The funds of the animal husbandry company have a lot of pressure on funds, and the "financial village official" on -site service promotes 80 million yuan loan

Author:Changjiang Daily Time:2022.06.16

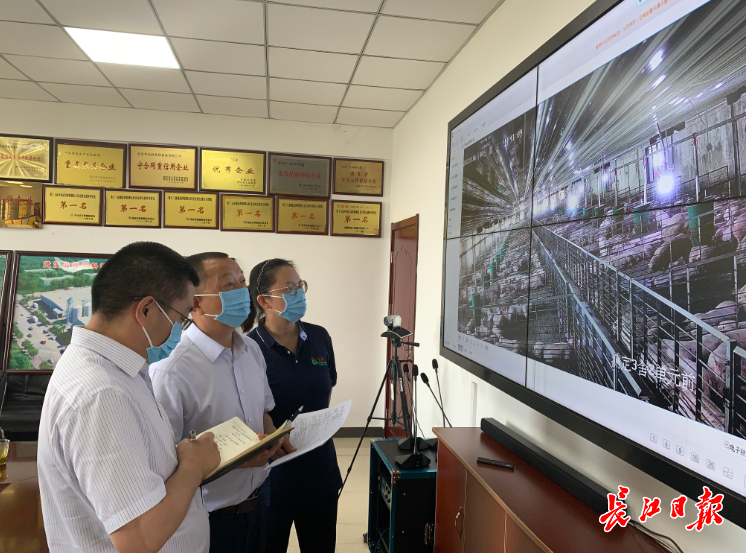

"You see, the tens of thousands of pigs and pigs in our base are now growing up. Thanks to your timely issuing loans, we have solved us the urgent urgent." On June 10, the third of the Wuhan Rural Commercial Bank of Wuhan Rural Commercial Bank of Jiangxia Sub -branch Wang Shengli, Secretary of the Party Branch, and the relevant person in charge of the Seventh Inspection Team of the Municipal Party Committee, Lin Wanqing, the person in charge of Hubei Jinlin Original Animal Husbandry Co., Ltd. enthusiastically introduced the production and operation of the enterprise. A group of pigs and pigs are eating cheerfully.

"Financial Village Officer" Wang Shengli (first from left) entered the enterprise to visit the production and operation, and sent financial services to the door. Reporter Tan Delei Photo

Things must start with the rectification of non -performing loans from Wuhan Rural Commercial Banks. This year, the seventh inspection team of the Municipal Party Committee carried out the inspection and feedback of the Municipal Party Committee's inspection and feedback on the inspection and supervision of the inspection and feedback of the municipal party committee, and promoted a number of rectifications involving people's livelihood and optimizing the business environment. By the end of April this year, the bank's non -performing loan rate dropped to a reasonable range, and through problems rectification, implementation of each bailout loan, and the main bank of agriculture, rural areas, and rural areas. In May, in accordance with the city's party members and cadres at the grassroots level to observe the people's affairs to relieve the people's worries about the people's hearts, the bank's Jiangxia Branch arranged more than 30 "financial village officials" to enter the village to understand the recent production and operation status and capital needs of enterprises and farmers in their jurisdictions.

Hubei Jinlin Original Animal Husbandry Co., Ltd., which is located in Yanghu Village, Wulongquan Street, Jiangxia District, is a science and technology environmentally friendly modern agricultural enterprise. "Laulin, what is the recent production status of the base, and is there any financial pressure?" As a "financial village official" who contacted the company, Wang Shengli, head of the business room of Jiangxia Sub -branch, visited the company. "You come here just! I am going to find you for help." Lin Wanqing took his fingers to give him a account: In the first half of the year, he was affected by the fluctuation of the price of pig products in the first half of the year. The company's monthly sales fell by about 16%, resulting in a decrease in cash flow. What matters worse is that the price of feed such as corn, soybean meal has risen by about 8%, and the increase in pig epidemic prevention costs increases, and the monthly comprehensive calculation funds gap reached 3 million yuan.

After understanding the difficulties of corporate funds, Wang Shengli reported the situation to Jiangxia Sub -branch as soon as possible. Subsequently, under the guidance of bank staff, the enterprise reported to the capital needs in a timely manner and submitted loan application materials. The bank opened the green channel, simplified process procedures, arranged special personnel docking, tracking services, and the business departments of the front and backstage jointly investigated, coupled with review of relevant information, and approved the mortgage loan procedures in a timely manner.

Wang Shengli entered the enterprise to visit the production and operation, and sent financial services to the door. Reporter Tan Delei Photo

"In order to help the enterprise get the loan as soon as possible, the bank staff does not rest on weekends, and help us to review the information overtime, which makes us very moved." The company's relevant financial staff said that from the application to the issuing loan, it was done in about two weeks. In order to reduce the cost of enterprises, banks actively reduce loan interest rates, which can reduce loan interest for more than 1.1 million yuan each year.

In early June, the enterprise successfully applied for 80 million yuan for bailout loans, and the loan has been issued in place. "With this money, we have greatly eased the pressure of funds in product research and development, improvement of breeding pig varieties, buying raw materials, and new feed factories." Lin Wanqing said happily.

"We chose 150 'Financial Village Officers' sinking to 1738 villages to allow funds, products, and policies to directly reach enterprises and farmers, and use financial services to help rural revitalization." Relevant person in charge of Wuhan Rural Commercial Bank said that he was inspected by the seventh inspection of the Municipal Party Committee Under the supervision of the group, in accordance with the relevant requirements of the Municipal Party Committee's inspection and feedback, the bank, on the premise of preventing financial risks, systematically promoted the "financial village official+whole village credit+state -owned enterprise joint village" model, sent financial support to enter the village, sent financial services to financial services On the door, the city's credit was fully covered. Since the beginning of this year, the bank has widely promoted the small credit of farmers and carried out "code scanning financing" to provide financial services for key agricultural industrial chains, new rural business entities and rural infrastructure construction. The newly issued agricultural loan was 3.684 billion yuan.

(Changjiang Daily reporter Tan Delei Correspondent Ji Zilian Kuan)

[Edit: Hou Fangyu]

For more exciting content, please download the "Da Wuhan" client in the major application markets.

- END -

Lintong: 15,000 acres of blueberries welcome the bumper harvest!

Qilu.com · Lightning News June 19th News In June, more than 15,000 acres of blueberries in Daxing Town, Lintong County entered the fruit period. In order to have a good harvest of fruit farmers this

Realize quality and efficiency in serving the county economy

Realize quality and efficiency in serving the county economyMo JiangfuLooking back...