Establish a new type of agricultural business entity credit system financial support empirical research

Author:China Economic Times Rural Fin Time:2022.08.05

Establish a new type of agricultural business entity credit system financial support empirical research

—— Take Xing'an League in Inner Mongolia as an example

With the in -depth advancement of the rural revitalization strategy, the traditional single farmer's business model can no longer meet the needs of agricultural and rural production and operation. New -type agricultural business entities with professionalism, large -scale and intensive agricultural operations have gradually become the mainstay of rural economic transformation and upgrading. In order to cultivate and promote the healthy development of the new type of agricultural operations, strengthening the construction of a credit system is particularly important. Therefore, in the context of implementing rural revitalization, build a new type of agricultural business entity credit system, consolidate the results of poverty alleviation, drive farmers to increase their employment, lead agricultural scale operation development, promote the structural reform of agricultural supply side, promote agricultural modernization and rural revitalization strategy strategy It is of great significance.

1. The current status of the construction of the new type of agricultural business entity

(1) The criteria for judging the new type of agricultural business entities are not uniform.

The new types of agricultural operations mainly include four categories: "breeding farmers, family agricultural pastures, farmers' professional cooperatives, and leading agricultural enterprises". There are situations where various financial institutions have expanded the scope of judgment or narrowing the scope of judgment, and the specific identification standards for the "four categories" subject are not uniform. For example, the postal savings bank Xing'an League Branch determined that the large planting households were not less than 50 acres, and the Alishan Rural Commercial Bank found that the planting area was not less than 200 acres; There are more than 300 heads and sheep. The Xing'an Branch of Agricultural Bank of China has determined that the large breeding households are 10 cows and 50 sheep.

(2) The credit assessment criteria for new agricultural business entities are not uniform.

Each financial institution has “their respective politics” for the credit assessment standards of new agricultural operations, and use their respective credit information systems to conduct credit assessment as the business entity. The credit competent department has not formulated a unified credit assessment standard for new agricultural business entities. At present, only five financial institutions in Xing'an League conduct credit rating of new agricultural business entities, and conducted credit assessment for 11,886 subjects. It accounts for 53.43%of the total number of main subjects.

(3) Insufficient supply of credit demand for new agricultural business entities.

As of the end of June 2022, various financial institutions issued 16,135 loans and 205,146,200 yuan for the new type of agricultural business entity; 13,628 credit loans were issued, 104,8002,700 yuan, and credit loan balance accounted for 51.08%of the loan balance. Due to the lack of operating income of the new type of agricultural business entities and the lack of cash flow, financing demand exceeds the income level, and financial institutions are difficult to meet the financing needs of new agricultural business entities in terms of risk considerations, regardless of the loan quota or loan method and period.

2. Finance supports the construction of a new type of agricultural business entity, the construction of the credit system still "shortcomings"

(1) The construction force of the department has not yet formed, resulting in "their own politics"

At present, the construction of the credit system for the new agricultural business entity of Xing'an League is mainly promoted by the People's Bank of China to promote agricultural financial institutions in the form of credit assessment. The identification and supervision of the new agricultural business entities are local agricultural rural areas, market supervision and other departments. At this stage, all relevant departments have the problems of cross -functional functions and unclear power and responsibilities, resulting in insufficient linkage effects, and no joint construction for construction.

(2) The information sharing platform has not yet been built, forming a "information island"

The financial infrastructure in rural areas is incomplete, and the information sharing platform between agricultural -related departments and financial institutions has not yet been completed, and information controlled by other agricultural departments cannot be obtained. The construction of the main credit system.

(3) Credit assessment standards have not been unified, and "authoritative rating" is lacking

At present, the state has not introduced a unified credit assessment standard, and relevant departments such as the Development and Reform Commission, the central bank and other relevant departments have not had relevant policy requirements, which has led to the lack of evaluation basis for financial institutions. Each agricultural financial institution can only formulate evaluation standards according to its own business actual or institutional requirements. It is not even a credit assessment, which is difficult to understand the credit status of the new type of agricultural business entity, and reduce credit assistance such as credit loans.

(4) Financial credit products are still insufficient, and the lack of "risk sharing"

At present, only three financial institutions in the jurisdiction have developed exclusive loans for new types of agricultural operations. Other financial institutions are mostly small farmers' loans. The types of credit loans with large quotas and long term are relatively short, and the supply of credit products is insufficient. The existing risk compensation mechanism and valid guarantee mechanism are not sound, the types of agricultural insurance are relatively single, and the coverage of rural property rights registration transaction services is limited. Once the risk of loans is difficult to resolve, it is also one of the reasons for financial institutions that they are unwilling to issue large credit loans for new types of agricultural business entities.

(5) The main management management is not standardized, and the lack of "brand awareness"

At present, some agricultural cooperatives are empty, and most of the operating entities still have problems such as irregular management, unclear financial systems, and lack of brand awareness. At the same time, it does not pay attention to shaping the brand image, the lack of characteristics of the production products, the high degree of marketization operation, and the weak ability to resist risks, resulting in the difficulty of improving the credit level of new agricultural operations.

