Suning

Author:Arai Telescope Time:2022.08.04

▍ Salt Finance

Author | He Guosheng

Edit | Fry

"How can a large company such as Suning owe your money."

When Wu Qian went to the public security economic investigation department to report the case, several policemen did not believe that Suning Tesco owed the money of their company.

As one of the millions of suppliers, Wu Qian's company provides the owner of Suning Tesco for department stores and small appliances. However, after the beginning of 2021, it changed.

Wu Qian told Nanfeng Window Salt Finance that Suning Tesco "970,000 commercial acceptance bills have not been paid, and there are more than 200,000 payments neither exchange or payment." It shows that there is no money in Suning Tesco accounts.

Like Wu Qian, Wang Peng is also a supplier of Suning Tesco. It has also started in early 2021. Suning Tesco has more than 8 million payments that did not pay Wang Peng.

The lack of money has caused Wang Peng's company to resign from most employees, leaving only 4 to maintain the company's operation.

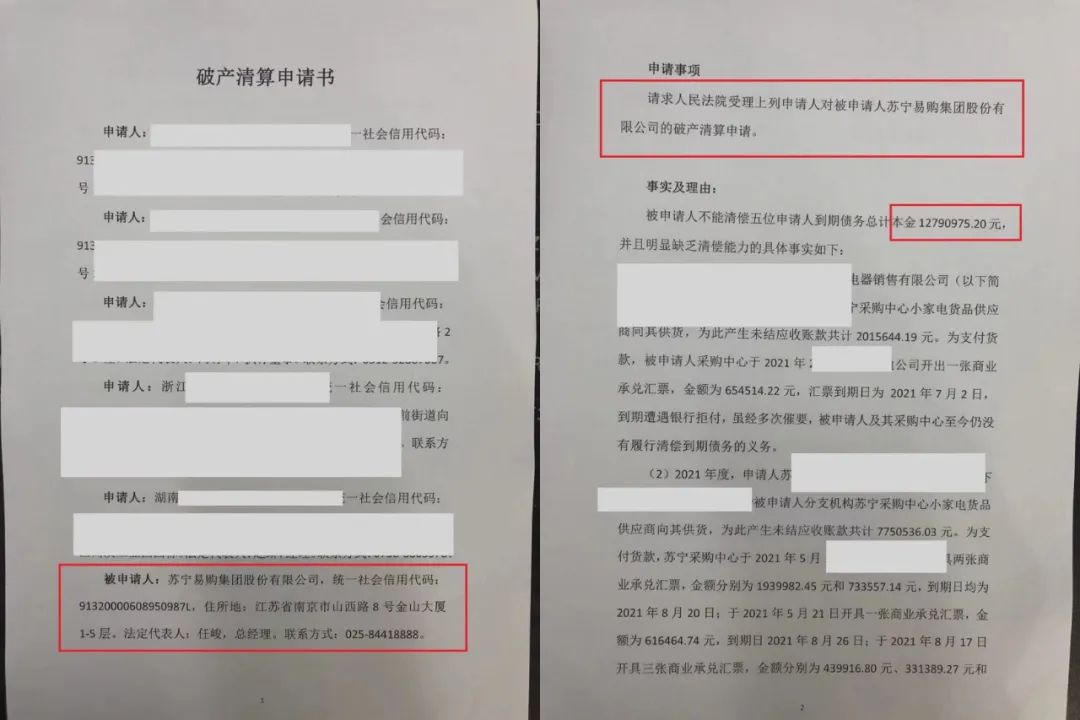

On July 12, a private legal consulting agency in Beijing, "Zhongcheng Institute of Case Center" (hereinafter referred to as the "Case Center"), was commissioned by Wu Qian and Wang Peng to submit to the Nanjing Intermediate People's Court for bankruptcy and liquidation of Suning Tesco. Application.

