Whether the IPO of Yihong shares will be available

Author:Cover news Time:2022.08.03

Cover reporter Ma Mengfei

On August 2nd, the 47th review meeting of the GEM Listed Committee was held. The main question of the Shanghai Municipal Party Committee's meeting is that Yihong has a large customer dependence, and the gross profit margin continues to decline. At the same time, I also asked if it was in line with the positioning of the GEM.

According to the data, Yihong Co., Ltd. is mainly engaged in the research and development, design, production, and sales of color packaging boxes, watermark boxes and other products. The company's products are mainly used in dairy products, food, health products, cosmetics, online education, alcohol or drinks, electronics and e -commerce fields. Customers include Mengniu, three squirrels, and pinoscopy.

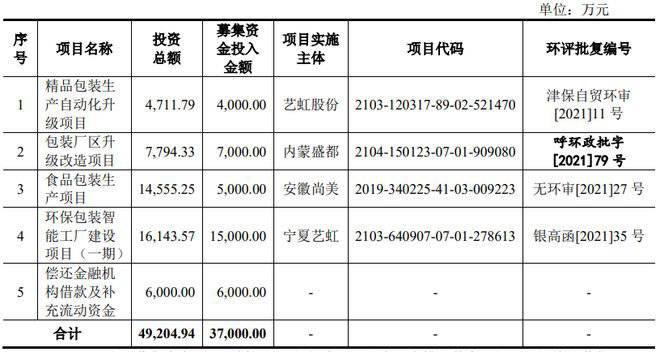

In this IPO, Yihong Co., Ltd. plans to raise 492 million yuan for environmental protection packaging intelligent factory construction projects (Phase 1), food packaging production projects, packaging plant upgrades and transformation projects, boutique packaging production automation projects and repayment of financial institutions borrowing, and financial institutions, and financial institutions, and financial institutions borrowing, and financial institutions, and financial institutions borrowing. Supplement mobile funds, etc.

With the continuous improvement of national income, the consumer market has continued to grow, the promotion of the booming of the printing and packaging industry, and the scale of the industry has steadily increased. According to data from the Foresight Industry Research Institute, the industry scale has increased from 277.1 billion yuan in 2013 to 363.3 billion yuan in 2018, with an average annual compound growth rate of 5.57%.

However, on the other hand, the barriers to the packaging industry are low, small and medium -sized enterprises, and fierce market competition, showing a highly scattered competition pattern. Yihong ranks only 35th and faces greater competition pressure.

At the IPO meeting, the main problems of Yihong shares were also pointed out.

Specifically, Yihong Co., Ltd. has a major dependence on the main customer Mengniu Group. During the reporting period (2019-2021), Yihong's sales revenue to Mengniu was about 642 million yuan, 682 million yuan, and 864 million yuan, respectively, accounting for 68.51%, 65.99%, and 66.11%of the company's operating income, respectively. And more than 60 %.

In addition, due to the joint influence of Mengniu Group's low product unit price and raw material prices such as the price of raw materials, the gross profit margin of Yihong has dropped from 20.05%in 2019 to 12.11%in 2021, falling nearly 8 points. At the same time, during the reporting period, the gross profit margin and account receivable turnover rate of Yihong shares were lower than the comparable company average in the same industry.

- END -

The IPO of the Zhengzhou Fedeke Bei Stock Exchange was accepted and was the first batch of special new "little giants" enterprises

[Dahe Daily · Dahecai Cube] (Reporter Chen Yuyao) On June 21, the Beijing Stock E...

The "grain" strategy of the big country | fast progress, good quality, and guarantee, the production of summer grain production in the country is hoping

Wind blowing wheat waves and granules.By the time of the summer harvest, an agricu...