Warehouse Vane | Zhongtai Asset Management Jiang Cheng: Ranking to "10 billion" investors, the equity warehouse is comprehensively improved

Author:China Fund News Time:2022.08.01

China Fund News Wei Zhongzhe

Editor's note: Recently, the Fund's second quarterly report has disclosed that the positioning movements and position changes of the star fund managers have also become the focus of the attention of the citizens. Behind each regular report, these outstanding manager's "investment secrets" are also hidden. Fund Jun will continue to update the character's database feature [positioning vane], decoding star fund product holding changes and its manager's investment philosophy.

As a fund manager who has been deeply cultivated in the field of value investment for a long time and has excellent risk control capabilities, Jiang Cheng still handed over a positive answer to investors this quarter. Faced with the strong rebound of the growth track led by new energy in the A -share market in the second quarter of this year, Jiang Cheng admitted in the second quarter that he and his team have always seen the problem from a long -term perspective, and hope that the price of the stock will provide sufficient protection, combined with the market, combined with the market The valuation level provided is more configured in value stocks compared with most peers, so it looks relatively stable.

In the recent capital market that continues to be a growing style, Jiang Cheng is still such a self -adherence. He faded the time to choose and maintain his original investment direction, even if he did not make style drift at the moment.

In this issue of [Warehouse Vane], Fund Jun will interpret the second -quarter report and position changes of China -Thailand assets Jiang Cheng.

The management scale is eight consecutive, and the position of equity assets holds the position

With Jiang Cheng's three newly -developed fund products raised in the first quarter, Jiang Cheng's current management scale increased by more than 30%to 12.436 billion, and successfully promoted to the "tens of billions" fund manager.

