Food problems are difficult to sell. Yanjinpu's half -year profit exceeds 100 million yuan. Zhang Xuewu does not need user reputation?

Author:Starting line of entrepreneurs Time:2022.08.04

Produced: the front line of entrepreneurship

According to the news on August 4, according to the signal financial Weibo, Ms. Liu, Xiangyang, Hubei, said that after watching the anchor recommendation, I bought a crispy bone sausage at the official flagship store of Yanjinpu. Note that when you eat the third one, you find that there are live maggots in the sausage climbing.

Ms. Liu said that she was disgusting at the time. After communicating with the customer service, Yanjinpu's customer service said that he could refund and pay himself 8 yuan in compensation. Douyin customer service said that he had to pay 20 yuan. He felt that he was too drama and did not accept it. Later, to communicate with the anchor with the goods, the other party said that communication with the brand will give a reply within a few days, but there has been no reply.

Coincidentally, on the black cat complaint platform, there is a lot of food in the complaints of Yanjinpu's complaints/moldy food, poor customer service communication, and foreign bodies such as maggots and duck hairs in food.

A consumer said that he purchased a snack on a shopping platform Yanjinpu Food Food Store and found that there was a deterioration of food. After contacting the merchant, the merchant explicitly expressed the compensation of 5 yuan for consumers to refuse to accept it, and hoped that the merchant would properly deal with it properly. The problem of food safety, and now I do n’t know if there is still such a situation that I have eaten before, and need to be compensated.

According to consumers' subsequent complaint content, no relevant staff contacted it. As of press time, the complaint has not been handled.

Yanjinpuzi, which belongs to Yanjinpu Food Co., Ltd. (hereinafter referred to as "Yanjinpuzi"), was established in 2005. The company's registered capital is 129.36 million yuan, and the actual payment capital is 93 million yuan. The actual controller and the ultimate beneficiary.

Yanjinpu is a company that is mainly engaged in the food manufacturing industry. In 2017, the A -share IPO was listed, with a transaction amount of 283 million yuan, and has completed the directional issuance in 2021.

It is worth noting that on September 20, 2019, Yanjinpu was punished by the Liuyang Market Supervision and Administration Bureau.

According to data from the China Commercial Industry Research Institute, the scale of China's casual food market has exceeded trillion, and the compound growth rate of more than 10%in the past five years has exceeded 10%.

According to the 2022 semi-annual performance forecast released by Yanjin Shop, from January to June this year, the net profit attributable to the mother was 1.23 to 130 million yuan, a year-on-year increase of 152.97%to 167.37%. 100 million yuan, a year -on -year increase of 491.35%to 528.10%.

Yanjin Shop said that the main reason for the rise in performance is the expansion of the two -pronged approach of "product+channel". It focuses on core products, and also provides various specifications of products in addition to bulk to meet diverse consumption needs. In addition to the previous mainstream supermarkets, new channels such as e -commerce, convenience stores, and snacks are opened.

It can be seen that although the epidemic affects the development of the leisure snack market, the development of emerging channels such as live e -commerce and community group purchase has also provided new ideas and new directions for all leisure snack companies.

However, under the background of normalization of epidemic prevention and control, consumption upgrades, and changing consumption habits of residents, companies are undergoing tests and also seeking development in challenges.

As a food company that is closely related to consumers, companies such as Yanjinpuzi and other companies must strictly control food quality and safety while developing, and provide users with comprehensive consumer services.

- END -

Xiangsheng Medical: It is expected to increase by 50.48% year -on -year net profit in 2022

On July 20, 2022, A-share listed company Xiangsheng Medical (code: 688358.SH) released the semi-annual report performance forecast. 785.1 million yuan, net profit increased by 50.48%year -on -year to

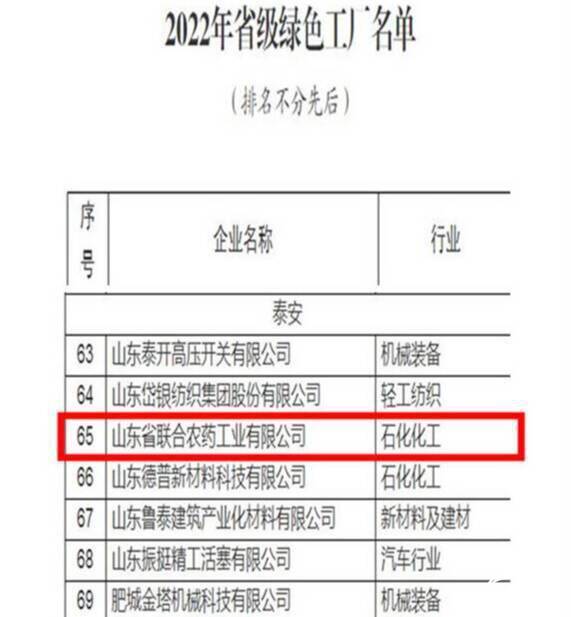

good news!Another provincial green factory in Tai'an Daiyue District

Qilu.com · Lightning News, June 29. Recently, the Shandong Provincial Department ...