"If it wasn't for the case, we would never want to reach this step." Wu Qian said that the payment was dragged for too long, and the company could not support it. We could only take this way to protect our rights.

As early as the two of them, the request center was commissioned by other suppliers of Suning Tesco, and the first batch of bankruptcy applications for Suning Tesco was submitted to Nanjing Intermediate Court on July 4.

This move has made the Internet "Suning Tesco's bankruptcy liquidation".

So that Suning Tesco issued a statement on July 6th that the rumor of bankruptcy liquidation was rumored. At present, everything is normal and the business is stable.

Suning Tesco Send Weibo clarification

"The suppliers of about 200 (as of July 29) have registered with us, and the number daily changes is changing, involving the principal of about 1 billion yuan in arrears. . "The relevant person in charge of the Case Center told Nanfeng Window Salt Finance reporter.

According to the Case Center, at present, they will maintain the frequency of a batch of bankruptcy applications to Nanjing Intermediate Court every week, and now they have submitted three batches.

In response to this, the reporter has repeatedly called Suning Tesco's office, but no one answered.

There is no money on the other party's account

The cooperation between Wu Qian's company and Suning Tesco began in April 2019 and signed a contract with Suning Tesco Nanjing Headquarters. They specialize in Suning Tesco's "Enterprise Purchasing" section.

In other words, customers order the Suning Tesco platform. Wu Qian's company is shipped. After the customer confirms the receipt, Qian first goes to the Suning Tesco platform, and then transferred to Wu Qian's company.

According to the contract, the payment of Wu Qian company and Suning Evisite is the current payment month. "We will get the ticket, they will directly transfer to the transfer."

"It was normal for the first one or two months." Wu Qian said that every time the payment was delayed, especially after the epidemic in 2020, it has been lagging behind.

At the beginning of 2021, Suning Tesco began to be unable to maintain a monthly payment month, and turned to a commercial acceptance bill. Wu Qian didn't know at the time that this was a signal of the cash flow crisis in Suning Tesco.

At that time, Suning Tesco workers negotiated with them and asked if they could pay the payment with a business acceptance bill of two or three months.

"We thought about it, and thought that such a big company would not owe us, at most it was dragging for a month or two." Wu Qian said.

However, in March 2021, Suning Tesco's commercial acceptance bills could not be issued, "it is said that the amount of the acceptance bill is gone."

When Wu Qian saw the bills and cash, he would no longer be supplied. Although the contract they signed in September 2021 expired. After that, she asked other colleagues and said that Suning Tesco payments have a big problem. She also asked the customers who bought the goods, and the other party said they paid Suning Tesco on time.

Those commercial acceptance bills have expired, and Wu Qian waited for not to pay the payment, but the prompt of the banking system -the other party's account had no money and could not pay it.

