After a wave of market market, but Bin started to increase the position?

Author:Daily Economic News Time:2022.06.16

On June 15th, driven by financial stocks such as brokerage and insurance, the Shanghai Index impacting 3,350 points, and the "bull market flag bearer" brokerage stocks set off a daily rising wave. For such an empty market, some markets shouted "the bull market is here."

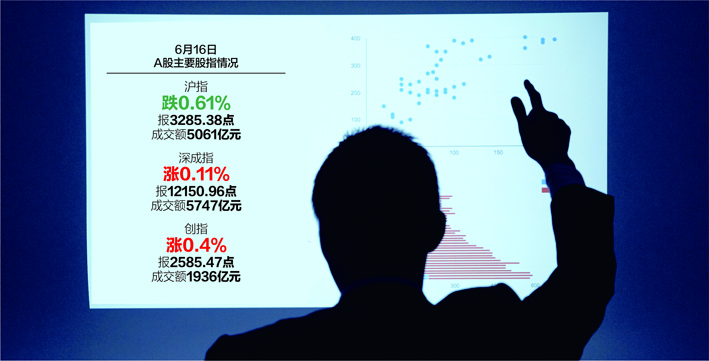

Data source: Reporter sorted out the visual Chinese map Yang Jing map

This situation has undoubtedly set off this wave of quotes for the private equity boss who has greatly reduced its holdings to a 10 % position in the early stage.

However, according to the "Daily Economic News" reporter's observation, the net value of Bin's product has recently fluctuated significantly, and most of them have fallen significantly. In response, Oriental Harbor responded to reporters that it is only some products to adjust positions, which is relatively optimistic about the opportunities in the third or fourth quarter of this year.

On June 16, the Shanghai Index fell 0.61%to 3285.38 points, with a turnover of 506.1 billion yuan; the Shenzhen Index rose 0.11%to 12150.96 points, with the turnover of 574.7 billion yuan; The amount is 193.6 billion yuan.

The net worth of its products plummeted against the trend

Since May, A shares have a significant rebound. Circuit stocks represented by new energy have emerged out of trend rising markets, and many stocks have doubled. And some of the 10 billion -level private equity still maintained low positions or empty positions. In June, the market continued the rebound trend. On June 15, the Shanghai Index was 3350 points.

The market is undoubtedly a bit uncomfortable for private equity institutions with low or empty warehouses. In March, the net value of the product of Bin's product was smaller suspected of empty warehouses. At that time, Bin responded that the position was relatively low, about 10%. In May, but Bin said that at the beginning of the year, he believed that the global market was facing systemic risks, and he had made a position reduction, and now it has maintained a 10%position, but the next stage will be 20%to 30%of small positions to participate in the phased rebound.

Since May, the market has shown obvious rebounds, but Bin previously said that the remarks of 20%to 30%of the small positions have been confirmed. Recently, the net value of the private equity products of Bin has fluctuated significantly. Under the market, the net value of some products under Bin has fallen significantly.

According to the data of private equity networks, but Bin's "Oriental Harbor Tianen Marathon No. 2", from May 13 to June 10, the net value of the product fell by 3%, while the CSI 300 index rose 6.28%in the same period. There are also the net value curve trend of "Oriental Harbor Marathon 8", "Oriental Harbor No. 6", "Oriental Harbor Blue Sky Fund", which are similar to the "Oriental Harbor Tianne Marathon 2", which has recently fallen significantly.

In fact, Bin low warehouse operation is not a case. Recently, the products of the tens of billions of private equity Linyuan have almost maintained the rhythm of "steps in place". The net value fluctuations of the products of Linyuan are suspected of empty or low warehouses. For example, Linyuan's representative product "Shenzhen State Investment-Linyuan Securities Investment". From March 18 to May 20, the net value rose slightly by 0.83%. From the perspective of the net value curve, it was also bland. In the same period, the CSI 300 Index fell 4.41%. In addition, the net value fluctuations in the nearly 3 months of "Linyuan Investment No. 15" and "Linyuan Investment No. 11" have fluctuated very small.

Ten billion private equity plus positions are the least

In fact, for Dan Bin's "additional positions", the relevant person in Eastern Harbor responded to the reporter of "Daily Economic News" that at present, some products have been adjusted by positions. Some products have been affected by the reasons for holding US stocks. As the market rebounds, the stock strategy private equity has begun to increase its positions, especially the 5 billion -scale stock private equity plus is the fiercest.

As of June 3, the 5 billion -level private equity position was 74.33%, and the position index rose 4.11%month -on -month. The tens of billions of private equity plus positions are the least, but the tens of billions of private equity positions are the highest, of which 58.80%of the 10 billion -level private equity positions exceed 80%.

At a channel communication meeting in Oriental Harbor at the end of May, Bin mentioned that there may be a chance to fight in the third or fourth quarter of this year. Just like at the end of 2018, a major investment opportunity may appear. Because in the third and fourth quarters, various feedback may be more thorough, including corporate profitability, changes in the industry, and changes in the world pattern, etc. At the end of the year, it should be clearly seen. Under the current circumstances, it may be mainly based on consumption and the Internet. Medicine is relatively supplemented. High -end manufacturing will increase some proportion, and there are some underestimated value stocks. Regarding risk control, there must be room for yourself to leave a lot of room for yourself. The future configuration industry may be slightly scattered, but in general, when there is a chance to hit the home run, I still hope to go all out.

Liu Youhua, deputy director of the Wealth Research Department of Paiwang.com, told reporters that from the analysis of its investment philosophy, on the one hand, it recognizes the bottom of the market and is full of confidence in the next market. On the other hand, after a round of plunge, many targets have fallen out of investment value, and the valuation has already had a safe margin, so there are more and more targets worth buying. Next, the market trend is more determined by the fundamental game. It is expected that the market will focus on wide shocks.

Daily Economic News

- END -

History moment!The qualification examination for securities practice is renamed, and the exam is postponed!This year has ushered in major adjustments in the past 20 years, and say goodbye to "access" ...

In those years, the Securities Qualification Exams we have tested were renamed.Yes...

Crowdsourced bags cover the nation's stores, Wal -Mart: offers more than 35,000 jobs

On the eve of 618, Wal -Mart China announced that after nearly two years of operat...