Sailin Stead sprints, and was asked to make supplementary instructions on commercial bribery | IPO observation

Author:City world Time:2022.08.03

In the context of global carbon neutrality, new energy is the absolute main line of the capital market. Another track environmental protection industry has gradually been paid by the market, and environmental protection enterprises have been frequently investigated by institutions.

In this context, Sail, known as the "little giant" in the field of metal pollution prevention and control, launched an impact on the capital market and successfully met on August 2. In this IPO, Sails plans to issue not less than 23.7067 million shares, and it is planned to raise 250 million yuan.

As a leading enterprise in the field of heavy metal pollution prevention and control, the development of Syynes before 2019. After 2019, due to the impact of the new crown epidemic and business adjustment, there was a problem in the operation of Senns.

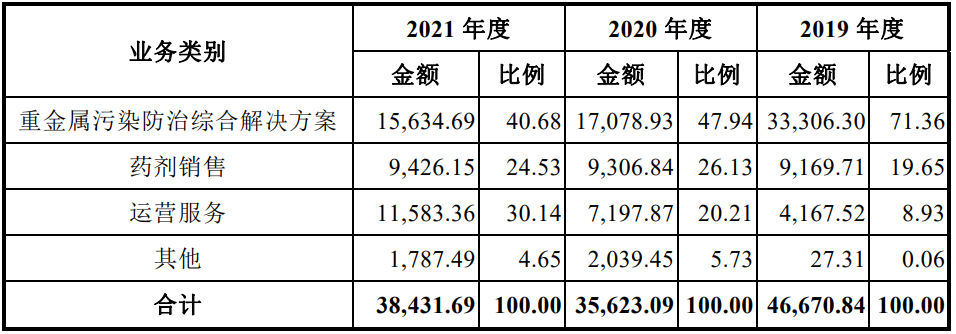

The prospectus shows that from 2019 to 2021, Sailis realized operating income of 467 million yuan, 356 million yuan, and 384 million yuan, respectively, and the net profit attributable to mothers was 36.0949 million yuan, 45.988 million yuan, and 44.629 million yuan, respectively.

The explanation given by Seynes has been stagnant for the decline in revenue and the growth of net profit attributable to mother. The explanation given by Senns is due to the impact of the epidemic and business adjustment. In the past few years, the company's revenue has the highest proportion of heavy metal pollution control business revenue.

Specifically, the business revenue dropped from 333 million yuan in 2019 to 156 million yuan in 2021. However, the company's operating services increased from 41.6752 million yuan to 115 million yuan. Although operating business revenue increased rapidly, the negative impact of the decline in the decline in the decline in the prevention and control of heavy metal pollution caused the decline in Sailis' revenue and decline in revenue and decline in revenue The growth of net profit of home is stagnant.

The decline in performance brought about by business adjustment is a major problem facing Seynes, and corporate compliance issues and actual controller risks are another major problem facing Seynes.

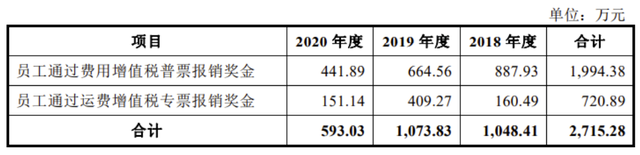

In September 2018 to September 2020, in order to reduce personal income tax to employees, Sailis collected VAT invoices through employees. Or the logistics supplier is paid by the freight payment method, and the supplier returns to the employees to pay the salary and commission of employees.

The prospectus shows that from 2018 to 2020, Sails issued a total of 27.1528 million yuan in employee bonuses and commissions through virtual increase of value -added tax invoices and supplier transfer payment. In 2021, under the guidance of the taxation department, Senns made up to 2.1017 million yuan in taxation.

In addition, from 2018 to 2020, Sail also paid prolonged bonuses and used employee accounts to pay sporadic materials or labor services at the project site, involving the amount of 4.477 million yuan, 3.796 million yuan, and 13.802 million yuan, respectively. In 2021, the amount purchased through individual suppliers was 1.4771 million yuan.

For private enterprises, the law does not stipulate that it will not be allowed to purchase from individuals. But in accordance with the industry regulations of various banks. Supply suppliers need to have specific supply qualifications.

In this regard, the CSRC also issued an inquiry letter for the reason why Sailnes explained to the individual. Syns said that purchasing from personal procurement is mainly to save time. At present, the importance of regulatory management of suppliers has been realized, and the situation of purchasing from individuals has been reduced, and it has instead purchased from large -scale and qualified enterprises.

