Xiamen Port's approximately 800 million yuan fixedly increased JPMORGAN and other institutions to share the shares

Author:Daily Economic News Time:2022.08.04

On August 3, Xiamen Port Affairs (SZ000905, stock price was 7.70 yuan, and a market value of 4.8 billion yuan) released the "Report on the Issuance of Non -Public Issuance A -Share Stocks".

The price of the non -public offering of Xiamen Port is 6.86 yuan/share, and the total amount of funds raised is about 800 million yuan. A total of 16 institutions and individual investors have been distributed, with a lock -up period of 6 months.

"Daily Economic News" reporter noticed that in recent years, Xiamen Port Affairs has frequently moved in the capital field. Last year, Fujian Port Resources Integration, Xiamen Port pragmatic controller was changed to Fujian SASAC. Subsequently, Xiamen Port launched this fixed increase. In April of this year, Xiamen Port announced the issuance of 2 billion yuan of corporate bonds.

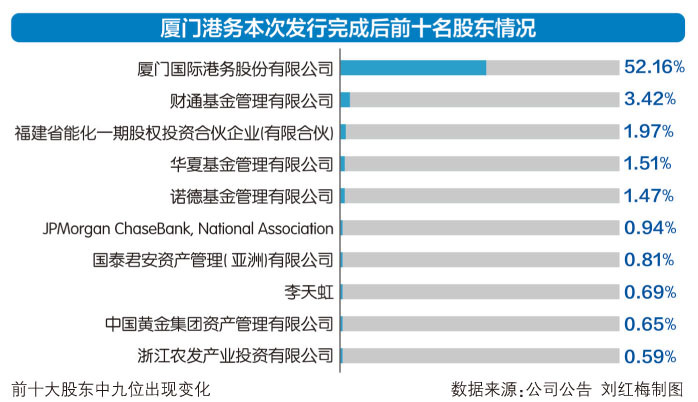

At the same time, with the completion of this fixed increase, nine of the top ten shareholders of Xiamen Port will change.

Nine of the top ten shareholders change

The reserve price of the shares issued by Xiamen Port was 80%of the company's stock transactions, which is not less than 6.28 yuan/share.

According to the announcement of Xiamen Port Affairs, it received a total of 28 orders for the purchase quotation, and the offer was concentrated between 6.28 yuan and 7.31 yuan. Based on the quotation of effective purchase of investors, the issue price was finally determined that the issue price was 6.86 yuan/share. It is worth noting that during the quotation phase, the highest price of 7.31 yuan/share is given by JPMORGANCHASEBANK, NATIONALASSOTION.

Judging from the final distribution situation, a total of 16 institutions and individuals have obtained fixed -increase shares, of which the top five are Caitong Fund Management Co., Ltd., Fujian Provincial Nenghua's first -phase equity investment partnership (limited partnership), Huaxia Fund Management Co., Ltd., Nond Fund Management Co., Ltd. and JPMORGANCHASEBANK, NationalALASSOCIATION, subscribed amounts of approximately 174 million yuan, 100 million yuan, 77 million yuan, 75 million yuan, and 48 million yuan, respectively.

It is worth noting that because of this distribution, the nine of the top ten shareholders of Xiamen Port will change. Before the issuance, the controlling shareholder of Xiamen Port Affairs was Xiamen International Port Co., Ltd., with a shareholding ratio of 61.89%. After the issuance, it was still the controlling shareholder, and the shareholding ratio would drop to 52.16%.

The top ten shareholders of Xiamen Port will be replaced by all the targets of this fixed increase. Before the issuance, the second largest shareholder of Xiamen Port Affairs was Liu Junfeng, with a shareholding of about 2.13 million shares and 0.34%of the shares. After the issuance, the threshold of the top ten shareholders of Xiamen Port Affairs increased to approximately 4.37 million shares.

"After the completion of the non -public issuance, the company's total assets and net assets will increase accordingly, and the capital structure will be effectively optimized. At the same time, the fundraising of raised funds will further improve the company's ability to resist risks, laying a solid foundation for the company's further development business. It is conducive to protecting the common interests of companies and all shareholders. "Xiamen Port said.

In recent years, capital actions are frequent

Due to the integration of the port resources of Fujian Province, Xiamen Port Holdings Group Co., Ltd., an indirect controlling shareholder of Xiamen Port Affairs, has become an integration of the Fujian Port Group Co., Ltd. of Fujian Port Group Co., Ltd. For this reason, in February 2021, the actual controller of Xiamen Port was changed from the Xiamen SASAC to the Fujian SASAC.

In August last year, Xiamen Port announced the non -public offering of A shares. According to the funding plan disclosed by the plan, the 800 million yuan raised by the 800 million yuan was used for the BAIC project project in the North 1-2#north of Gu Lei Port District, 160 million yuan for trailer purchase projects, and the remaining 240 million yuan for supplementation to supplement Louple funds.

Gulei Port District North 1 ~ 2#Passing Engineering Project is located in Gulei Port District. The Gree Port District is the supporting project of the Gutai Petrochemical Industrial Park in Zhangzhou. The main content of the project is the 1#and 2#wharf berth in the North Port area of Gree, including 2 50,000 tons of multi -purpose berths, 1 5,000 -ton multi -purpose berth, and 1 workboat berth and other supporting facilities. The annual throughput of the project is 3.35 million tons. After the project is completed, it will be mainly used to meet the needs of various petrochemical projects in the Gulei Petrochemical Industrial Park for port transportation.

In response to the above projects, Xiamen Port Affairs stated: "After the completion of this project, two 50,000 tons of berths will be added in the Grand Port area to significantly improve the cargo throughput capacity in the port area and meet the logistics needs of the hinterland enterprises. The loading and unloading capabilities of Leigang District will drive the economic development of the Gu Lei Petrochemical Industrial Park and the hinterland of Zhangzhou, and it is of great significance to improve the role of the hub portfolio port in Xiamen Port. "

The trailer buying project is mainly intended to purchase two 6,800 horsepower trailers, one 5000 -horsepower trailer, and one 4,000 horsepower trailer.

In addition, in April this year, Xiamen Port disclosed the "Plan for the Issuance of Company's Bonds", which planned to raise funds of not more than 2 billion yuan. It was used to supplement the company's operating funds, repay interest liabilities, or other laws and regulations that did not violate relevant laws and regulations.

As of the end of the first quarter of this year, Xiamen Port's asset -liability ratio was about 61.5%. During the recent investigation of institutions, Xiamen Port Affairs said: "The port industry is a typical heavy assets and capital -intensive industries."

Xiamen Port Affairs said that its "Fourteenth Five -Year Plan" strategy is positioned as "the first -class port comprehensive logistics supply chain service provider of the southeast coast". The first is the industry planning to increase the loading and unloading business of port scattered grocery. Linking Hong Kong service; Third, we need to do a big and excellent logistics supply chain integration service; fourth is to do excellent and refined modern logistics business.

It is worth noting that after the news of the fixed increase and decision came out, the stock price of Xiamen Port affairs fell significantly.As of the close of August 4, Xiamen Port's stock price closed at 7.70 yuan/share, a decline of more than 4%.

Daily Economic News

- END -

"East to Far" completes tens of millions of yuan A+round of financing

Tencent News on the 30th, SAR/INSAR startup Beijing Dongfang to Yuanyuan Technolog...

In the second half of the year, "fight" 丨 Provincial Development and Reform Commission: Anchor annual goals and tasks, strive for economy, and build construction

In the next step, the Provincial Development and Reform Commission will anchor the annual target tasks, lock the key tasks, and strive to fight for the economy and build construction.Focus on stable e