Jinlong Co., Ltd. disclosed the performance of two brokerage subsidiaries under the first half of 2022

Author:Capital state Time:2022.07.20

After the market on July 19, 2022, Jinlong Co., Ltd. (000712.SZ) disclosed two unveiled financial data of Dongguan Securities and Zhongshan Securities in the first half of 2022.

As of the end of the first half of 2022, Dongguan Securities and Zhongshan Securities Assets accumulated 53.695 billion yuan and 16.272 billion yuan, respectively, an increase of 8.51%and 18.81%from the beginning. Increase 9.25%and 29.15%.

In terms of profitability, from January to June 2022, Dongguan Securities realized operating income of 1.232 billion yuan, and net profit was 447 million yuan, a year-on-year decrease of 3.32%and 5.62%; Zhongshan Securities achieved operating income of 44 million yuan, a year-on-year decrease of 90.75%. The loss of net profit was 173 million yuan, which was from profit to losses year -on -year.

Earlier on July 14, the performance trailer released by Jinlong Co., Ltd. revealed that the company's net profit loss attributable to shareholders of listed companies in the first half of the year was about 221 million yuan to 225 million yuan, a decrease of 16200%-16500%over the same period last year. , Basic earnings per share are -0.246 yuan/share to -0.251 yuan/share.

Jinlong shares said that the reason for the change in performance is that the securities regulatory authorities have adopted regulatory measures to restrict some business activities on the company's holding subsidiary Zhongshan Securities. Affected by this, the business income of Zhongshan Securities Investment Bank during the reporting period has declined to decline. In addition, affected by the macroeconomic and industry policies, the valuation of the real estate bonds in Zhongshan Securities has fallen, and the fair value changes have suffered losses.

- END -

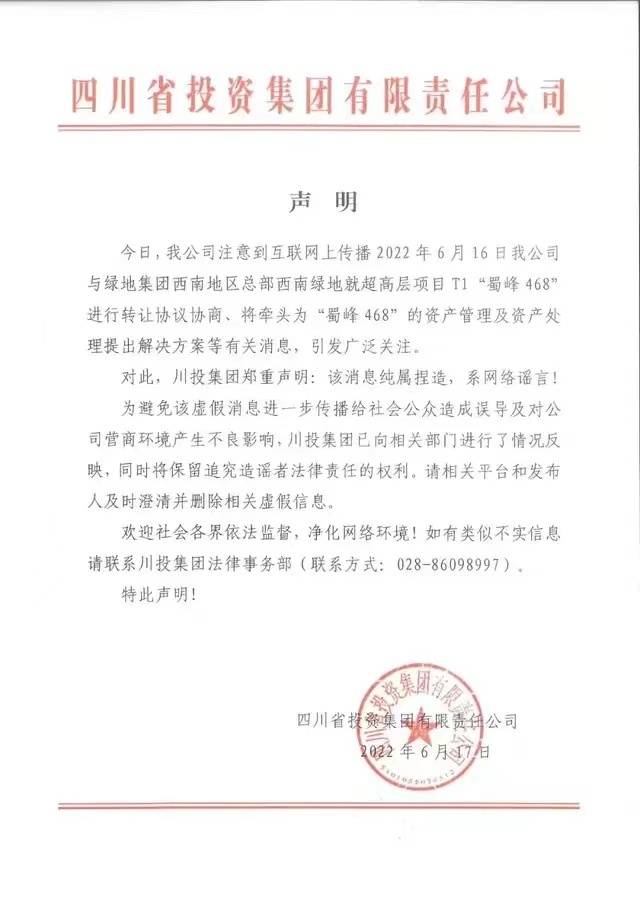

"Shu Feng 468" is to be transferred?Sichuan Investment, Greenland response: Internet rumors!

Recently, a news about the famous landmark building in Chengdu -the green land Shu...

Central Bank Shanghai Headquarters: The total amount of cash in cash in the first half of June reached nearly four times the same period last year

After the comprehensive resumption of work in Shanghai, more than two months of sealing and controlling the need for citizens' financial business to handle the need for a blowout. On June 20, the repo...