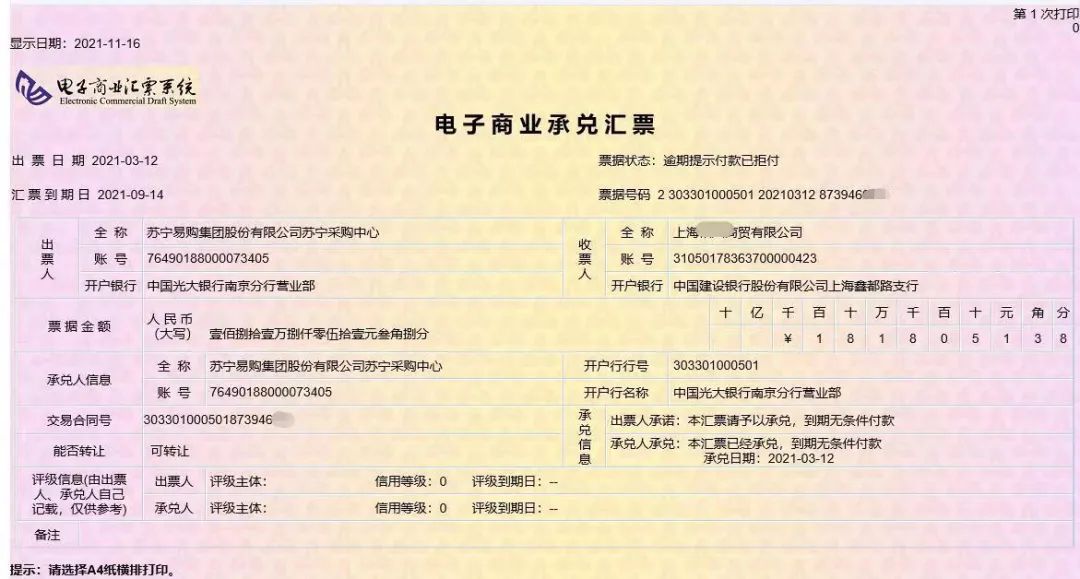

Wu Qian sent five electronic commercial acceptance bills to Nanfeng Window Salt Finance, with a total amount of 895,400 yuan. The issuer is the Suning Purchasing Center of Suning Tesco Group Co., Ltd., and the column of the bill status reads: "Overdue prompts, payment has been refused to pay."

The commercial acceptance bill issued by Suning Tesco cannot be paid after the expiration of the expiration, and the bill status bar reads "overdue prompt payment has refused to pay" (the interviewee confession)

At that time, Wu Qian really felt that the incident was serious.

After some understanding, she judged that Suning Tesco knew that she was unable to pay, but gave them a commercial acceptance bill, which was a bill fraud. She decided to report to the public security department.

After going to the Economic Investigation Department, the police were reviewed by the police, and the case was not filed in the end. The police told Wu Qian that they had a contract dispute with Suning Tesco's belongings, and they were not fraud.

After waiting for more than a year, Wu Qian hoped to repay the other party, and then found the centers for the case and commissioned them to apply for bankruptcy application for Suning Tesco.

According to the above -mentioned person in charge of the Case Center, the first batch of bankruptcy applications submitted to Nanfeng Window Salt Finance, which they submitted, have been withdrawn because Suning Tesco reached mediation with two suppliers. The second and third applications have been signed by the Nanjing Intermediate Court and were transferred to the court for review.

The third batch of bankruptcy applications submitted the third batch of bankruptcy applications on July 23. A total of five suppliers "are possible in accordance with the requirements for the filing specified by the Enterprise Bankruptcy Law." Nanfeng Window Salt Financial reporter, the subject of the application for bankruptcy can be creditor or the debtor. "As long as the debt company cannot claim the debt, it can apply for bankruptcy."

Specific to Suning Tesco, "First of all, this debt is legal, and then the debt expires. The supplier has repeatedly urged the debt company to claim the debt." Wen Chunsheng said, "If it has already After a lawsuit, it is also a major evidence through the enforcement of enforcement. " Based on this, you can apply to the court for Suning Tesco bankruptcy.

The relevant person in charge of the Case Center directly told reporters to Nanfeng Window Salt Finance that they learned that "Suning Tesco has lost its debt claim."

Fortune 500 losses ranked third

The above -mentioned person in charge of the Case Center told Nanfeng Window Salt Finance reporter that they made the above judgments and have a certain basis.

"The company's book liability ratio is too high, which has exceeded 83%, long -term liabilities of nearly 140 billion yuan, and the default account payable for 32.8 billion yuan." The relevant person in charge of the Case Center said that the business model of Suning Tesco also has risks. The gross profit margin of income is between 2%-5%, but the delayed interest rate of default is generally higher than 4%, or even 18%.

