Xingyuan material: reduced funds to 3.5 billion, accounts receivable accounted for over 169%

Author:Flower finance Time:2022.07.28

Flower Finance Original

There is a kind of reversal called dilemma reversal, and there is a strategy called Davis double -click.

With the explosion of the new energy industry chain, the above two situations happened to the body of Xingyuan material. With the lithium -ion battery separation film, the material of Xingyuan made a lot of money.

According to the semi-annual preview of 2022, the company's net profit attributable to mothers was about 365 million yuan to 385 million yuan, a year-on-year increase of 227.05%-244.97%.

This is since the reversal of performance in the second half of 2020, Xingyuan's material has been in high -growth trend for multiple consecutive periods.

Thanks to this, the shareholders of Xingyuan materials have not rarely made money from it. According to statistics, since the second half of 2020, the stock price of Xingyuan's material has risen by about 270%, and shareholders have continued to reduce their holdings during the period.

The stock price of the stock price is high, and the material of Xingyuan has also thrown a huge increase in issuance, raising approximately 3.5 billion yuan.

However, whether Xingyuan material can rely on this huge amount, the game's style, and the higher performance level, at present, there are still a lot of doubts.

Fixed increase raised funds to fall

Since the end of September last year, a fixed increase plan was proposed.

On September 27, 2021, the company passed the "Proposal on the issuance of A -share stock plans to specific objects in 2021", and the total amount of funds planned to raise was not more than 6 billion yuan.

Among them, high -performance lithium -ion battery wet diaphragm and coating diaphragm (phase first, second phase) project intends to invest 5 billion yuan with the raised funds, and 1 billion yuan will be used to supplement mobile funds.

In the end, the company also stated that in combination with the changes in the market environment and the actual situation of the company, the scale of raising funds raised to specific objects to specific objects was adjusted to no more than 3.5 billion yuan.

High -performance lithium -ion battery wet diaphragm and coating diaphragm (phase first, second phase) project intends to be adjusted by 2.917 billion yuan after the amount of investment raised funds, and 583 million yuan after the adjustment of mobile funds.

In the face of such a large reduction of raising funds, it is worth noting that because of the high funding of raising funds, Xingyuan material has encountered multiple rounds of supervision inquiries.

The regulatory authorities have pointed out that the company's proposed financing scale has been higher than the issuer's recent issue of the equity of shareholders of the parent company 4.176 billion. As of September 30, 2021, the net assets of Xingyuan Materials were 4.294 billion yuan.

According to the information previously disclosed by Xingyuan material, from January to July 2021, the capacity utilization rate of the company's wet coating diaphragm was 99.08%, 99.18%, 63.59%, and 43.73%, respectively.

Facing the sharp decline in capacity utilization, Xingyuan material has once again sacrificed the banner of expanding production. Whether the company can digest the expansion production capacity in the future is obviously more doubtful.

Accounts receivable account for sales ratio exceeding percentage

At this stage, the competitiveness of the products of Xingyuan materials in the market seems to have insufficiency.

Official information shows that the lithium -ion battery diaphragm produced by the company mainly includes dry diaphragm, wet diaphragm, and coating diaphragm based on coating processing on the basis of dry and wet diaphragm. Essence

As of the end of 2021, the company's cadre market share was 21%, ranking second in the industry; the wet market share was 12%, ranking third in the industry. In the field of wet diaphragm, there is a lot of gaps compared to the 57%market share of Enjie.

The market share is far behind competitors, and the gross profit margin of Xingyuan material is relatively low. In 2021, the gross profit margin of Enjie was 49.86%, and the sales gross profit margin of Xingyuan material was only 37.8%.

From the perspective of the sales side, the accounts receivable of Xingyuan material also account for a large proportion of sales revenue.

From 2020 to the first quarter of 2021, the amount of receivables and accounts receivables of various periods of Xingyuan Materials were 628 million yuan, 1.099 billion yuan, and 1.125 billion yuan, respectively, accounting for 64.95%and 59.09%of the company's sales percentage of each period. And 169.29%.

The underwriting of downstream companies is large, and Xingyuan Materials is not as strong as its upstream companies owed to their upstream suppliers.

From 2020 to the first quarter of 2021, the amount of bills payable and account payables of Xingyuan Materials were 656 million yuan, 530 million yuan, and 600 million yuan, respectively.

Management reduction action continues

Xingyuan material has also been brilliant.

In 2008, after a long technology research and development, the company had built two dry diaphragm production lines. This is the first diaphragm production line in the country. As a result, Xingyuan material has also become the first manufacturer with diaphragm production capacity.

