Tonghua Dongbao's performance trailer "changing face", the sales costs are high, the controlling shareholder's equity is high pledge, and the situation of the shares of the joint venture shares reversed the performance decline.

Author:Time data Time:2022.08.05

On the evening of August 4th, Tonghua Dongbao Pharmaceutical Co., Ltd. (hereinafter referred to as "Tonghua Dongbao") disclosed the correction announcement of the 2022 semi -annual performance trailer (hereinafter referred to as the "correction announcement"). Mother's net profit is expected to be 1.19 million yuan, an increase of about 76.74%year -on -year; while the net profit of the mother after deduction is expected to decrease of 206 million yuan year -on -year, a year -on -year decrease of about 31.36%, which has fallen significantly compared with the previous performance forecast.

The correction announcement shows that "In order to better implement the relevant policies of insulin product collection and mining, in accordance with the relevant provisions of the" Enterprise Accounting Guidelines "and the company's accounting policy, the company's entire inventory products existing in the circulation process before the implementation of the collection of collection and the original supply price For one -time or return to the difference between the implementation price of the collection, the above -mentioned business confirmation will lead to a reduction in the company's revenue. "

It is reported that Tonghua Dongbao is engaged in the research and development, production and sales of drugs in the fields of diabetes and endocrine therapy. The main products include human insulin ingredients, human insulin injection, glycry insulin substance drugs, glycry insulin injections, door winter insulin drugs, doors, doors Winter insulin injections, town brain capsules, diabetes -related medical devices, etc., are one of the domestic insulin leading companies.

On the evening of November 26, 2021, Tonghua Dongbao disclosed the announcement of the company's participation in the national drug centralized procurement. The five types of products in the door of the door Winter Winter Injection are bidd by Class B.

At the same time, the results of the selection of centralized procurement (insulin project) of the sixth batch of national organizational drugs this year will be implemented in various provinces across the country. It may be further pressed.

In this regard, Time Data sent an interview letter to Tonghua Dongbao on July 13.

On July 18, Tonghua Dongbao responded to the interview letter of Times data and said, "When the company's special collection quotation, the company's long -term development of the company, considering the particularity of insulin products, adopted mild mildness, and a gentleness was adopted. The quotation strategy is far less than the average decrease in price.

Over 70 % of the revenue comes from human insulin products, the sales volume is less than the growth rate of inventory

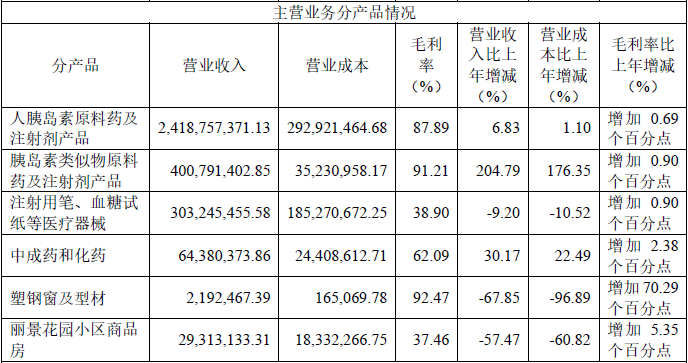

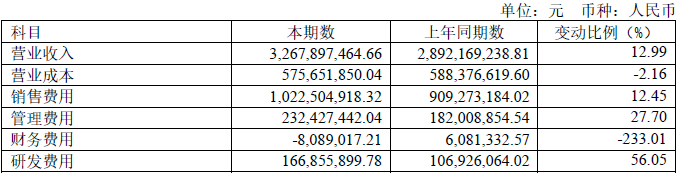

According to the 2021 annual report, Tonghua Dongbao's operating income reached 3.268 billion yuan, an increase of 12.99%year -on -year; of which, the revenue of human insulin and injection products was 2.419 billion yuan, an increase of 6.83%year -on -year, accounting for 74.02%of operating income. The interest rate is as high as 87.89%, which is the company's maximum source of income.

At the same time, the production and sales of insulin products of Tonghua Dongbao people have also increased. Among them, the production and sales of human insulin injection products increased to 62.188 million and 60.8792 million, respectively, an increase of 4.44%and 7.32%year -on -year. However Sales.