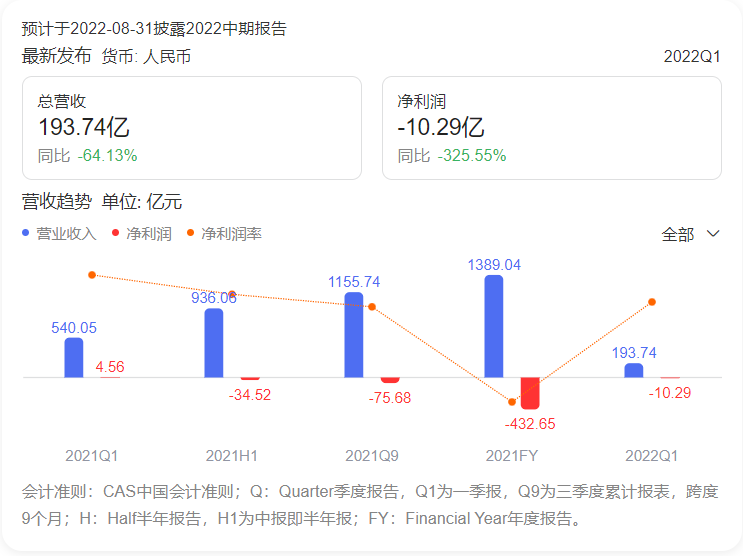

Suning Tesco's 2021 financial report also reflects its historic losses. In 2021, Suning Tesco's annual revenue was 138.9 billion yuan, a year-on-year decrease of 44.94%; the non-net profit of deduction was -44.6 billion yuan, a year-on-year decrease of 556.23%.

Suning Tesco 2021 Financial Report

In 2022, in the ranking of Fortune's Fortune 500 companies, Suning ranked third with losses of 43.265 billion yuan.

At the same time, due to the three years of losses and the audit reports in the last year showing uncertainty in the company's continued operating capacity, Suning Tesco was implemented by the Shenzhen Stock Exchange "other risk warnings". The company's stock is referred to as "Suning Tesco" to "ST Tesco" and entered the A -share risk warning board transaction.

"This will be severely restricted by its credit and financing capabilities." The above -mentioned person in charge of the Case Center said: "Then you can't make it yourself, and you can't borrow it.

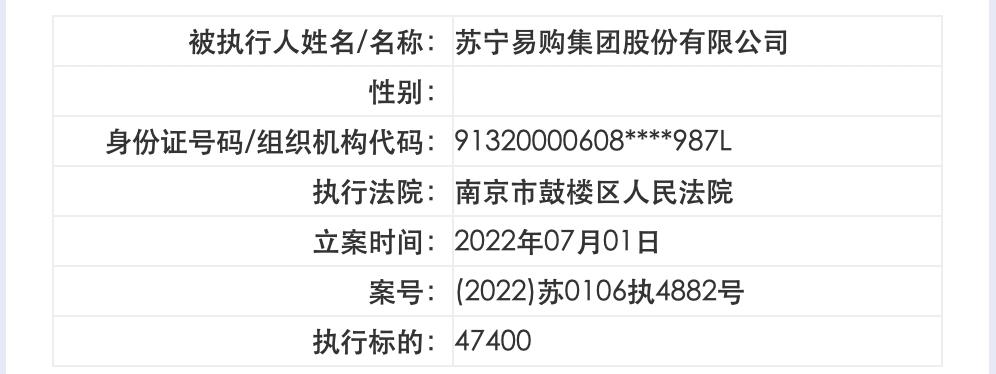

In addition, the Case Center told Nanfeng Window Salt Financial reporter that according to China's information on the information disclosure network, Suning Tesco was included in the list of the executives six times in June, with a total amount of 490,700 cases involved. In July, Suning Tesco was once again included in the list of executive personnel by the court, involving the amount of 757,700 yuan.

Suning Tesco was listed as the executed person by the Gulou District Court of Nanjing, Jiangsu

"It shows that it has the actual actions that do not perform the debt due and the risk of obvious lack of liquidation capacity. It should be bankrupt and liquidated." The above -mentioned person in charge of the Case Center said.