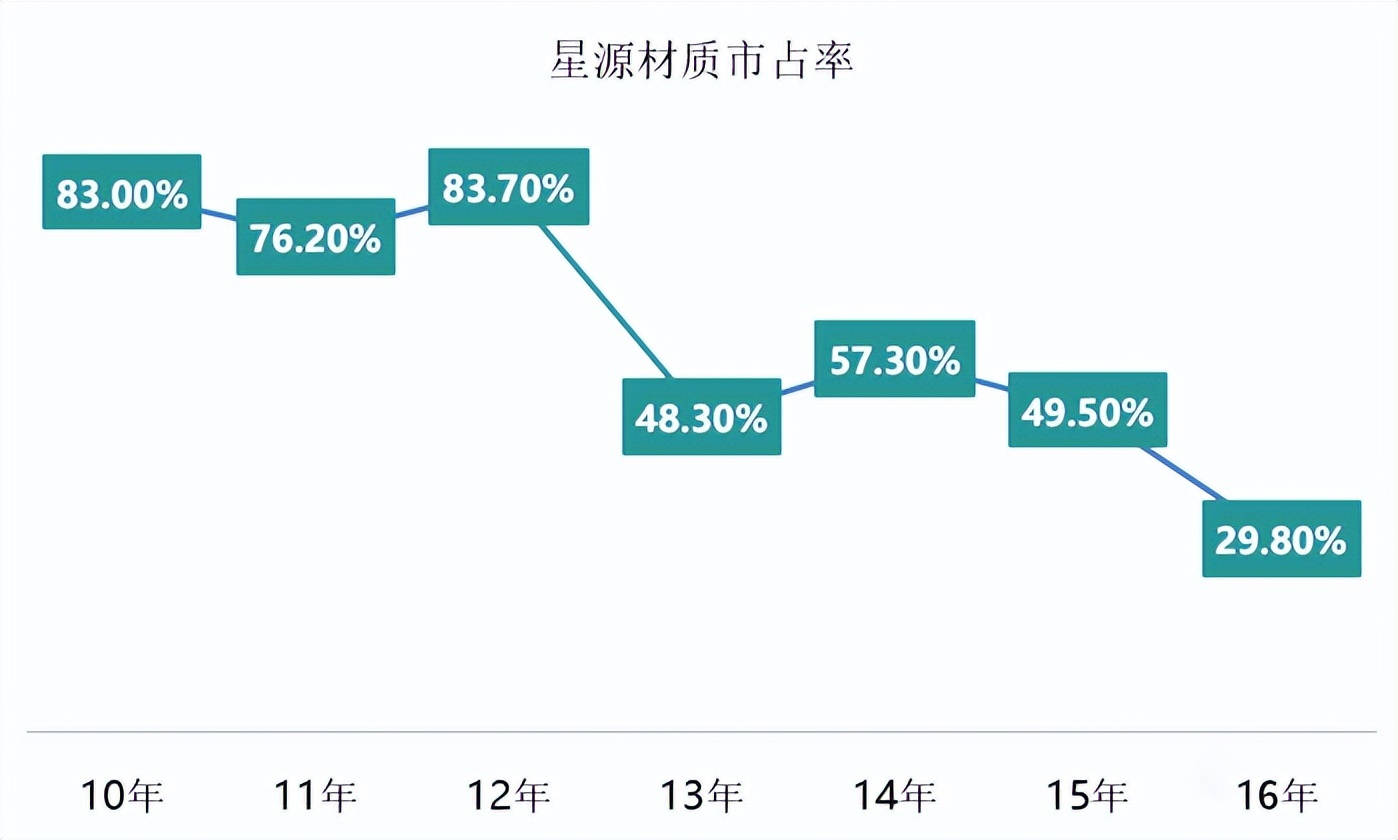

Later, the market share of Xingyuan Materials in the country was as high as 83%, ranking first in the industry.

However, this high market share has not been maintained for too long. Soon after a short time, the market share of Xingyuan material has severely declined. To this day, the company has not returned to the peak period of the past, even in the past The proud of the market share of the dry law can only win the second in the industry.

Relatively speaking, the thickness of the wet diaphragm is thinner, the pore diameter is smaller, and the pore rate is higher. It can effectively increase the energy density of the battery. In the early days of the development of power batteries, the battery life is higher. It has quickly become the first choice for lithium battery manufacturers, which is also the key to the defeat of Xingyuan.

Although Star source materials have benefited from the tide of lithium iron phosphate batteries, it is worth mentioning that during this period, the company's shareholders continued to reduce their holdings.According to statistics, from September 2021 to early 2022, the company's controlling shareholders, actual controller Chen Xiufeng and Chen Liang jointly reduced their holdings of over 17 million shares of the company, with a cumulative cash more than 800 million yuan.

In June 2022, the company issued an announcement on pre -disclosure of directors and senior managers. Directors and chief financial officer Wang Changhong and director Wang Yongguo planned to reduce the company's shares of not more than 257,300 shares and 64,400 shares.

Seeing that the company executives are constantly cash out at this moment, and I do n’t know how long the performance of Xingyuan material can last for this round of performance?Senior executives are constantly reducing holdings, and does it mean that managers are not optimistic about enterprises can go to the next level?

- END -

Lintong County, Linyi City, Wan Mu Qi Liu will get a bumper harvest again

Qilu.com · Lightning News, July 4th. On July 3rd, in the Qianchi Liuliu Planting ...

Reject cash!The maximum was fined 190,000 yuan!

The People's Bank of China announced on July 21 that in the second quarter of 2022...