The national power grid announced that the sector was boiling collectively; the semiconductor continued to crazy, and a leading drainage skyrocketed exceeding 200%!

Author:China Fund News Time:2022.08.04

Source: E company

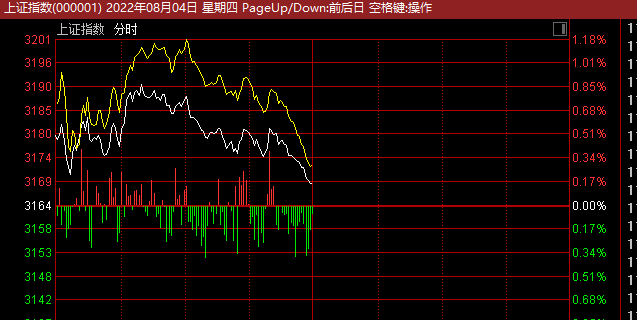

On August 4, the three major Indoices of A -shares were treated after opening, and the GEM finger fell before lunch.

As of the afternoon closing, the Shanghai Stock Exchange Index rose 0.15%, the Shenzhen Stock Exchange Index rose 0.04%, and the GEM index fell 0.2%. On the disk, the concept of high -voltage pressure performed strongly, over 10 daily limits such as Tongguang cables, CXO concepts, semiconductors, organic silicon concepts, east counting, vocational education, brewing and other sectors are the top; Flows such as photovoltaic inverters have fallen. Solid stocks rose more, and more than 2,800 stocks in the two cities rose.

As far as the market trend, Galaxy Securities pointed out that the disclosure of the semi -annual report of A -share listed companies was slow, revealing the certainty in uncertainty. In the future, structural income opportunities are still dominant, and new energy tracks involved in high boom (including wind power, photovoltaic, hydropower, new energy vehicle industry chain, etc.), infrastructure construction theme sections, consumer sections (food, beverage, medicine, transportation, transportation Industry), the theme of domestic technology innovation; upstream energy products, agricultural sectors, national defense military industry, etc.

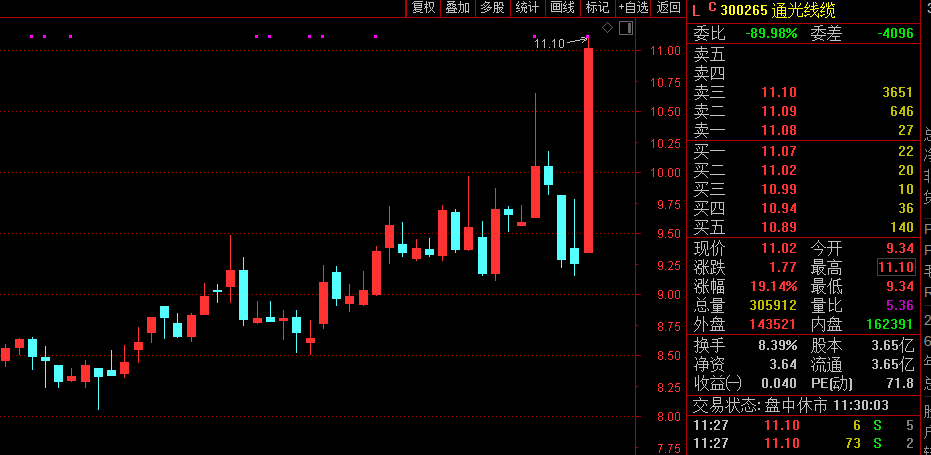

UHV rise

The total investment of the National State Grid will exceed trillion yuan. In the context of the "dual carbon", the concept of UHV and smart grids continued to rise on August 4th. As of the afternoon closing, the Wind UHV Index rose 3.46%. In the daily limit of conservation electrical, Huijintong and Pingzhong Electric once rose nearly 9%. Golden Crown Electric, Perry, and Guodian South were rushing.

On August 3, the State Grid's full effort promoted the construction of major projects, saying that it would make every effort to expand investment in the power grid, accelerate the construction of projects such as high -voltage, pumping storage, and ultra -high pressure. The total investment of projects under construction will exceed trillion yuan during the year.