However, it is worth noting that at present, the above -mentioned execution information has not been found on the public implementation information of China.

"If it is still included in the list of executors, it is not executed in place three months, and when the court is censorship, the court will use it as a basis that cannot be repaid due." Wen Chunsheng further explained to Nanfeng Window Salt Finance. Essence

However, Wen Chunsheng believes that Suning Tesco, as a listed company, if you really apply for bankruptcy, will choose to go bankrupt and reorganize, not bankruptcy liquidation.

"Because its shell is still valuable, and the entire layout of Suning's easy -to -buy, the channels for operation, etc., also have many advantages." Wen Chunsheng said that the most important thing is that the settlement rate of bankruptcy and reorganization is higher than that of bankruptcy. Interest protection, the development of enterprises, and the interests of investors are a win -win situation.

But Suning Tesco is not waiting for "bankruptcy".

As early as February 2021, Shenzhen International announced the acquisition of Suning Tesco worth 14.8 billion yuan. However, after five months of dedication, Shenzhen International announced the termination of Suning Tesco. It states that after comprehensive considerations, they have decided to terminate potential acquisitions after prudent analysis and argument.

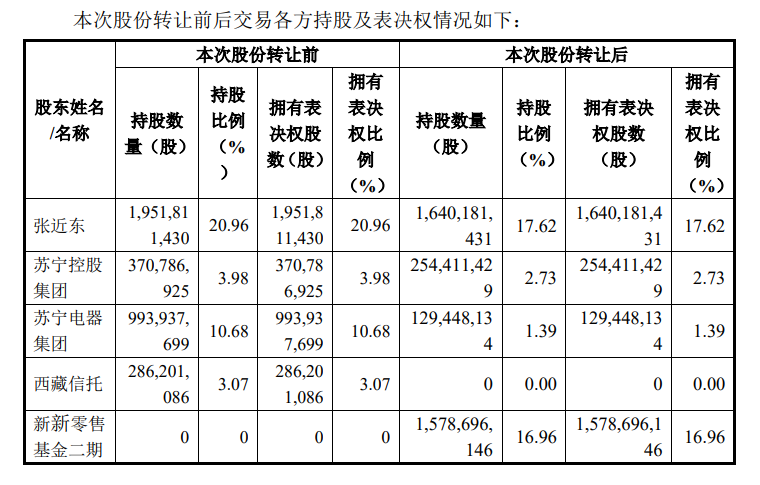

On the same day, Suning Tesco issued an announcement that Jiangsu and Nanjing State -owned Assets Leading the establishment of the second phase of the Jiangsu New Retail Innovation Fund (limited partnership), with a total scale of 8.83 billion yuan, intending to transfer nearly 17%of the shares of Suning Tesco. Essence

The fund invites Huatai Securities, Ali, Xiaomi, Haier, Midea, TCL industry investors to participate.

Suning Tesco issued an announcement on shares change

This action was regarded by the outside world as the local leading company in Jiangsu began to rescue Suning Tesco.

The "monetization" of the employee is no longer connected

After the above -mentioned mixed reforms were completed, Zhang Jindong, the chairman of Suning Tesco, withdrew from the board of directors, making the company no controlling shareholder and no actual controller. At that time, there was a voice saying that the entry of state assets made Suning Tesco lightly in the battlefield and ushered in a new stage of development.

Former Suning Holding Group Chairman Zhang Jindong

Suning Tesco has been "lightly on the battlefield" for a year, without false.

But Wu Qian and Wang Peng still failed to receive the arrears of payment, nor did they.

Compared with Wu Qian's disconnection, Wang Peng still sighed that he would supply Suning Tesco in a symbolic supply of more than 8 million yuan in payment, "more than 100,000 goods a month."

Wu Qian feels that there is still hope for Suning Tesco supply to be deeper and deeper. But the reason why Wang Peng chose to continue supply is not hope.

