Military industry prosperity is fulfilled, medicine continues to rise, and breeding is adjusted as scheduled

Author:Capital state Time:2022.07.21

On July 20th, the three major indexes performed strongly. The Shanghai Composite Index opened high, and the strong shocks were rising. The daily line received Sanlian Yang and successfully stood on the 3300 mark. The deep syndromes and the GEM fingers have risen. From the perspective of the market, the military industry sector was favored by market funds on July 20, and the pharmaceutical and tourism sectors also performed well, while coal and breeding sectors were adjusted on the same day. Solid stocks rose more on the 20th, rose more than 3,100 households, and declined less than 1,500.

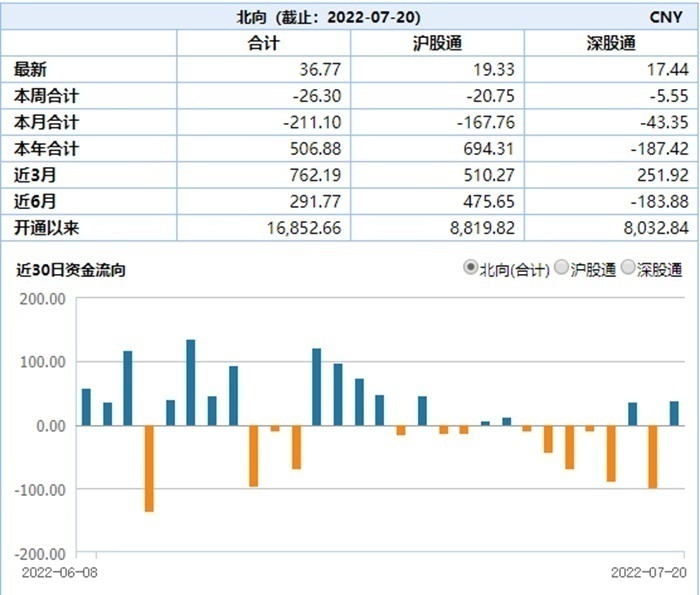

In terms of quantity, the turnover of the two cities on the 20th has shrunk, and the total amount is less than trillion. In terms of funds in the north, it flowed slightly by 3.677 billion yuan on the day, of which the Shanghai stocks were underwritten of 1.933 billion yuan, and deep shares inflow of 1.744 billion yuan.

Recently, the flow of funds in the north direction, the data comes from Wind

On July 20th, the military sector performed well. The military industry ETF (512660) went up one side. As of the close of 4.19%, the transaction value reached 865 million yuan. The strong performance of the military industry is due to the dazzling performance trailer for some enterprises. The following table shows you the disclosure of the second quarter of the component stocks of the Sino -Stock Exchange Index. From the perspective of the 20 companies that have been disclosed, the year -on -year growth rate of net profit is expected to exceed 50%. There are 8 more than 100%. The high prosperity of the military industry is being verified by the market step by step. Thanks to the high prosperity of the industry, since this wave of rebounds on April 27, the cumulative increase of military industry ETF reached 41.42%, while the increase in the CSI 300 index during the same period was only 13.20%, and the industry excess revenue was obvious.

The second quarter performance forecast of the Sino -Stock Exchange Military Industry Index Establishment Stocks, the data comes from Wind

Looking forward to the market outlook, we mentioned in "Ai Xiaojun: The Big Season of the Base of Military Workers in the Third quarter" that the recent international situation has further strengthened our country's determination to develop in the military industry in the future. The liquidity is relatively loose. At present, the market is more concerned about the interim report. In terms of interim reporting, the military industry is expected to achieve a steady growth in the second quarter. Looking at it later, on the one hand in the third quarter, there will be a shortage of the second quarter, and on the other hand, there may be advanced workers in the fourth quarter. It is expected that the third quarter will become a major season for military industry. You can continue to pay attention to the military ETF (512660).

In addition to military industry, the pharmaceutical sector also performed well on July 20. Medical ETF (159828) rose 1.58%, with a transaction value of over 70 million; Biomedical ETF (512290) rose 1.01%, with a transaction value of 130 million yuan; Innovation Pharmaceutical ETF (517110) rose 1.21%. The pharmaceutical sector has continued to adjust since July last year, and stabilized in the market index in March this year. After a rebound in May and June, the performance of the sector gradually got rid of the embarrassment of unilateral downward.

From the fundamental point of view, the pharmaceutical sector has entered the two -year newspaper period and consumer medical care in the summer vacation. On the one hand, the semi -annual report and the preview of the second quarter performance, on the other hand, the performance of the performance of medical and consumer medical care in the summer and Q3 hospitals. In addition, the seventh batch of national organizational drugs was opened in Nanjing last week. With the continuous deepening of the national collection work, the market has been fully expected to collect the collection, and the overall price decline has also stabilized. Subsequent companies' cost reduction and efficiency and innovation transformation will become the main line of the future and long -term.

From the perspective of valuation, the overall valuation of the pharmaceutical sector is about 30 times, and it is at the lowest level in history. The safety margin of investment in the current time is relatively high. In the future, you can continue to pay attention to Medical ETF (159828), biomedical ETF (512290), and mid -to -long -term investment opportunities in the Shanghai Shenzhen and Hong Kong ETF (517110) (see "Medicine: Short -term Care and Optimism, Long -term bottom up").

On July 20, the breeding sector fell the top, and the breeding ETF (159865) fell 1.03%. In the futures market, the main contract of pig futures fell 1.95%on the day. In "Liang Xing: The future of pig prices rises or falls? Where is the pig cycle? "," The technology sector may enter the adjustment period, and the breeding sector may fluctuate with the pork price back "to everyone. The short -term pig price adjustment may bring the adjustment of the breeding ETF, but due to the incomplete production capacity, the price is incomplete, the price It may not be able to hold it up when I go up. After that, it may enter the loss period again, and the capacity will continue to be de -degraded. This process is repeated. Therefore, the bottom of this round of pig cycle may be longer than the previous expectations. Therefore, the current adjustment of ETFs is also very normal. The current production capacity is not over, indicating that the right side of the pig cycle has not yet arrived, and the breeding industry still has space in the secondary market. If you encounter adjustments, you can pay attention to the breeding ETF (159865).

- END -

Column interpretation | This principle helps gold ore companies' long -term stable development

Since the 2019 World Gold Association's release of the Principles of Responsible G...

The monthly income exceeds 100,000, and the creation of web3.0 is not a good business?

China Economic Weekly reporter Guo Yiyao | Beijing reportThe virtual fashion of 39...