Jiu Gua | How to help the bank to help the bank dig out the customer's needs and carry out precise marketing?

Author:Jiu Gua Financial Circle Time:2022.08.04

Author | Ding Ren (China Construction Bank Platform Operation Center)

Source | China Credit Card

Edit | Wu Wen Zhang Yundi

Beauty | Yang Wenhua

O Voice of Customer (VOC) as an important starting point for improving customer experience, it helps commercial banks to solve practical problems for customers, tap customer needs, and carry out precise marketing.

户 This article mainly introduces the analysis methods and applications of customer voice data, in order to provide reference for commercial banks to enhance customer experience and enhance customer stickiness.

With the rapid development of Internet finance, commercial banks and Internet financial companies provide customers with very rich and diverse financial products and services. Financial products and services have gradually shifted from the seller's market to the buyer's market. Commercial banks can only attract customers and continue to tap customer value only by accurately grasping customer needs, developing products that meet customer needs, and strive to enhance customer experience.

1

Voice of customers and its meaning

According to the definition of Six Sigma, customers 'voices refer to customers' feedback sounds for brand products and services, including comments, expectations, and preferences. Commercial banks can find problems in products and services through collecting customer data and further tap customer needs.

1. The collection channel of customer voice data

Commercial bank customers generally "make sounds" through offline and online channels. The voice of customers in traditional offline channels mainly includes the interaction with the teller of the outlets during the business process of the bank outlets, or the communication between the business and the outlet manager, and even chatting with the outlet manager. At present, the voice of offline customers mainly rely on the active analysis and refining of the staff of the outlets, and reflect the valuable content reflected by the customer.

With the rapid development of mobile finance, the main channels for commercial banks to collect customers' voices have gradually moved to online. One is online text and voice customer service, including smart customer service and artificial customer service; the second is Internet message, which mainly includes comments from customers in major forums or other online channels; third, media reports, that is, Internet media comments on commercial banks' comments on commercial banks And reports, etc. Based on the current level of data quality and technical analysis, the voice data of the customer referred to in this article mainly refers to the text data left by the customer and the online artificial customer service interaction.

2. The significance of the customer's voice data

The voice of customers is an important channel for finding problems. Customers make feedback generally because they encounter problems or blockages in the business processing process, and then enter the line for consultation or complaints. If the business processing process is simple and smooth, the customer will go away, and generally will not actively speak. Therefore, the voice of customers can be used as an important channel for discovering products and service experience.

A large number of customer needs are hidden in the voice of customers. For example, the annual fee of customers in consulting credit cards on the one hand shows that the display of the annual fee of bank credit cards is not eye -catching, and customers are not easy to find; on the other hand, it also reflects the customer's need for cards. Therefore, in addition to solving problems encountered by customers, commercial banks can also use the voice of customers to explore deep -seated customer needs for precision marketing.

2

Analysis method of customer voice data

The analysis method of customer voice data mainly includes three types: one is cluster analysis, the other is focusing on identification, and the third is to analyze one by one.

1. Cluster analysis

The analysis of clustering is mainly based on a large number of customers' voice text to understand the hot spots that customers pay attention to within a certain period of time. The workflow mainly includes data cleaning, system analysis and manual analysis. Data cleaning is to connect the data connected to the data to eliminate some data that is not related to the business, and then the cleaning data access system is analyzed to analyze the heat words and heat. And summarize the customer experience. Taking the voice analysis of mobile banking customers as an example, first of all, all the data data of mobile banking customers will be packaged, and the text text of the customer who has nothing to do with mobile banking products is eliminated, while the data is organized in a certain format. Secondly, the customer's voice text is analyzed through the hot word analysis tool, and the popularity is statistical. Finally, you can choose the hot words that are interested in to check the original text containing the hot word, and analyze the hot topic of customer attention.

2. Focus on identification

Focus on refining and analysis of known attention points. By actively searching for the concerns of commercial banks, all related texts are accumulated and then analyzed. For example, a commercial bank held an online marketing activity at the beginning of the year, and wanted to know the customer's experience of the event. First of all, Kero lists the relevant keywords for marketing activities for customer recognition. Secondly, all texts containing the keywords are screened. If the order is less than 5,000, the personnel can be arranged to analyze them one by one. If the magnitude is large, you can analyze hot words through the method of clustering analysis, and then find the customer's attention through hot words.

