Jinshan Cloud has sprinted in Hong Kong stocks for the second time. Where is Jinshan Cloud, which has been losing money for three consecutive years?

Author:Jiang Han Vision Time:2022.07.31

In the China Cloud Computing Market, in addition to the familiar Alibaba Cloud, Tencent Cloud, and Huawei Cloud, there is also a large number of second echelons. Among them, Jinshan Cloud is undoubtedly its best. After the second listing of sprinting Hong Kong stocks, in the face of the three consecutive years of losses, many people are asking where is Jinshan Yun's future?

I. Jinshan Cloud Two Settlement Spring Hong Kong Stocks?

According to Global Network, the news on July 28, according to the information disclosure of the Hong Kong Stock Exchange website on the 27th, the independent cloud service provider Jinshan Cloud has submitted a listing application.

At the same time, Jinshan Cloud's average revenue increased from 2019-2021, with an increase of 66.2%and 37.8%. In 2021, Jinshan Cloud revenue reached 9.061 billion yuan. In addition, revenue in the first quarter of 2022 also increased to 2.174 billion yuan.

In addition, the prospectus shows that Jinshan Software, Xiaomi Group, and Lei Jun are the three major shareholders of Jinshan Cloud, with a shareholding ratio of 37.4%, 11.82%and 11.82%, respectively. At the same time, Jinshan Software and Xiaomi Group are existing customers of Jinshan Cloud. In 2021, the income from the two companies accounted for 10.9%and 2.2%of Jinshan Cloud's total revenue, respectively.

It is worth noting that the company has recorded losses during the reporting period. From 2019 to 2021, Jinshan Cloud achieved net loss 1.111 billion yuan, 962 million yuan, 1.592 billion yuan, and a net loss in the past three years reached 3.665 billion yuan. In the first quarter of 2022, Jinshan Cloud achieved a net loss of 555 million yuan, a trend of losses.

Jinshan Cloud is a cloud computing company under Jinshan Software. It was founded in Beijing in 2012 and successfully listed in the United States in May 2020. The highest stock price reached $ 74.67. As of the closing of July 27, Jinshan Yunmei stock rose 2.66%to $ 3.47, which has shrunk by more than 95%from the highest stock price. The prospectus shows that Jinshan Cloud's main business is divided into two parts: public cloud and industry cloud.

2. Where is Jinshan Cloud's future?

We saw Jinshan Cloud's second sprint for the second time and chose Hong Kong stocks to list. What should we think of this sprint of Jinshan Cloud? Where is Jinshan Cloud, which has been losing money for three consecutive years?

First of all, we see that the current Jinshan Cloud sprint listing is actually a normal phenomenon. After all, in the background of the entire market development, various Chinese stock companies have begun to choose to go public. The secondary listing is also normal at this time. At this time, it is also normal for the second listing. After all, the uncertainty faced as a Chinese stock company in the future is increasing. By the second listing in the Hong Kong capital market Essence The advantages of the capital market can ensure certain certainty, so as to hedge the potential risks. Therefore, it is normal to choose the Hong Kong capital market to go public, and it is normal to use the second main listing method. Development trend.

Secondly, everyone is most concerned about the continuous losses of Jinshan Cloud. We must say that whether you observe the development process of Amazon Cloud or Microsoft Cloud, we will find that in the development process of these cloud computing companies, long -term losses are almost almost almost almost almost lost. It is an inevitable result. If any company wants to develop well in cloud computing, it may need to support losses for a long time, because for a cloud computing company, a large amount of money in the early stage to smash hardware investment is a core foundation for providing good services to provide good services In this regard, if a company does not really build its own advantages in this regard, it is likely to be eliminated by the market. Therefore, for the current Jinshan Cloud, this time period is state.