The State Grid revealed that from January to July this year, the grid investment was 236.4 billion yuan, an increase of 19%year -on -year. At present, the total investment in projects under construction was 883.2 billion yuan, of which 110 kV and above power grids and pumping storage power stations were 3299. By the end of the year, the State Grid is expected to complete nearly 300 billion yuan of power grid investment, starting a large number of major projects, with a total investment of 416.9 billion yuan, of which 110 kV and above power grids and pumping storage power stations are 1173. It is expected to hit a record high to reach 1.3 trillion yuan, driving upstream and downstream industries exceeding 2.6 trillion yuan.

As of now, 11 companies have disclosed the first half of the performance forecast, and 5 of them have pre -increased in the first half of the year. The special transformer of the main transmission and transformation business preview the highest amount of net profit in the first half of the year, reaching 6.8 billion yuan. Specifically, special transformers are expected to achieve net profit of 6.8 billion yuan to 7.2 billion yuan in the first half of 2022, an increase of 119%to 132%year -on -year.

CICC Research Report believes that centralized+distributed new energy drives the upgrade and transformation of the grid, and the intelligent and power distribution grid intelligence is the key direction. The construction of a new energy base requires a matching high -voltage channel delivery. It is expected that from 2022 to 2023 may have a peak of high -pressure approval. Demand for passage. The power distribution network is a distributed power supply main battlefield. CICC believes that active distribution networks, enterprise -level source network loads integrated micro -power grids or represent future distributed smart grid development directions. Opportunities such as fusion equipment, micro grids and other opportunities.

Ali is about to release a financial report

As U.S. stocks rebounded last night, Hong Kong stocks continued to recover.

On Wednesday, local time, the three major indexes of US stocks closed up sharply. The Dow rose 1.29%, the S & P 500 Index rose 1.56%, and the Nasda Index rose 2.59%. On August 4, Hong Kong stocks opened high, and the Hang Seng Technology Index once rose more than 3%, and the HSI and the national index rose by more than 2%. Ali's health rose over 8%, BYD Electronics once rose 12%, and Alibaba rose nearly 6%. Follow up.

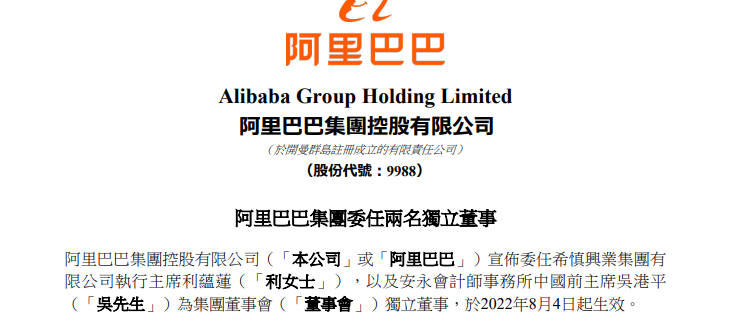

Ali has changes in high -level people. Alibaba announced on August 4th that the executive chairman of Xichen Xingye Group Co., Ltd. Li Yaolian and Ernst & Young Certified Public Accountants, the former chairman of China, were an independent director of the Group's board of directors. It took effect on August 4, 2022.

After this appointment, the board of directors of Alibaba Group has a total of 12 directors, 7 of which are independent directors, and female directors have increased to 3, reflecting their continued pursuit of excellent corporate governance, and promoting the board of directors to be more diversified. In addition, Dong Jianhua, an independent director of Alibaba Group, will no longer participate in the selection of the board of directors after this year's shareholders' meeting. Dong Jianhua has been an independent director of Alibaba Group since September 2014. In addition, Alibaba will announce its performance after the Hong Kong stock market today.

The global ranking of China Stock's Internet leader has continued to rise. In 2022, the Fortune 500 rankings of "Fortune" were announced on August 3. A total of 145 companies in China (including Hong Kong, China, Taiwan) were on the list. China's Internet company has a new ranking, JD.com, Alibaba, and Tencent have risen on the list this year, ranking 46th, 55th and 121st, respectively. This is the highest year since the three companies on the list. Among them, Alibaba's ranking has advanced from 63rd last year to 8th to 55th. The list shows that Alibaba's operating income in the past year was US $ 132.935.7 billion, with a profit of $ 9.7 billion.