3. An article analysis

An article analysis is mainly based on the work order recorded by customer service one by one, and it mainly focuses on the customers who reflect the strong and more complicated problems of the customer service. At present, commercial banks all have the work order management system and related processing system. Customer service records the customer's problem or customer report that cannot be solved or the customer reflects the problem. Relevant departments will perform artificial screening according to the work order label, emergency analysis and treatment of the complaint work order, analyze the difficulty or consulting work orders one by one, refine the customer experience problem and systematically solve it. 3

Application of customer voice data

1. Improve the customer experience

Through hot analysis and making hot topics, it can directly show hot topics that customers pay attention to during a certain period of time. The higher the topic of the topic, the higher the use of a product function. Under normal circumstances, hot topics that customers pay attention to mainly focus on transfer, credit cards and financial management. New hot topics often revolves around the recent marketing activities, or the launch of new functions and new products. For new hot topics, banks need to analyze and study in depth, because there may be more experience problems, and through hot analysis, it can provide direction for product optimization or process improvement.

Taking a new marketing activity of a commercial bank as an example, after the analysis of the customer's voice, it was found that the topic of the marketing activity was very popular because of the problem of the renovation process of the marketing activity. Without timely use or copying the voucher number, the redemption code of the lottery will "disappear", resulting in more customer complaints. The commercial bank extracts the problem and reports it to the technical department in a timely manner, and then adds the "My Tickets" column to the design, and display the status and expiration time of the vouchers to facilitate customers to find the prize tickets in time to redeem the prize.

For another example, a commercial bank analyzed the voice of customers and found that the word "password" of mobile banking channels was very popular, and then packed and analyzed the voice of customers with "passwords". Then analyze the original text of customers who contain "passwords" and "forgot", and summarize the core issue of the customer is "What should I forget my mobile banking password?" After verification by customer issues, it is found that the mobile banking has problems when setting the "forgetting password" function, causing customers to obstruct when logging in to the mobile banking. In response to this problem, after the commercial bank improved the mobile phone function, it solved the problem of customer feedback and enhanced the customer experience.

2. Precision marketing

Customer voice data can be used as an important basis for precision marketing. Commercial banks can analyze the business scenario through the voice data of customers, and through the customer's basic information, active status, trading behavior and other data segmentation, and can effectively combine the two to build a marketing model. At the same time, it is based on regional characteristics. Marketing plans to improve marketing success rates. The general workflow can include the following four steps: one is to accurately locate text scenarios to identify customers' needs; second, identify marketing opportunities, superimposed structured data to group groups; third, carefully match marketing resources, combined with existing marketing activities to formulate Speaking; Fourth, push marketing information through appropriate channels.

For example, a commercial bank analyzes the needs of customers through the voice of customers, and then the mobile banking is released to open the situation of mobile banking, and marketing text messages will be sent targeted. After the pilot verification, the overall marketing effect is very good, and the success rate of daily marketing has increased by more than 50%.

Customer Voice Data is a valuable asset of commercial banks. At present, there is still a lot of space for the digging of customer data data value, such as the increase in data analysis and the upgrade of the data analysis model. In the future, with the continuous application and development of new technologies, customer voice data will play a more important role in the operation and development of commercial banks.

(Original Title: Application and Research on the Voice of the Customer Voice of the Customer)

- END -

Sudden!Oil price plummeted!

The 15th round adjustment of the domestic oil retail price will be opened on Tuesd...

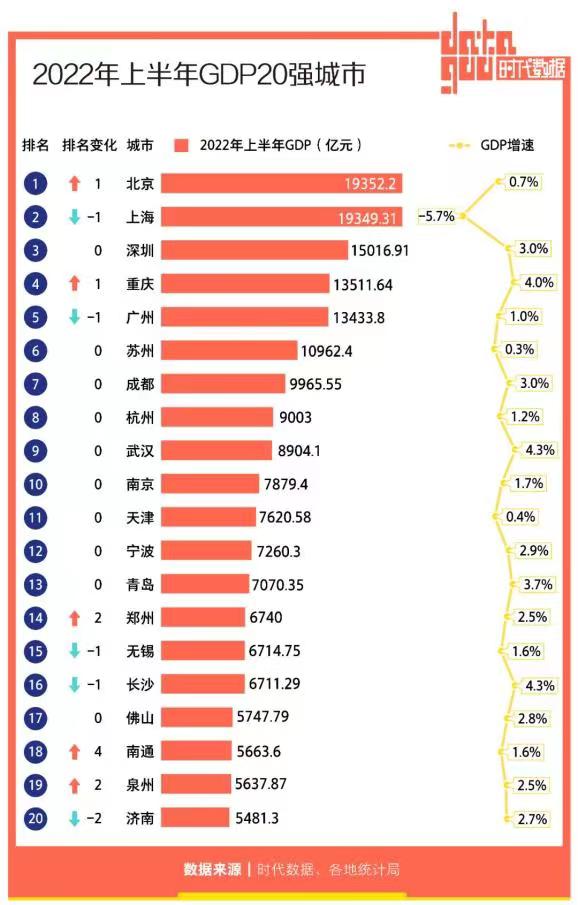

Zhengzhou lives 14th, and moves two positions!In the first half of 2022

Henan Daily Client reporter Wang YanhuiIn recent days, with the successive release...