In this regard, Tonghua Dongbao stated in the annual report that "the reporting period has appropriately increased the inventory reserves of each product, and the sales of human insulin injection products have increased slightly."

R & D investment is far less than sales expenses

In terms of R & D investment, Tonghua Dongbao's research and development costs in 2021 reached 167 million yuan, an increase of 56.05%year -on -year, accounting for 5.11%of total revenue. However, at the same time, the company's sales costs are still high. In 2021, the sales cost was as high as 1.023 billion yuan, accounting for 31.27%of the total revenue ratio.

In this regard, the company replied that the company's total investment in R & D in 2021 should be 380 million yuan, and the proportion of R & D investment accounted for 11.63%; and the relatively high sales costs were due to the special nature of insulin products that needed patient education and after -sales service. Corresponding investment is required to provide patients with excellent after -sales service; at the same time, it is said that the higher sales rate is higher than the proportion of R & D investment in revenue.

Increased accounts receivable steadily increased

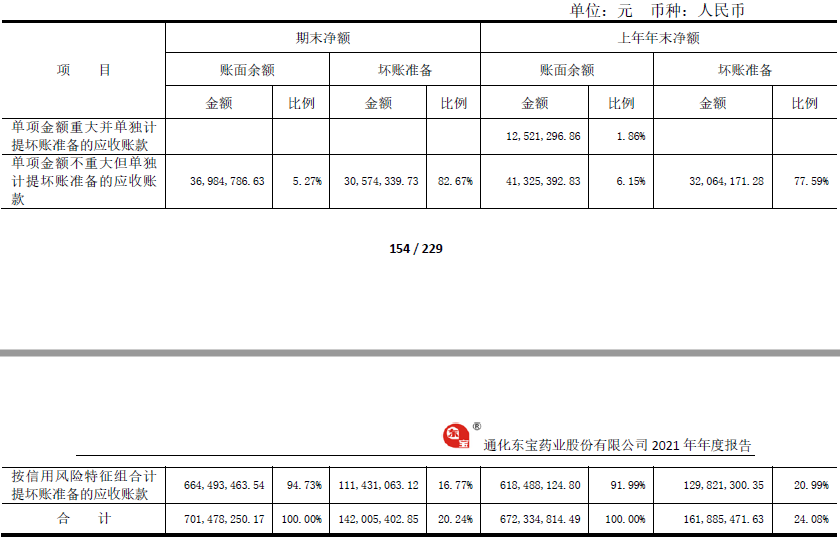

At the same time, Tonghua Dongbao's receivables have continued to increase. According to the annual report, the company's account balance at the end of 2021 has reached 701 million yuan, an increase of 4.32%over the current book balance. To this end, the company's period of 142 million yuan was provided during the company's period.

According to the first quarter of the 2022, the company's account value receivable continued to increase to 599 million yuan, an increase of 7.16%from the end of the 2021 period.

In this regard, the company replied, "The company's receivables are listed in the balance sheet's receivables and receivables of the receivables, and the two items can accurately reflect the company's receivables. In the first quarter of 2022, compared with the end of 2021, the receivables were reduced. "

High pledge of the controlling shareholder, the hidden risk of the hidden positioning of the stock price

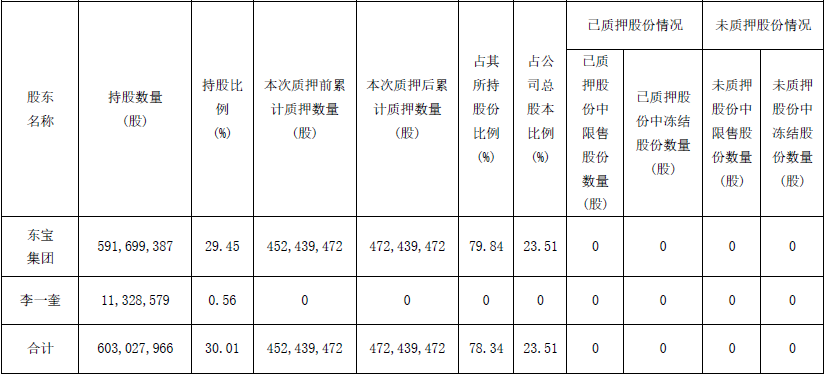

According to the statistics of the times, as of July 28, 2022, Tonghua Dongbao controlling shareholder Dongbao Industrial Group Co., Ltd. (hereinafter referred to as "Dongbao Group") has pledged 472 million shares, accounting %.

