Cooperators were exposed to raw materials for counterfeiting Huaxi Bioxin toxin seven -year layout declined

Author:Radar finance Time:2022.08.05

Radar Finance Hongtu Products | Editor Wu Yanrui | Deep Sea

Following Huaxi Biotoxin cooperation parties were exposed to fake raw materials and product recalls and destruction, the company recently terminated related cooperation with the partner.

Huaxi Bio said that since the signing of the joint venture agreement, the partner has never provided any related products to the joint venture for sales.

The cooperation of Huaxi Bio began in 2015. On the eve of the partner in 2020, the two parties also increased capital to joint ventures. As of the end of 2021, the total assets of the joint venture company were 350.258 million yuan, and the net profit was -5.537 million yuan.

Some people in the industry believe that the termination of this cooperation has changed the botulinum toxin layout of Huaxi Bio to its peers from advanced.

Huaxi Biological Termination Botox Cooperation

On August 2nd, Huaxi Biological issued a follow -up progress announcement on investing in Medybloom.

According to the announcement, in May 2015, Huaxi Bio registered in the Cayman Islands, the former Hong Kong joint company listed company Huaxi Biotechnology Co., Ltd. (currently delisted, hereinafter referred to as "Cayman Huaxi") and Korean company Medytox Inc (Hereinafter referred to as "Medytox") signed a joint venture agreement.

The agreement stipulates that the two parties registered and established a joint venture Huaxi Mimi Decision Co., Ltd. Specific injections (hereinafter referred to as "botulinum products") and other medical cosmetic products for specific injection.

Huaxi Mimi is invested by Cayman Huaxi to hold 50%of the equity of HK $ 50 million. Medytox contributed with 25 million Hong Kong dollars and the relevant agency of related products in mainland China, which is granted to Huaxi Mimi, owns Huaxi 50%equity.

The two parties have completed the signing of the exclusive agency agreement in August 2016. Huaxi Mimi has the exclusive agency rights of related products in mainland China, and assumes the registration of related products in mainland China.

Since then, Huaxi Biological Party has replaced specific cooperation holding companies. In September 2018, Huaxi Bio acquired the Huaxi Hito Hero Huali to Cayman Huaxi with a consideration of 16.78 million Hong Kong dollars through its Hong Kong wholly -owned subsidiary, 50%of the equity, and undertake the rights and interests of Cayman Huaxi under the joint venture agreement, and deemed the initial signing party of the joint venture agreement, which is subject to the terms of the joint venture agreement.

In March 2020, Ji Lang Company and Medytox decided to jointly increase the capital of HK $ 17 million to Huaxi Mimi, a total of 34 million Hong Kong dollars, and used to support the further development of Huaxi Meimei and pay the follow -up of related products to follow -up products. Registration costs and operating costs.

As of the disclosure of the announcement, Langlang Company has paid HK $ 12 million of the capital increase.

There are two main reasons for the termination of cooperation. On the one hand, a series of products from Medytox have been recalled and destroyed in South Korea; on the other hand, the approval of related products in China has not completed product registration procedures since November 2019.

At the same time, the Medytox has never provided any related products to Huaxi Mimi since the signing of the joint venture agreement for sales.

In the annual report of Huaxi Biological 2021, Huaxi Mimi was announced as a shareholding company. As of the end of 2021, the company's total assets were RMB 350.258 million, and the net profit was -5.374 million yuan.

From "Strong Union" to encountering black swans

Radar Finance has noticed that the predecessor of Huaxi Bio, "Shandong Furida Biochemical Co., Ltd.", has been mass -produced by microbial fermentation in 2000 to mass produce hyaluronic acid through microbial fermentation method. In 2007, Huaxi Bio became the world's largest hyaluronic acid producer.

"In fact, we are not only a hyaluronic acid company. Hyaluronic acid is just our basic disk." Zhao Yan, chairman and general manager of Huaxi Bio, said at the 2021 performance briefing.

Huaxi Bio has high hopes for botulinum toxin.

Baidu Encyclopedia introduced that the thin face needle is the type A botulinum injection, which is mainly used for muscle tissue. Because it is commonly used to solve the masseter muscle hypertrophy, it is called a thin face needle. The professional name of the face -to -face needle is botulinum, which is a biological product that can be produced on a large scale through genetic engineering methods. Because it has neurological effects, it is commonly used in neurology, ophthalmology, plastic surgery, and beauty surgery.

