A number of banks in 3 years and 5 years are flat, and small and medium -sized banks "increased their prices" to ensemble reserves

Author:First financial Time:2022.08.03

03.08.2022

Number of this text: 1803, about 3 minutes old reading time

Guide: Regional bank fixed deposit interest rates are significantly higher than large banks.

Author | First Finance Guo Haoyi

"The interest of our bank's deposit will start to be lowered tomorrow, and seize the last chance to lock the income!" On August 1st, the customer manager of a city commercial bank released the regular deposit interest rate information of its bank in the circle of friends.

In April this year, the People's Bank of China guided interest rate self -discipline mechanisms established a market -oriented adjustment mechanism for deposit interest rates. Subsequently, the interest rates of regular deposits and large -scale deposit deposits of large banks and shares were reduced to different degrees. As of now, many banks have leveled the phenomenon of three -year and 5 -year deposit interest rates.

At the same time, the First Financial Reporter learned from many regional banks in Guangdong that compared with Da Bank, the deposit interest rate of most urban commercial banks and rural commercial banks is not low. More than 3%, higher than the listing interest rate of large banks. However, this may not be good for small and medium banks. A Rural Commercial Bank told reporters: "For small and medium banks, although interest rates can attract deposits, it is not conducive to the overall development of the bank."

Many big banks' 3 or 5 years of fixed deposit interest rates are "flat"

On August 1, the reporter learned through the official website of various banks that many national commercial banks' 3 -year and 5 -year deposit interest rates were 2.75%, which was flat. In contrast, the interest rate of regional banks is not low. For example, Bank of Guangzhou's three -year fixed deposit rate is as high as 3.45%, and 5 -year (50,000 yuan) is set to 3.5%.

In fact, as early as April, the central bank disclosed that major state -owned banks and most joint -stock banks have lowered their interest rates and large amount deposit interest rates in the one -year or higher period in late April, which further promoted the decline in interest rates and generated " The phenomenon of inverted or "flat".

Some people in the industry said that the reason for interest rates is that my country's medium- and long -term interest rates will show a downward trend. After the central bank's guidance interest rate self -discipline mechanism has established a market -oriented adjustment mechanism for deposit interest rates in April this year, the regulatory agency encourages the self -discipline member bank to refer to 10 years. The bond market interest rate represented by Treasury yields and loan market interest rates represented by a one -year LPR reasonably adjust the level of deposit interest rates, and bank deposit interest rates should also go down.

The three -year and 5 -year deposit interest rate has been flat for a long time. Cai Hao, a senior researcher at the China Chief Economist Forum, believes that since November 22, 2014, the central bank will no longer announce the benchmark interest rate. Narrow, until October 24, 2015 (the central bank's last adjustment of the deposit benchmark interest rate), the spread between the two narrowed to 0 and both was 2.75%. Large -scale banks have imitated them. Although they are added on this basis, the difference between the two is 0.

So, why has the recent bank deposit market attracted much attention? Cai Hao pointed out that first of all, the market -oriented adjustment mechanism of deposit interest rates is to guide major banks to reduce large -deposit interest rates and better relieve and serve physical enterprises through structural reduction of bank liabilities. Secondly, after the epidemic, the stock market downturn, funds and wealth management revenue declined, and the financial system and residents lacked the assets of conjunction, making the attraction of market -oriented deposits such as large deposits that had been reduced in interest rates still remained high.

Small and medium -sized bank deposits are high but not "selling"

In addition to the entire deposit, the deposit interest rate of regional banks in large deposits is also significantly higher than large and medium -sized banks. Among them, most regional banks' three -year large deposit orders are close to 3.5%, and Bank of Guangzhou's 5 -year (starting amount 100,000 yuan) is approaching 4%.

In fact, the deposit interest rate of small and medium -sized banks has been in a downward trend. "This year (regular deposit interest rate) has been lowered." The aforementioned Rural Commercial Bank told reporters. He believes that the deposit interest rate of many small and medium -sized banks is still high, which is related to the pressure of small and medium -sized banks. However, for some small and medium -sized banks, it is not a good thing to attract deposits with high interest rates.

