Warehouse Vane | Guohai Franklin Fund Xu Li Rong: Buy semiconductors and new energy stocks in the big conclusion

Author:China Fund News Time:2022.07.25

China Fund News

Editor's note: Recently, the Fund's second quarterly report has been disclosed. The changes and changes in the position and position of the star fund managers have also become the focus of the attention of the citizens. Behind each regular report, these outstanding manager's "investment secrets" are also hidden. Fund Jun will continue to update the character's database feature [positioning vane], decoding star fund product holding changes and its manager's investment philosophy.

Xu Li Rong, general manager of Guohai Franklin Fund, has gone through the top five of the "long -distance running fund managers" for more than ten years after a few rounds of composite returns.

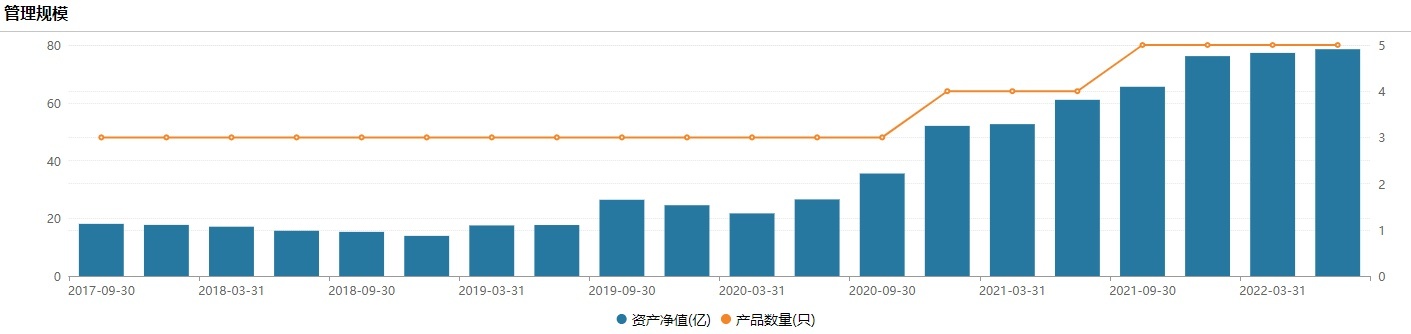

Xu Lirong has more than 25 years of securities experience and 15 years of public fund management experience. Since February 2008, he joined Guohai Franklin Fund Management Co., Ltd., and he has five in management funds, with a scale of 7.726 billion.

After the disclosure of the second quarter report of 2022, compared with the previous issue, Xu Lirong made different degrees of mobilization in the position, increasing the position of equity positions, and slightly reduced the position of the solid income position to perform a balanced configuration. On the whole, Xu Lirong's configuration industry is relatively decentralized, and it is more particular about balanced configuration. In the second quarter, Xu Li Rong bought semiconductors sharply, increasing new energy sources, and reduced their positions for the financial industry that had always preferred.

In this issue of [Warehouse Vane], Fund Jun will explain the second quarterly report and position changes of Xu Lirong, the National Hai Franklin Fund.

Stable product scale and retreat control capacity strong

The second quarterly report showed that the scale of Xu Lirong's management continued to rise, from 7.726 billion yuan to 7.854 billion yuan, and the net growth was 128 million yuan.

The second quarterly report showed that Xu Lirong's funds on behalf of the fund rose from 3.027 billion to 3.222 billion, and recorded 316 million subscriptions and 121 million redemptions, maintaining a higher net purchase amount of 195 million copies.

The second quarterly report of the just disclosed by the 2022 shows that the position of the Guofu China income hybrid fund has not changed much. The equity position increased from 61.17%to 61.76%, and the solid income positions were reduced from 37.52.%to 35.44%.

