Fengkou Think Tank · Chief Connection | Wen Bin: Increase consumption capacity, you need to stabilize and expand employment

Author:First wind Time:2022.08.04

Liu Xiao, chief reporter of Fengkou Finance Liu Xiao

Since the beginning of this year, the new coronary pneumonia's epidemic and the Ukraine crisis have affected the overlapping overlap, and the world economy has faced the dilemma of stagnation and the risk of recession; the demand shrinkage, supply shock, and weakening of the three stress of demand for development have continued to appear, and the foundation of economic recovery is still unstable. The Political Bureau of the Central Committee of the Communist Party of China held a meeting on July 28 to analyze and study the current economic situation, and deploy the economic work in the second half of the year. The meeting emphasized that macro policies should actively actively act in expanding demand. The fiscal monetary policy must effectively make up for the lack of social demand. The Executive Meeting of the State Council held on July 29 deployed further expansion of demand measures to promote effective investment and increase consumption.

Insufficient demand is one of the main contradictions facing the current economy. In the next step, how will macro policies be exerted in accelerating the construction of investment projects, boosting consumption, and mobilizing the enthusiasm of private investment? On August 5th, Fengkou Finance and Economics exclusively conversed Wen Bin, chief economist of China Minsheng Bank and dean of the Institute of Research.

》》 Economic provinces must use the special debt limit for good use

Wind Financial: Acting around how macro policies actively actively actively actively actively actively actively, the Politburo Conference has deployed from various aspects such as fiscal and monetary policies. What do you think of expanding demand in the current stable economic market?

Wen Bin: On July 28, the Politburo Meeting requested that "macro policies must actively actively act as" expanded demand "and" fiscal and monetary policy must effectively make up for insufficient social needs ", indicating that the decision -making level has realized that insufficient demand is exactly the main facing the current economy facing the current economy facing the current economy facing the current economy. contradiction.

From the level of macro policy, expanded demand should achieve broad credit through positive fiscal policies and more targeted monetary policies and iron economic fluctuations.

In terms of fiscal policy, the Politburo meeting requested that "make good use of local government bond funds and support local governments to use special debt limits to make good use of special debt." As of the end of June, this year's special debt quota has been issued. The next step is to strive to be basically used by the end of August and transform into physical workload as soon as possible. At present, there is still 1.55 trillion space for local governments. However, it is mainly concentrated in large economic provinces. Therefore, the Politburo requires that "economic provinces must be bravely picked up, and provinces with conditions must strive to complete the expected goal of economic and social development."

In terms of monetary policy, the meeting requires that "monetary policy should maintain reasonable liquidity, increase credit support for enterprises, and use policy banks to build investment funds for new credit and infrastructure construction." It is expected that the policy will continue to be continuous in the second half of the year. While increasing credit support, it will focus on new credit and infrastructure investment funds through policy banks to increase wide credit.

From the level of growth momentum, expanding the demand should not only play the key role of effective investment in the development of economic recovery, but also to play the role of consumption to lead the economic cycle. The country often deployed this on July 29.

In terms of investment, the key is to pay attention to effectiveness, not only in time, decisive implementation, no time to delay the opportunity, and do not engage in large water irrigation, and not "radishes are faster and not washing mud." Consumption is mainly focused on consumption, housing demand, and green smart home appliances, green building materials and other large consumption.

"Insufficient demand is the main difficulty facing the manufacturing industry

Fengkou Finance: According to the data recently released by the National Bureau of Statistics, in July, the manufacturing procurement manager index (PMI) was 49%, a decrease of 1.2 percentage points from the previous month. In addition, the price index fell significantly. What do you think is the main reason for data changes?

Wen Bin: From a historical point of view, in July, due to the hot weather and stopping maintenance, the manufacturing PMI usually declined. The average drop in 2011-2021 was 0.3 percentage points. The fall of 1.2 percentage points in July this year did exceed seasonality.

Among the five types of PMIs of the synthetic manufacturing industry, the production index fell 3.0 percentage points to 49.8%, the new order index fell by 1.9 percentage points to 48.5%, and the supplier delivery time index decreased by 1.2 percentage points to 50.1%, the most obvious drag. The raw material inventory index fell 0.2 percentage points, and the employee index fell 0.1 percentage points, which could almost ignore it.

The reasons for the decline in the production index are mainly due to the significant decline in the prices and factory price indexes of the main raw materials in July, which leads to the worsening of the viewing of downstream enterprises, weakening the willingness to procurement, and then affecting production. The decline in the new order index is due to insufficient demand. The Statistics Bureau pointed out that the proportion of enterprises that reflect the insufficient market demand have increased for 4 consecutive months, and this month exceeds 50 %. Insufficient market demand is the main difficulty facing the current manufacturing enterprises. To a certain extent, the supplier delivery time index decreased to a certain extent due to the repeated epidemic in the July, and many areas tightened prevention and control measures, which caused disturbance to production and logistics.

