The three major stock indexes of A shares have been closed collectively, and the travel, liquor and other sectors have been severely frustrated

Author:Zhongxin Jingwei Time:2022.07.29

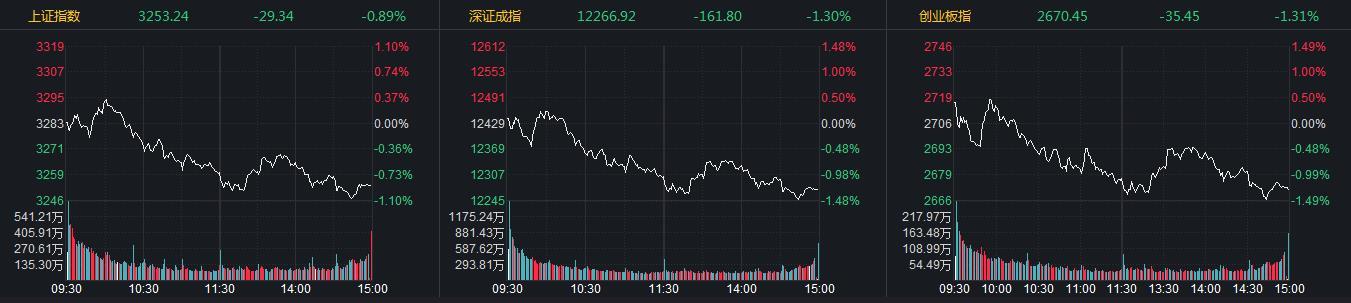

Zhongxin Jingwei, July 29th. On the 29th, the three major A -share stock indexes opened high and lowered, and fell again after the afternoon rose slightly. As of the close, the Shanghai Index fell 0.89%, the Shenzhen Stock Exchange Index fell 1.30%, and the GEM index fell 1.31%. The two cities fell over 3300 shares. This week, the Shanghai Index fell 0.51%, the Shenzhen Stock Exchange Index fell 1.03%, the GEM index fell 2.44%.

Source: Flush iFind

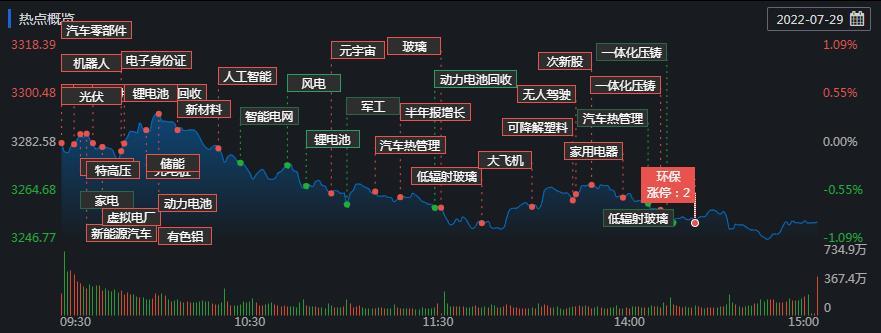

On the plate, agriculture, forestry, animal husbandry, fishing, fishing, automobiles, and mineral products have risen, and hotel catering, tourism, coal and other sectors have fallen first.

On July 29th, hot spots concept Source: Flush iFind

The entire vehicle stock stocks have strengthened again, Jianghuai Automobile rose more than 8%, and the daily limit was touched during the session; Xiaokang's shares rose more than 4%, Ankai Bus and Changan Automobile rose more than 3%.

The liquor stocks settled throughout the world, Gujing Gongjiu fell more than 7%, and the wine industry fell nearly 7%, and Guangyu fell more than 6%. Lao Baigan wine, alcoholic wine, Shuijingfang, Wuliangye, etc. fell sharply.

Tourism and airport sectors continue to fall, and tourism in the western region fell more than 7%. Tianmu Lake, Tongqing Building, Junting Hotel, Lijiang Co., Ltd. fell more than 5%. Over 6%, Air China, Shanghai Airport, and Southern Airlines fell more than 3%, Spring and Autumn Airlines fell.

CITIC Securities Research Report pointed out that the central bank and the Ministry of Culture and Tourism jointly issued a document to launch financial support measures for the cultural tourism industry. For the tourism industry with high operating leverage and the need to improve cash flow. The confidence is to further resume the creation of the demand side. The short -term epidemic has a relatively weakened impact. At the same time, it is in the summer season. The tourism industry has ushered in a significant year -on -month recovery. In the same period last year, especially after July, the base was low, and the year -on -year repair trend will continue to be strengthened. Policies to determine the rhythm of confidence and epidemic, the impact of the epidemic will eventually fade, reiterate the opportunity to seize the theme of the epidemic recovery, and actively configure it.

CITIC Construction Investment Securities Research reports that comprehensive consideration of comprehensive prosperity, valuation, and congestion, it is expected that in August or facing the stagflation stage after the rapid repair of high prosperity, the short -term market may have a certain high and low switching. Following three clues in August: First, the valuation is relatively low and the fundamental expectations are better: medical services/medical beauty (significant improvement in the margins), beer (looking forward to the performance of the peak season), tax exemption, military, green power, pig farming, Internet; It is a low -level defense focus on white electricity; the third is that the offensive choices are in the new direction of cars and new energy in the outbreak of penetration: integrated die -casting, automotive intelligence, new photovoltaic technology, and sea breeze. In addition, there are still prosperous new energy vehicles and photovoltaic in the fourth quarter that the expected expectations remain unchanged in the mid -term configuration. (Zhongxin Jingwei APP)

(The views in the article are for reference only, do not constitute investment suggestions, have risks in investment, and need to be cautious to enter the market.)

- END -

Dafeng District Agricultural and Rural Bureau Pu Hui Huimin played strong wind

Modern Express News (Correspondent Zhiyue Juan Wang Liyuan) Constructing a rural ...

The 25th anniversary of the return of the motherland in Hong Kong | The Champions League of the Executive Officer of the Hong Kong Stock Exchange is promoted: "One country, two systems" helps Hong Kong's financial industry growth

From the high -rise building (information picture) of the Hong Kong Island Central...