The Chinese people are behind the scenes of eating, drinking and upgrading, and a sigh of relief from the IPO

Author:Financial and economic Time:2022.08.02

Wen | Xiao Tian

Buffett, who loves consumer stocks in his life, has a very classic famous sentence: "Life is like snowballs. It is important to discover very wet snow and long slopes."

The implication of words is nothing more than: through the compound interest (long slope), high -quality target (very wet snow) can achieve the accumulation of wealth (rolling out of the snowball).

Over the past ten years, the investment in China's consumer track is unprecedented. Under the wave of new consumer goods, one after another brand that we can know well.

Under this round of boom, Tian Tu Investment focused on the consumer field and cast one seed player after another. Including the brands of China Feihe, Zhong Xue Gao, Jiang Xiaobai, Chayueyue, San Dan, Zhou Heiya, Master Bao, Xiaohongshu, etc., all have the figures of Tian Tu investment. Many companies have also been listed, or are sprinting towards the capital market.

In the past, Tiantu Investment was holding a whip to urge the investment companies to do so fast. Now, it is finally the "crossroad" that he tries to dock with the capital market.

On June 30, Tiantu Investment officially submitted a prospectus to the Hong Kong Stock Exchange and was planned to be listed on the main board of Hong Kong. Earlier, Tiantu Investment's Listing Stocks were suspended on May 20. Before the company was suspended, the total shares were 520 million shares, 5 yuan per share, with a market value of 2.599 billion yuan.

Once the listing is successfully listed, Tiantu Investment may become the first local VC that is listed on the New Third Board and listed on the Hong Kong stock market at the same time.

But for investors, as an old PE institution with a history of 20 years, how does Tiantu Investment become the largest investment institution in China? In the impact of "consumer PE's first share", did it find "long slope and thick snow"? Choose to go public at this time, can the final result be as expected?

From "large and complete" to "essence and deep", how does consumer investment sniper be born?

The big consumer industry from cattle stocks is a wide and crowded avenue.

Food, food, housing, and a small biscuits from the e -commerce platform, consumers are always waiting for better, new business models, products and services. Because of this, groups of entrepreneurs and investment institutions jumped into this track, and they staged "myths and beauty" in the consumer track with a bloody blood.

In the prospectus of Tiantu Investment, there is such a description: "From 2019 to 2021, the number of investment projects of Tiantu in China's consumer industry ranks third among all private equity investors, second only to Tencent Investment and Sequoia China; During the same period, Tian Tu ranked first among all private equity companies focusing on consumption. "

Judging from some indicators, as of the end of 2021, Tiantu has invested 205 companies (including the withdrawal company), and its total asset management scale reached 24.9 billion yuan. The valuation of the investment portfolio is doubled.

Sky Figure 2022 Investment industry subdivision, Source: Tianyancha

To a certain extent, Tiantu Investment, as the behind -the -scenes push of national food, is worthy of the title of "investment expert in China's consumer industry".

Tracing history, Tiantu Investment was founded in Shenzhen in 2002. Wang Yonghua, deputy general manager and chief investment officer of the former Southern Fund Management Company, and Feng Weidong, who graduated from Tsinghua MBA. By this year, it happened for 20 years.

At first, Tian Tu used its own funds to make PE investment, mainly investing in the Pre-IPO stage. In the first 10 years, Tiantu Investment, like most PE, showed the image of "full track players". The summary of Wang Yonghua's own words is "investing everything, and the investment method is a bit simple and rude."

In an interview with the outside world, Feng Weidong, the founder of Tiantu Investment, once told that they have paid tuition fees in the exploration process:

"We have invested in a company in Xiamen in their early years, and it produces wireless fixed -line. Because China Mobile competes for fixed -line words and China Telecom based on this mobile network without wiring, this company has grown rapidly, and the profit of 3 years will be done in 3 years. It has reached more than 70 million. But soon three years fell back and returned to the original shape, so Tian Tu lost money in this project. "

Around 2011, when the PE agency was facing severe homogeneous competition, the original investment model of Guangsha.com was unsustainable. On the other hand, at the time, when China was in the prosperity of mobile Internet, investment institutions stood on historical choices.