"First of all, the cost of cost. While opening a high interest rate, the bank is also dragging itself. The cost has squeezed the financing space of the economic entity. If the bank insists on not letting go of the high interest rate of loans, it may be transmitted to the bond market and trust market through the fund chain, and even indirectly transmitted to the entire capital market. "The person further pointed out.

However, even if the deposit interest rate is significantly higher, many customers still prefer to deposit in large banks. A bank wealth management manager told reporters that compared with the big bank, the credit and stability of small and medium -sized banks are more vulnerable to the customer's doubt; at the same time, because of the uncertainty of the epidemic, the regular deposit is not enough to attract customers for customers. Force, the longer the deposit life, the greater the risk, the more the customer pays attention to the credibility of the bank; in addition, small and medium banks lack enough outlets, and due to the restrictions of small banks by the central bank, many banks can only pass offline through offline. Many customers do not understand even if there are high interest rate deposit business or financial projects with high interest rate deposit business or financial projects.

In addition, small and medium -sized banks are still in a dilemma. Zhang Jiqiang, deputy dean of Huatai Securities Research Institute, said that small and medium -sized banks are in a dilemma of asset liabilities. The loan storm and village bank incidents have a blow to the quality and credit environment of local small and medium -sized banks. Differentiated by the big bank, cautiously sank the qualifications of the bank's subject. From a longer -term perspective, when high -interest collection has passed, small and medium banks need to explore new liability management models.

- END -

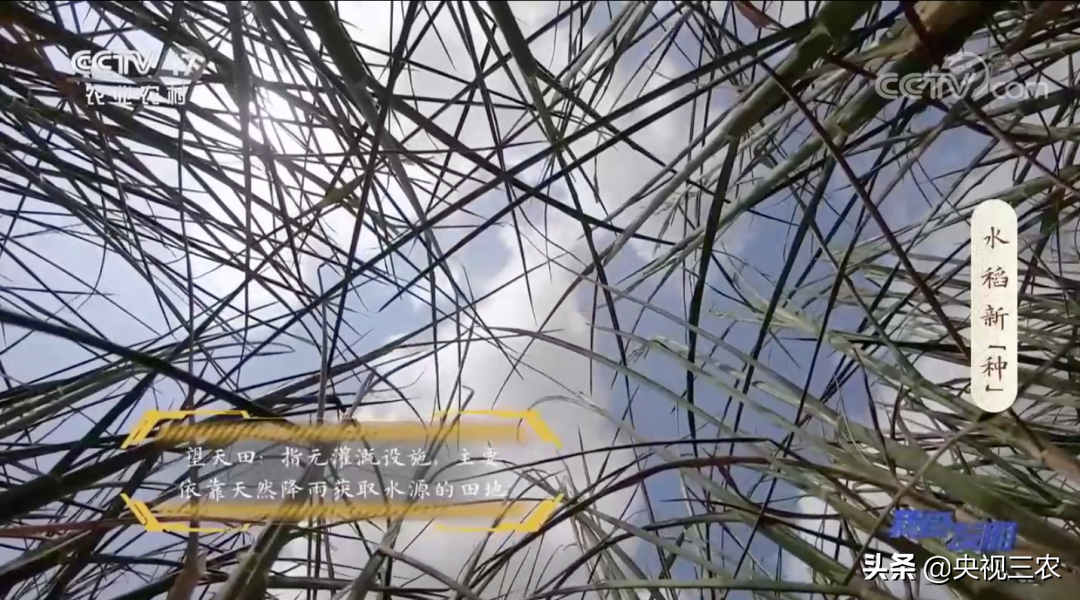

From the "sea fishing" from 200,000 genes, he cultivated water -saving drought -resistant rice

Research things, not just written in the paperAlso planted on the earthLet everyon...

The monthly salary is 50,000 urgent anchor!New Oriental responds to bilingual live broadcast: I feel

After the bilingual live broadcast and the stock price climbed, New Oriental began...