Performance of thunder, great changes in personnel, Sophia fell into the crisis of "Waterloo"

Author:Flower finance Time:2022.08.03

Flower Finance Original

Sofia "Lian Po Lao".

In 2021, Sophia also ushered in the most heavy blow at the company's historic moment when the company entered the tens of billions of milestones.

The company's major business encountered a major customer due to a business acceptance bill of business acceptance. The company had to submit special impairment losses for the customer, which led to a sharp decline in the company's net profit.

Although the company emphasized the management of management and conducting a deep review and accountability, the capital market did not buy it, and even the key executives chose to run away.

Standing at the tens of billions, Sophia is undoubtedly full of challenges today!

Real estate dividend retirement

Sofia became real estate and was defeated in real estate.

According to the National Gold Securities Research Report, the history of the 11th year after the listing of Sophia was relying on real estate dividends from 2011 to 2017, and the overall scale expanded rapidly.

During the period, the compound annual growth rate of the company's revenue and mother's net profit reached 35.3%and 37.4%, respectively, and the valuation center was basically more than 30 times.

But since 2018, the company has experienced "Davis Double Kill". From 2018 to 2020, the company's net profit growth rate of net profit was only 10.7%and 9.5%, respectively, and the valuation center gradually moved down to 10-15 times.

The most critical reason for the reason is that the change of the times is undoubtedly the change of the times, and the real estate dividend has begun to subscribe.

Since 2018, the sales area of commercial housing has gradually begun to grow, and the completion area has continued to grow negatively.

As the real estate dividend gradually faded, the overall needs of the furniture also began to be under pressure. After years of high growth in the retail sales of furniture, it has begun to enter the negative growth stage since 2018.

In the case of weak growth in industry demand, Sophia and real estate developers in depth bundling the community business business even exploded.

In 2021, the company's business channel income (including wardrobes, cabinets, wooden doors and others) reached 1.604 billion yuan, an increase of 6.64%year -on -year.

According to the company's 2021 annual measurement of asset impairment announcements, the total impairment losses were provided by about 927 million yuan. Among them, the corresponding receipt of the Evergrande Group's payment was provided with a total of 909 million yuan.

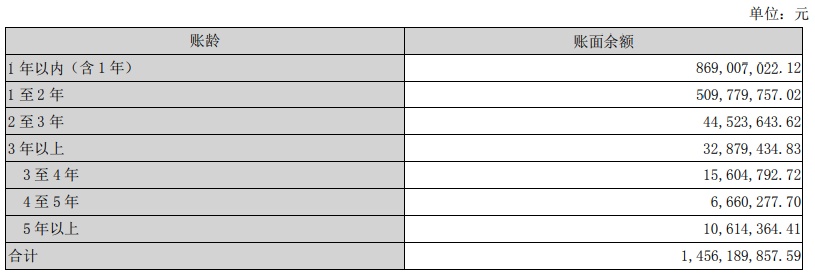

Flower Finance also noticed that according to the account age disclosure, Sophia's account receivable balance of 1 to 2 years is also relatively high. In 2021, the company's account receivable balance within one year was 869 million yuan, and the balance of receivables for 1 to 2 years was 51 billion yuan.

There is no doubt that Sophia may face a higher risk of losses receivable.

Sophia said in the financial report that the company will do a good job of risk control, do a good job of recovery of accounts receivable and the risk control of bills.

Financial indicators deteriorate

What is worse is that Sofia's financial indicators are deteriorating at the same time.

In 2021, the company achieved operating income of 10.407 billion yuan, an increase of 24.59%year -on -year; net profit of home mother was 123 million yuan, a significant decline of 89.72%year -on -year.

In addition, the company's inventory weekly number rose from 26.25 days in 2017 to 31.95 days in 2021, and the number of accounts receivables increased from 10.03 days in 2017 to 32.32 days in 2021.

Speaking of competition, Sophia has also begun to lose.

Although Sophia continued to increase investment in marketing in 2021, the sales cost reached 1 billion yuan, a historical high, an increase of 31.69%year -on -year, far exceeding the growth rate of revenue. But Sophia still shows the slump in the competition with its peers.

In April 2021, Oupai Home Furnishing released the 2020 financial report. Ou Pai Wardrobe and its supporting products achieved revenue of 6.803 billion yuan, overtaking Sophia with a scale of 6.702 billion yuan for 101 million yuan. The throne of "brother".