“我们也没办法,欠了银行400多万贷款,还有近200多万的民间借贷,之所以继续在做,就是为了让我的债权人看到我们公司还在。”王鹏说,一旦他The company's suspension of business or cancellation must face the prosecution of banks and private borrowers, so they can barely maintain the company's symbolic operation.

In fact, as early as March of this year, Wang Peng's 4 million bank loans have been overdue, and banks have also filed a lawsuit. But because of the epidemic in Shanghai at the time, after their application, the bank extended the loan for half a year.

Now, the semi -annual period is about to expire, and Wang Peng's nearly 2 million civil loan will also expire in November this year.

How to do?

"We have no plans now. There are really no plans. The money that we should borrow is borrowed. When they hear Suning's supplier, they will not borrow money for you." Wang Peng told reporters helplessly.

In order to pass the difficulties, they even cut off most employees, leaving only 4 people. The current salary of these four people was paid by Wang Peng's family.

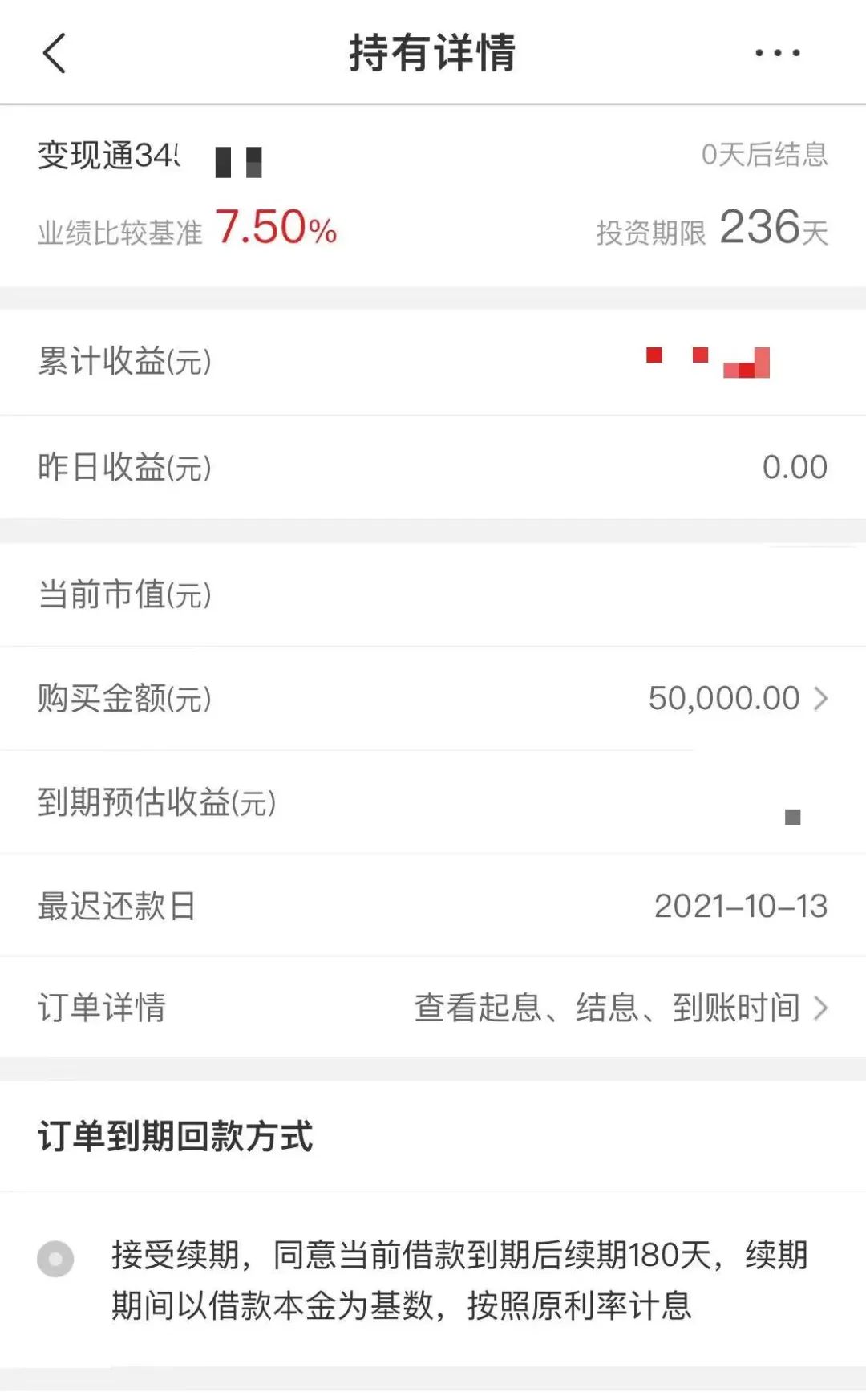

It was not only the "outsiders" of Wang Peng and Wu Qian who could not receive the money. They bought the "own family" of their own wealth management products, that is, Suning Tesco employees have also been unable to withdraw from November 2021.

On November 12, 2021, Suning Group issued an open letter that called the employee's financial management "employee borrowing". The public letter mentioned that the reason why some borrowings could not be repaid on time were because Suning Group's recent progress in arrears of debt recovery and asset disposal failed to be completed as scheduled. At the same time, Suning also promised to reserve a "employee borrowing" for full assets.

Xu Yun could not withdraw nearly 80,000 yuan in financial management.

She said that in Suning Tesco for a few years, this internal wealth management product called "Monument" is similar to regular deposits. Because of the good income, many colleagues will buy it, and only Suning employees can buy it.

"Regularly save 1 year, there are 7 interests to 7.5 points." Xu Yun revealed to the South Wind Window Salt Financial.

Before November 2021, this wealth management product had never had problems and could always withdraw on time.

