The "original sin" and new story of onion

Author:Value Planet Planet Time:2022.07.20

Author | Oujin

On May 7, 2021, a Chinese company that was not well known to consumers was listed on the New York Stock Exchange.

But on the day of listing, a group of media was surprisingly given various loud names to the company- "the first share of the quality life brand platform", "first share of cross -border e -commerce" and so on.

This company is onion group. Its business includes three major blocks: O'Mall e -commerce, foreign cross -border supply chain and foreign goods. The business covers global brand incubation and cross -border direct e -commerce. As of the end of 2020, the onion Group has reached cooperation with 4001 brands, covering more than 6,1317 SKUs, 86 direct cooperation brands and 21 own brands.

However, the highlights brought by listing have not last. On the first day of listing, the onion group opened high, and it touched up to $ 11.71, an increase of more than 57%. Since then, it has started to fluctuate for more than a year. As of July 18 this year, only 0.68 US dollars remaining on the onion Group's stock price has evaporated over 90 %.

The embarrassing performance of the stock price is also a microcosm of a series of unsuccessful businesses of the onion group itself.

For onions, product sales were made through KOC (key opinion consumers) in the early days, and successfully broke the market in a crowd of going out of the sea. However, as the number of players in the field of cross -border e -commerce increased Brand and marketing services have only improved; in recent years, they want to rely on incubating their own brands to increase profits and market share, but the early investment has been huge and has little effect. The above bottlenecks directly caused the company's performance and stock price "double drop".

In the future, how this company going to the sea to pay market expectations is an urgent question that needs to be answered.

6 -year -old speed listing

In June 2015, the General Office of the State Council issued the "Guiding Opinions on Promoting the Healthy and Fast Development of Cross -border E -commerce", which proposed that "encourage strong enterprises to become bigger and stronger ... foster a group of highly well -known self -built platforms, encourage encouragement Enterprises use their own platforms to accelerate brand cultivation and expand marketing channels. "

It was also this year that Li Yan officially founded the onion. In the early days, he started to directly sell directly. In the later period, he provided services for the new generation of consumers through the company through the company through the company's online mall and KOC traffic matrix, three -party channels and offline physical business.

Among them, the "KOC traffic matrix" is critical to the development of onion groups.

"KOC is the unique way to dialogue on the onion Group to talk to the young consumer market." Li Yan, the founder and CEO of the onion Group, said, "When the KOC over 700,000 also acts as a" salesman 'at the same time, it can get a 700 million exposure of the exposure of 700 million The amount can quickly start the new brand to start from 0 to 1, so as to leverage the market volume more efficiently. "

Specifically, the "KOC traffic matrix" is to invite users to become the KOC of the platform, allowing them to use social tools or scenes to use the personal network of personal networks for commodity transactions and services. At the same time, KOC itself is consumers. The content shared is mostly personal experience. Therefore, compared to shopping guides, they are more affinity and persuasive.

So in a sense, the KOC model of the onion Group is very similar to the "anchor with the goods" in everyone's mouth today.

According to the CIC report, according to the total revenue of 2019, the onion Group is the tenth largest quality life brand platform in China; according to the GMV calculation generated by online cross -border retail in 2019, about 30 onion Group provides import and export quality in China in China Ranking fifth of the cross -border platforms of life brand business.

Although the name is loud, these rankings have added a lot of attributives.

However, this does not delay the smooth listing of the onion Group. On the evening of May 7, 2021, the onion Group officially listed on the NYSE, with the stock code "OG". It took 6 years to go to the United States to knock on the bell, and the onion group ran faster than many colleagues. On the first day of listing, the company's stock price reached a maximum of $ 11.42, with a maximum increase of more than 57%.

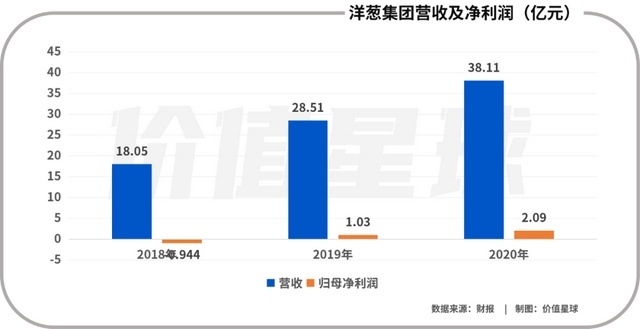

The prospectus shows that from 2018 to 2020, the revenue of the onion Group was 1.805 billion yuan, 2.851 billion yuan, and 3.811 billion yuan, respectively; the net profit of the same period was -94.4 million yuan, 103 million yuan, and 209 million yuan. Essence

The reason why there are such achievements is that the director and CFO He Shan of the onion Group believe that the onion Group continues to work on the new consumer track of high -speed growth. The traffic channels of tens of thousands of KOC are important competitiveness that has always been optimistic about by the management, and the key to maintaining stickiness with users.