Third, although we say that Jinshan Cloud is now a state that requires a lot of money, the pressure faced by Jinshan Cloud cannot be underestimated because it is on the entire market. On the one hand, they have to face giants like Alibaba Cloud Tencent Cloud, and on the other hand, they will face the common competition of more Xiaoyun computing companies. In the process of development of the entire market, cloud computing companies, if you If you cannot have your own differentiated competitive advantage in the market competition process, it may be a massive investment but cannot collect the due results. This is also the biggest risk of Jinshan Cloud at present. Therefore, after the second listing, can you use this money well and truly find out his own differentiated advantage. This is what Jinshan Yun needs to do the most.

- END -

Chicheng Co., Ltd.: Completed the Counseling Acceptance of the Bei Stock Exchange

On June 30, Capital State learned that the New Third Board Enterprise Chicheng (834407.NQ) recently issued a prompt announcement for the completion of the application for public offering and the compl

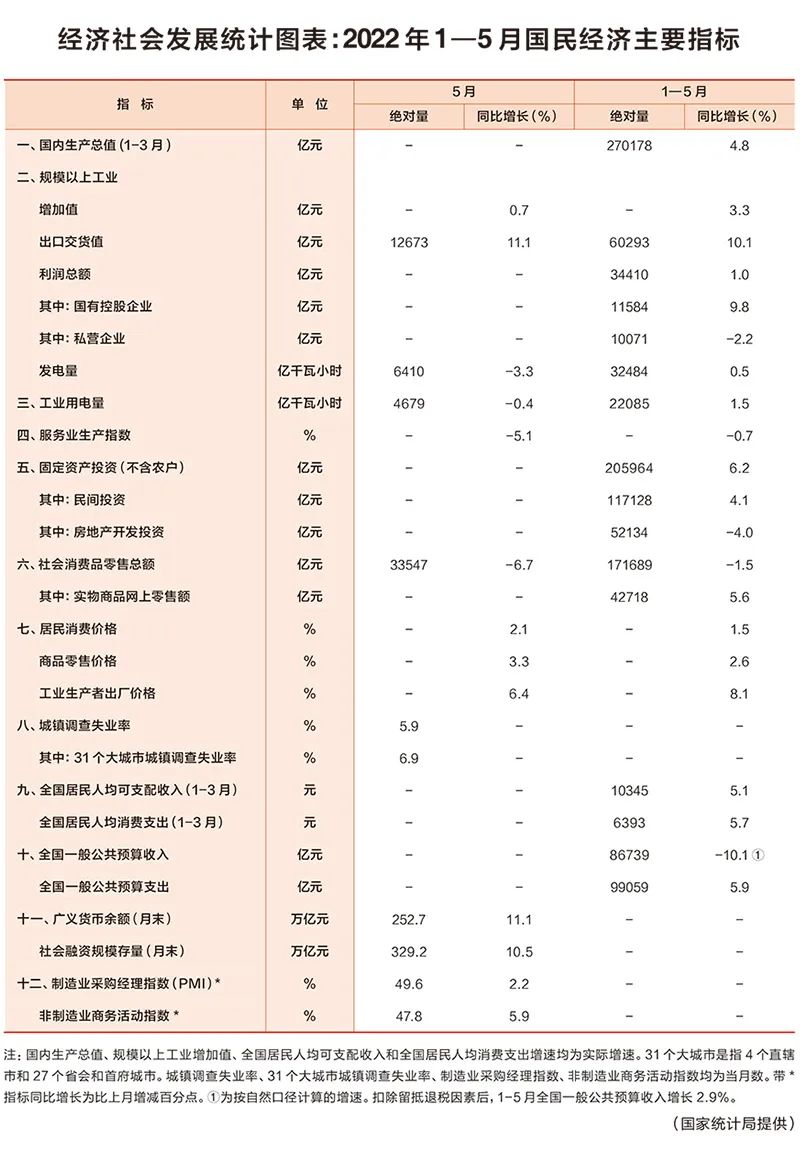

Statistics of Economic and Social Development: From January to May of the National Economy, the main indicators of the national economy

Source: "Seeking" 2022/13Author: National Bureau of StatisticsProduction: Wang H...