Ministry of Finance: State -owned financial enterprises must effectively implement the "two are not higher than" requirements for wages

Author:21st Century Economic report Time:2022.08.02

21st Century Business Herald reporter Li Yue Beijing report

On August 2nd, the website of the Ministry of Finance disclosed the "Notice on Further Strengthening the Financial Management of State -owned Financial Enterprises" (hereinafter referred to as the "Notice"). Guide financial enterprises to standardize orderly, healthy and stable operation, and promote the high -quality development of the financial industry.

"In recent years, some risk events and violations of laws and disciplines in the financial sector have exposed outstanding issues such as incomplete financial discipline execution, unrealistic financial accounting information, and irregular revenue and expenditure management. When financial units, we also pointed out related issues. "The relevant person in charge of the Ministry of Finance answered the reporter and said that in order to focus on blocking vulnerabilities, supplementing shortcomings, and strong weaknesses, he drafted the" Notice "and further strengthened the financial management of state -owned financial enterprises. Prevent financial risks and safeguard state -owned financial capital rights.

The "Notice" adheres to the problem -oriented, and the income and expenditure management found in the financial management management of financial enterprises, the poor classification of asset risks, the inadequate management after verification, weak overseas asset management, and inaccurate accounting accounting. Standardize financial enterprises' financial behavior and strengthen financial management financial management.

The "Notice" is implemented from July 20 and is suitable for state -owned financial enterprises, including state -owned wholly state -owned and state -owned controlling financial enterprises (including state -owned actual control financial enterprises), sovereign wealth fund, state -owned finance, and state -owned finance established in accordance with the law at home and abroad of the People's Republic of China. Holding companies, state -owned financial investment and operation institutions, and other enterprises or institutions that carry out financial business in substantially developing financial business. Other financial companies can refer to execution.

Effectively implement the "two are not higher than" requirements for salary

In order to regulate the management of financial enterprises' revenue and expenditure, consolidate the financial foundation, and promote the high -quality development of cost reduction and efficiency, the "Notice" has strictly implemented the management requirements of duties and business expenditure from strengthening the management of duties. The four aspects of salary distribution and delayed payment and accountability of salary recovery are put forward.

In terms of strengthening financial budget management, the "Notice" proposes that financial enterprises should strictly abide by financial laws and regulations and institutional regulations, firmly establish the thoughts of tight life, focus on cost control, strict budget management, strengthen internal control, and pay for non -necessary expense expenditures. Reduce depletion, avoid waste and waste, and timely correct unnecessary and irregular expenditures.

For example, we should streamline meetings, travel, training, forums, celebrations and other related activities, strengthen the integration of activities such as the same location, overlapping objects, and similar content, and actively adopt new methods such as video, telephone, and network General sponsorship expenditure, effectively integrate advertising expenditure and corporate culture construction expenditure; when the state's strict implementation of the relevant regulations on personal treatment of employees, the expenditures such as entertainment, fitness, tourism, entertainment, shopping, and gifts shall not be listed in corporate costs and fees. branch.

In terms of actively optimizing the structure of internal income distribution, the "Notice" proposes that financial enterprises should actively optimize the internal income distribution structure, give full play to the positive incentive role of wage salary, and effectively implement the "two less than higher" policy requirements, that is, the average employee headquarters employees average In principle, the increase in wages should be lower than the average salary increase of employees in the enterprise, and the average salary increase in the middle and senior management positions is not higher than the average salary increase of employees in the enterprise in principle.

At the same time, financial enterprises must effectively fulfill the responsibility of the salary management subject of branches, sub -institutions, direct management enterprises, and other actual control enterprises at all levels, effectively balance the income distribution of leadership, middle -level cadres and grassroots employees, and increase to the front line Employees and grass -roots employees are inclined.

In terms of the establishment of a sound salary distribution delay payment, the "Notice" clearly states that the basic salary is generally not higher than the total salary of the total salary for senior managers of financial enterprises and employees who have a direct or important impact on the positions of risks. Perform performance salary delay payments with risk installment assessment. More than 40%of performance salary should be delayed. The extended payment period is generally not less than 3 years to ensure that the duration of the risk duration of the performance salary payment is matched. There are regulations.

