On the 12th of the listing, the stock price skyrocketed hundreds of times, and the market value was close to trillion yuan, which is equivalent to two Pinduoduo!Li Ka -shing flickering behind the crazy "Chinese stocks"

Author:Daily Economic News Time:2022.08.02

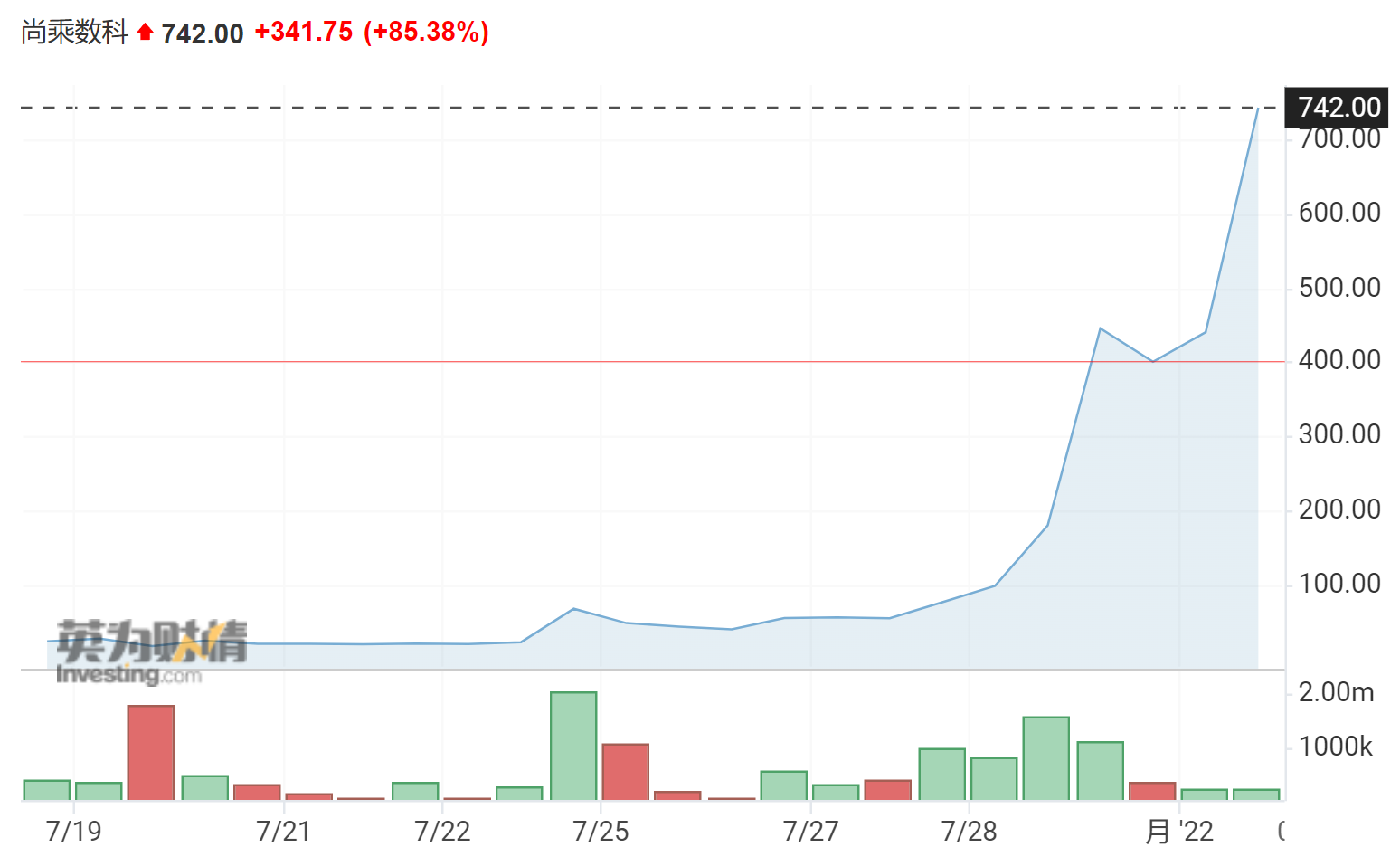

Only 12 trading days after listing, the stock price skyrocketed by nearly a hundred times.