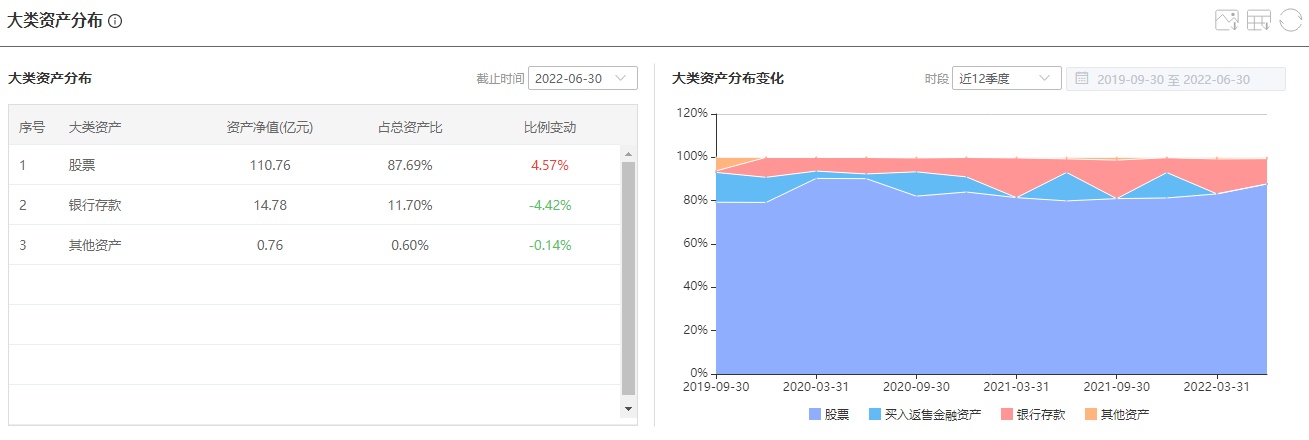

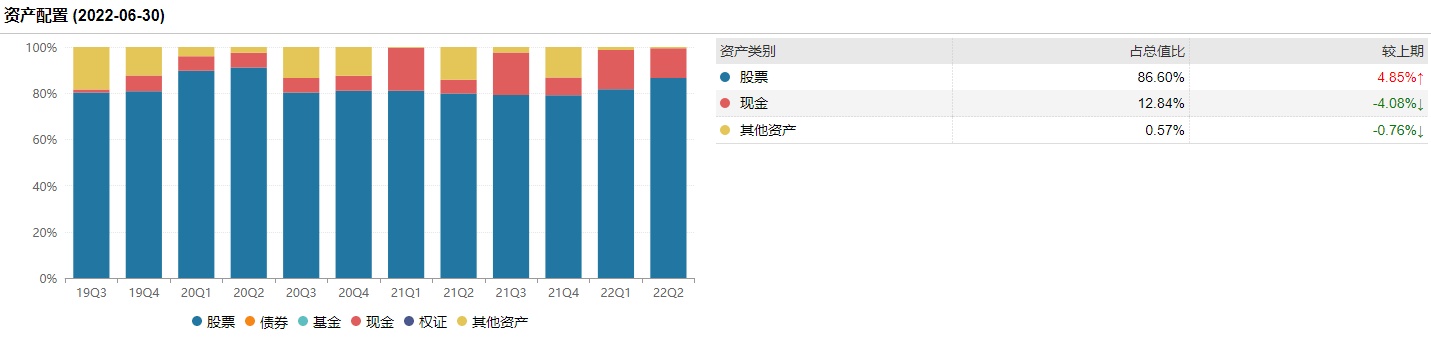

In terms of asset allocation, Jiang Cheng chose to increase the stock again, and the proportion of equity assets accounted for 87.69%, an increase of 4.57%compared to the previous period, and it has reached a relatively high position in the data over the years.

In terms of the choice of investment industry, Jiang Cheng still mainly focuses on manufacturing, construction, real estate, and wholesale and retail, and expresses his attitude towards the traditional value industry with actual investment actions.

The heavy holding of heavy positions increases its holdings and adjusts cautiously

In the second quarter of the growth style, the results of value investment will appear relatively weak, but Jiang Cheng adheres to the concept of diluted time choice, and the idea of giving guarantee risk control for the use of the stock price, and the original heavy stock stocks are all all heavy stock stocks. Do a certain degree of positioning. Due to the rise in the overall management scale, the proportion of the top ten heavy stocks in the assets has declined, reaching 49.45%.

The integration of all products under Jiang Cheng's products continued the operation of the previous quarter, and in the adjustment of the top ten heavy stocks, only Huaru Hengsheng was new. Because of the strong development momentum of the new energy industry, he is cautious about the prospect of the traditional energy industry. In this quarter, Jiang Cheng transferred the coal stock China Shenhua from the top ten heavy warehouses.

From the perspective of the product, Jiang Cheng's represented product is also consistent with its overall positioning style. The proportion of stock assets accounted for 86.60%, which is not much different from all its products.

Among the value of China and Thailand, among the top ten heavy stocks, with Hualu Hengsheng's entry into the top ten, Zhejiang Longsheng and China Shenhua have been reduced to 9th and 10th, and the top ten in the martial arts group. Similarly, the proportion of China Shenhua's position in this product has also been reduced. The overall positions are mainly low -valuation stocks, the industry is relatively decentralized, and the proportion of consumer stocks is low.

