The bank encountered "serial fraud loan" and lost a total of 800 million yuan!

Author:Science and Technology Finance Time:2022.07.26

After fabricating the audit report, the "benefits" of more than 100,000 yuan were charged. As a result, the auditor was involved in a fraud case involving 800 million yuan, and he was sentenced to this.

On July 20, the Beijing Court Judgment Information Network disclosed a first -instance criminal verdict document, revealing the document of the registered accountant to make a false audit report, and issued a formal audit report through a long -term cooperation accounting firm for relevant enterprises to pick up the bank to the bank. The process of loan.

Xiao Mou, a registered accountant who fabricated a full set of audit documents for the three companies, only received more than 100,000 yuan, and the Accounting Institute made only 3300 yuan, but caused an economic loss of over 800 million yuan to the bank.

In the end, Zhang Moujun, the person in charge of the Accounting Institute, was sentenced to one year and eight months in prison for one year.

Profit 3300 yuan Accounting Institute issued false audit reports

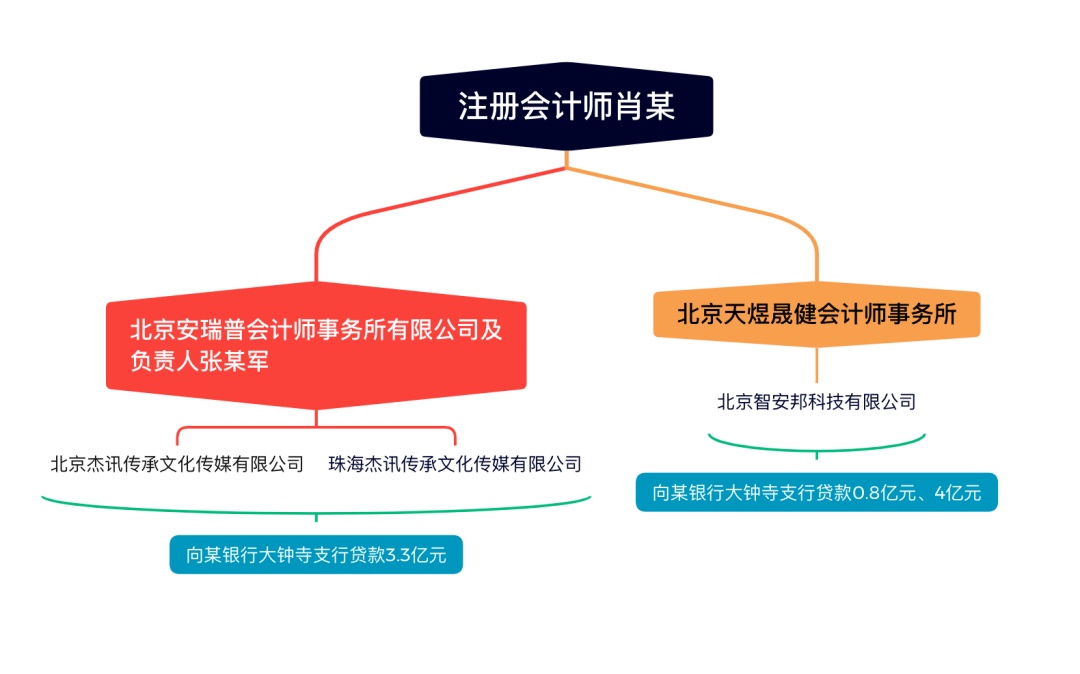

The case occurred in 2019 and the incident was issued in mid -2021. As the main criminal, Xiao Mou, a registered accountant, operated a accounting firm established in 2019, Beijing Tianyu Shengjian Accounting Firm (ordinary partnership) (hereinafter referred to as "Beijing Tianyu"). Fame partners, holding a shareholding ratio 8: 2.

Xiao Mou and another in the 2004 accountant firm, Beijing Anrup Accounting Firm (hereinafter referred to as "Anrup"), have long -term cooperation. The person in charge of the institute is Zhang Moujun. AnRup's registered capital is 500,000 yuan. There are 9 registered accountants registered in the China Note Association, 5 partners, and 20 employees. In contrast, Anrup appears more formal, and it is not difficult to understand that Xiao's "long -term cooperative relationship".

After hearing the court, it was found that in May 2019, Xiao made a false draft of the audit report of 2017 to 2018 in Fangshan District, Beijing, and Zhuhai Jiexun Inheritance Culture Media Co., Ltd. Rup issued a formal audit report.

Subsequently, the defendant Anrup Company and the defendant Zhang Moujun directly issued the 2017 to 2018 audit report for Beijing Jiexun and Zhuhai Jiexun without fulfilling any audit duties.

Coincidentally, in August 2019, Xiao made a false Beijing Zhi Anbang Technology Co., Ltd. from 2016 to 2018, and issued a formal audit report in the name of Beijing Tianyu Shengjian Accounting Firm.

In October 2019, Xiao Mou once again fabricated the fake Zhianbang Company's 2016 to 2018 audit report, and asked Anrup to issue a formal audit report. Similarly, Anrup and Zhang Moujun directly issued the 2016 to 2018 audit report for Beijing Zhianbang without fulfilling any audit duties.

