Tune Vane | Yinhua Fund Lee Xiaoxing: Heavy Warehouse Target is optimistic about the consumption recovery of medium and long -term dimensions

Author:China Fund News Time:2022.07.20

China Fund reporter Zhang Xue

Editor's note: Recently, the Fund's second quarterly report has disclosed that the positioning movements and position changes of the star fund managers have also become the focus of the attention of the citizens. Behind each regular report, these outstanding manager's "investment secrets" are also hidden. Fund Jun will continue to update the character's database feature [positioning vane], decoding star fund product holding changes and its manager's investment philosophy.

In the first quarter of this year, the irrational decline of A shares that was raided in multiple profit and air factors made many 10 billion funds "very injured" and the income was helpless. However, as the A -shares weerated at the end of April, the top -flow fund managers seized the opportunity to take back the "lost land" to achieve the rapid blood return of the fund's net value. Li Xiaoxing, a star fund manager of Yinhua Fund, is listed. The net decline in the two tens of billions of funds in the first half of the year has narrowed to 5%.

As a serious and diligent fund manager, this quarterly report Li Xiaoxing still reported to the holder's operating ideas in the first half of the year with a long composition of nearly 6,000 words, and shared the view of the macro and industry in the second half of the year.

For the market outlook, Li Xiaoxing is more optimistic. Generally speaking, he is optimistic about the V -type reversal of the Chinese economy and the consumption recovery of the medium and long -term dimension.

In this issue of the "Warehouse Vane", the Fund will explain the second quarterly report and its positioning of Li Xiaoxing, the Yinhua Fund.

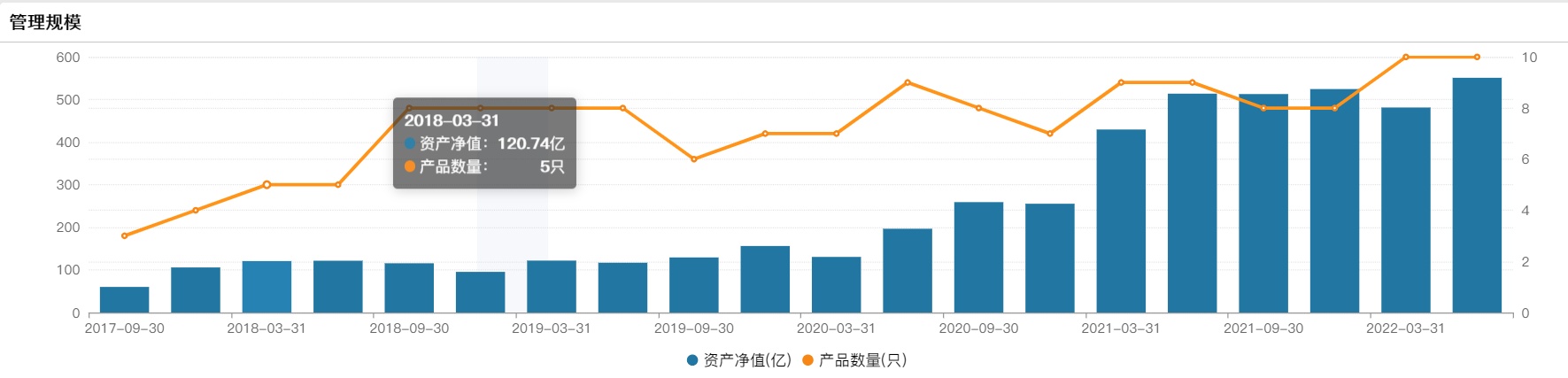

Return to the 50 billion mark in the scale of the pipeline

In the second quarter, the fund's net value quickly returned blood

Thanks to the recent strong rebound of liquor faucet, and this round of lithium battery, wind power, photovoltaic, new energy vehicle and other high -boom circuit stocks rose rapidly from the bottom, all 10 products in Li Xiaoxing in the second quarter obtained a positive return, of which silver was silver. Among them, silver Hua Xincheng's fund's net value growth rate is the highest, which is 12.88%. Except for the earlier Yinhua small and medium -sized plates and the Yinhua market, the net value of the other 7 funds increased by more than 10%in the second quarter.