However, it was not expected that the onion group "debuted at its peak", and today the market value has evaporated over 90 %.

Encounter a huge change

The evaporation of the market value is only the appearance, and the greater difficulties of the onion group come from the business itself.

First of all, the size of the onion is too small.

According to the "China Cross -border Import Retail E -commerce Market Quarterly Monitoring Report" released by Analysys Analysis, in the fourth quarter of 2020, Tmall's international market share was 37.2%; Koala sea purchase market share was 27.5%; JD international market share was 14.3 %, The three of them account for nearly 80%of the total.

Analysys also shows that in the fourth quarter of 2020, in China's cross -border import retail e -commerce ranking, the onion group ranked in the top ten, and the market share was less than 0.2%.

Secondly, KOC's contribution is reduced.

In 2019, the active KOC onion recommended 5,590 products to customers, an increase of 491%compared to 2018. But by 2020, KOC only recommended 3,420 products, a significant decrease. In addition to the decrease in categories, the GMV contributed by a single KOC is also decreasing. From 2018 to 2020, the GMV contributed by a single KOC decreased from 8131 to 7767 yuan, a decrease of more than 4%.

Cui Lili, executive director of the Institute of Electronic Commerce of Shanghai University of Finance and Economics, said that in her opinion, the current model of the onion O'Mall is the S2B2C model, and KOC plays the B -end role. , Using the model of social distribution to sell goods, the advantage of this model is the private domain traffic. Under the traffic of the public domain, the giants are Lin Li, and the new e -commerce company wants to grow under the pattern of the platform. "

Finally, its own brand "drag down" performance.

Generally speaking, its own brands can bring higher gross profit, but this also means more investment. Before listing, onion Group stated in the prospectus that about 50%of the net funds raised by IPOs used to cultivate their own brands and development strategic partnerships.

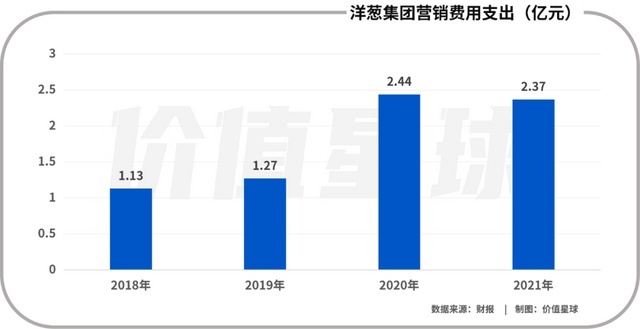

The financial report data also shows that the marketing expenses of onion groups increased from 113 million in 2018 to 227 million yuan in 2021, but the gross profit decreased from 779 million to 522 million from 2020.

From the perspective of the industry, the field of cross -border e -commerce seems to be a "strange circle", making money fast, fast financing, fast fire. But the risks are also fast.

In the past period of time, from UMKA's suspension of merchant business in China, to AWOK announced bankruptcy shutdown, from Jumia for 6 consecutive quarters of GMV, to the crisis of supply to discuss the debt discussion, and then VOVA was accused of frozen seller funds. The decline of the regional and middle -waisted cross -border e -commerce platforms one after another, except for its own business problems, all show the ultimate fate of the platform model -only first or death.

At present, the mid -waist platform is facing "two sides". As a global e -commerce platform, Amazon, as always, a steady development, a unique family, and a cross -border e -commerce, no one can bypass him. On the other hand, the decentralized independent station forces promoted by Shopify have sprung up globally like mushrooms. Which independent brand wants to build an official website.

In this context, it is difficult for onions to be alone.

Embarrassing

In a sense, the "tragedy" of onions has been written since its listing.

The revenue growth rates of onion Group from 2019-2021 are 57.92%, 33.67%, and -32.90%, respectively, and the growth rate of net profit attributable to mothers is 209.31%, 103.17%and -269.90%. The growth rate of profit is like taking the "roller coaster".