An unknown Chinese stock market has recently emerged in the US stock capital market and staged a "Chinese stock myth". This "monster stock" is the current multiplication (HKD, the stock price is US $ 742, and the market value is US $ 137.3 billion).

As of the closing of August 1st, the market value of the Division of Division has reached US $ 137.3 billion (about 928 billion yuan). According to Wind Financial terminal data, the stills have surpassed Jingdong (JD, the stock price is 58.76 US dollars, and the market value is 91.77 billion US dollars) US stocks, which has become second only to TSMC (TSM, $ 86.31, $ 447.6 billion) and BABA (BABA (BABA (BABA (BABA (BABA (BABA (BABA The third largest stock price of 90.34 US dollars and a market value of 239.2 billion US dollars) is listed in the United States.

The lifting seems to continue. As of the release on August 2, it rose nearly 16%before the section.

However, in addition to soaring, the market questioned whether the market value of the Rasali Division can support the market value of nearly trillion yuan. It is undeniable that the business of the stills still faces a lot of challenges.

Behind the surge is the concept of Li Ka -shing?

The number of Shangqi Division landed on the US stocks on July 15th, the issue price of $ 7.8, and raised about 125 million US dollars (about 845 million yuan), becoming the largest IPO of the New York Stock Exchange since 2022.

During the more than 10 trading days after listing, the company opened a "rushing journey". As of the last trading day of the trading day in July, the stock price of the stills soared to $ 400.25.

What is unexpected is that this may be just the beginning.

As of the closing of August 1st, the stock price of the stills has soared to $ 742. This means that in the short 12 trading days since listing, the company's stock price has risen by nearly 100 times, the price -earnings ratio exceeds 6,000 times, and the market value has reached 137.3 billion US dollars, which is equivalent to two Pinduoduo (PDD, $ 47.69, a market value of 603 $ 100 million), TSMC and Alibaba, the highest market value in China stocks.

Regarding the rapid rise of the company's recent stock price, the reporter of "Daily Economic News" sent a comment request to Shangbuke, but as of press time, the reporter has not received a reply.

Image source: Yingwei Caiqing

Shangbuki Digital Section is the Asian Digital Financial subsidiary of Shangbo Group, and the English name AMTD DIGITAL Inc is split out from the financial service company of the New York Stock Exchange. Founded in 2003, Shangchang Group was involved in financial services, digital technology, art, culture and entertainment. One of the founding shareholders was Li Jiacheng's Yangtze River Industrial Group and Hutchison Whampoa.

According to public information, Shangbo Group currently holds 86.7%of Shangbao International, but its equity structure has not been disclosed. Therefore, in this "Chinese stock myth", it is impossible to know that Li Ka -shing has harvested in this "capital carnival". Fortune value. If its share ratio exceeds 25%, the current value will reach 100 billion yuan.

From the perspective of the equity structure before the IPO of the Shangbo Division, the Shangbo Group was the controlling shareholder of the stills of the stills at that time, and the shareholding ratio reached 72.2%; ; Shangcheng International holds 14.4%. In addition, the company also introduced radio investment companies and Huili Greater China High Income Fund. "Daily Economic News" reporter also noticed that the shareholders of the stills also include the Greater Bay Area Common Home Fund, Huili, one of the largest independent asset management companies in Asia, and Jiayu Fund founded by former Ali CEO Wei Zhe.

Cen Zhiyong, a strategist in Hong Kong Baihui Securities in China, told the reporter of "Daily Economic News" through WeChat, "I think (I think (the skyrocketing of the stills) may be related to some concepts of Li Jiacheng. Famous. Because the company is listed in the United States now, then American investors may also have a certain hope. ","

In addition, it is worth noting that with the help of many well -known shareholders, the company has completed multiple investment before.

According to the prospectus of Shangbuki, the company has previously invested in artificial intelligence company Pei Xing Interactive Technology (Appier Inc.), Asia's largest food network information multimedia multimedia service platform, DAYDAYCOOK, and Internet Medical Platform Micro -Medicine Group, etc. Essence

The follow -up challenge is not small

However, while many investors were surprised to create "Chinese stocks myth" for the Shangbuke Section, there were also many market participants in revenue of HK $ 195.8 million (about 170 million yuan). The capacity of the dollar market value is suspicious.

