CICC ’s employees were exposed to 80,000 monthly salary by their wives.

Author:Peninsula Metropolis Daily Time:2022.07.30

Surging news, an employee of the domestic broker Zhongjin Company was suspended for investigation for the "salary" storm.

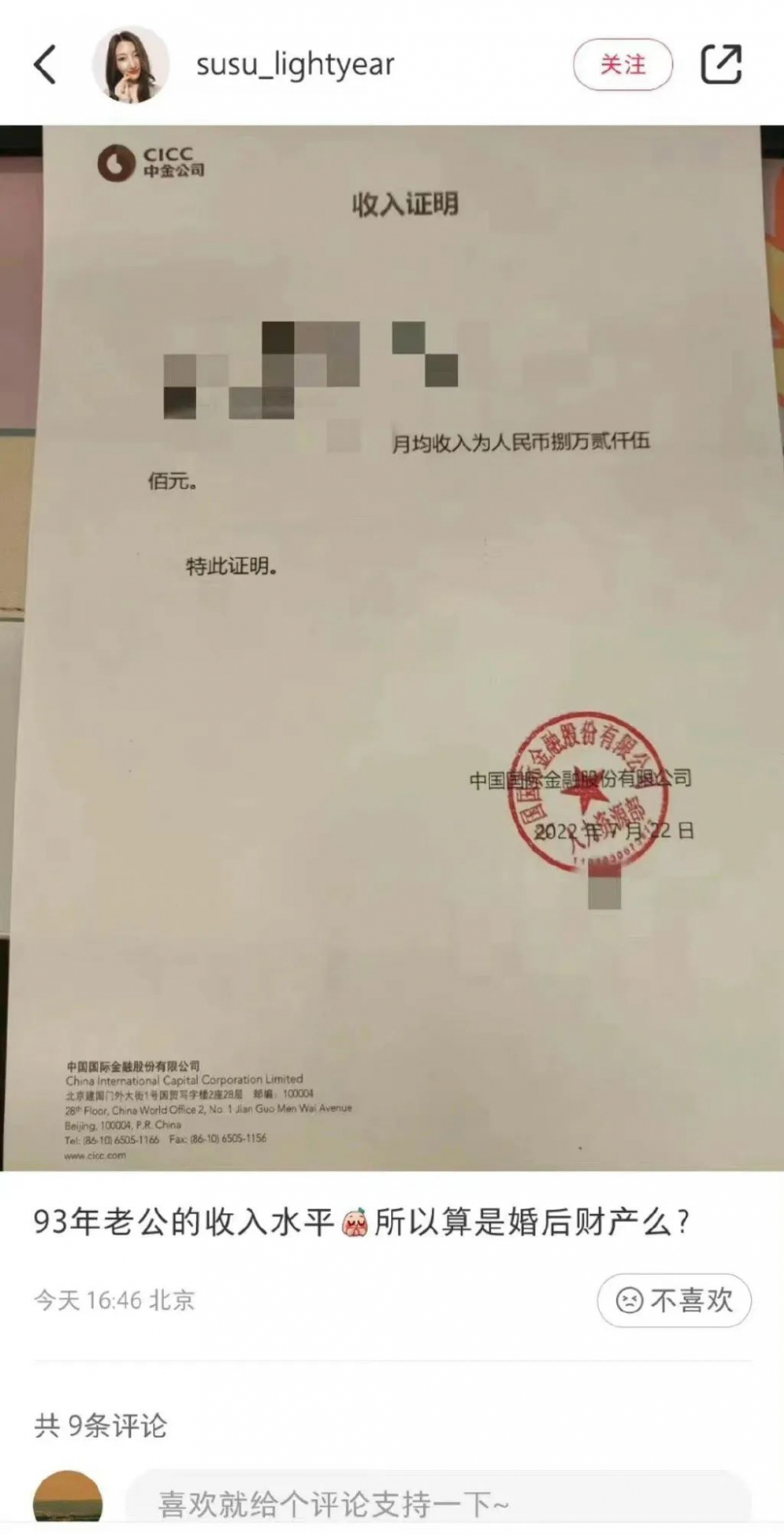

On July 28, the salary level of the employees of the securities firms appeared again on the hot search, causing widespread attention. The spouse of a trader at the Internet Corporation exposed the proof of his husband's income, and the certification material printed with the official seal of the CICC showed that the average monthly income of the trader was 82,500 yuan. The picture is called: "In 1993, my husband's income level, so is the property after marriage?"