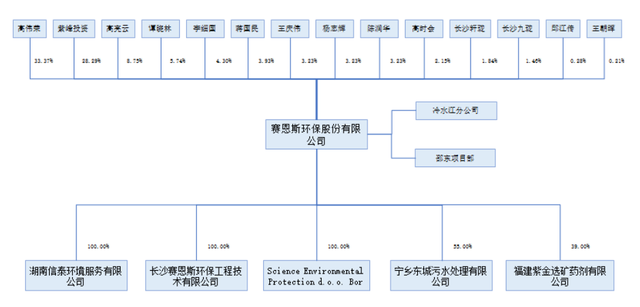

The prospectus shows that the company's actual control is Gao Weirong, Gao Liangyun, and Gao Shihui, and holds a total of 44.27%of the shares of Senns. Among them, Gao Weirong holds 33.37%of the company's shareholder and is a major shareholder of Sail. The other three also served as chairman, director and deputy general manager, and project management department managers of the company.

Before he served as Cyys, Gao Weirong, Gao Liangyun, and Gao Shihui brothers and sisters of Gao Weirong, Gao Liangyun, and Gao Shi will serve as chairman, deputy general manager, and engineering manager of the engineering department in Hunan Wutian Pharmaceutical Co., Ltd.. Wutian Pharmaceutical was exposed by the media for bribery Xiangya Hospital.

The core figure of this case is Tian Qiangquan. According to media reports, Wutian Pharmaceutical's Back is Tianqiangquan's remote control affiliated enterprise. Wutian Medicine is also the main drug supplier of Xiangya Hospital.

Beginning in 2006, Wutian Medicine monopolized the infusion of Xiangya Hospital for 5 years. Subsequently, Wutian Medicine was bribed to Xiangya Hospital by the media. The three brothers and sisters of Gao Weirong also left the pharmaceutical industry. In July 2012, Gao Weirong invested 1.23 million yuan to control Says. Since then, the three brothers and sisters of Gao Weirong have entered the management of Sail.

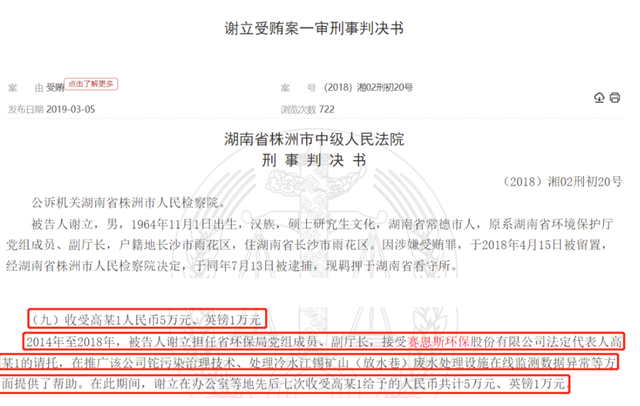

In 2019, the ruling announced by the China Referee Website. From 2014 to 2018, Xie Mou, the former deputy director of the Environmental Protection Department of Hunan Province, revealed in the review of RMB 50,000 and pound 10,000 yuan given by the actual controller Gao Mou. Give help.

In this bribery case, Sailnes said that the supervisory organs had inquired about Gao, but did not conduct a case investigation.

According to the information disclosed by China Magistrate Network, from 2013-2015, Chen, then Chen, then director of the Environmental Protection Bureau of Yizhang County, Hunan Province, used his position to give Cyynes in terms of environmental protection projects and engineering construction. In return, Deng Mou, a marketing manager of Senns, bribed Chen Mou twice, and the amount of bribes was 30,000 yuan.

In response to the emergence of frequent bribes, the CSRC also asked Sayes to make supplementary instructions in commercial bribery. Senns said that the "Anti -Commercial Bribery System" had been formulated, and Selins managers also issued relevant statements and commitments, and promised that bribery will not occur in the future.

(Author: Duan Nannan)

- END -

On September 8-11, the 2022 China International Industrial Internet Innovation Development Conference meets you Xiamen!

The industrial Internet is the strategic direction of industrial development and h...

Optimize the business environment | Hubei Jingzhou awarded the first hotel industry "one industry, one certificate"

It is really fast and good to submit materials for each window! On June 13, the po...