Judging from the growth rate of the fund's net value in the first half of the year, the two funds of Li Xiaoxing's two -year fund -Yinhua Xinjia held two years of holding and Yinhua Xinyi in the first half of the year have narrowed to 5%. They were -4.25%and -4.76%, and Yinhua Xincheng and Yinhua Xinxin enjoyed the half-year holdings of the semi-annual holding of -5.96%and -6.67%.

Under the strong rebound of performance, as of the end of the second quarter, Li Xiaoxing's total size of the fund had reached 55.091 billion yuan, and returned to the 50 billion mark, an increase of nearly 7 billion yuan from 48.117 billion yuan at the end of the previous quarter.

(Data source: Wind, as of July 20, 2022)

From the perspective of the fund share, except for Yinhua Xinxin's one year, the remaining funds have recorded a net growth of different degrees of share.

As Li Xiaoxing has always believed that "long -term stable excess returns are long -term absolute returns, insist on buying at reasonable prices

Entering high -quality listed companies, making money for performance growth. "Under the premise of the overall valuation of the market, when he is easily selected, he will only combine the matching degree of the industry and the company's fundamentals, prosperity and valuation to continuously adjust the cost -effectiveness of the combination. Therefore In the second quarter, about 90 % of the high warehouse operations still maintained, and the adjustment was not large.

On the whole, except for the selected stock positions selected by the Silver Wasteen Shengshi, from 92.27%at the end of the last quarter to 89.66%, other funds remained at more than 90%, of which Yinhuafeng enjoyed it in the first and second quarters. The fund raised the stock position, and the five funds lowered the stock position. In the management fund, the highest stock position is currently held by Yinhua Xinxing, which was just established in the first quarter of this year, with 93.04%.

Half of heavy warehouse stocks were replaced

Consumer stocks are greatly adjusted into the portfolio

In terms of holdings, Li Xiaoxing's positions are relatively scattered, but they are concentrated in a certain segment. For the targets without positions, pay more attention to opportunities; for the heavier targets, they pay more attention to risks.