"Financial enterprises are different from general enterprises, and risk exposure has a certain delay. Therefore, both the CBRC and the Ministry of Finance require delayed issuance, and the CBRC has stricter the delayed payment conditions. In recent years, the number of related penalties is significantly increasing. "Industry insiders pointed out.

Do not transport interest by dealing with non -performing assets

In order to strengthen financial asset management, safeguard financial debt, and effectively prevent financial risks, the "Notice" is classified as the risk of actual assets, strengthened the verification and disposal management of non -performing assets, and strengthened three aspects of overseas investment management.

In terms of the classification of real asset risks, the "Notice" proposes that financial enterprises should strengthen the quality management of assets, do real asset risks, and regularly conduct re -examinations of various types of asset risk classifications. They truly and accurately reflect the quality of assets. They must not conceal the quality of assets. The real risk of assets; comprehensively evaluate the status of its own assets, predict potential risks scientifically, objectively and reasonably evaluate the loss of asset impairment according to the changes in the quality of the assets, and the assets that bear the risks and losses shall timely withdraw all the reserves in time in accordance with relevant regulations. , Enhance risk resistance, truly reflect profitability, and must not manually adjust the reserve to manipulate profits.

Regarding the invalid reorganization, the "Notice" clearly refers to the reorganization of debt agreements that do not meet the qualified debtors (excluding judicial reorganizations such as bankruptcy and reorganization under the court), or the debtor is difficult to substantially improve quality and efficiency after reorganization. Risk reorganization. In terms of strengthening the management and disposal management of non -performing assets, the "Notice" proposes that financial enterprises should strictly implement the basic principles of "meet the conditions of identification, provide valid evidence, account for deposit, and power in power", and increase the nuclear sales of non -performing assets, and use it with use of non -performing assets. Good use of existing nuclear sales policies.

At the same time, for non -performing assets to apply for verification, necessary preservation measures should be taken and the necessary recovery procedures should be taken to effectively perform due diligence of borrower and debt related persons, guarantee property, etc. If the cause of the assets is formed, the relevant responsibility is identified and pursued in accordance with regulations.

The "Notice" stipulates that non -performing assets of financial enterprises should adhere to the principles of "compliance, public transparency, clean transfer, and real sale" in accordance with law, and timely disclose relevant information. delivery. It is strictly forbidden to transfer non -performing assets through false transfer to cover up the quality of the real assets of financial enterprises. The non -performing assets (including the first transfer of banks and the subsequent transfer of asset management companies), in addition to in accordance with relevant national regulations, with the debt reorganization of the original debtors and the stakeholders, the asset -heavy, shall not be transferred to the original debtor and related enterprises of the asset Stakeholders.

- END -

Taiyuan Environmental Protection Adjustment Plan, to withdraw the IPO application materials of the Beijing Stock Exchange

On July 20, 2022, Taiyuan Environmental Protection (836479.NQ) issued an announcement on the application of shares that plans to terminate to unspecified investors and listed on the Beijing Stock Exch

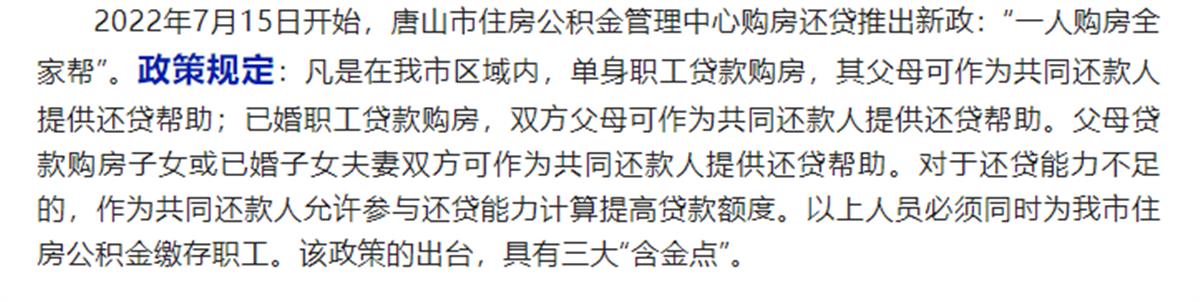

Tangshan's "One Man Buy the Family Gang" Cheng Chengcheng No. 14 City, Expert: Can be promoted nationwide

Jimu Journalist Liu YeruiOn July 5th, Tangshan Housing Provident Fund Management C...