"Finance and Economics" Chen Daofu: The key market expected to effectively reverse the weaker market is in real estate and local debt

Author:Chang'an Street Reading Club Time:2022.07.26

Chen Daofu: Effectively reversing the weaker market expectation is the key in real estate and local debt

Finance

★★★★★

2022 is the year of the Chinese government. Based on past experience, this annual economic growth is often strong. However, in 2022, it is obviously different from that in the past. All sectors of society have not had high expectations of my country's economic growth in 2022, and even more worried. It is currently in the "unscrupulous change of a century", the international situation is complex and severe, the undercurrent surging is closely related to our country. In addition, the factors that affect the economic operation in 2022 are more complicated, showing more obvious differentiation, non -linearity and structural nature Features, lack of insights provided by theory and history, are not easy to accurately predict. There are factors that affect market expectations in the domestic economic field alone.

First, economic differentiation makes the market difficult to form consensus. After the epidemic impact, the global and my country's economic "K" recovery, different industries, different industries in different areas, upstream and downstream, different sizes and ownership companies "ice and fire". CPI and PPI scissors have reached a record high, which not only reflects the different economic environment of upper and middle -down enterprises, but also exacerbates economic differentiation. Macro data based on "overall" and "average" and micro feelings based on "industry" and "individuals" are huge. Micro feelings in different fields are different, and the market is difficult to form consensus.

The second is different judgments on the nature and severity of the adjustment of real estate and local debt. Real estate and local government debt are the two highly related "gray rhinos" risks in China. The real estate market in my country began to be adjusted significantly in the third quarter of 2021, and the sales, development investment and land purchase indicators were comprehensive and significant. my country's real estate industry has distinctive regional characteristics. The scale of new housing transactions is large and highly related to the macroeconomic. It has the characteristics of the financial industry. It is expected and cash to play a key role in it. There is a strong mechanism for self -reinforcement. Recently, the number of land auctions has increased, land revenue has declined, and state -owned enterprises and local financing platforms in some areas have become the main body of land purchase. In addition, the central government has increased the hidden debt of local governments, and the market has begun to worry about the sustainability of local government debt.

The previous regulation of real estate in my country will change the scale and rate of flowing into the real estate industry's funds, but it is still net inflow, reflecting the stability of the real estate industry itself. However, this time the net flow of real estate funds has emerged. The adjustment of real estate is a temporary adjustment caused by the failure of policy implementation, or will it cause a certain degree of structural adjustment? Recently, the price of the second -hand housing market has been rebounded under the policy stimulus, but the new house and the land market are still sluggish. It has occupied nearly 75%of private housing companies in the land auction market difficulty in operating difficulties. The market has closely observed high -frequency data released by different regions and listed companies, paying attention to the adjustment of real estate -related policies, and has different cognition and judgment.

Third, the policy understanding of "common prosperity" and "disorderly expansion of capital" and other long -term goals are still unclear, and there are still certain misunderstandings. These major and long -term major propositions lack detailed goals, paths, and even lack of theoretical explanations, and it is difficult to form a unified consensus. Different departments and different groups have different understanding. The Central Economic Work Conference clearly put forward the need to "stabilize the word" and "steady progress", and re -refill the "centered on economic construction" to achieve steady improvement and reasonable growth of economic growth. However, due to the weakening of the hard constraints of the number of economic growth in recent years, the market is anxious before confirmation.

Whether the stable policy is sufficient and sustainable is the focus of market attention. There are different judgments to the nature and strength of this round of economy, and there will be different requirements for the intensity and duration of stable policies. If the market is worried that although the monetary policy is loose in advance, if the currency credit data has reached a new high, will it recover and turn to neutrality? Another example is whether fiscal expenditure is sufficient to stimulate investment such as infrastructure and other investment with possible real estate investment, whether the estimation of fiscal expenditure multiplication is accurate, and considering the changes in the economic environment and operating mechanism? In particular, due to the limited project limited projects and the decline in land revenue, and resolutely curbing hidden debt policies, what are the willingness, financial resources and project support infrastructure investment to grow high? Considering the particularity of 2022, as much as possible without a tightening effect, will it be accelerated after 2022?

There are different evaluations of policy effects. The high -quality growth, the new development pattern of dual -cycle, and the supply -side structural reform have profoundly affected my country's economic operation mechanism, market structure and micro -subject behavior characteristics. The policy effects of the same policy are large, and the model parameters and policy multiplications are unstable. In recent years, the mistakes in policy implementation have also affected the market's judgment of policy effectiveness.

There are still two dilemma in the macro regulation in 2022. The first is to face long -term goals, short -term economic regulation and risk disposal. These three have different logic, which is essentially to balance the relationship between "reform, development and stability". For macro -control, it is to distinguish between normal environment, transformation and change period, and crisis period, adhere to different concepts of control, and adopt different regulatory frameworks to ensure reasonable connection.

Secondly, there are many dilemmas in demand regulation. Such as monetary policy, in the expected weak environment, the monetary policy is "easy to pull and difficult." Monetary policy should also be cope with "supply impact" and "demand contraction". The former requires the stability of monetary policy or even shrinking when necessary, and the latter requires loose monetary policy. The United States is managed by continuous "shouting", and through "speaking more and less", "small steps slowly" to achieve balance, after financial assistance, etc., after the demand is hot, the monetary policy plan accelerates the rate hikes. my country also pays attention to expected management, but has to use structural tool balance with certain fiscal functions. At the same time, under the framework of grain, energy, and important raw materials, it "guarantees stable prices" through administrative, quantity and price. In addition, the current China -US economic cycle and policy selection are different. Fund flow, etc. Monetary policy is also deeply influenced by industries such as real estate and local governments. Industry supervision strengthened the restrictions of micro -subjects to avoid currency looseness caused by bubbles, but also affects the ability of credit creation. It is necessary to avoid the "credit collapse". Another example is fiscal policy, which must not only achieve short -term "effective", but also ensure long -term sustainability, but also face the fund gap caused by land revenue decline, and has to emphasize accuracy and structuralness.