According to Wind data, there are still 23 pledge that the controlling shareholder Dongbao Group. Among them, the reference price of 3 pledge days has fallen by more than 40%, and there is a certain risk of liquidation.

In this regard, the company replied that "the company's controlling shareholder Dongbao Industrial Group Co., Ltd. has no above risks", and also said that Dongbao Group will "reduce the amount of pledge financing and reasonably control the proportion of pledge." Continue to reduce the shares of joint venture and reverse the decline in the performance in the first half of the year

According to the annual report, Tonghua Dongbao has accumulated a total of 10.84 million shares of Xiamen Treasure Biological Engineering Co., Ltd. (hereinafter referred to as "Treasure Bio") shares in September and December 2021. 2.66%, which caused investment income during the company to increase by 650.78%year -on -year.

It is reported that Tonghua Dongbao is one of the sponsor of the Tiber Biology and was once the largest shareholder of Temple creatures. After the successful listing of Temple creatures, Tonghua Dongbao held 122 million foster creatures, accounting for 30.06%of its total share capital.

Entering 2022, Tonghua Dongbao continued to reduce holdings of Treasure Biological shares, from January 5, January 7 to January 14, and March 16, respectively. Stocks, 5.395 million shares, and 20.5 million shares, accounted for 5.0025%, 1.33%, and 5.04%of the total biological stocks of Treasures, respectively, of which the total price of two agreements was 873 million yuan.

Regarding the sale of Treasure Biological equity, the company replied that it was the overall arrangement made to achieve the company's long -term development strategic planning, which is conducive to the company's return funds, creating a larger space for future innovation research and development and high -quality project cooperation; On the other hand, the company will also continue to increase cash dividends and take advantage of the market situation in a timely manner.

On July 15th, Tonghua Dongbao disclosed the semi -annual performance forecast of 2022. It is expected to achieve net profit of 1.364 billion yuan in the semi -annual 2022, an increase of about 102.41%year -on -year; A year -on -year decrease of about 4.96%.

In this regard, the company stated in the performance trailer that during the reporting period, the sales of foster biological parts, the increase in investment income increased the net profit of the company; but on the other hand, during the reporting period The rise in raw material prices has led to a decline in gross profit margin compared with the same period last year, and the epidemic in some areas was affected by the epidemic, which eventually led to a decrease in net profit after deduction.

On the evening of August 4th, Tonghua Dongbao corrected the semi -annual performance forecast. It is expected that the net profit of home mother in 2022 was 1.191 billion yuan, an increase of about 76.74%year -on -year; the net profit after deduction was expected to decrease by 206 million yuan year -on -year. A year -on -year decrease of about 31.36%.

In this regard, the company stated in the correction announcement that "because insulin products have certain particularity in transportation and storage, especially under the impact of the epidemic, medical travel and logistics are blocked. . In order to better implement the relevant policies of insulin products collection and mining, in accordance with the relevant provisions of the "Corporate Accounting Guidelines" and the company's accounting policy, the company's all inventory products that exist in the circulation before the implementation The difference between the price is performed or returned at one time, and the confirmation of the above business will lead to a decrease in the company's revenue. "

Author | Zhang Zhao

Edit | Zhang Zhao

—————

- END -

27 countries continued to sell, why is the US debt not fragrant?

Zhongxin Jingwei, June 17th (Song Yafen) accompanied by the continuous interest rate hike of the Fed, US Treasury (hereinafter referred to as U.S. debt) also ushered in the wave of selling. Following

Disposal

In order to further promote the pairing cooperation of Suzhou and Fuyang, on the morning of June 14, the Sufu Famous Products Exhibition Center was unveiled in Fu. The platform will provide more oppor