In this regard, the relevant person in charge of CICC told the surging news reporter on July 29: "The incident has attracted attention from CICC, and employees involved are being suspended and investigated."

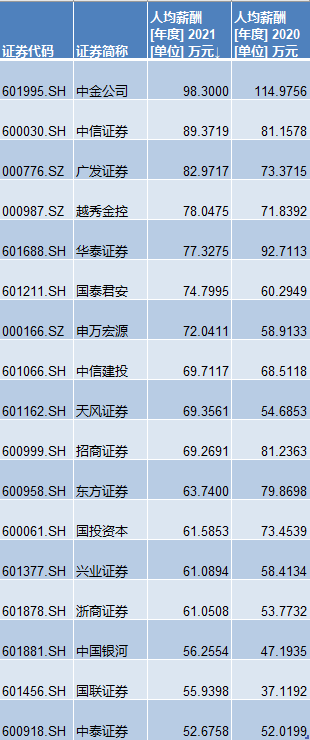

Wind data shows that in 2021, CICC ranked first with the first place of salary of 98.30 million yuan. However, the per capita salary level has declined compared to 1.1498 million yuan in 2020.

In fact, on May 13, the salary system of the securities firm just ushered in further standardization. The China Securities Industry Association (referred to as the "China Securities Association") issued the "Guidelines for the Establishment of a Stable Salary System" (referred to as "Guidelines" "), which requires securities companies to comprehensively consider formulating a stable salary plan when formulating a salary system. Point specifications.

A trader of CICC was involved in the salary storm. It has been suspended and investigated. Last year

Back to the incident itself, on July 28, circulating on the Internet, the income certificate of the husband's husband's husband's income from the spouse of a trader of CICC. Prospective materials printed with the official seal of the CICC show that the average monthly income of the trader was 82,500 yuan. The picture is called: "In 1993, my husband's income level, so is the property after marriage?"

After the news continues to ferment, the high salary of the brokerage industry has been on the hot search again.

Wind data shows that in 2021, 17 listed brokers had a per capita salary of more than 500,000 yuan. Among them, there are 14 levels of more than 600,000 yuan, 7 more than 700,000 yuan, 3 are more than 800,000 yuan, and 1 with more than 900,000 yuan.

Specifically, CICC ranks first with a per capita salary level of 98.30 million yuan. CITIC Securities and Guangfa Securities followed closely, and per capita salary was 893,700 yuan and 829,700 yuan, respectively.

It is worth mentioning that although CICC's per capita salary ranks first, the level of 980,000 yuan in 2021, compared with the per capita salary level of 1.1498 million yuan in 2020, still declined to a certain extent.

Coincidentally, in 2020, the average salary of people exceeded 900,000 yuan to Huatai Securities at the level of 927,100 yuan. In 2021, the average salary of people also settle down to a certain degree of down to 773,300 yuan.

The salary system of the securities firm just welcomed further standards in May.

It is worth mentioning that this is not the first brokerage employee to appear on the hot search for "exposure".

Coincidentally, on January 6 this year, a screenshot of a salary of a securities company non -silver analyst was circulated on the Internet. The screenshot content shows that the analysts' pre -tax revenue in October and November 2021 exceeded 100,000 yuan. As of November 2021, the analyst at the annual tax revenue of 2.2467 million yuan, which also caused widespread market attention.

On May 13, the China Securities Association stated that in order to guide the securities company to establish a stable salary system, improve the compensation incentive and restraint mechanism, in accordance with the "Securities Law" and other laws and regulations and regulatory regulations, the "Guidelines for Establishing a Stable Salary System for Establishment of Stable Salary" (here below " Referred to as "Guidelines"), and it will be implemented from the date of release.

On the whole, the "Guidelines" have a total of 6 chapters and 25 chapters, including general rules, principles and goals, formulation and implementation, basic norms, self -discipline management, attachment, etc.