Policy effectiveness also faces the challenge of changes in economic operation mechanisms and micro -subject behavior models. There are always some presets for economic regulation, such as potential growth, economic internal elasticity, and characteristics of micro -subject behavior. However, the market environment and incentive constraint mechanisms of the micro -subject have changed, and the behavior mode has also changed profoundly. These all affect the policy of the policy, change the parameters of the macro model, and make the regulatory effect uncertain.

In 2022, the difficulty of my country's macro regulation is how to effectively reverse the weaker market expectations. The issue of real estate and local debt is the key. It is recommended to clarify and implement a sufficient scale of affordable housing as soon as possible, and accelerate the supply of land in first- and second -tier cities based on the reasonable meetings of real estate credit demand policies. On the basis of resolutely curbing the hidden debt of local governments, the reasonable replacement of existing debt can be explored.

The key to stabilizing the demand side is to stabilize the real estate market and increase infrastructure and high -tech industrial investment hedging. Exports are the biggest highlights of economic growth in 2021. There will still be a certain amount of sustainability in 2022, but from the perspective of incremental perspective, it cannot be reported to greater expectations. The real estate market is still under adjustment, and it will further drag consumption and investment growth. Therefore, the necessary growth rate of fixed asset investment in 2022 depends on the growth rate of infrastructure investment and the high growth rate of high -tech manufacturing investment.

Chen Daofu: Member of Chang'an Street Reading Club and Deputy Director of the Financial Institute of the Development Research Center of the State Council

"107_29221773", "biz_uin": "3002294955", "SKU_ID": "107_29221773", "Source_id": 7, "Source_name": "Dangdang", "AUDIT_STATE": 1, "Main_img": "https: // img".zhls.qq.com/330A0C365A2143D0AF5F458CF4A6A27b.jpg "," Product_name ":" Selection of Party Style and Clean Government Construction and Anti -Corruption Regulations "," Current_price ": 67530," first_category_id ":" 0 "," APPUIN "" APPUIN ": APPUIN" APPUIN ": APPUIN" APPUIN ": APPUIN" APPUIN ": APPUIN" APPUIN ": APPUIN" APPUIN ": APPUIN" APPUIN ": APPUIN" APPUIN "APPUIN" APPUIN "APPUIN" APPUIN3002294955 "," Isnewcpskol ": 1" /> For more exciting, please click on

New Book Recommend Chang'an Street Reading Club No. 20220707 Cadres to Learn the New Book List

Chang'an Street Good Book Changan Street Reading Club Annual Recommended Cadre Learning Book List (Classic, Popular Articles)

- END -

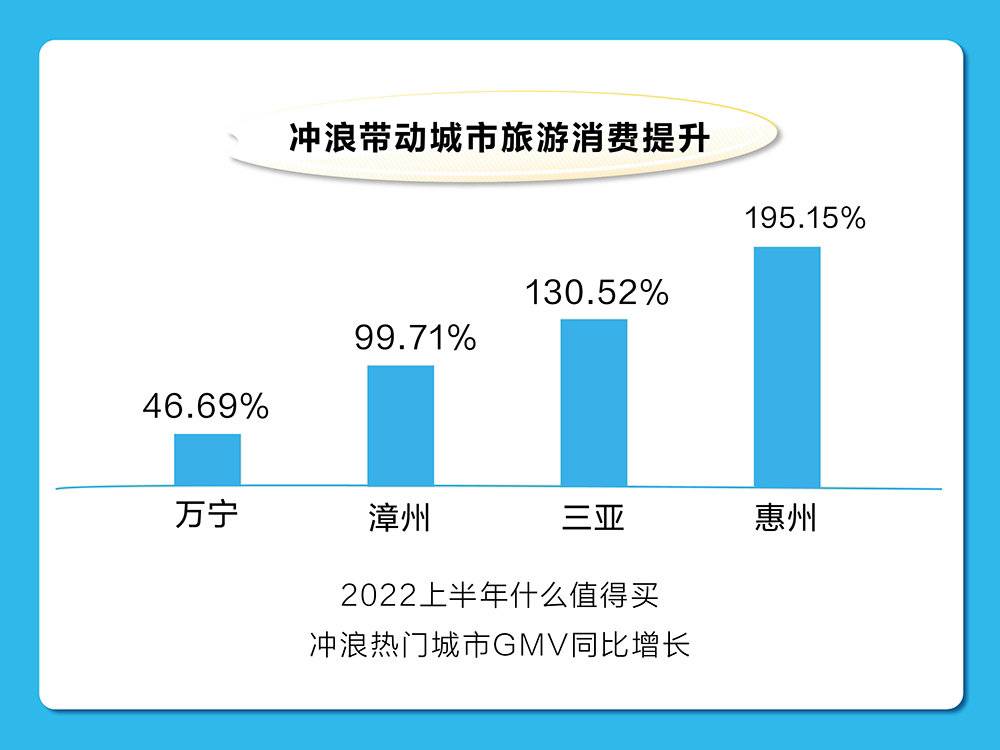

New consumption observation 丨 domestic surfing boom gradually starts, and the field of rinse consumers is still in its infancy

Cover reporter Wu YujiaIn the past, there was a wave of national movement in the W...

New Gongtong Biological Reagent Industrial Club is officially put into use in the Binjiang Development Zone

On June 30, the new Gongtong Biological Reagation Industry Gathering Zone's major ...