In this context, Tian Tu held a "Zunyi Conference". In 2012, Tian Tu made strategic adjustments to shrink the investment front to the consumer field. In the second half of 2015, Tian Tu Investment was listed on the New Third Board. In 2017, the Tiantu PE Fund was reforming internally, and VC, PE, and M & A and Holding Investment Division were established respectively.

One year later, Tiantu set up an angel fund, from the establishment of the project, internal discussion, and the formulation of decision -making mechanisms to negotiating LP and registration for record. It does not exceed 90 days before and after. Among them, the Angel Fund was managed by the core team of Tiantu VC Fund and continued the independent decision -making mechanism.

Since then, Tian Tu has established a comprehensive investment section, and a more agile investment mechanism and system have been established. Over the years, in more attention to high -tech and Internet investment communities, it has unique in the industry with a large number of excellent companies in the field of "eating, drinking and playing", and successfully reborn.

What is the investment logic behind "Super Food"?

Domestic VC/PE has been discussing the listing of venture capital companies for a long time, and listing has always been the pursuit of some venture capital institutions. However, the listing of venture capital companies and the whole body needs to be considered carefully. An industry insider said with the road to the listing of A shares of venture capital agencies: First, private equity cannot be publicized; the other is that the capital market must support the real economy, and it cannot allow financial institutions such as venture capital to be listed.

As of now, no venture capital agency has entered the A -share market through an IPO. Today, the "Venture Capital's first share" Luxin Venture Capital is only successfully listed through the backdoor method in 2010.

Based on this, in 2017, Tiantu Investment became the first investment institution of the New Third Board of Innovation Entrepreneurship Corporation (Double Bonds), with a scale of 1.8 billion yuan. In Feng Weidong's view, it is because of Tiansu "through professional creation value" has been recognized by the regulatory level.

Objectively speaking, as the first investment company in China, the development of Tiantu Investment is indeed remarkable.

Take Zhou Heiya as an example. As the earliest institutional investor in Zhou Heiya, in 2010, Tian Tu Investment invested 58 million yuan to enter Zhou Heiya at the time of only dozens of stores. Six years later, Zhou Heiya, which has 700 chain stores, was listed in Hong Kong with a market value of more than 16 billion yuan, and its profits were even 3 times more than 7,000 stores with more than 7,000 stores. In this project alone, the estimated return of Tiantu Investment exceeds 1.5 billion yuan.

As of the end of last year, the company has invested a total of 205 investment portfolios and 169 companies in the consumer field, involving food, clothing and drinks such as food, clothing and beverages. 23 companies have a valuation of $ 1 billion.

The consumer track is a very simple industry that has been growing in obscurity. From the perspective of financial and economic, the reason why Tiantu Investment can obtain the above -mentioned good investment is inseparable from the two most important factors: grasping the new consumption wind and Tian Tu's own methodology.

On the one hand, according to the information of burning consumption, the market size of China's consumer industry increased from 43.8 trillion yuan in 2017 to 55.5 trillion yuan in 2021, with a compound annual growth rate of 6.1%. It is expected that it will reach 739,000 in 2026 100 million yuan. The golden age of Chinese consumer goods investment has arrived;

On the other hand, with the deepening of reform and opening up, the consumption level of residents has increased significantly, and the consumption upgrade demand is very urgent. A few days ago, the market size of China's new consumption has increased from 5.3 trillion yuan in 2017 to 10.6 trillion yuan in 2021, with a compound annual growth rate of 18.7%, and last year's proportion of all consumer markets reached 19.0%.

Looking at it carefully, whether it is Zhou Heiya, China Feihe, Beluo Garden, Naixue's tea, or tea Yan Yue Se, Zhong Xuegao, Master Bao, etc., behind this is "improved the living standards of the Chinese people to improve the living standards of the Chinese people. "Investment logic of quality".