Xu Yun remembered that at the time, the person in charge of the department informed that the money was not yet on, and they asked them to order the options that agreed to extend for half a year. Said her mouth, but she was unwilling, but the person in charge of the department asked several times successively. Xu Yun, who couldn't bear the pressure, agreed to postponed for half a year.

But half a year later, "Xu Yun" did not wait for the principal.

Xu Yun's financial management, originally scheduled to expire in October 2021, has not received the "principal" (the interviewee confession)

"By June 30th (2022), many people came to the company's door to make trouble. We notified that the employees were not allowed to make trouble." Xu Yun said.

In fact, after the Suning Group issued an open letter in November 2021, Xu Yun received the interest of "employee borrowing". It was also since then that Xu Yun received 1%or 5%arrears from the company's principal paid every week, and by April this year, it became 0.5%of the principal.

"Hundreds of dollars per week, when will it be done?" Xu Yun questioned.

In addition, Xu Yun said that they had not paid the housing provident fund for half a year. "In May this year, the company made up for the provident fund last December, but the company was deducted from our salary every month from our salary, but they did not pay us."

Xu Yun said that she checked in the provident fund system that the provident fund deducted from her salary did not pay, and the company did not pay the half of the provident fund paid by the company.

Debt and sports car

Xu Yun listened to other colleagues that some people went to the court to prosecute the company due to postponed payment, but heard that the court no longer accepted the case of Suning Tesco.

The fact is that the case involving Su Ning Tesco was concentrated.

Zhang Kangyang, director of Suning Tesco Group Co., Ltd.

The above -mentioned person in charge of the Case Center told reporters that in July 2021, when they provided daily services to a legal consultant company in Beijing, they found that the company was owed to Suning Tesco more than 16 million yuan. During the prosecution, they found that the case of Suning Tesco was under the jurisdiction of Nanjing Intermediate Court by the Supreme Law.