Among the above factors, the most fundamental demand is insufficient. Insufficient demand is mainly manifested in two aspects: on the one hand, weak external needs. At present, under the dual squeezing of the sharp surge in prices and accelerated interest rate hikes, the economic operation is gradually declining from stagnation to sliding, and then transmitted to my country through trade channels and price channels, dragging PMI through new export orders and price indexes to drag PMI Essence On the other hand, there is insufficient domestic demand. In particular, the downturn of real estate under the disturbance of the epidemic disturbance and the unexpected real estate has become the main shortcoming of the economic recovery. Although infrastructure investment is playing a bottom -up role, it is necessary to further play a positive role by relying on the difficulty of the infrastructure.

"" Preventive savings tendency is still high

Wind Financial: Data show that market demand in July has fallen, and the production and operation activities of enterprises have slowed down. What do you think is the main reasons for the current restriction of market demand? Wen Bin: Insufficient market demand is concentrated in two aspects, one is consumption and the other is real estate. The central bank's survey of urban reserves in the second quarter showed that the savings willingness of the residential sector reached 58.3%, which was the highest level of statistics. The lowest level since the quarter.

Residents are neither willing to consume nor to buy a house. I think there are two common factors behind it. One is that it is expected to be weak. In the third year of anti -epidemic, the savings and accumulation of many families and enterprises have been continuously consumed, and the impact resistance has decreased. In recent years, the number of uncertainties in international and domestic uncertainty has led to lack of confidence in the future. The consumer confidence index issued by the Bureau of Statistics was 86.7 and 86.8 in April and May, respectively, respectively, respectively, the lowest and low levels of statistics, respectively. As of the end of June, residents' households had added 10.3 trillion yuan in deposits, an increase of 2.88 trillion year -on -year, which hit a record high in the same period, showing that the preventive savings tendency of the residential sector is still high.

The second is insufficient ability. The consumption power is mainly affected by income, and the income is directly linked to the employment status. In the first half of this year, the urban survey unemployment rate once rushed to 6.1%. Although it has fallen, the overall level is still high. The survey unemployment rate of population in 16-24 has continued to refresh the historical high. From the perspective of medium- and long -term perspective, with the slowdown of the potential economic growth rate, the production and operation of enterprises will shrink accordingly, and the ability to create employment will decline, which will affect residents' income growth and leverage. Since the first quarter of 2020 exceeded 60%in the third quarter of 2020, it has been maintained in the narrow range of 61.7%and 62.2%in the past two years, and has entered a platform period.

》》 You can issue the opportunity to issue special national debt

Wind Finance: At present, my country's economy is in the key window of a steady recovery. It is very important in the third quarter. Actively expanding effective investment is an important support for the economy. What do you think of macro policies in accelerating the construction of investment projects?

Wen Bin: Infrastructure investment is responsible for the economic function of the bottom. At the end of last year, the Central Economic Work Conference emphasized that it was necessary to "moderate to carry out infrastructure investment in advance". In late April this year, the Central Finance and Economic Commission meeting requested comprehensively strengthening infrastructure construction and constructing a modern infrastructure system. Since then, the State Frequently increases the credit line of 800 billion yuan in policy banks and has established an infrastructure construction investment fund. It is expected that the growth rate of infrastructure investment in the second half of the year is expected to continue to rise.

In fact, the key to infrastructure investment depends on two aspects, one is funds and the other is the project. At the funding level, the efforts of the policy include: First, support local governments to make good use of special debt limits. At present, there is still 155 trillion spaces from the limit. In the second half of the year, the local government can use this space to use enough to fill the policy empty window period.

At the project level, it can be divided into traditional infrastructure and new infrastructure. Among them, the scale and development space of traditional infrastructure are relatively large, and it should focus on supporting key water conservancy projects, comprehensive three -dimensional transportation networks, important energy bases and facilities, urban gas pipelines, flood control and drainage facilities, and underground comprehensive pipe galleries. The growth potential of the new infrastructure field should focus on investment in related fields such as innovation development, green low -carbon, and digital economy, which can not only create short -term demand, but also lay the foundation for medium and long -term high -quality development.

Repair consumer scenarios, improve consumption capacity, and boost consumption willingness

Wind Financial: Consumption is the ultimate demand. It is a key link and important engine that can unblock domestic large cycles and has a long -lasting force for the economy. In the first half of this year, affected by factors such as frequent epidemics, my country's consumer market was greatly impacted. In the next stage, how should we promote consumption to expand and improve quality and help form a strong domestic market?

Wen Bin: The Politburo Conference held on April 29 demanded that "fully expand domestic demand", especially "to play the role of consumption for the traction of the economic cycle." In my opinion, if you want to promote consumption to expand the quality and form a strong domestic market, you need to make a force from the following aspects:

The first is to repair the consumer scene. In recent years, the epidemic has had a fierce impact on consumption, especially the catering consumption relying on offline contact. At the end of July, the Politburo meeting requested that "to protect the safety of people's lives and health to the greatest extent, and minimize the impact of epidemic on economic and social development", showing that the policy will try its best to grasp the balance between epidemic prevention and control and economic and social development. As the epidemic is gradually controlled, the offline contact service industry is expected to continue to recover.

