Warehouse Vane | Ruiyuan Fund Fu Pengbo: Dynamic adjustment and optimization combination, discover the impact of the epidemic, have tough and elastic companies under the impact of the epidemic

Author:China Fund News Time:2022.08.03

China Fund News Wang Yunlong

Editor's note: Recently, the Fund's second quarterly report has disclosed that the positioning movements and position changes of the star fund managers have also become the focus of the attention of the citizens. Behind each regular report, these outstanding manager's "investment secrets" are also hidden. Fund Jun will continue to update the character's database feature [positioning vane], decoding star fund product holding changes and its manager's investment philosophy.

In the second quarter, the market ushered in a rebound, and the value of Ruiyuan, a subsidiary of Fu Pengbo, continued to maintain the operation of a higher position. At the same time, Fu Pengbo added the configuration of the coal resource sector, photovoltaic and new energy and new energy and special effects pharmaceutical sectors in the second quarter.

Looking forward to the second half of the year, Fu Pengbo believes that the dynamic adjustment and optimization combination is still the focus of work. In terms of stock selection, the long -term growth capabilities will be more comprehensively examined, including the growth and new growth curve of the stock, the performance of performance, and the management of the management of management and internal execution, and comprehensively evaluate the valuation level of the company. In addition, Fu Pengbo stated that he would continue to disclose the intercourse and continue to explore investment opportunities, especially companies with toughness and elasticity under the impact of the epidemic. At the same time, it will also adjust companies with a large macroeconomic impact and try their best to control the fluctuations of net worth.

In this issue of [Warehouse Vane], Fund Jun will explain the second quarter report and position changes of Ruiyuan Fund Fu Pengbo.

Market rebound+product net purchase

The management scale of Fu Pengbo rose to 32.5 billion in the second quarter

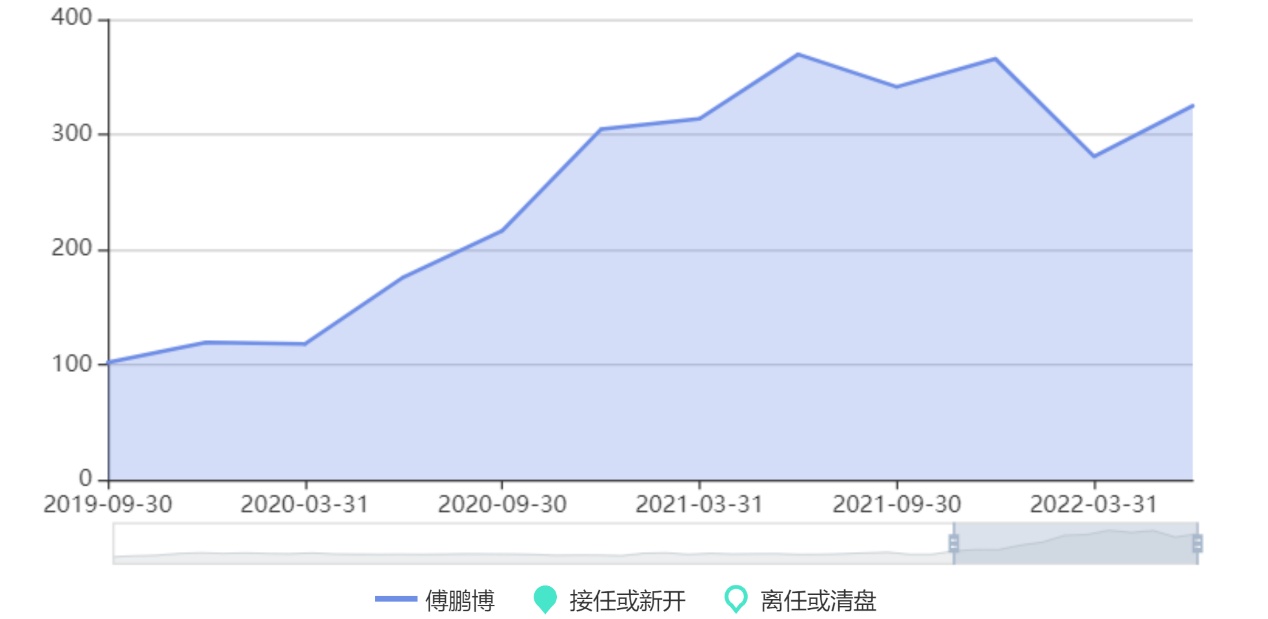

In the second quarter, the market showed signs of recovery, and many early adjustments obviously welcomed a rebound. The second quarter report of the product shows that Ruiyuan's growth value of Fu Pengbo's product has increased by 12.08%, while Ruiyuan's growth value hybrid C net value has increased by 11.98%, all of which win a comparative benchmark.

At the same time, after the scale of the first quarter, Fu Pengbo picked up the product scale in the second quarter, and rose from 28.09 billion yuan at the end of the first quarter of 2022 to 32.488 billion yuan.