Poor operating performance, Sophia's debt pressure is also rising step by step. From 2018 to 2021, Sofia's asset-liability ratio was 31.41%, 30.35%, 39.07%, and 52.23%, respectively.

Strangely, Sophia's dividends have not diminished during the poor operation and asset -liability ratio. In 2021, the total dividend of Sofia was 544 million yuan, and the dividend payment rate was as high as 444.20%.

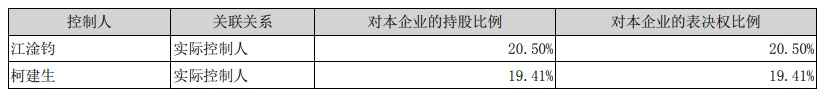

The list of shareholders shows that as of the end of 2021, Sofia's actual controller Jiang Yanjun and Ke Jiansheng held 20.50%and 19.41%of the company's shareholders, respectively. In other words, nearly 40 % of Sofia's previous large dividend funds fell into the company's two actual controllers.

It is reported that as of the end of 2021, Jiang Yanjun and Ke Jian biological pledge accounted for 13.36%and 14.11%, respectively, which may indicate that the company's actual controller had previously had relevant capital pressure.

If the actual controller lacks money, I think of the listed company. If this is true, how can Sophia's small and medium shareholders' interests be guaranteed?

Key figures

When the performance was "Waterloo", Sofia's management also had a huge shock, and the company even fell over.

On the evening of July 8, Sofia issued an announcement on the resignation of senior managers. The board of directors received a written resignation application from Mr. Yang Xin, deputy general manager of the company, and Mr. Yang Xin applied to the company's deputy general manager's position to the company's board of directors for personal reasons. After his resignation, Mr. Yang Xin will no longer hold any position in the company.

Subsey Sophia's stock price ushered in two successive daily limits. Since July 8, the company's stock price has fallen exceeding 30%. As of August 2, the company's latest offer was 16.93 yuan/share. Can Yang Xin also have such a great influence?

In fact, Opai's home can put Sofiara's "closet brother" throne, Yang Xin has a lot of credit.

Public information shows that Yang Xin has worked for more than ten years in Ou Pai's home, and has successively served as the regional manager, director, general manager of the sanitaryics department, and chairman marketing assistant of Ou Pai Home Furnishing.

At the end of 2015, when Yang Xin took over the Oupai Wardrobe, the scale of Ou Pai Home Wardrobe was less than 50 % of Sofia Wardrobe, and now the results of the Ou Pai wardrobe are obvious to all.

So Sophia dug these characters in his own circle in May 2021.

Yang Xin, who came with "aura", was a direct action. Sophia launched the strategy of "whole family customization" at the end of the year and was led by Yang Xin.

However, from the high hopes to the departure, did Yang Xin's departure represent that Sofia could not get back to life?

Standing at the tens of billions, Sophia has been working hard to find the second growth pole.

On July 9, Sophia's doors and windows nationwide first strategic summit opened at the China Construction Expo. Sophia officially launched do door and window products to further expand the border of quality.

According to the report of the Youju Research Institute, the size of the door and window market broke through trillion in 2021, and the CAGR of 3 years exceeded 10%. Among them, the high -end system door and window market was over 30%in 3 years, and the industry growth rate was higher.

However, although the space in the industry is large, competition is highly scattered.

According to the statistics of Youju Research Institute, the current market share of TOP 10 companies in the door and window industry is less than 5%, and the market share of TOP30 companies is less than 10%. Among them, there are only 2 companies in the door and window industry of 1 billion income, and only about 10 companies with more than 200 million income.

It is true that for Sophia, which has reached 10 billion, it is difficult for doors and windows to support the company's second growth pole.

In the current post -real estate cycle, if Sofia wants to play better results in the short term, it seems obviously not easy.

- END -

China Railway Five Bureau empowers high -quality development with high standards of large -scale bus

Editor -in -chief 丨 Li Yuan, Shen SuEditor -in -chief 丨 Wu Xiaopeng (Five Bureau...

Hao throwing 80 million buildings, what did Xiaomi look at Vietnam?

Source | BohufnAuthor | Li XiaIn May of this year, Vietnamese Prime Minister visit...