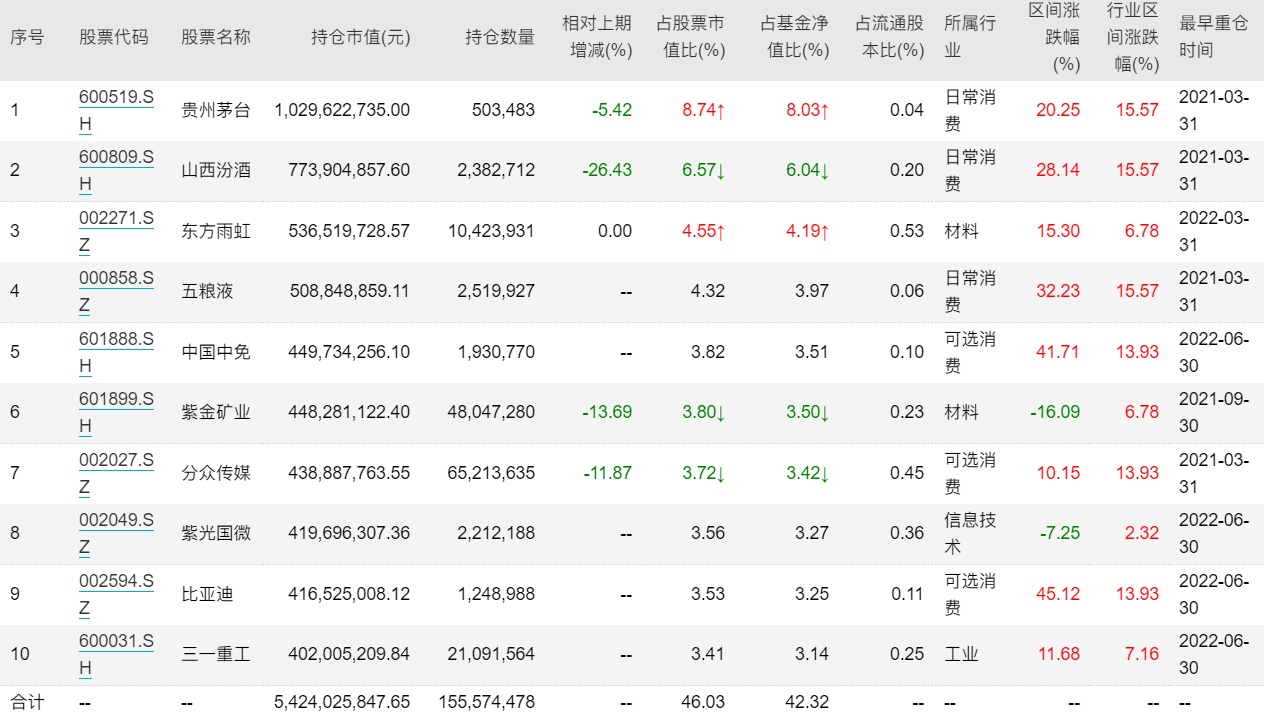

From the perspective of Li Xiaoxing's current representative product, although the position of positions in the second quarter was not large, it only reduced from 92.63%at the end of the previous quarter to 91.65%, down 0.98 percentage points. However, the top ten heavy warehouses have undergone a "wind and cloud", and at the same time, the moderate set of positions has also decreased further, from 55.20%at the end of the last quarter to 42.17%, a decrease of more than 13 percentage points.

As of the end of the second quarter, the top ten heavy stocks of Yinhua Xinyi managed by Li Xiaoxing were Guizhou Maotai, Shanxi Fenjiu, Oriental Yuhong, Wuliangye, China -free, Zijin Mining, Focus Media, BYD, Ziguang Guowei, Sanyi Heavy work.

Compared with the end of the previous quarter, the top ten heavy warehouses were replaced by half. Ningde Times, Yaoming Kangde, Huichuan Technology, Tianci Materials, Jinshan Office withdrew from the top ten heavy stocks of the fund, Wuliangye, China, BYD, Ziguang Guowei and Sanyi Heavy Industries are new.

It is worth noting that the second quarterly report showed that Guizhou Moutai has replaced the Ningde era as the fund's largest heavy stock stock. This is the first time in the Ningde era since the third quarter of 2020. At the end of the quarter, the stock even fell out of the top ten heavy stocks. At the same time, among the top ten heavy stocks of Li Xiaoxing in the top ten stocks of the fund, it is also difficult to find the Ningde era.

Li Xiaoxing has also adopted the same operations in the currently largest -scale product to maintain high positions. Consumption and technology configuration are relatively balanced. Focusing on the configuration of food beverages, real estate chains, consumer services, national defense military workers, electronics, computers, media, non -ferrous metals, non -ferrous metals, non -ferrous metals, non -ferrous metals, non -ferrous metals, non -ferrous metals, non -ferrous metals, non -ferrous metals, and non -ferrous metals, and non -ferrous metals. In the pharmaceutical and new energy industries, high -growth individual stocks in the high prosperity industry are selected. Specifically, the top ten heavy warehouse stocks have been replaced by half of the stocks. Among them, Ningde Times, Yin Kangde, Huichuan Technology, Tianci Materials, and Jinshan Office withdrew from the top ten heavy stocks. Five stocks of Guowei, BYD and Sany Heavy Industry.

This time, Li Xiaoxing reduced the Cang Ningde era, consumer "white horse stocks" Wuliangye, China -free, and the leading stocks of stock markets in the new energy vehicle sector, which are also seen in the quarterly report. It is more balanced. It is optimistic about the domestic economic recovery, so it appropriately increases the proportion of value shares related to investment; medium- and long -term dimensions are optimistic about consumption recovery, so continue to increase the configuration ratio of consumer stocks; out of liquidity considerations, appropriate reduction of holding valuation overdue some stocks in the future growth are some stocks that grow in the future. ; And more attention to companies related to external needs.