In 2020, the "non -surgical" project on the new oxygen online transaction is based on the transaction amount. The top three projects are botulinum toxin, hyaluronic acid filling, and hydraulic needle (skin protective agent with hyaluronic acid as the main ingredient). The proportion is more than 50%. Since the new crown epidemic, medical beauty consumption habits have changed a lot. In the past, surgery -based consumption habits changed to the skin anti -aging and injection micro -shaping direction. Skin beauty and injection beauty were more popular with customers. Developed slightly with injection.

Huaxi Biological's previous products were only one of the botulinum products under Medytox. Medytox also owns two botulinum products: Innotox and Coretox. As the first company in South Korea to obtain botulinum toxin, its market share in South Korea is about 40%, ranking first in ten years.

Behind the seemingly "strong union", he encountered a black swan.

In June 2020, according to a survey of relevant Korean departments, Medytox used unruly original liquid during the production process to obtain circulation permits through material fraud, and violated relevant laws and regulations. According to CCTV Finance reports that the Korean Food and Medical Safety Department (Food and Medicine Department) will suspend products with three specifications of production, sales and use of MediToxin, and the approval number of Meditoxin will be revoked on June 25, 2020. Huaxi biological layout needs to start again for 7 years, and botulinum toxin has been approved for listing in other companies in China.

As of now, there are four botulinum toxins in the domestic market, which have been approved to be listed, namely Bao Shi, a subsidiary of the United States, Jishi, British IPSEN, Ledi, and Lanzhou Bio. Among them, Jishi has been represented by Gaodeme, and Leste is proxy by Four Ring Pharmaceuticals.

Sales gross profit margin is lower than Emerae

In the first half of 2022, Huaxi's biological operating income was 2.936 billion yuan, an increase of 51.62%year -on -year; net profit of home mother was 471 million yuan, an increase of 30.49%year -on -year.

Huaxi Bio said that in the first half of 2022, the company continued to steadily promote the "four -wheel drive" business layout, and the overall operating income achieved a high speed growth. Among them, the raw materials business increased steadily, the medical terminal business was basically flat, and the functional skin care business maintained a high -speed growth. , A significant growth of functional food business has increased significantly.

For the reasons for the growth of operating income, the sales revenue of functional skin care products increased significantly by more than 75%year -on -year, and the raw material business increased steadily by more than 10%year -on -year.

At the same time, in the second quarter of 2022, although the raw material business and medical terminal business were negatively affected by the new crown epidemic, the functional skin care products continued to grow high, and the company gradually entered the refined operation stage by strengthening operation control. The gap between the growth rate of operating profit and the growth rate of operating income has improved.

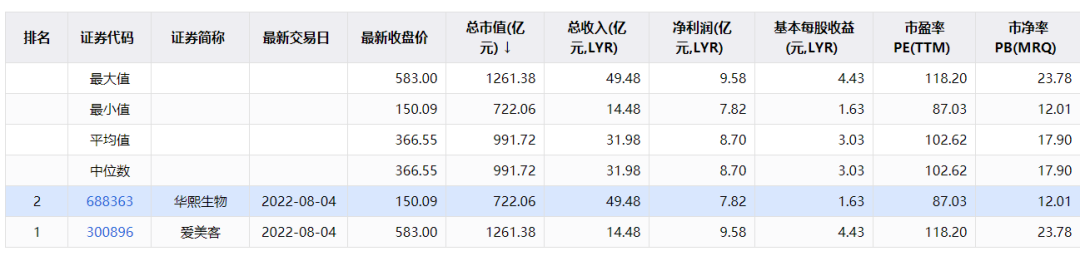

The medical beauty consumables, which are also the third -level industry of Shenyin, are not as good as Huaxi creatures, but the market value is much higher than Huaxi creatures. In addition, although Aimei is less than that of Huaxi creatures, the net profit is higher than the latter.

In the first quarter of 2022, the gross profit margin of Huaxi Bio was 77.13%, and the beauty guest was 94.45%.

- END -

The signing of 18 projects and a total investment of 13.55 billion yuan!China (Mianyang) Science and Technology City Xiamen Promotion Meeting results fruit

Accelerate the establishment of the northern Sichuan Provincial Economic Sub -cent...

Luzhou, Hunan: Give full play to the role of the government's new special bonds

Luzhou Daily All Media Reporter Tang SisiAfter the implementation of the 1+7 policy measures for the implementation of the stable economic measures of the country and the province, the Several meas