The accumulation of accumulated losses and unsuccessful situations, Guofu hydrogen can break through the science and innovation board IPO

Author:Capital state Time:2022.07.23

Recently, Jiangsu Guofu Hydrogen Energy Technology Equipment Co., Ltd. (hereinafter referred to as "Guofu Hydrogen Energy") broke the customs and innovation board IPO was accepted by the Shanghai Stock Exchange.

Picture source: Shanghai Stock Exchange official website

Guofu Hydrogen Energy focuses on providing core equipment for customers such as fuel cell integration manufacturers, vehicle manufacturers, energy companies, and urban bus operation companies.

Picture source: company prospectus

Financial data shows that the company's revenue in 2019, 2020, and 2021 was 176 million yuan, 251 million yuan, and 330 million yuan, respectively; the net profit corresponding to the mother-in-law at the same time was -17.735 million yuan, -6,2014,700 yuan, -6,577.38 10,000 yuan.

According to the "Audit Report" issued by the accountant (to No. 332A018695), the issuer's operating income was RMB 32,999,900 in 2021. Based on the pre -assessment of the issuer's market value, it is expected that the total market value after the issuer will not be less than RMB 3 billion.

The company chooses to apply the listing standards of Article 2.1.2 of the Listing Rules: "The estimated market value is expected to be less than RMB 3 billion, and the operating income in the past year will not be less than RMB 300 million."

This time, it is planned to raise funds for the third phase of the hydrogen energy equipment industry base and supplementary funds.

Picture source: company prospectus

As of the date of the signing of this prospectus, Xinyun Technology directly held 19.25 million shares of Guofu Hydrogen Energy, accounting for 21.38%of the issuer's share capital, which is the controlling shareholder of the issuer. The issuer's actual controllers are Wu Pinfang and Wang Kai. The two controlled 24,175,987 shares, accounting for 26.85%.

Guofu hydrogen can admit that the company has the following risks:

(1) The company has the risk of cumulative losses and unsuccessful losses

During the reporting period, the company's net profit attributable to the parent company was -177.735 million yuan, -62,214,700 yuan, and -65.773 million yuan, respectively. The net profit attributable to the parent company owner after deducting non-recurring profit or loss was -277.493 million yuan, respectively. , -348.8057 million yuan and -76.837 million yuan.

As of December 31, 2021, the company's cumulative uniplied profit was -117.4295 million yuan. During the reporting period, the company's operating income achieved rapid growth, but there were still cumulative situations that did not make up for losses and have not yet been profitable. The main reasons for the market applications of the downstream are still at the level with relatively low penetration, the price of the main raw materials fluctuated, and the continuous research and development investment in investment. , Share payment, credit impairment losses, etc. In the future, the company still has the risk of accumulating cumulative losses and may continue to lose money.

(2) The risk of technical upgrade iteration

The vehicle high -pressure hydrogen supply system and the complete set of equipment produced by the issuer are technical dense products. The vehicle high -pressure hydrogen supply system has technical requirements such as high safety, high stability, and lightweight. The safety and accuracy of the note, the two products are applied to the hydrogenation stations of fuel cell vehicles and transportation infrastructure. As various energy companies and some related listed companies have strengthened the investment in the research and development resources in the field of hydrogen energy, if breakthrough technology or new technical routes in the industry will appear in the future, the company is in lack of continuous technological innovation or failed to adjust the research and development technology route in time. Being able to upgrade and iterates in time leads to backward technology, which may cause the company's products to be unable to meet market demand. The company will face the risk of lack of product competitiveness, decline in market status, and decline in profitability.

(3) The risk of increasingly fierce competition in the industry

As the hydrogen energy industry policy is becoming dense and the technical path becomes clearer, the industry direction is becoming more clear. In addition to companies focusing on hydrogen energy, energy companies and some listed companies such as Sinopec, Donghua Energy, Jiahua Energy, and some listed companies have developed through endogenous development through endogenous development. , Outreach M & A and other methods to deploy hydrogen energy and participate in the entire industry chain. If the issuer cannot ensure its own advantages through various ways such as technological innovation, reduce production costs, and improve product comprehensive performance, it will face the risk of declining operating performance due to intensified industry competition.