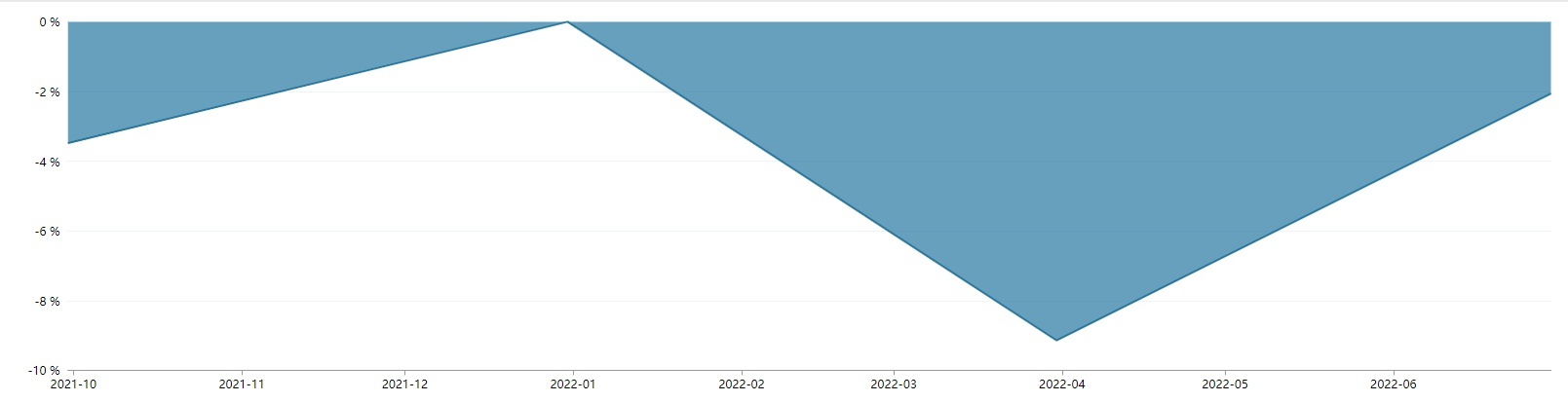

In the second quarterly report, the net value of the Guofu China Revenue Hybrid Fund increased by 7.80%in the second quarter. In the long run, the fund's net value in the past three years and the past five years rose 103.81%and 130.94%. In the long run, Xu Lirong's fund performance can be said to be very outstanding.

In terms of dynamic retracement, from the quarter as a unit, Xu Lirong showed the same control as ever. Xu Lirong's represented product's retracement in the second quarter was -2.06%, which was further narrowed compared to the previous period of retreat-9.14%.

Rewinding semiconductor plus position new energy

Generally speaking, Xu Lirong's preference for balanced configuration, the funds he managed in the industry maintain a relatively balanced layout. In his group, he will choose companies with different industries and different styles, and there are companies with relatively unpopular and relatively cheap prices. He will not bet on a certain direction, hoping to find companies that can create excess returns in as many industries. This is also a manifestation of Xu Lirong's extensive capacity and research.

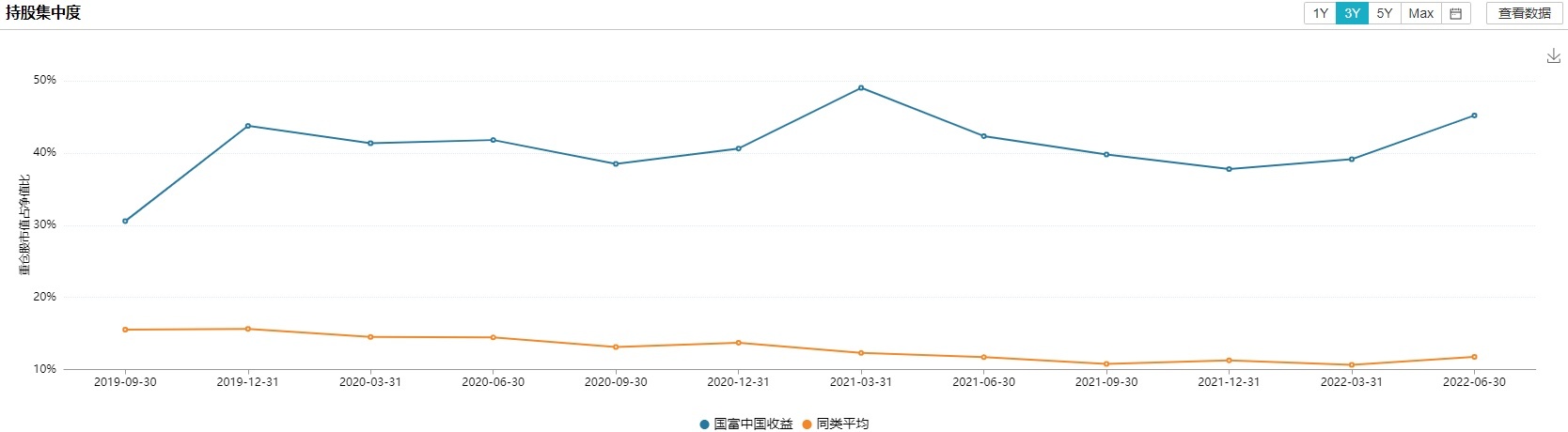

From the perspective of the concentration of shareholding, Xu Lirong's shareholding concentration has increased, from 39.13%to 45.20%, which also reflects Xu Lirong's more confidence in the market in the second half of the year.

From the perspective of the overall management of the management fund industry, the central report shows that according to the net value ratio arrangement (60.78%); the financial industry (15.74%); information transmission, software and information technology (2.45%); leasing and business services Industry (2.39%); and transportation, warehousing and postal industry (1.74%). It can be seen that the manufacturing industry is an absolutely leading proportion.

In terms of individual stocks, the largest heavy positions in controlling the five products are Zhuoshengwei of the semiconductor industry, and for the first time, the new energy industry's Longji Green Energy and Mai are in the state of stocks. The Oriental wealth of the financial industry has been reduced compared to the previous issue. It can be seen that Xu Lirong is optimistic about the subsequent market space of semiconductor and new energy industry.

