The "high -quality student" of the Bei Stock Exchange has continued to continue the New Third Board listed enterprise over the years, which has exceeded last year

Author:Securities daily Time:2022.08.04

Reporter Meng Ke

The expansion of the New Third Board is accelerating. Wind data shows that as of August 3, since this year, there have been 113 listed companies in the New Third Board, which has exceeded 91 levels last year.

In this regard, Zhang Keliang, the person in charge of the city business of Bohai Securities, told a reporter from the Securities Daily that the number of listed companies this year has exceeded the reasons for the whole year of last year. In order to go to the North Stock Exchange to go public. This positive trend will be continued during the year, and more high -quality companies will be listed on the New Third Board.

During the year, listed companies "increased" and "quality excellent"

The reporter sorted out and found that the number of listed companies on the New Third Board has increased in the past two days. A total of 6 companies were listed on August 2, and 5 companies were listed on August 3. Among them, August 2nd hit a record high in the past three years. Many of them have the potential of the "impact" Bei Stock Exchange. For example, 7 companies including Haosteel Heavy Industry, Huihui Biological, and Chenguang Technology were between 25 million yuan and 100 million yuan last year.

Shen Wanhongyuan's specialized new chief analyst Liu Jing said in an interview with the Securities Daily that the Beijing Stock Exchange has become another important place for SMEs to list. After nearly a period of counseling, many companies have begun to listed on the New Third Board one after another. Many companies come directly to the Beijing Stock Exchange. Therefore, the level of net profit is relatively high.

"The increasing number of newly listed companies will help better play the incubation role of the New Third Board market for innovative SMEs. While contributing a large number of high -quality students to the Peking Stock Exchange, my country's multi -level capital market structure will gradually improve." Beijing will gradually improve. "Beijing will gradually improve." Beijing will gradually improve. "Beijing will gradually improve." Beijing Chang Chunlin, the founder and partner of Liwu Investment Management Co., Ltd., told a reporter from the Securities Daily.

Judging from the above -mentioned 113 listed enterprises this year, 14 companies have a net profit of more than 50 million yuan in 2021, and the annual net profit of 3 companies exceeds 100 million yuan, showing the characteristics of "increase" and "excellent quality".

From the perspective of the Wind industry, the number of listed companies, which belongs to the three major industries of machinery, chemical, electronic equipment and components, are 20, 12, and 9, respectively. It is worth noting that there are many vanguard companies that focus on subdivided areas and master key core technologies. There are 16 special specialized enterprises.

Zhu Haibin, the chief analyst of Anxin Securities New Third Board, pointed out in the research report that among more than 6,000 new third board listed companies, companies with development potential and investment value will become high -quality reserve forces of the Bei Stock Exchange.

129 companies in the North Stock Exchange

Wind data shows that there are currently 6,726 listed companies on the New Third Board, including 5118 in basic layers and 1,608 innovation layers. It is understood that an innovative -layer enterprise listed on the New Third Board can declare the listing of the Bei Stock Exchange.

Chang Chunlin predicts that in the future, there will be more innovative SMEs with excellent quality and strong profitability to actively apply for listing on the New Third Board market, prepare to enter the innovation layer, and apply for the Bei Stock Exchange.

According to data disclosed by the Beijing Stock Exchange website, as of August 3, a total of 129 companies in line with the Beijing Stock Exchange (excluding registered and termination issuance), including 4, passed the Shanghai Municipal Party Committee, 112 inquiries, and 3 suspension of review. , 7 stops and 3 newspapers were sent to the CSRC.

Under this trend, which measures should the New Third Board be improved more effectively to support the development of the enterprise? Zhang Keliang believes that first is to strengthen the construction of secondary markets, and introduce social funds in many aspects and channels to achieve reasonable matching of both ends of investment and financing. A flexible re -financing system, truly the matching system and the re -financing system; the third is to effectively give play to the system advantage of the new third board and the Beijing Stock Exchange system, and to activate the basic layer and innovation market of the New Third Board. Explore the new model of inclusive finance in the capital market.

- END -

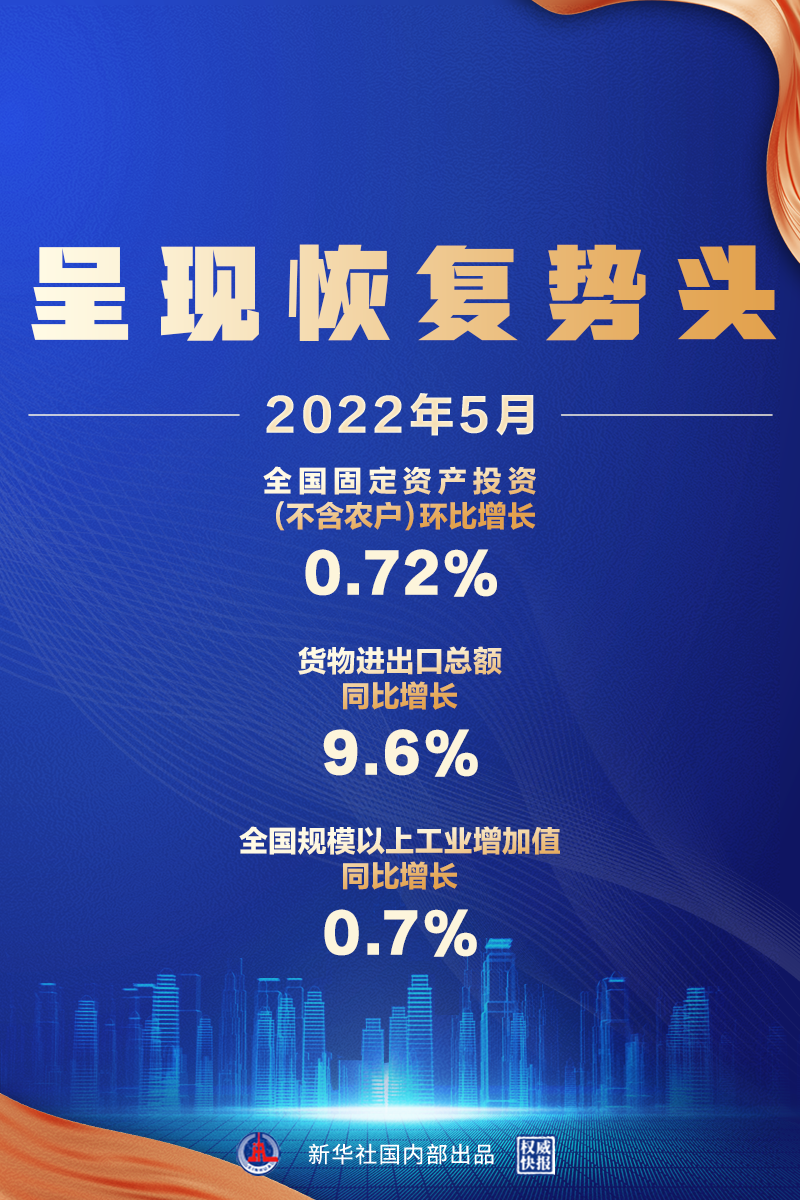

In May, the national economy operation showed a restoration momentum

According to the National Bureau of Statistics released data on June 15MayNational...

China's continuous release of "magnetic power" to the United States and European companies (internationalism)

The picture shows on December 21, 2021, and the BMW Shenyang Tiexi New Factory of ...