(4) The risk of seasonal fluctuations in sales income

The main downstream customers of the company's vehicle high -voltage hydrogen supply system are integrated fuel cell system integrators and vehicle manufacturers. The main downstream customers of hydrogen refueling stations are large domestic energy groups and urban bus operating companies. Essence

During the reporting period, the proportion of sales in the fourth quarter accounted for 35.12%, 60.08%, and 59.61%, respectively. On the one hand, product sales of fuel cell system integrators and vehicle manufacturers are affected by industrial policies. New energy vehicle -related government subsidy policies are usually approved at the beginning of each year. After the government subsidy policy is announced, the fuel cell system integrators and vehicle manufacturers are announced. Apply for the announcement of the recommendation of the recommended model according to the requirements. After the announcement of the announcement of the announcement of the recommended model is released, customers usually confirm the purchase order to the company in the second half of the year. According to the internal budget requirements, customers of hydrogen refueling are usually confirmed to the company in the second half of the year. The company combines the construction conditions of the hydrogen refueling station and the customer requirements to carry out on -site installation and complete the debugging.

Therefore, the company's sales revenue was concentrated in the fourth quarter, and there were seasonal fluctuation risks of performance.

(5) At the end of each period of the risk reporting period of accounts receivable, the balance of accounts receivable was 160.190 million yuan, 229,527,900 yuan, and 36,093,300 yuan, respectively, accounting for 90.80%, 91.47%, and 109.51%of operating income, respectively. At the end of each period of the company's reporting period, the turnover rate of accounts receivable was 1.63, 1.29, and 1.12, respectively. The main customers of the company are fuel cell system integrators, vehicle manufacturers, large domestic energy groups, urban bus operation companies, etc. The fuel cell vehicle industry is in a rapid development stage. The influence, the company's account receivable balance is high as a whole, and the turnover rate of accounts receivable is low. In addition, if the future macroeconomic situation and industry development prospects have undergone major adverse changes, some customers have difficulties in production and operation and deterioration of financial conditions, which may cause accounts receivables to be able to be repaid in time or difficult to recover, and the company will face a sharp decline in profits. risk.

(6) The risk that affects the company's operating performance

The outbreak has a great adverse impact on global economic operations and enterprise production and operation activities.

Although it has been effectively controlled in China before, since March 2022, the local area has still shown sporadic distribution and clustered intertwined stacks, especially the impact of Shanghai has led to the suspension of some companies. , And then adversely affect the company's order execution. For a long time in the future, it may still break out across the country, and the upstream and downstream companies in the company and the company may be affected by the suspension of production and production, which will adversely affect the company's production and operation and operating performance.

- END -

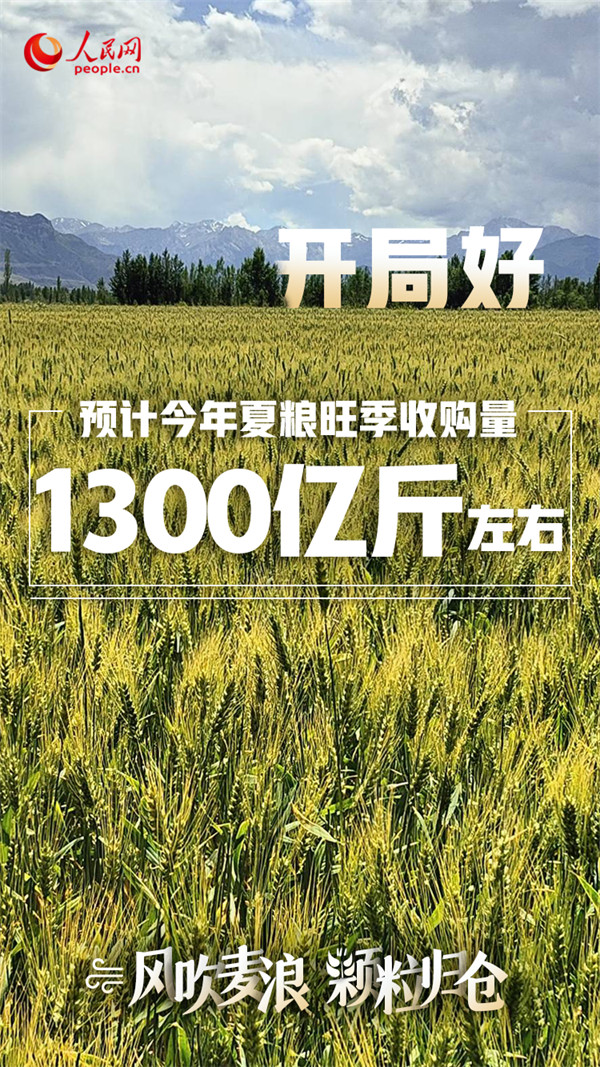

The "grain" strategy of the big country | fast progress, good quality, and guarantee, the production of summer grain production in the country is hoping

Wind blowing wheat waves and granules.By the time of the summer harvest, an agricu...

Who occupied the nearly half of the Zhejiang Enterprise on the North Stock Exchange?You can't think of this city

Zhejiang News Client reporter Xiao Yanwen Ji WenleiJiaxing City Smart Industry Inn...