From the perspective of Xu Lirong's largest representative fund products, the top ten heavy stocks shares, according to the proportion of the market value, the shares of Zhuo Shengwei, Mai Mai, Longji Green Energy, Ningbo Bank, Xinhecheng, Feike Electric, Satellite Chemistry, Oriental, Oriental Wealth, Chenguang, China Merchants Bank.

Among them, Zhuo Shengwei entered the top ten heavy stocks for the first time, and the market value of holding positions was far ahead, which belongs to the semiconductor industry. Mai is a shares and Longji Green Energy belongs to the new energy industry, both in a position. China Merchants Bank, Longji Green Energy, and Bank of Ningbo are the largest number of heavy positions, all of which have exceeded 15 periods. It can be seen that Xu Lirong has a long shareholding cycle and a significant characteristics of the low turnover rate.

Let's look at Xu Lirong's top ten heavy stocks representing the products. The 2022 interim report showed that Xu Li Rong had significantly increased the Oriental Wealth, Longji Green Energy, and Satellite Chemistry. In addition, the Hong Kong stocks Meituan entered the top ten heavy stocks for the first time. Although Hong Kong stocks were the largest heavy positions, the number of holdings in the previous period was not increased. At the same time, the number of shares of Hong Kong stocks Tencent was the same as that of the previous period. It can be seen that Xu Lirong, who has an international investment horizon, does not diminish Hong Kong stocks, but at the same time adds a caution.

The "sweet inflection point" has now appeared in the market or entered a better layout period

Xu Lirong once said: "Investment is a combination of art and science. Fund managers should find balanced and flexible, protect the good ability circle, and continue to learn and progress."

Xu Lirong's positioning strategy is mainly based on large -scale growth stocks and large -scale value stocks, which are less involved in small -cap stocks. He is mainly based on Growth AtResonable Price and pursues "growth under reasonable valuation." In the specific stock selection, Xu Lirong mainly looked at the following three aspects: the first is the company's management. Xu Lirong mainly establishes awareness of management through many aspects of management, employees, competitors, and other aspects, and he will pay attention to the management point and focus of management. Pay attention to whether the interests of management are consistent with the interests of investors.

The second is the company's growth space and development potential. Xu Lirong does not value whether the company is in the industry or unpopular, but whether the company's growth space and development potential is enough to be what he cares about.

The third is the risk ratio of income. In the future, the possible decline in stock prices will be far less than possible, and the balance of industry, market value, and stock price trends will be focused on Xu Lirong's focus.

In the second quarter report, Xu Lirong said, "The main driving force of market retreat since this year is the return on the average value of growth companies after the valuation has increased significantly. At the same time, the changes in the domestic and international economic situation are superimposed. In the long -term rising channel of raising. "

Looking forward to the market outlook, Xu Lirong insisted that China's stock market has gradually entered the bull stocks to lead the bull market, which is a new stage where excellent companies lead the market. "In the past, our market volume was small, but the economy developed to the present stage, and more and more industries entered the 'sweet inflection point'. Many high -quality leading companies rely on good brand appeal and stable and reliable quality. The price war can increase the return on net assets and enter the stage of accelerated market share. Such companies have continuously emerged from various fields in recent years, which will become the mainstay of the market. "

In terms of operation, Xu Lirong said that in the future, the proportion of investors in the future and the continuous inflow of long -term funds, the market's overall steady rising long -term trend will not change. Various types of fluctuations can provide a higher -income risk -based stock selection opportunity. Xu Li Rong's inverse inversion of the bottom -up stock selection idea also makes full use of the opportunity to decline significantly in growth stocks. The low -end warehouse also operates some of the companies with good excess returns. The overall fund combination still maintains a relatively balanced structure.

Xu Lirong believes that it is now a relatively suitable base area, but everyone needs to lower the rate of return. The macro environment is mapped to the stock market. It takes a certain amount of time. Therefore, due to the increase in risk premium, the expected return may decline. In addition, the secondary market is no longer a general situation, and it will show more structured markets.

(Note: If there is no special indication of the chart data in this article, it comes from Zhijun Technology and Wind data)

Risk reminder: The fund has risks, and investment needs to be cautious. Fund's past performance does not indicate its future performance. Fund research and analysis do not constitute investment consulting or consulting services, nor does it constitute any substantial investment suggestions or commitments to readers or investors. Please read the "Fund Contract", "Recruitment Manual" and related announcements carefully.

- END -

Shaanxi food companies gathered again to sing Shaanxi flavor prefabricated dishes

On July 22, with the theme of Food Enterprises Cultivating Shaanxi Food Pre -produ...

Notice on the organization and development of national quality benchmarks in 2022

Each city (including Dingzhou, Xinji City) Industry and Information Technology Bur...