[Economic KE] The key is the "guarantee of the building"

Author:China Economic Weekly Time:2022.07.25

This column is jointly produced by Xia Ke Island and "China Economic Weekly"

This is the 89th article of Economic Ke

"China Economic Weekly" reporter Li Yonghua | Beijing report

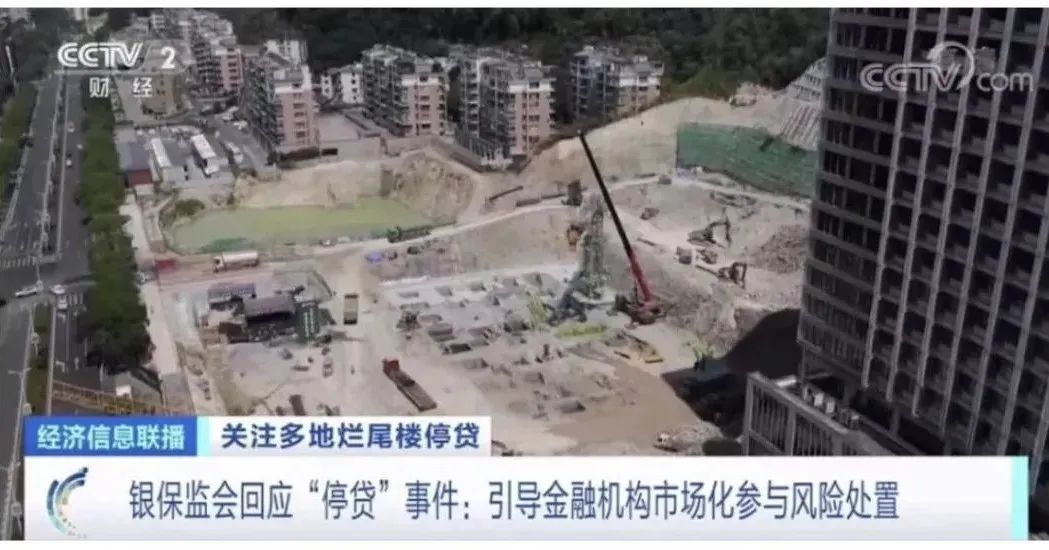

Recently, the "suspension" storm of rotten real estate in many cities across the country has made real estate risks the focus of attention from all parties. All kinds of rumors that seem to be right and wrong also bring negative energy to the market.

In fact, the data shows that the proportion of personal housing mortgage loans involved in the suspension of loan incidents is about 0.01%. Judging from the announcement of major banks, the ICBC's suspension project involves a non -performing loan balance of 637 million yuan, accounting for 0.01%of the bank's mortgage loan balance; The loan balance is 0.012%.

Small scale and low proportion are facts, but risks cannot be ignored.

Picture source: CCTV screenshot

Although the impact of the fundamental impact on the bank is small, it must pay more attention to the "emotional impact". A real estate person analyzed that if the suspension of loan storms continue to spread, the real estate market that may be slowly recovered may also make the pressure on the existing existing building buildings.

Inspection of intersections, living livelihood, and stability. The three are intertwined. Putting the "guarantee to the building" first is the key to resolve market risks and restore market confidence.

In the preservation of the property, all parties are working.

For example, in Changsha, a real estate that had stopped working in 2021 began to resume work since April this year. In fact, the number of real estate involved in overdue house delivery is in the top of the country. Several major developers such as Evergrande, Sunshine City, and Sunac all have stopped working real estate, and the pressure of delivery is high. At the end of 2021, in order to ensure that Evergrande re -production in Changsha Real Estate, a special course for preventing and resolving real estate projects was established locally to urge enterprises to solve their difficulties in accordance with self -employment, joint venture and transfer.

This model is also used in other housing companies. On July 13, the information of Sunshine City in a project in Changsha High -tech Zone, the information of the high -tech zone official website showed that the special class organized a special meeting for developers, total contracting bags, financial institutions, and owners to coordinate and solve project problems. Supervise enterprises to preserve quality and guarantee delivery.