Overall optimistic about the Chinese economy V -type reversal

Looking forward to the recovery of consumption of medium and long -term dimensions

In the second quarterly report, Li Xiaoxing talked about the outlook for the second half of the year. First of all, he judged that Russia and Ukraine's high -intensity conflict stage was close to the end. The high inflation caused by the Russian -Ukraine conflict may be at an inflection point. Oil prices are currently at the crossroads, coexisting upward risks and downward risks. Whether the uplink risk comes from whether Europe and the United States will really reduce the import of Russian oil like what they call, and the downlink risk comes from whether it will import a upper limit price like the G7 and NATO summit. The progress of production capacity is also a point that is worthy of attention. From the perspective of Europe and the United States, it is a high probability that it is highly choosing to set up a upper limit to buy Russian oil, so Li Xiaoxing does not optimize the continued rise in oil prices.

Secondly, for the Fed's interest rate hike rhythm, Li Xiaoxing believes that the second half of the year will slow down. In the first half of next year, there will be difficulty in interest rate hikes. At least the probability of cutting interest rates in the first half of next year is very small.

"After the epidemic, the Federal Reserve has greatly increased the proportion of purchasing US bonds and directly reached residents and enterprises. The economic stimulus is very high and fast, strongly supports the total demand, the residents 'savings rate has increased sharply, and residents' consumption rebound sharply, and it also puts pressure on the inflation of goods. At this stage, we can see that the excess savings rate of American residents has declined, and the growth rate of expenditure is below the growth rate of revenue for the first time, and the growth of US growth is expected to continue to reduce. Therefore, I judge that in the future, the US economic growth is greater. The risk of decline in the United States has also increased significantly, and the Fed's interest rate hike may also slow down. "Li Xiaoxing said.

Li Xiaoxing feels more pessimistic about Europe's fundamentals. He said that Britain itself has petroleum resources and may not be seriously damaged, but continental Europe is the biggest damaged person in Russia and Ukraine. Whether it is a high -proof natural gas and oil prices for the crackdown on their manufacturing, or the decline in consumption expenditure caused by the decline in the economic downturn, European demand will be reduced. Based on the above factors, Li Xiaoxing has a very pessimistic attitude towards the needs of Europe and the United States.

Finally, Li Xiaoxing is very optimistic about domestic economic prospects. He analyzed that under the comprehensive relaxation of real estate, the exertion of the infrastructure project and the financing side, and the multi -dimensional support consumption, although the export data of overseas demand may gradually weaken, it is generally optimistic about the V -type V -shaped reversal of the Chinese economy. In the long run, the struggle with the new crown epidemic is believed to win the final victory. In the face of uncertainty, residents generally increased the savings rate, and grew more than before the epidemic. When the new crown epidemic is close to the end, the excess savings will be transformed into consumption, and at the same time, the effect of the low base is superimposed, which is very optimistic about the consumption recovery of medium and long -term dimensions.

"At present, many people in the market think that the consumption power of residents is decreasing, but combined with the significant increase in the excess savings rate, we believe that it is mainly the issue of consumption willingness, and the consumption power of the overall residents has been increasing. It will usher in a rebound, this is the biggest difference between our views from the market. "

Balancing holder

Pay attention to multi -track investment opportunities

In the second quarterly report, Li Xiaoxing shared his views on the industry and the corresponding combination of configuration ideas.

In terms of the consumer sector, the second quarter of the epidemic prevention was achieved in the second quarter, and the economic activities were gradually recovered. In the first half of the year, the V -type reversal was out of the year. However, the progress and amplitude of consumption recovery are still uncertain. Since the current consumer demand is still in a state of weak recovery, the expected income of the sector should not be too high. In terms of configuration, he mainly focuses on high -end and sub -high -end liquor, and has added related companies in beer, beauty, and consumer medical sectors. In addition, Volkswagen Food and Social Services are also allocated.