3. Finance supports the construction of a new type of agricultural business entity, the construction of the credit system is urgent to "break the question"

(1) Integrate the construction resources of the credit system and strengthen departmental cooperation

Integrate the strength of local governments, the People's Bank of China, and agricultural -related financial institutions, strengthen communication and cooperation between various government departments and financial institutions, and lead the government to study and formulate the construction plan and development plan for new agricultural business entities mechanism. (2) Accelerate the construction of credit information sharing platforms and strengthen data collection

Local governments have accelerated the establishment of a platform for agricultural credit information sharing in the jurisdiction, and organically combined with the strategic strategy of "digital villages" to achieve disclosure sharing of new types of agricultural business entities. Realize database docking such as agricultural and rural departments, market supervision departments, and financial institutions, and shape the three -dimensional credit image of new agricultural business entities.

(3) Strengthen the application of credit assessment results, uniform assessment standards

The first is to fully consider the development of agricultural cooperatives, family farms, breeding farmers, and leading agricultural enterprises, formulate credit assessment standards from top -down from top to bottom, and improve the credit assessment system for new agricultural business entities. The second is to introduce professional enterprise rating agencies to use market -oriented and professional rating methods to conduct credit evaluation of new agricultural business entities within their jurisdiction. The third is to strengthen the use of assessment results to achieve differentiated credit funds and policy support, such as increasing loan quotas, reducing loan interest rates and credit acquisition rates.

(4) Establish a sound risk sharing mechanism and strengthen policy support

Strengthen the policy support for the new type of agricultural business entity, improve the financial subsidy policy, set up risk compensation funds, build a platform for banking enterprise cooperation, improve the risk resistance capabilities of new agricultural business entities, and help new agricultural business entities to obtain more financial support.

(5) Innovative concepts Standardize operations and improve the quality of personnel

Actively carry out training and education from the perspective of enterprise production and operation, financial management, and breeding technology from the perspective of enterprise production and operation, in order to improve the business quality of managers and professional levels of employees. Guide new types of agricultural business entities to establish a scientific and efficient management system, improve the level of intensive production, broaden e -commerce sales channels, and form a professional, market -oriented, and large -scale business model.

(6) Strengthen the publicity of integrity culture and shape the credit image

Establish a long -term mechanism for integrity culture, explore new methods of integrity culture publicity, and increase the integrity of the integrity of new agricultural business entities and the popularization of financial knowledge, and help improve the awareness of integrity and brand awareness of new agricultural business entities. Encourage new -type agricultural business entities to create their own brands, rely on long -term continuous integrity operations, continuously expand the brand's influence, enhance the level of credit, and create a good credit image. (The People's Bank of China Xing'an League Center Branch Yu Jianbo Wang Hao)

Responsible editor: Zhang Wei Guo Jinhui

- END -

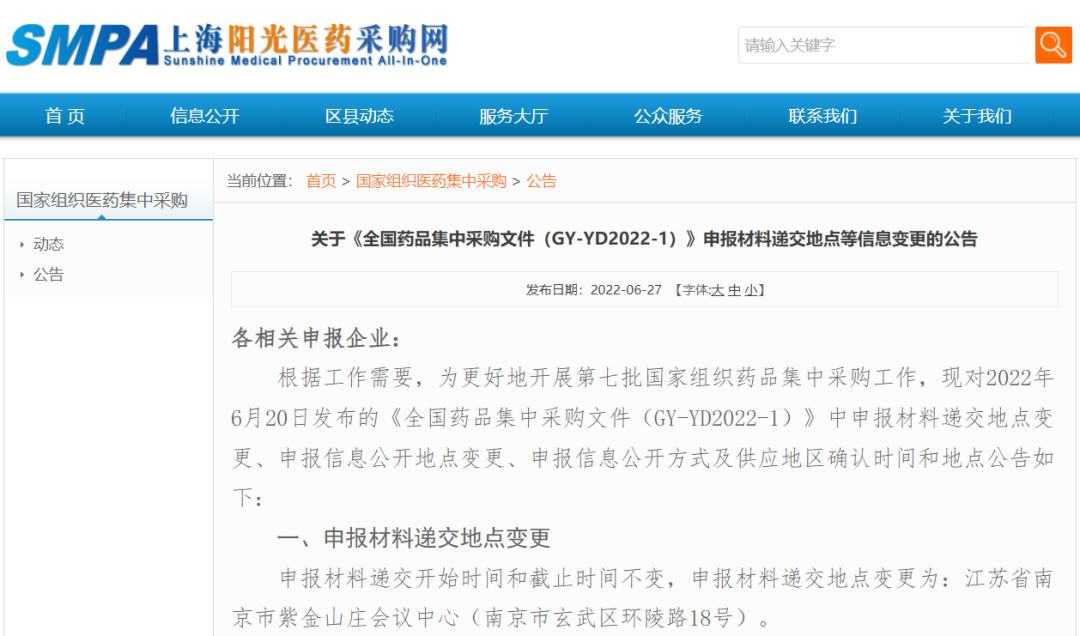

The seventh batch of collecting bids and opening the bidding place to Nanjing

On June 27, Shanghai Sunshine Procurement Network issued an announcement that the ...

Guiding Changming: 收 收 贵 贵 贵 贵 贵 贵 as scheduled

In recent years, Changming Town, Guiding County has promoted the development of in...