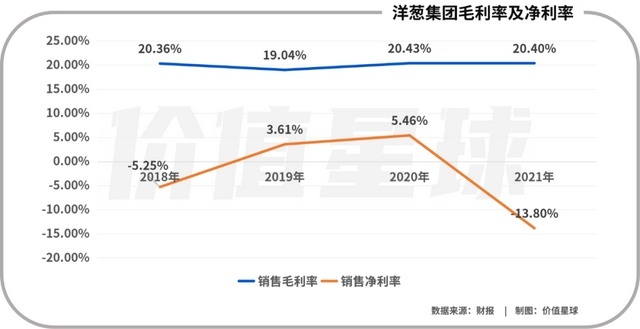

The financial report shows that the gross profit margin of the onion Group has basically stabilized at about 20%in the past three years, but the net interest rate has dropped from 3.61%in 2019 to -13.80%in 2021.

In addition to the embarrassment on the core performance indicators, the "KOC traffic matrix" relying on the onion Group adopts the model of hierarchical franchise and level distribution, which also causes the industry to question.

According to the data, the owners and service providers of the onion Group are: the franchise fee of the onion owner is 1,000 yuan, and the profitable profits are 70%of the total profit of each order, which is about 15%-20%of the sales; The franchise fee of the merchant is 20,000 yuan, and the service provider's store profit is 30%more than the shop owner. It can get 100%of the total profit per order, about 25%-30%of the sales.

In addition, service providers can also recruit the owner by themselves, 1,000 yuan for each recruitment, and at the same time, you can also recruit service providers. Each recruitment can get a reward income of 4,000 yuan.

This is very similar to the once hot "Weishang joining" business model, that is, through layers of agency management, you can easily obtain agency sales qualifications to pay a certain franchise fee.

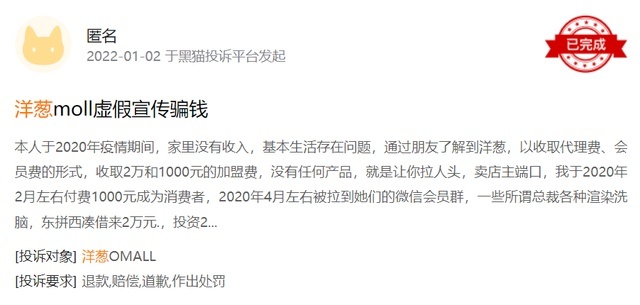

Under the above -mentioned rules of joining and promoting sales, some shop owners and service providers have to increase product sales, attract more people to participate in joining, and obtain more benefits. It is very easy to exaggerate product results and perform false publicity.

According to Tianyancha, in February 2017, "Guangzhou Onion Fashion Group Co., Ltd." had been ordered by the Food and Drug Administration of Tianhe District, Guangzhou due to the sale of counterfeit and shoddy cosmetics. , Punished for fines.

Facing the questioning of the KOC model of the onion Group, its internal personnel responded: "MLM is a multi -layer paid, and the onion has only two layers. It only does the sales of store products and does not belong to the MLM model."

Picture source: black cat complaint

Having said that, the comments on the Internet about "Onion Group" are still overwhelming. In the black cat complaint, there are 41 complaints related to the "Onion Group", of which the false publicity, the sales of fakes, and the difficulty of refunds have appeared at high frequency.

It is worth noting that there are only 89 companies in the field of physical retail in the field of physical retail. However, in the field of "Internet+Direct Sales", the concept of online direct sales is still in a blurred area, and onions are also taboo for the business. However, it disclosed related potential risks in the IPO prospectus.

Summarize

In general, the onion Group has experienced the turbulence from the peak to the valley since its listing. The embarrassment of onions is a microcosm of the concept of cross -border e -commerce -since 2016, from flames to seawater, from websites, APPs to short videos, from full of gimmicks to dull, more importantly, a sudden came. The impact of the epidemic, the entire industry has repeatedly folded.

Like the onion Group, the distribution social e -commerce model has gathered. The stock price has fallen from $ 11 to about $ 1 in three years, and the market value has evaporated by 90%.

An industry insider said that cross -border e -commerce has no mid -waist platform, "big", with Amazon; "small" and independent stations. There are only two ways to survive, either first or unique.

Reference materials:

[1] "China Cross -border E -commerce Service Industry Trends Report", Iri Consultation

[2] "China Cross -border Import Retail E -commerce Market Quarterly Monitoring Report", an illusion analysis

[3] "Cross -border e -commerce platform 2022: High -cost, high -growth sad and happy intersection", First Finance and Economics

[4] New forces · 202.1 billion State Cross -border E -commerce Conference -Brand Globalization Summit

*This article is based on public information, which is only used as information exchange, and does not constitute any investment suggestions

- END -

Nanyang Branch is a good pilot service economic entity

Economic entities are the support of social development. Since the beginning of this year, in accordance with the arrangement of the Municipal Party Committee and Municipal Government, the Nanyang Bra

The price continues to fall!

The international gold price hit a high of 2070.42 US dollars per ounce in March t...