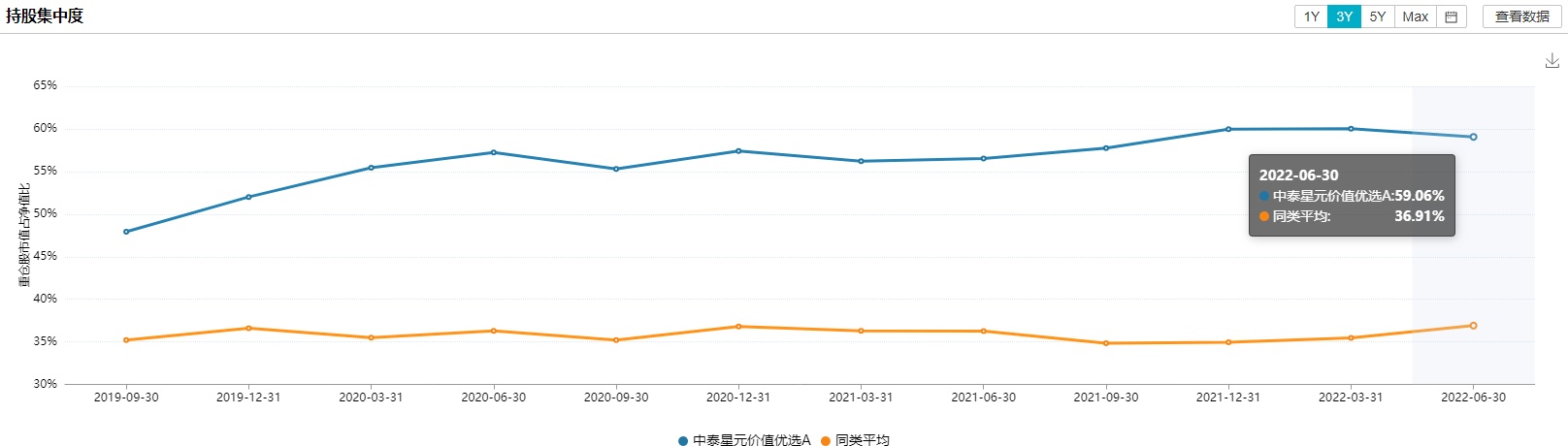

From a moderate point of view of the positioning, the value of Zhongtai Xingyuan is preferred in the concentration of this quarter by nearly 1%, but it is still high among similar products, and has maintained a slow growth in the past three years. From the perspective of the holding time of the top ten heavy warehouses. As of this cycle, Jiang Cheng's average holding of heavy stocks in the product reached 7.3 quarters.

Look at market fluctuations calmly

"Mr. Good Luck" is still optimistic about the present and the future

At the time of the first quarterly report, Jiang Cheng once described his outstanding performance of his products: he made good luck, and in the face of the relatively conservative rate of return in the second quarter, Jiang Cheng still described in a light and light attitude in the second quarter report: "Without greedy, there is no need to run a marathon with the rhythm of a 100 -meter sprint." Regarding the direction of the market in the second half of the year, Jiang Cheng also answered "the market can only deal with the market and not predict."

Regarding the fierce market fluctuations in the first half of the year, Jiang Cheng expressed in the second quarterly report: The root cause may be the overall anxiety of investors, and the anxiety comes from the ultimate pursuit of "efficiency". In investment, the method of getting in efficiency is nothing more than "buying is to rise, and selling will fall. And this needs to take the lead in the marginal information chase. Jiang Cheng said that the marginal information that needs to be concerned is different: monetary policy, stable growth policy, repeated epidemic, international capital and fundamental "prosperity".

Regarding the many factors above, Jiang Cheng said that "we are easy to do Zhuge Liang after doing things, but it is difficult to be a foresight prophet", so we gave up the time to choose a long time, and let the net worth rising in the market. The probability of making money for a long time. For Jiang Cheng, who has always adhered to this investment principle, he admits that this investment framework has some swords, but it is very useful -unsuccessful and more disastrous; willing to endure fluctuations, it may not fluctuate.

For the view of the market outlook, Jiang Cheng believes that it is still optimistic from the long term:

The first is optimistic about China's economic prospects.The fluctuations are inevitable, and the long -term potential growth rate will decrease, but the stock economy is easier to form a good industrial structure. The good industrial structure brings better capital returns.Excellent enterprises provide a broad performance stage, and the vacant nationals are worried; the second is optimistic about the current state of the combination.Under the guidance of safe margins, I was accustomed to waiting for their wishes. Jiang Cheng said: The premise of a stock of heavy warehouses is to tolerate its shortcomings, rather than infinitely enlarging its advantages.How much can I get? "

Risk reminder: The fund has risks, and investment needs to be cautious.Fund's past performance does not indicate its future performance.Fund research and analysis do not constitute investment consulting or consulting services, nor does it constitute any substantial investment suggestions or commitments to readers or investors.Please read the "Fund Contract", "Recruitment Manual" and related announcements carefully.

- END -

Minsheng direct vehicle 丨 Accelerate the creation of the backbone force of the seed industry -the relevant person in charge of the Ministry of Agriculture and Rural Affairs answers the reporter from the development of the national breeding industry enterprise

Xinhua News Agency, Beijing, August 8th: Accelerate the creation of the backbone force of the seed industry -the relevant person in charge of the Ministry of Agriculture and Rural Affairs answers the

The scope of Shanxi phased social premium policy expands to these 17 industries

On June 14, the Provincial Human Resources and Social Affairs Department, the Provincial Development and Reform Commission, the Provincial Department of Finance, and the Shanxi Provincial Taxation Bur