The second is to improve consumption power. Employment and consumption have a close linkage effect. Only by maintaining the stability of employment can residents have a continuous source of income and then have consumption power, which requires stabilizing the market entity. In the short term, it is necessary to implement a package of bailout assistance policies for industries, small and medium -sized enterprises, and individual industrial and commercial households that have been severely impacted, and then stabilize and expand employment, and promote the gradual rebound of residents' income growth. The policy and institutional environment allows state -owned enterprises to dare to work, private enterprises, and foreign companies. In addition, it is necessary to do a good job of employment in key groups, formulate related employment policies for the disadvantaged groups in the employment market, improve the policies and systems such as the protection of labor rights and interests of flexible employment personnel, premium payment, salary payment, etc., and better open up new consumption and employment space. The third is to boost the willingness of consumption. To allow residents to dare to consume, the specific proportion of residents' income in the distribution of national income and the proportion of labor remuneration in the initial distribution as the focus of adjustment of income distribution. Adjust the income gap between the income entities and pay attention to fairness. In addition, we should continue to improve the social security system, further expand the coverage of social security, increase reforms in terms of medical, health, education, and housing, so that the system is more reasonable and the mechanism is more standardized. Let people dare to consume and willing to consume.

》》 Break the glass doors, spring doors, and rotating doors that restrict private investment

Fengkou Finance: Activating private investment, and expanding domestic demand to have the source of living water, and mobilizing the enthusiasm of private investment is essential. What do you think? How should we further reduce the threshold for private investment, eliminate hidden barriers, and mobilize the enthusiasm of private investment?

Wen Bin: Since the beginning of this year, the growth rate of private investment has continued to be lower than the growth rate of the overall fixed asset investment, affecting the vitality of the economy. The executive meeting of the State Council has repeatedly emphasized that private investment accounted for more than half of the investment in the whole society. It is necessary to adhere to "two unshakables", increase policy support, and use market methods and reform measures to stimulate private investment vitality.

In recent years, the country has been trying to reduce the threshold for private investment, eliminate hidden barriers, and mobilize the enthusiasm of private investment, but the effect has not been fully exerted. The main reason may be because it has not fundamentally reversed the expectations of private enterprises. The work continues to implement it.

The first is to continue to optimize the private investment environment. Focusing on the reform of deepening "decentralization of service", removing glass doors, spring doors, and rotating doors that restrict private investment, and further improve the policy environment that is conducive to the development of private investment. Implement various policies and measures to encourage the development of the private economy, create a fair, transparent, and rule of law development environment for various types of ownership enterprises, and promote high -quality development of private investment. It is important to point out that the platform economy is a typical representative of private enterprises. In recent years, it has been greatly affected by policies. This will help stabilize the confidence of the platform economy and private enterprises.

Second, in the process of steady growth, it is necessary to play a major project traction and government investment to leverage the role. In 102 major projects of the "Fourteenth Five -Year Plan" plan, you can choose projects with a certain level of income and relatively mature conditions. Attract the participation of civil capital. When arranging various government investment funds, he treats private enterprises with colleagues and gives play to government investment guidance.

The third is to encourage private investment to actively participate in active existing assets. Encourage high -quality private investment projects to issue the real estate investment trust fund (REITs) to form a demonstration effect. Encourage private capital to participate in the average existing assets of state -owned stock through PPP and other methods to improve the convenience of participating in infrastructure projects. Support private enterprises to revitalize their assets through property rights transactions, mergers and acquisitions, and encourage recycling funds for new project construction.

- END -

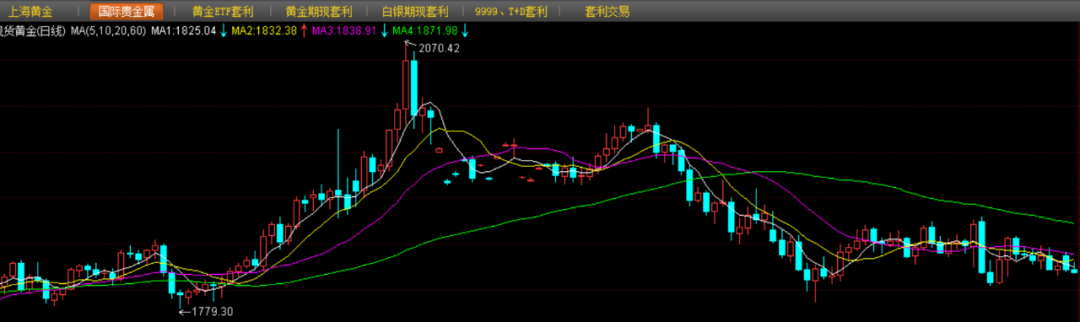

Gold price analysis in the first half of the year and the trend of the second half of the year

In the first half of 2022, the adjustment of the geopolitical situation and the Fe...

From understanding your water dispenser to treadmill, why do you want to be intelligent?

Source | BohufnAuthor | TwilightOn July 20, Tmall Elf held an ecological partner c...