"After accepting the case of the Nanjing Intermediate People's Court, the calculation was suspended, and the court would not be preserved without the court." The person in charge of the case center said.

Wu Qian and Wang Peng do not understand this approach. Mo Fei Court is maintaining local enterprises? Lawyer Wen Chunsheng said that this understanding was somewhat devoted.

"The main purpose of concentrating its jurisdiction is to achieve a fair and settlement effect." Wen Chunsheng said that after a large number of debt lawsuits, courts at all levels are entering the stage of compulsory implementation. The courts near the water tower will be realized by some high -quality assets to achieve compensation for some creditor's rights. This execution may be bad for the overall effect, sometimes even fatal. "

In this case, a court is implemented uniformly. "It can not only protect the interests of all creditors, but also coordinate all contradictions. It may also be prepared for the next bankruptcy and reorganization." Wen Chunsheng explained.

Wu Qian and Wang Peng did not consider this kind of problem, they just wanted to get the payment as soon as possible to save their own business. They said that it is helpless to apply for bankruptcy of Suning Tesco, and I don't know what is the best way.

Wen Chunsheng analyzed that the supplier and Suning Tesco should be signed by the general trading contract, not a contract with guarantee or ownership. In this case, once the buyer's Suning Tesco, once bankruptcy, the debt of the supplier is ordinary creditor's rights, and its compensation rate may be lower, because there are employee claims and tax claims in front, and then they are then before. It is ordinary creditor's rights. "

But at the same time, Wen Chunsheng understood the supplier's response. "If you want to go bankrupt sooner or later, it is better to break early than late, and some debts can be settled early.

Wu Qian and Wang Peng have never thought of this step. In their cognition, Suning Tesco should not have money.

At present, mainstream analysis believes that the reason why Suning has a serious liquidity crisis is mainly due to its unsuccessful diversified investment and long -term main business.

Since 2012, Suning Tesco has invested or acquired many companies. Among them, many are the areas that they are not familiar with.

For example, $ 250 million acquisition of PPTV, US $ 1.93 billion acquisitions Nubia, 2.7 euro acquisition of Inter Milan Club, etc.

In 2016, Suning held a press conference to announce the acquisition of Inter shares of Inter shares

Unfortunately, these projects acquired by Suning did not bring considerable returns.

In addition, as the main indicators and its main business benefits indicators for corporate operating benefits, Suning's deduction non -net profit has become more serious since 2014 and is difficult to return to "positive". This means that Suning Tesco's main business has been in a state of blood loss for a long time, and the income is unspeakable.

So, does Suning lack money?

Not long ago, Zhang Jindong's son, also known as Suning Tesco, was not an independent director Zhang Kangyang. He appeared at Milan, Italy with a limited euro -value euro -worth euro, and caused heated discussions on Weibo.

In April 2022, there were fans on the streets of Milan to photograph Zhang Kangyang and his new car

At the same time, it was news that Zhang Kangyang was chased 1.7 billion yuan by CCB's debt.

1.7 billion people who owe 1.7 billion can also buy sports cars -the incredible degree of incredible Wang Peng has been thinking recently: "See if there is a miracle that appears, can we pay us back to us."

(Except for Wen Chunsheng, the other person's name is a pseudonym except for Wen Chunsheng.)

The picture parts in the text comes from visual China, and part of it comes from the Internet

Capture | Yang Jun, Shuhua

Welcome to the circle of friends without reprinting without authorization

point

- END -

During the year, 152 companies landed in more than nine of A shares to become strategic emerging enterprises

Reporter Wu XiaoluOn June 14, the CSRC agreed to the first public offering of stocks for the first public offering of stocks. According to Wind information data statistics, as of June 15, since this y

[Micro Video] my country's first 330 kV "Liu Tianguan" transmission line in 50 years has been put into operation for 50 years to transport a total of 74 billion kilowatt -hours

my country ’s first ultra-high voltage transmission line 330 kV Liujiaxia-Tian...