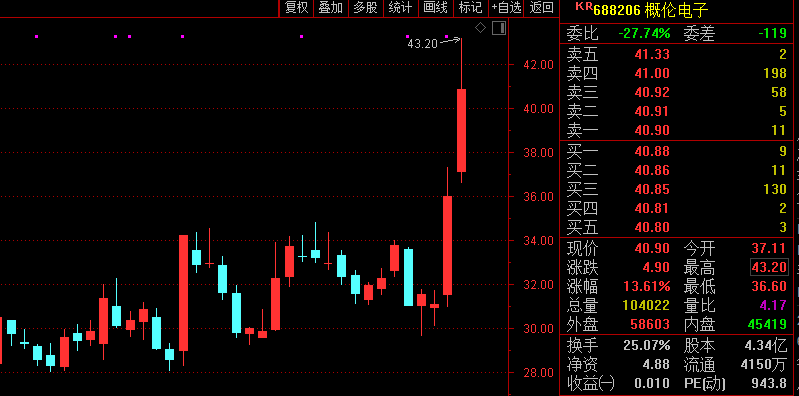

Semiconductor continues to rise

Distanized by domestic replacement, the semiconductor sector continued yesterday's rise and continued to rise on August 4. The Wind semiconductor index once rose 1.7%, and the inner Lun Electronics rose a daily limit of 20cm, and the nine days of Huada rose over 16%. The Minnes shares exceeded 17%. Anlu Technology once rose more than 12%. Wait more than 8%. The nine days of Huada have continued to rise since the listing on July 29. On August 4, it reached a high of 108.38 yuan, which has increased by more than 232%from the issue price of 32.69 yuan.

As a domestic EDA leader, Huada Nine Days have continued to increase in performance since this year, and the naked eye can be visible to the naked eye. In the first quarter of this year, the operating income of WAD was 970.66 million yuan, an increase of 51.86%year -on -year; net profit was 10.4833 million yuan, an increase of 64.34%over the year -on -year increase. The company's operations maintained the continuous and rapid development trend, and the growth of sales revenue based on EDA software sales drove the company's operating income to maintain a significant increase from the same period last year. At the same time, the company's profitability increased from the same period last year. At the same time, the nine days of Huada are expected to operate about 263 million yuan in the first half of this year, an increase of 44.22%year -on -year; net profit is about 40 million yuan, an increase of 102.84%year -on -year.

CITIC Securities Research Report pointed out that the current stage of changes in the global semiconductor supply chain. On the one hand, in the context of increasing policy subsidies in various countries, the expansion of production capacity continues to increase, and the expansion of the production of equipment companies has benefited significantly; In the context, the security of the supply chain has received key attention, and local equipment materials and component suppliers have more to undertake local demand and obtain continuous share improvement.

Mainland China has advantages in the world's most widely used electronic manufacturing, terminal brands and market demand. Demand downstream demand drives upstream supply chain transfer is a trend in accordance with historical trends. On the one hand, domestic mature process still has a full basis for cooperation with overseas manufacturers. On the other hand, the security considerations of the supply chain are expected to accelerate the research and development and verification of domestic equipment and components. It is recommended to pay attention to the development opportunities of equipment and components under the trend of domesticization.

In addition, as the track stocks such as photovoltaic wind power are at a high level of valuation, funds also have high or low rotation needs. The Wind Semiconductor Index has fallen deeper by about 32%this year. Although it has rebounded significantly by nearly 20%since the end of April, the semiconductor index still has a sharp decline compared to the beginning of the year.

Start up today! Multi -scenic spot announcement

- END -

The aging service is fully upgraded to the elderly to handle the "barrier -free" financial business for the elderly

Wen, Picture/Zhou XiaolingOn May 10, 2022, the China Banking Regulatory Commission...

Shuijingfang can't drop high inventory

Author | Tang FeiIn terms of cultural heritage, Shuijingfang does not lose Moutai ...