On the one hand, the management scale is due to the growth of product net value in the second quarter. On the other hand, Ruiyuan's growth value mixes the net purchase in the second quarter. The second quarter report shows that in the second quarter, Ruiyuan's growth value hybrid A realized 487.5 million copies of net purchase, and Ruiyuan's growth value hybrid C realized net purchase of 79.2 million copies.

Keep higher position operation

Increase the allocation of coal resources, photovoltaic new energy, and new crown -related sectors

From the point of view of the position, the growth value of Ruiyuan's growth in the second quarter maintains a higher position operation. The top ten key holdings account for more than 40%, and the first 20 positions account for more than 65%. high.

The second quarter report showed that in the second quarter, Fu Pengbo's product equity assets accounted for 91.53%, a slight decrease of 0.82%from the end of the first quarter. 4.86%, basically back to the level a year ago.

From the perspective of heavy warehouse holding allocation, the value of Ruiyuan's growth at the end of the second quarter is still mainly allocated in the manufacturing sector, and the track telecommunications, information technology, materials and other tracks are heavy.

From the perspective of the top ten heavy stocks of the product, according to the market value of the market value: San'an Optoelectronics, China Mobile (0941.HK), Lixin Precision, Oriental Yuhong, Wanhua Chemistry, Tongwei, Geely Automobile (0175.HK ), Watson Biology, Mai is a shares and national porcelain materials.

Among them, Fu Pengbo's report period for "Favorite" Lixun Precision and Oriental Yuhong Heavy Warehouses reached 13, and the number of reporting periods for Wanhua Chemical and Guo Porcelain Materials was 12.

Specifically, in the list of the top ten heavy warehouses in Fu Pengbo in the second quarter, the three stocks of pilot intelligence, big laser, and Wei Ning Health were transferred from the top ten heavy warehouses. Mai is a shares of three stocks. Among them, Tongwei and Mai were two shares for the first time to enter the list of Fu Pengbo heavy warehouses. All related to the new energy sector.

In addition, in the second quarter report of the product, Fu Pengbo pointed out that in the second quarter, the coal resource sector, photovoltaic and new energy and new crown -related vaccines and special effects drug stocks were added to the configuration in the second quarter.

Fu Pengbo wrote: (1) Added a coal resource sector stock. Empirical shows that the revenue of the resource sector in the context of inflation generally leads the other sectors, and in the future, the central and long -term domestic fossil energy price operating central or upward shifts have enhanced the possibility of the sector realized revenue and profitable growth. (2) Added photovoltaic and new energy stocks. Silicon materials and battery boom are improved, the technology and efficiency of photovoltaic battery equipment have improved, and the rapid resumption of new energy vehicles after the epidemic is a logical starting point we increased. Related stocks have also contributed more obvious to the net worth of the portfolio. (3) Added vaccine and special effects drugs related to the new crown. To achieve uninterrupted economic life and the prevention and control of normalized epidemics, the general vaccination of more effective vaccines for the whole people and timely and effective treatment for patients are the two key points. This is the main reason for our positions.

Economic recovery requires incremental policies

Dynamic adjustment and optimization combination, discover the impact of the epidemic, have tough and elastic companies under the impact of the epidemic

In the second quarterly report, Fu Pengbo pointed out that since the end of April, the domestic epidemic has gradually been controlled, and the prevention and control policies have become optimized.

Even so, Fu Pengbo still said that the epidemic has repeatedly limited domestic consumption recovery and residents' willingness to spend, and the uncertainty of overseas economic policies and geopolitics. Whether the economy can return to the level of reasonable growth in the second half of the year requires the effort of incremental policy. Real estate and infrastructure are visible specific grasps. The consumer price index announced in June has a new high within the year. In the second half of the year, anti -inflation may also become a variable of regulatory policies. Looking forward to the second half of the year, Fu Pengbo wrote in the second quarterly report: The dynamic adjustment and optimization combination is still the focus of work. For the comparison and screening between the company and the company, he will more comprehensively examine the long -term growth capabilities, including the growth and new growth curve of the stock, the performance of performance, the management of management and internal execution, and comprehensively evaluate the company's estimate Value level. Combined with the interim report disclosure, investment opportunities will continue to be discovered, especially companies with toughness and elasticity under the impact of the epidemic. It will also adjust companies with a large macroeconomic impact and try their best to control the fluctuations of net worth.

(Note: If there is no special indication of the chart data in this article, it comes from Zhijun Technology and Wind data)

Risk reminder: The fund has risks, and investment needs to be cautious. Fund's past performance does not indicate its future performance. Fund research and analysis do not constitute investment consulting or consulting services, nor does it constitute any substantial investment suggestions or commitments to readers or investors. Please read the "Fund Contract", "Recruitment Manual" and related announcements carefully.

- END -

7 Profile companies were ordered to investigate and rectify for their product terms and rates

Economic Observation Network Reporter Jiang Xin received a fine of 7 property insu...

Digital RMB Industry Alliance established related concept stocks on the 24th today

Cover News Profile reporter Tan YuqingOn the morning of July 25th, as of press time, the digital concept stock reported 1158.86 yuan per share, which was reported to 0.08%. The new mainland of the ing