Under the "one operation", Xiao Mou made a total of 109,000 yuan in profit, while the Profit of two false audit reports issued by the Anrup Accounting Institute was only 3,300 yuan.

Corporate defrauding loan banks directly lost more than 800 million yuan

The false audit report produced by Xiao and Anrup Accounting has brought major losses to the bank.

Why does the false audit report come? Naturally, it is used by enterprises to loans from banks. Among them, the 2017-2018 audit report issued by the Xiao Mou and Anrup Accounting Institute was a 2017-2018 audit report issued by Zhuhai Jiexun.

Two 2016-2018 audit report issued for Zhi'an Bang was also used to loans of 80 million yuan and 400 million yuan from a bank Dazhong Temple Sub-branch. The aforementioned loans are unable to recover.

A decision of a financial loan contract dispute by the bank Dalzhong Temple and Beijing Jiexun obtained by Xiaobian showed that in May 2019, the bank provided 330 million yuan to Beijing Jiexun, with a loan period of 1 year Zhuhai Jiexun and Beijing Jiexun's legal representative Li Mou provided joint liability guarantees, and there were 7 house mortgages.

After the loan was issued, Beijing Jiexun did not pay the corresponding interest as agreed. In April 2020, the Bank of Dazhong Temple Sub -branch announced that the loan expired in advance and asked Beijing Jiexun to pay the debt immediately, but all parties have not fulfilled the principal and interest obligations. During the trial, Beijing Jiexun, Zhuhai Jiexun and many guarantees did not appear in court and defense. Although the bank's Dazhong Temple Sub -branch finally won the lawsuit, the defendant who did not occur often meant that the subsequent execution was not smooth and there may still be losses.

Why are there always a few false audit reports that are always "damage". The above -mentioned bank Dazhong Temple Sub -branch has not been answered in this question judgment, but the above banks have indeed become the victims of the case.

According to the charges of the procuratorate, Xiao Mou's false audit report caused a direct economic loss of more than 800 million yuan to the bank. The false audit report issued by Anrup caused the bank to a direct economic loss of more than 700 million yuan.

Certified Public Accountants+Accounting Institute Both were sentenced

In June 2021, Xiao Mou and Zhang Moujun were summoned by the public security organs to the case, and eventually the east windows issued.

The public prosecution agency pointed out that the defendant Xiao, as an intermediary who assumed the duties of the audit, deliberately provided false certification documents. The circumstances were serious and should be held criminally responsible for providing false certification documents. As an intermediary party who assumes the duties of audit, it is seriously irresponsible. The certification documents issued are significant and cause serious consequences. They should be held criminally responsible for issuing a document significant disappointment and shall be submitted to the court to deal with it in accordance with the law.

Xiao Mou and Zhang Moujun did not objection to the accusations of the public prosecutor's organs, and both expressed their convictions and punishment. In addition to the confession of Anptarian accounting, he did not know that the use of the audit report was issued by the trusted report of Xiao Mou, who had long -term cooperation. The litigation agent of the victims proposed that Xiao Mou's behavior constituted a criminal criminal criminal criminal liability for the crime of fraud, and should not respond to Xiao Mou's probation; criminal responsibility.

The Fangshan District Court of Beijing believes that the public prosecution authorities have accused the defendant Xiao Mou's crime of providing false certification documents, the accusation of the defendant Anrup Accounting Institute and the defendant Zhang Moumou issued the fact that the document was issued with a clear guilty of the law. The charges were established and the court supported.

In addition, because the two were summoned by the police call automatically, after the case, they confessed their main criminal facts, surrendered, and voluntarily pleaded guilty. It is punished from light penalties and eliminates probation. Before the public security organs of the public security organs of the Anpry Accounting, the public security organs actively cooperated with the public security organs to investigate and provide relevant evidence materials. They surrendered and punished them lightly.

In the end, the court's judgment was as follows:

First, the defendant Xiao Mou provided the crime of providing false certification documents, sentenced to one year in prison, one year of probation, and fined 50,000 yuan.

2. The defendant's Beijing Anrup Accounting Firm owner's limited company committed the document of the document of the document and was sentenced to 20,000 yuan.

Third, the defendant Zhang Moufeng's commitment to the document was seriously false, sentenced to 8 months in prison, one year of probation, and a fine of 5,000 yuan.

Fourth, the defendant Xiao Mou recovered 109,000 yuan in crimes, recovered 3,300 yuan of criminal income to the defendant's Beijing Anrup Accounting Firm, all confiscated and paid the state treasury.

Fifth, one notebook computer and two mobile phones transferred with the case are confiscated.

Source: Daily Economic News, the layout belongs to the original author.

- END -

Foreign media: Sri Lanka Central Bank's interest rate hikes 100 basis points to respond to inflation

Zhongxin Jingwei, July 7th. Singapore's Lianhe Zaobao reported that the Sri Lankan central bank raised the loan interest rate of 100 basis to 15.5%on the 7th.Due to the rise in prices, Sri Lank cart...

Heilongjiang Jiamusi City: Hold the "Aishang Sanjiang" cooking contest

On the morning of July 8th, the fragrance of food in the air in the commercial str...