Li Ka -shing makes money!The "China Stock Myth" has risen 214 times in 15 days, and the market value is super Ali Tencent

Author:Refer to the business Time:2022.08.03

Chinese stocks still have a single show.

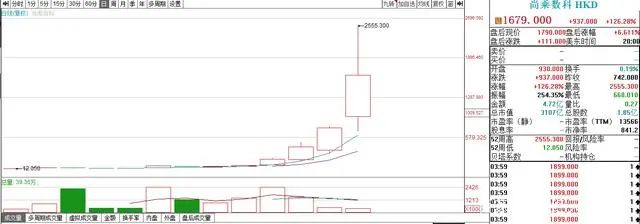

On August 2nd, the three major stock indexes of the US stocks fell collectively, but the stills rose against the trend. As of the close of the day, the number of Science and Technology University of Science and Technology rose 126.28%.

According to the statistics of the "Finance and Economics" weekly, Shangbian Division landed on the New York Stock Exchange on July 15th, and the stock price of only 13 trading days soared from $ 7.8 to 1679 US dollars, with a cumulative increase of 214 times. The current market value is the total market value is the current total market value. $ 3107 billion.

As of now, there are only three Chinese stocks with a market value of over 100 billion yuan, and this stills that have just been launched shortly are one of them.

It is worth noting that, in the context of the recent rise in stock prices, the market value of the stills not only shakes away the popular Chinese stocks such as Jingdong, PetroChina, Pinduoduo, and NetEase, but also surpass Alibaba to become the second market value of Chinese stocks.

Public information shows that the Shangbo Digital Section was split from the HKIB International (HKIB), and the latter was a subsidiary of the Shangrae Group, which was founded by the financial crocodile Li Jiacheng's Changjiang Industrial Group in 2003.

The market value once super Ali and Tencent

According to the Qianjiang Evening News · hour news report, the market value of the maximum of 472.73 billion US dollars in the number of Shangbiankes exceeded Alibaba (US $ 245.27 billion) and Tencent (2.8 trillion Hong Kong dollars, about 356.7 billion U.S. dollars).

Behind the surge is the concept of Li Ka -shing?

According to the Daily Economic News, Shangbuki Digital Division is the Asian Digital Financial subsidiary of Shangbo Group. The English name AMTD DIGITAL Inc is split out from the financial service company of the New York Stock Exchange. Founded in 2003, Shangchang Group was involved in financial services, digital technology, art, culture and entertainment. One of the founding shareholders was Li Jiacheng's Yangtze River Industrial Group and Hutchison Whampoa.

According to public information, Shangbo Group currently holds 86.7%of Shangbao International, but its equity structure has not been disclosed. Therefore, in this "Chinese stock myth", it is impossible to know that Li Ka -shing has harvested in this "capital carnival". Fortune value. If its share ratio exceeds 25%, the current value will reach 100 billion yuan.

From the perspective of the equity structure before the IPO of the Shangbo Division, the Shangbo Group was the controlling shareholder of the stills of the stills at that time, and the shareholding ratio reached 72.2%; ; Shangcheng International holds 14.4%. In addition, the company also introduced radio investment companies and Huili Greater China High Income Fund. The reporter also noticed that the shareholders of the Shangbuke also include the Greater Bay Area Common Home Fund, one of the largest independent asset management companies in Asia, and the Jiayu Fund founded by former Ali CEO Wei Zhe.

Hexun Integrated from "Finance and Economics" Weekly, Qianjiang Evening News · hour News, Daily Economic News

- END -

"The economy is expected to continue to rise in the second half of the year" -The National Development Reform Commission talks about the current economic trend

Xinhua News Agency, Beijing, July 14th: The economy is expected to continue to ris...

Shenzhen issued the fourth batch of new local government bonds 5.898 billion yuan for these areas →

A few days ago, through the government bond issuance system of the Ministry of Finance, Shenzhen successfully issued the fourth batch of new local government bonds in 2022, with a total scale of 5.898