Some people in the housing and construction department believe that the government needs to play a coordinated and guiding role. On the first floor, a strategy is to find out the bottom number, to close the management of assets, for the tail sweeping project, and at the same time work the work tasks to ensure the delivery of the building.

The first floor and the organization of special classes are the response to the cities where the non -housing enterprise headquarters is located. As for the cities where the housing enterprise headquarters is located, in addition to ensuring specific real estate delivery, the entire enterprise needs to be revitalized to drive the successful delivery of real estate across the country.

A Guangdong Real Estate executive said that the broken capital chain is the main reason for the explosion of real estate enterprises. If it can inject sufficient funds in time, the rotten tail building can be "rescued". For example, Guangdong has been working hard to promote the stable financial company. Real estate companies have been connected with thunderous real estate companies.

Injecting liquidity, the bank was highly hoped.

On July 17, the person in charge of the Banking Insurance Regulatory Commission stated that under the leadership of the local party committee and government, bank insurance institutions should actively participate in relevant working mechanisms and cooperate with the responsibilities of compact enterprises, shareholders and other parties. Banks must actively perform their duties and do everything possible building. The CBRC also requires all banks to take the initiative to participate in the research on solution to the hard gap in the hard gap in funds, do a good job of credit delivery with conditions, and assist in promoting the project to resume work, early resumption of work, and delivery early.

The disposal of the assets is still indispensable for AMC (asset management company).

In April of this year, regulators began to encourage banks and AMC to participate in housing companies. For example, the Great Wall of China and China Merchants Shekou aid Jia Zhaoye, China Huarong and Central South Construction cooperation, oriental assets issued 10 billion yuan in financial bonds, focusing on resolving the risk of real estate projects.

Local AMC also started to enter the field. On July 19, Henan Asset Management Co., Ltd. released news that Zhengzhou Real Estate Group will join forces Henan Asset Management Co., Ltd. to set up real estate bailout funds to participate in the activity of real estate and difficulties through asset disposal, resource integration, and reorganization consultant. The rescue of housing companies rescue the siege work.

Photography: "China Economic Weekly" Chief Photography Reporter Xiao Yan

Several banks said that regulators and banks are strengthening the supervision of the development of loans and pre -sale funds for real estate enterprises to block the loopholes of the system. For example, Zhengzhou and Xi'an have strengthened the supervision of pre -sale funds in many places to ensure that the funds are closed and used to insured the property, and strive to make the special households for pre -sale funds.

However, the purpose of strengthening the management of pre -sale funds is to keep the property. If you cut it in one shot, you may bring the risk of breaking the capital chain of the developer. For example, some media reports, some developers are lying tens of billions of yuan in pre -sale funds on the financial report, but they cannot pay hundreds of millions of dollars in debt, nor can they pay money to pay the project progress, which will eventually affect the insurance delivery building.

In some places, you start trying to promote the sales of existing housing. On May 7th, Hainan announced that starting from that day, the newly existed land construction commercial housing implemented existing housing sales. Hainan has also become the first province in the country to fully implement existing house sales. According to reports, Fuzhou will auction a residential land on August 5th, and the government has clearly proposed that "the land is implemented according to the sales of existing houses."

The reason why China ’s previous real estate models are not sustainable is that the root cause is that the real estate industry“ leverage ”, and the house has been fired into financial products.Whether it is a "empty glove white wolf" or "left hand down and right hand", if you still have high leverage and extensive development of high turnover, the funding chain of individual housing companies is broken and thunderous is sooner or later."Insurance to the property" is a short -term task. To continue to develop and develop the real estate market in China, it must be painful and developed.In the final analysis, as the central government is required, insist on "housing and not frying."

Responsible editor | 绫 绫, Yunge

- END -

In the middle of the year, the big promotion enters the countdown: small home appliances have emerged, and the post -95s love

Jimu Journalist Zhou DanSmall appliances have become one of the biggest surprises ...

The 25th anniversary of the return of the motherland in Hong Kong | The Champions League of the Executive Officer of the Hong Kong Stock Exchange is promoted: "One country, two systems" helps Hong Kong's financial industry growth

From the high -rise building (information picture) of the Hong Kong Island Central...