After the stock price of Yiluo Dust has soared, the current price -earnings ratio of the Division of Division exceeded 6000 times. Compared with it, the average price -earnings ratio of the S & P 500 index is currently less than 20 times, and the US financial giant Morgan Chase P / E ratio is less than 9 times. Shidanley's price -earnings ratio is 10.7 times, Goldman Sachs Group's price -earnings ratio is 7.3 times ... This also makes the market began to worry about whether the stock price and market value can be supported by the current multiplication, and whether its stock price will cause large fluctuations in the short term.

It is not difficult to see from the prospectus that there are indeed many problems in the number of divisions.

The first is the decline in revenue growth. According to the prospectus, as of February 2022, the current revenue rate of the number of sections was as low as 4%, and the annual revenue rate of 2021 fiscal revenue was approximately 17%. Secondly, the supervision of fintech tracks is getting strict, and the legal compliance issues in the regional market are in front of the stills of the stills.

For example, in the "risk factors" chapter of the prospectus, "When providing new products and services, transactions with more wide market customers will expose more risks." Next, Shangbo, Shangbi The goal of several subjects is to continue to expand to Southeast Asia and other regions, set up banks in Singapore and merge to report -all need to be approved by the regulatory authorities.

In the end, the reporter of "Daily Economic News" also noticed that the Shangbian Section also clearly mentioned the company's high risk of the company's high dependence on the "spider web" ecosystem business.

Shangbian Digital Division mainly divides business into four parts -digital financial services, "SpiderNet" ecosystem solutions, digital media, content and marketing, and digital investment business.

Photo source: Shangbuki Division Prospectus

The prospectus shows that in fiscal year, fiscal year 2020 and fiscal 2021 (as of April 30), the income of the Digital Division mainly comes from the charges and commissions of the digital financial service business and the "cobweb" ecosystem solution business. The "spider web" ecosystem mainly plays a multi -party resource connection and re -empowerment. The company said that partners from different fields such as the digital and traditional finance industries, technology industries, and academic institutions can all be connected in the cobweb ecosystem. The system can provide customers with capital, technology, guidance and other resources, accelerate and enhance enhancement The digital transformation of its business.

Specifically, in fiscal year 2019 to 2021, the revenue of the number of Hong Kong dollars was HK $ 14.55 million, 167.5 billion Hong Kong dollars, and 195.8 million Hong Kong dollars, with profits of HK $ 215.44 million, HK $ 158 million, and HK $ 172 million. Both growth grows faster. In the first ten months of these three fiscal years and 2022 fiscal year, the "cobweb" ecosystem accounted for 40.4%, 94.1%, 94%, and 93.7%of the total revenue of the stills.

"However, the limited operating history of the 'spider web' ecosystem business does not mean that our future can continue to achieve performance growth. No one can guarantee that we can maintain the previous growth rate in the future. Our growth prospects should consider the company and the industry that may be possible. The risks and uncertainty faced ... Once the existing contract expires, our customers may not continue to use our solutions, or they may not buy additional solutions. This risk is replacing service providers in the replacement service provider It is particularly obvious when the cost is not high. We maintain and expand the customer foundation and strengthen contact with customers depends on many factors, and some of these factors are not within our control scope. "

However, it is worth noting that in digital media, content and marketing business, there are still good performances.

The film "Bomb Demolition Expert 2" released in 2020 is the first film that is officially involved in the digital film and television cultural industry and participated in production. The investment of this film has made Shangbuki Hiroshima a return of over 1.3 billion yuan.

(Disclaimer: The content and data of this article are for reference only, do not constitute investment suggestions, verified before use. According to this, the risk is self -affordable.)

Daily Economic News

- END -

Give full play to the role of youth taxation pioneers to improve the efficiency of tax handling

In order to further help enterprises to resume work as soon as possible and accurately implement the preferential tax policies, the Taxation Bureau of Ningwu County, State Administration of Taxation t

The entry price is 5 yuan over 400 times and sold to the godfather!These dried sons are not ordinary cheating ...

Xiao Chai's former office, often the elderly came to knock on the door, saying tha...