At the same time, Tian Tu also has its own set of methodology. Partner Feng Weidong's "Upgrade Positioning" and the "New Consumption Era" by another partner Li Kanglin, the essence of its methodology:

Paying great attention to the brand effect, it is believed that the brand is to have uniqueness, and the category is the foundation of the brand. The category is to continuously refine it, and every refinement will be split into a new track.

Focusing on this methodology and influence, Tiantu Investment has accumulated a number of investment talents such as chief operating officers and chief risk control officers. In addition to Wang Yonghua and Feng Weidong, there are Zou Yunli who dominate the Chinese Feihe; Li Xiaoyi, who dominates Texas Chicken and Baza Tea Industry; dominates Naixue's tea, Pan Pan of Bai Guo Garden.

It is worth mentioning that since 2013, the "grinding knife meeting" has been continuously held, which means "grinding the knife to cut the firewood by mistake". At the meeting, some business practice experience will be shared to build a resource platform for entrepreneurs. The agency chooses to grow with the invested enterprise to cultivate the latter's ability to solve problems.

此外,为了尽可能保证决策的正确性和规避风险,天图还专门设立了一套独特的法定反对派机制,由团队中一名资深的投资人员作为反对派,对投资论点提出质疑,保证投Members of the committee can understand potential investment opportunities and risk points from more perspectives.

On the one hand, on the other hand, through his own efforts, Tian Tu Investment gradually explored a set of knowledge framework and investment and research systems after focusing on the consumption field 11 years, and was recognized by the industry.

In China's consumption investment in rivers and lakes, almost no one knows the picture.

The hidden and worries of the "PEM PE" listing

However, this does not mean that Tian Tu investment on the market can not worry about it. In fact, although the consumer track is huge but not easy to do, there is no eternal "Chang Sheng general".

Last year, Tiantu's investment performance fluctuated significantly. Both business income and net profit fell in 2021. Among them, in 2021, operating income was 2 billion yuan, a year -on -year decrease of 18.63%; net profit was 730 million yuan, a year -on -year decrease of 29.77%.

Explore the reason behind the inquiry, whether the hidden investment in Tiansu can be listed or long -term investment potential after listing.

According to the report of the Qingke Research Center, in the first quarter of 2022, China's equity investment market fundraising scale was 409.27 billion yuan, a year -on -year decrease of 3.2%; 1374 new funds, a year -on -year decrease of 0.6%; according to the market segment, early investment markets, early investment markets The total amount of new funds raised by the VC market has decreased by more than 20%year -on -year.

The new consumer track is the first. According to IT orange statistics, in the past five quarters, the amount of new consumption investment has continued to decline. In the first quarter of this year, the total amount of new consumer financing was 15.27 billion yuan, a decrease of 69%year -on -year. Under the double pinch of the cold winter and cold consumption, Tian Tu investment that has always been self -proclaimed by consumer track investment experts can not help but be impacted.

On the basis of a significant increase in investment projects last year, the total investment amount of Tiantu investment decreased slightly. The annual report shows that in 2021, the company invested a total of 56 projects through the funds and its own funds, an increase of 51%over 2020; the total investment amount was 1.629 billion yuan, compared with the investment amount of 1.801 billion yuan in 2020, Fall nearly 10%.

More importantly, leaving aside the environment of the entire economic situation, several star consumer companies voted for Tian Tu are either a bumpy way to go public or the days after listing are not good. They all questioned the capital market about their investment strength.

Since the beginning of this year, the three -degree sprint IPO garden has not only fallen into negative public opinion storms on the eve of the listing, but also has begun to appear; Baya Tea has not been on the market. In May, it took the initiative to withdraw from the application during the listing process.

In addition, Naixue's tea stocks, which have been listed, have fallen all the way since listing, and currently have fallen by 68.5%; all new life under the title of "China Stock ESG's first share", since its listing last year, the stock price has fallen by more than 80%. Essence

Tiantu Investment does not have never thought of self -help.

