points in July.

The strong US dollar caused (Asia -Pacific) emerging market currency to face risks in the field of trade balance and macro policy. Further currency depreciation will also put additional pressure on the tightening policy of the central bank. Pauder's Holland (PGIM) stated that people's focus is from their credibility of anti -inflation to their ability to maintain financial stability with their respective currencies.

The Federal Reserve has a greater interest rate hike or on the way

From April to June, the appreciation of the US dollar was increasingly significantly, an increase of 4.5%; in the first week of July, the US dollar index sharply strengthened, up 1.78%of the weekly; on July 12, the US dollar index exceeded 108, a new high Puzzle; on July 13, the US dollar index reached 108.3720, the euro reached the US dollar and broke through the parity. The exchange rate fell to 0.998 during the day, the first time in the past 20 years.

The relative economic situation has become one of the basis of this strong US dollar. Calvin TSE, a bank market strategist in Paris, France, said that this is not only an increase in concerns about the global economic recession, but also because of the increase in the global economic recession. The economic situation is relatively better.

However, monetary policy is the most important influencing factor. Bank of America analysts estimate that the Fed's relatively radical policy can explain more than half of the appreciation of the US dollar this year.

"The expectations of the differentiation of monetary policy have promoted the overall U.S. dollar to continue to maintain an upward trend." CICC Studies said that US economic data represented by non -agricultural employment is better than expected. Rapid interest rates, US debt interest rates have risen again to give the US dollar to continue to maintain a strong environment. At the same time, the risks of non -US countries have frequently supported the upward of the US dollar from another angle.

The prospects in a short time are still very beneficial to the US dollar. In June, the US CPI rose 9.1%year -on -year, a new high since 1981, and once again accelerated the "creation" environment for the Fed in July. The 75 basis points are the current forecast range, and the expectations of the Fed's interest rate level at the end of this year also remained near a high level of 3.3%.

Last week, the Federal Reserve director Christopher Waller reiterated to support 75 basis points to raise interest rates, and also hinted that he was open to a greater interest rate hike.

"The basic situation in July depends on the new data." Christopher Waller said that before July FOMC, there will be important retail sales and housing data release. If the data is significantly stronger than expected, he will tend to July in July in July At the meeting, a greater interest rate hike.

On July 15, local time, the US Department of Commerce announced data. The US retail sales rose 1.0%in June and higher than the market expected value of 0.9%.

Zhao Yaoting, a global market strategist in the Asia -Pacific region (except Japan), said that the overall inflation rate of the United States has soared to 9.1%, which is likely to raise 75 basis points at the July interest rate interest rate. However, it believes that the Fed is unlikely to announce the interest rate hike at the later meeting of this month.

"June CPI may cause the Federal Reserve officials to be alert." PIMCO North American economist Tiffany Wilding and American economist Allison Boxer said that core inflation is currently ingrained in the field of goods and services. Sex monetary policy. PIMCO expects the Federal Reserve to raise interest rates at least 75 basis points at the July and September meeting.

PIMCO said that for the Federal Reserve, the discussion of restricted monetary policy may have changed from "whether it is appropriate" to "how strict". At present, the interest rate of federal funds still maintains a loose level, which seems to be not synchronized with the current economic situation and the pressure of inflation in the United States.

Tone

Compared with the currency of other developed countries, the US dollar can bring higher returns, global capital flows have shifted, and new investment will be re -oriented. According to Morgan Chase's data, as of July 10, investors have withdrawn approximately $ 52 billion from the emerging market bond funds, with the highest scale of 17 years. But the impact of emerging markets in Asia is not uniform. In June, the flow of funds from the north of Shanghai -Shenzhen -Hong Kong Stock Connect rose to US $ 10 billion, of which the consumer sector was flowing at most; the funds in Taiwan and South Korea's market fell again; the Indian stock market continued to escape from foreign capital. Since the month, the total flow of funds exceeds $ 35 billion.

At the same time, as the dollar has accelerated, foreign investment may continue to flow into China from other parts of Asia. According to data on July 6, the Global Flowing Data Data on July 6 shows that in June, the total investment of emerging market countries was $ 4 billion. In terms of categories, in June, among the emerging market countries, the stock market flowed out of US $ 10.5 billion, and the bond market flowed for $ 6.6 billion. China's stock market has attracted $ 9.1 billion in inflow, while the bond market flows out of $ 2.5 billion.

Investors must seek both a shelter and require higher yields. For the US dollar, what they want to know is that this is only part of the basis of the global economy basically balanced, or a super -tuned transcendence.

Wang Xinjie said that the current Russian -Ukraine conflict, epidemic and the Fed's interest rate hikes have caused funds to avoid risk aversion, or trades, and have accelerated their return to the United States. As the consequences of a large loose period of the epidemic period, the inflation problem formed by the broken supply chain caused by geographical conflicts.

"The Federal Reserve was initially regulated the monetary policy to balance the economy and inflation." Wang Xinjie explained, but the superposition of multiple issues and the rise in inflation exceeded the Fed's expectations, which eventually led to the "error correction" of "error correction" to fight inflation. Essence

Wang Xinjie pointed out that such a tightening policy will undoubtedly slow down the steps of economy. But not all inflation problems can be solved through inflation rate hikes, such as the breaks of the supply chain and the rise in energy and food prices. In addition, the Fed in the future will still be balanced between inflation and growth. "At present, the depth of such correction of superconducting is still decided when the risk of inflation can be relieved."