In terms of the pharmaceutical sector, medicines in the first half of the year were repeatedly affected by geopolitics and domestic epidemic. The overall sector performed poorly, but there were structural opportunities inside the sector. In the case of increasing investment risks of innovative drugs and continuous increase in outsourcing rates, CRO/CDMO is still the strongest and most certain sector in the pharmaceutical sector. For the target of stable performance and sustainable performance, Li Xiaoxing continues to be optimistic. In addition, with the economic recovery of the epidemic in the third quarter, the sectors that are damaged by short -term epidemic will improve from the previous month, especially the demand and optional medical beauty, medical services, etc. He is expected to have good excess returns in the third quarter. Other sub -sectors, such as vaccine, medical devices, and high -quality stocks in Chinese medicine, Li Xiaoxing will also participate moderately to maintain a balanced configuration of the combination. In the new energy track, looking forward to the second half of the year and next year, Li Xiaoxing is relatively more cautious about the midstream materials and photovoltaic manufacturing of electric vehicles in new energy. Energy storage industry chain and some wind power parts. Focus on the segmentation of new technologies and penetration and the increase in market share, as well as the advantages of differentiation, closer to consumers, enjoying the price reduction of materials in the future, and reserving profits.

In the past year, Li Xiaoxing believes that energy storage is the fastest -growing new energy segmentation track, so it is continuously optimistic about the energy storage industry chain. Because the overall valuation of wind power is cheaper, he is relatively optimistic, but the repair of performance is not as fast as optimistic expectations.

Speaking of technology stocks, Li Xiaoxing said that the impact of geopolitical changes brought about by Russia and Ukraine's conflict has made the main investment opportunities focusing on the two directions of national defense military workers and information technology autonomous and controllable. He will select stock selection based on the two dimensions of supply and demand, the supply side, preferably enter the links with high barriers, large industry supply constraints, and domestic alternative space; demand side, focusing on high prosperity such as aviation engines, fourth -generation aircraft, missiles and other high prosperity. Subdivided track.

In terms of the Xinchuang section, Li Xiaoxing layout a leading company with a good competitive pattern and strong commercial promotion capabilities. In terms of semiconductors, the global overall entering the inventory cycle should avoid strong cyclical price attributes; he is optimistic about the domestic alternative direction of the independent prosperity cycle, mainly including semiconductor equipment, materials localized, and non -linear growth equipment parts.

In the Internet track, Li Xiaoxing mainly focuses on two directions. One is the performance flexibility brought by the new business, represented by the digitalization of the cultural industry; the second is the performance brought about by the epidemic repair. Internet companies are mainly. In the direction of the low valuation period, Li Xiaoxing continues to be optimistic about the brand advertisement of long -term benefit consumption and upgrading dividends.

Speaking of value stocks, as the epidemic has gradually been controlled and the economy gradually stabilizes, Li Xiaoxing believes that the cyclical value stocks will usher in a certain amount of relative benefits. From a long -term perspective, he continues to be optimistic about wealth management brokers. In the traditional cycle stocks related to infrastructure and real estate investment, while optimistic about the investment cycle, he is also optimistic about the growth of aggregate in the construction machinery and the expansion of the aggregate in the cement.

(Note: If there is no special indication of the chart data in this article, it comes from Zhijun Technology and Wind data)

Risk reminder: The fund has risks, and investment needs to be cautious. Fund's past performance does not indicate its future performance. Fund research and analysis do not constitute investment consulting or consulting services, nor does it constitute any substantial investment suggestions or commitments to readers or investors. Please read the "Fund Contract", "Recruitment Manual" and related announcements carefully.

- END -

Yu Jian · Foresee 丨 "Time aged long -lasting" Renhuai Wine · Over -end high -end test meeting is held in Zhengzhou

On July 2nd, the Time Overwhelming Overwhelming Renhuai Wine · Chen's high -end t...

In order to harvest the earth 丨 Jilin Shuangliao: Promoting protective farming technology has achieved significant results

The Shuangliao City in western Jilin Province has a semi -arid area. 80%of the cul...