According to media reports, in 2021 and this year, Tian Tu's investment style has taken great drift compared with the previous overall situation.

In 2021, large consumption investment was 30 times, accounting for 71.4%; while other investments of the single variety of biomedicine, the investment of 6 times, accounted for 14.3%; in 2022, large consumption investment was 7 times Investing in a single variety of biomedicine in the investment 5 times, accounting for 31.3%.

The problem is that at the "Zunyi Conference" of Tiantu Investment, chief investment officer Feng Weidong had proposed a strategic abandonment of the pure technology field and fully focused on consumer goods investment. The self -cognition of this decision is that most of the team members are financial or consulting backgrounds, and technology is not above their director.

"This is an important turning point. Because you can only do consumption, the ability to look at the project must be improved, which also forces us to find a threshold in this industry that looks like a low threshold."

Nowadays, in the case of cold in the entire consumer industry, not only can not only test the poisonous vision of Tiantu Investment on consumer companies, but for the "second growth curve", the change of investment style is also a huge test for investment teams.

In the short term, the current listing is not a good time for the individual of Tiangu. Facing the geopolitical conflict, the raging epidemic, the global economy has declined, and the situation of the financial market shock and the central bank's interest rate hikes, the entire investment field Slowing steps, the uncertainty of the listing and after the listing is the risk that the company cannot predict.

However, from the long -term consideration of the industry, for private equity investment institutions, it can sometimes be able to reserve ammunition to avoid risks, which will become the way to cross the economic cycle.

On the eve of the listing of Blackstone in 2007, the United States was on the eve of the subprime crisis. The founder of Blackstone Su Shimin said in "My Experience and Teaching", "My intuition tells me that the world is going crazy, and the company needs to reserve cash as soon as possible. We can't wait anymore."

In the book, Su Shimin also disclosed the reason why Blackstone must be listed: "Successful listing can raise permanent capital for investment companies, and expand the scope of Blackstone's business; even if the market turns The competitors are thrown behind. "Blackstone also used the financing of listing, and eventually escaped the subprime crisis and achieved a bottom.

As mentioned earlier, logging in to the capital market has always been in the heart of VC/PE. The listing of Tiantu Investment Testing Water to the Hong Kong Stock Exchange is a good start for the industry, but it is still unknown whether it can open a door for "venture capital institutions" to open a door for "venture capital institutions".

And even if the listing is completed, the survival and development opinions provided by the entrepreneurs as an investment institution are worthy of their own reluctance:

"If you compare the entrepreneurial enterprise to a bucket, when this bucket has a plate to the extreme and the length exceeds other buckets, it may be favored by investors. The remaining shortcomings are exactly the future of investors gambling in the future. Potential: The team's determination, whether the institutional resources can turn itself into a complete and strong bucket through expansion, transformation, or innovation. "

- END -

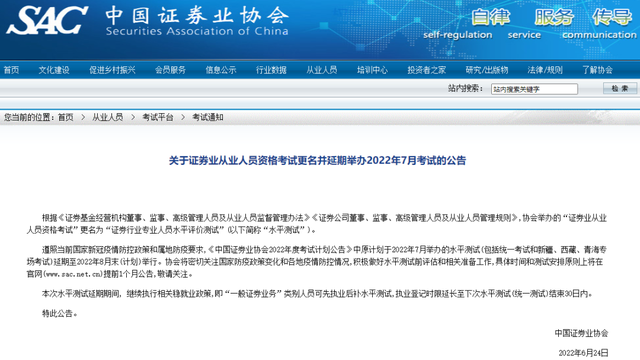

"Securities Practitioner Qualification Exam" officially renamed "Level Evaluation Test of Professional Staff in the Securities Industry"

In those years, the Securities Qualification Exams we have tested were renamed.On ...

Focusing on the Provincial Party Congress | Together, Shandong has stabilized and stabilized and sta

Last year, we invested a lot in the construction project and had difficulty in cap...