"The tightening cycle of the Federal Reserve is far from end." Zhao Yaoting said that from a historical point of view, when the policy interest rate is higher than that of inflation, the tightening cycle will end.

SP Global Market Intelligence, the chief economist of the Asia -Pacific region, Rajiv Biswas, said in an interview with the 21st Century Business Herald that a large amount of investment flowed into the US dollar and the US fixed income assets reflected the soaring inflation and rising interest rates of the United States. Essence With the slowdown of global growth, global investors have been reducing the opening of global stock markets. The Federal Reserve (FED) further actively tighten the expectations of the policy and also supports the appreciation of the US dollar.

Rajiv Biswas said that the asset allocation of global investors is turning to the US dollar and US Treasury bonds, because of its attractiveness as a shelter assets and the increasing yield of US Treasury bonds. "Therefore, there is almost no reason to take multilateral actions for the US dollar. In any case, the attempt to take action on these powerful macroeconomic fundamentals may be futile."

Emerging market finance is facing testing

By promoting the cheaper imported goods, strong dollars can help alleviate part of the domestic inflation, but on the other hand, for emerging market assets, especially in the Asian emerging markets, strong dollar is the strong backwind they are facing.

Currency depreciation is the first response to emerging markets in Asia. The currencies of emerging economies of Asian economies in India, Indonesia, Thailand, Malaysia, the Philippines, and other Asian economies have been affected in the past few weeks. Since the beginning of April, the Indonesian shield has fallen 4.4%, Thai baht has fallen by 8%, Malaysia Lynch has fallen 5.5%. The exchange rate fell more than 9%.

Some Asian emerging market central banks have begun to use foreign exchange reserves to stabilize the exchange rate. India has adopted positive measures to curb the speed of capital outflow. The central bank of the country relaxed the bond market regulations for foreign securities investors last week and allowed commercial banks to increase interest rates of non -residents' foreign exchange deposits.

Bloomberg Intelligence Stephen Chiu, the chief Asian foreign exchange and interest rate strategist, predicts that the Asian currency against the US dollar may still be under pressure in the third quarter, and the remaining time in the quarter is maintained.

Stephen Chiu said that Asian currencies with relatively high attractive attractiveness and the urgency of the country's tightening of monetary policy will win, such as RMB or Indonesian Shield. In contrast, due to the unfavorable form of trade and inflation, the Korean and Indian rupees may be lost.

The strong dollar will continue to bring significant pressure on the Japanese currency. Wang Xinjie, chief investment strategist of Standard Chartered China Wealth Management Department, told reporters of the 21st Century Business Herald that the Bank of Japan has not yet relaxed the control of interest rate curves. This has formed a sharp contrast with the tightening of the American eagle. Japanese currency formed a very large pressure.

Wang Xinjie said that the best situation for the yen exchange rate is that the Bank of Japan relaxes the control of interest rate curves and maintains stable interest spreads in the United States. In this way, inflation and capital outflow can be controlled to a certain extent.

Wang Xinjie further stated that South Korea has actually experienced similar situations, but the Central Bank of Korea raised interest rate hikes 50 basis points on the 13th, keeping up with the pace of interest rate hikes in the United States, and took the lead in the attitude of benchmarking the US dollar. Pradeep Kumar and chief European economist Katharine Neis, the manager of PGIM FIXED Income, believes that emerging market currencies are facing risks in the field of trade balance and macro policy, and they are vigilant in the short term.

The two pointed out that the strengthening of the US dollar brought new pressure on the price of commodities, and the depreciation of the currency of the emerging commodity exporters also put an additional pressure on its central bank's tightening policy. "At the same time, the macro aspect of the region is mainly related to China: If the central bank adjusts the currency basket to lower the RMB exchange rate, the tightening policy of the currency of Asian countries and its central bank will be under pressure again.

Rajiv Biswas said that in the first half of 2022, many other emerging market currencies in the Asia -Pacific region also appreciated. However, the currency appreciation of the US dollar to the Asia -Pacific region is relatively mild, and the central banks of these countries have been tightening monetary policies, such as the Australian Bank, the Bank of Korea, the Indian Central Bank and the Philippine Central Bank.

South Korea and the New Zealand Central Bank have raised interest rates 50 basis points last week. UBS reminded that the Asian emerging markets increased further in the second half of the year, but in view of the deterioration of high inflation and trade accounts, interest rates may have a risk of over -adjusting.

In addition, Pradeep Kumar and Katharine Neis said that although the central bank of emerging markets is one of the first countries that take anti -inflation measures, the focus of people's attention is from their credibility of anti -inflation to them to maintain finance when their respective currencies are weak. Stable ability.

- END -

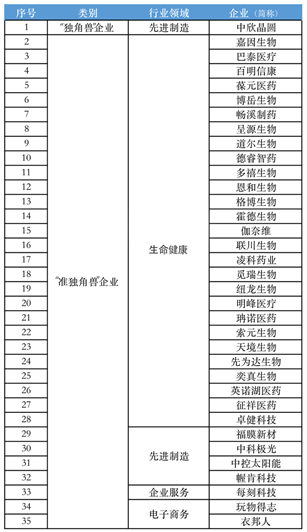

35 Qiantang companies are on the list of 2022 two "unicorn" lists!

A few days ago, the 2022 Hangzhou Unicorn (Quasi -Unicorn) List was released in th...

The Hubei Provincial Games Social Fair race race is suitable for shooting, a small soft ball releases the magic power

Jimu Journalist Wang ChenxiVideo editing Wang Chenxi