Specifically, the "Guideline" has made three regulations for the salary system of the securities firm:

First of all, the principles and goals that the salary system should be followed should be proposed. The "Guidelines" pointed out that the establishment of a stable salary system for securities companies should take the principle of implementing the principles of implementing the concept of stable business, ensuring the requirements of the bottom line of compliance, promoting the formation of positive incentives, and improving the company's long -term value. By establishing a sound stable salary system, we consolidate the foundation, risk control foundation, compliance, cultural foundation, and talent foundation of the high -quality development of the securities industry.

Secondly, it is the basic specification that the salary system of the securities company should follow. The "Guideline" states that when formulating a salary system, salary standard, and assessment system, securities companies should comprehensively consider the risk attributes and characteristics of business and positions, as well as the corresponding social responsibility and professional responsibilities, and improve the compensation incentives and constraint mechanism. Through the establishment of a stable salary system that consistent with the company's long -term interests and the connection with comprehensive risks and compliance management, it enhances the ability of securities companies to serve the real economy and national strategy.

The "Guidelines" requires that when the securities company formulates the salary system, it shall comprehensively consider the ten o'clock specifications.

First, the total amount of compensation budget should be made in conjunction with the company's actual situation, compliance risk control effect, its own development strategy, and long -term interests of shareholders. Salary level.

The second is to formulate a stable salary plan in conjunction with the characteristics of the industry, fully consider the impact of market cycle fluctuations and the development trend of the industry and the company's business, and appropriate smooth salary distribution arrangements, and at the same time do a good job of extreme value control and rhythm control of salary incentives.

The third is to comprehensively consider the risk attributes and characteristics of business and positions, social responsibilities and professional responsibilities, improve the performance assessment system, take care of professional ethics, integrity, performance of social responsibility, and service customer level as important consideration factors, and in assessment China implements one -vote veto on major co -regulations risk control incidents to strengthen positive guidance and incentives and reverse disciplinary constraints. The fourth is to ensure the effective implementation of comprehensive risk management and compliance management, unilateral pursuit of market ranking, scale indicators, and short -term performance, and formulate specific provisions to prevent hidden dangers or compliance risks due to excessive incentives. Reduce the correlation between salary and risk.

Fifth, the chairman, senior managers, heads of major business departments, heads of branches, and core business personnel shall establish a deferred payment mechanism, and clarify the applicable conditions, payment standards, years, and proportion.

Sixth, a strict accountability mechanism should be established to enhance the binding power of compensation management.

Seventh, in accordance with the relevant laws and regulations, establish a compensation mechanism such as annuity, employee holding, and equity incentives that are consistent with the company's long -term interests.

Eighth, the concept and guidance, principles and goals of the company's salary management should be disclosed in the annual report.

Nine is to incorporate salary management into the company's reputation risk management system and strengthen the management of reputation and risk management.

Ten should be clearly notified of the main principles of the salary system, the relevant requirements of labor discipline, and the relevant provisions of the compensation confidentiality.

Thirdly, the securities company is required to ensure the effective implementation of the stable salary system. According to the Guidelines, securities companies should clarify the decision -making, implementation and supervision mechanism of the salary system, establish and improve relevant mechanisms such as delayed payment, accountability, strengthen reputation risk management and employee value guidance, and enhance the effectiveness and binding power of compensation management Promote the sustainable development of securities companies and industries.

The China Securities Association stated that guiding securities companies to establish a stable salary system is an important measure to consolidate the high -quality development foundation of the securities industry, and it is also an important guarantee for the industry to promote the steady operation and sustainable development of the industry.

Original title: Behind the screen of CICC employees: Behind the screen: last year, the average annual salary of the person fell to 980,000, and it was still the first in the industry.

- END -

The practitioner who is changing from time to time and is integrated with knowledge and deeds

introductionSince the new crown epidemic, global economic vitality has continued t...

Zhejiang's 124.7 billion yuan reserved tax refund direct enterprise small and micro enterprises

Zhejiang News Client reporter Xia Dan correspondent Yu LijiaoOn the 13th, the reporter learned from the Zhejiang Provincial Taxation Bureau that since the implementation of the large -scale VAT tax re