Behind Bank

Author:WEMONEY Research Room Time:2022.08.02

Produced | WEMONEY Research Room

Edit | Liu Shuangxia

On August 2nd,#8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 Search, causing heated discussions.

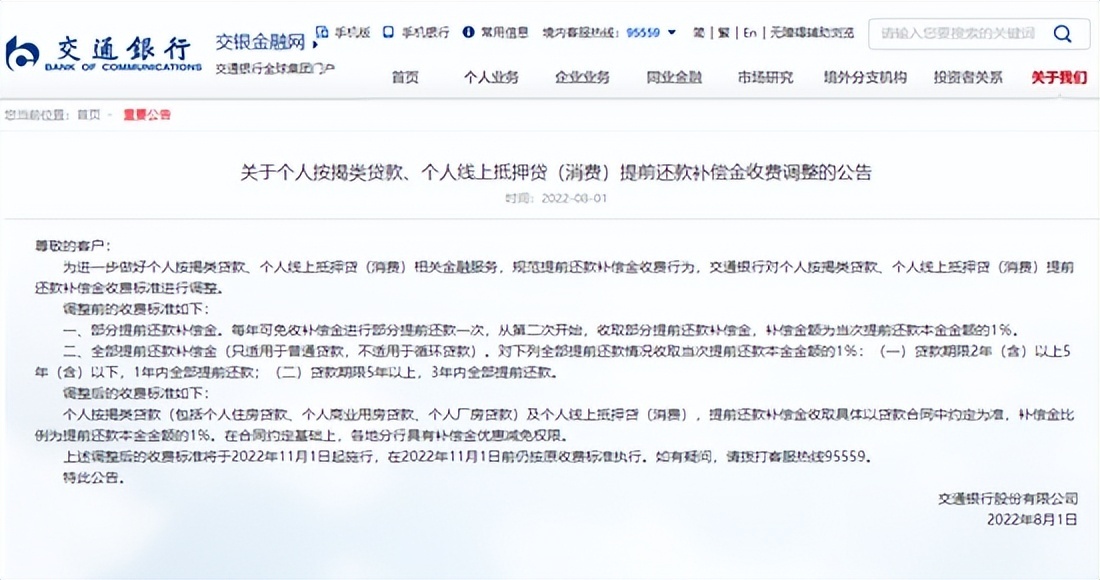

It is reported that on August 1, the Bank of Communications issued an announcement that since November this year, the bank will adjust personal mortgage loans and personal online mortgage (consumption) advance repayment compensation charging standards. Among them, personal mortgage loans include personal housing loans, personal commercial housing loans, and personal factory loans.

The charging standards before adjustment are as follows:

First, partial repayment compensation. Each year can be exempted from the compensation for partial repayment once, starting from the second time, the collection of some repayment compensation is collected, and the compensation amount is 1 % of the amount of the principal repayment in advance.

Second, all of the early repayment compensation (only applicable to ordinary loans, not applicable to circular loans). 1 % of the amount of early repayment principal is charged for the following in -advance repayment situation: (1) the loan period of 2 years (inclusive) or less, and all of them will be repaid within 1 year; (2) the loan period of the loan period For more than 5 years, all of them are repaid within 3 years.

The adjusted charging standards are as follows:

Personal mortgage loans (including personal housing loans, personal commercial housing loans, personal factory loans) and personal online mortgage (consumption) (consumption). 1%of the amount of repayment principal. On the basis of the contract, branches in various places have preferential compensation and exemption permissions.

It is understood that generally, banks will not collect early repayment compensation. Even if there are such expressions in the contract terms, the bank branches will be reduced in actual operation.

Yan Yuejin, the research director of the Think Tank Center of the E -House Research Institute, believes that the policy of announced the relevant compensation after the adjustment of the Bank of Communications is tightened.

"In the past, 1%of compensation or liquidated damages for such banks was to refer to the types that were repaid in advance and repaid for less than 3 years in one year. There were certain limited standards." He analyzed, It can be seen this time that the behavior of various types of early loans may be requisitioned by 1%of the penalty, which shows that the compensation or liquidated penalty policy is strict. In addition, the loan repayment in advance is not simply aimed at personal mortgage loans, but also includes commercial housing loans and factory loans, so it involves personal mortgage loans that we understand.

Yan Yuejin said that the starting point of this policy is obvious, that is, the standard of early repayment compensation is standardized. This also shows that the recent repayment phenomenon of some banks may increase, which is a new phenomenon of mortgage that needs to be paid attention to. The announcement and policies of the Bank of China need to pay attention to the regulatory level and industry. Although it is a seemingly ordinary announcement, in fact, the phenomenon of the current repayment is increasing behind it. The market issues and people's psychological need to be posted actively.

Many buyers believe that the Bank of China is not friendly. On August 2nd, the Bank of Communications also appeared on Weibo hot search.

Perhaps affected by the pressure of public opinion, on the afternoon of August 2, the official website of the Bank of Communications has deleted the above announcement.

Yan Yuejin believes that the current main tone is to reduce the burden of home buyers, and the relevant measures of banks must also fully stand on the perspective of protecting the rights of home buyers. This kind of approach also requires the financial sector to pay close attention to prevent the new financial risks and disputes of the banking system. It is necessary to fully understand the financial needs of customers and actively improve services. Disputes and complaints on loans.

The annual report of the Bank of China shows that in 2021, the balance of personal housing mortgage loans of the Bank of Communications was 1.49 trillion yuan, an increase of 15.13%over the end of the previous year, accounting for 22.70%, an increase of 0.58 percentage points.

Regarding this year's mortgage policy, the Bank of China has stated that "this year, it will continue to actively meet the reasonable demand for home buyers and maintain a steady growth of mortgage loan business. At present, the proportion of transportation mortgage loans is not high, which also gives us room for development. "

- END -

Yantai High -tech Zone Tax: Xiang Haitu's strong tax trend rides in the wind and waves.

Qilu.com · Lightning News, July 1st, deeply cultivated the Bihai Sea, the future ...

Why can these bank services be recognized by Hangzhou small and micro enterprises?

Economy is the body and finance is blood. How to make financial blood flow through...