Six new in, increase holding 11!These targets became the "good heart" in the second quarter of the social security fund

Author:Huaxia Times Time:2022.08.05

China Times (chinatimes.net.cn) reporter Hu Jinhua, an apprenticeship reporter Geng Qian Shanghai reported

The National Social Security Fund is a part of the state's funds of the pension insurance premium paid by enterprises and institutions to professional institutional management, thereby achieving value -added fund assets on the premise of ensuring asset security and liquidity. As a fund to manage 1.4 billion people in the country, there is often a strong investment research team and strict stock selection strategy behind it. Each quarter of heavy warehouse stocks have certain reference value for individual investors.

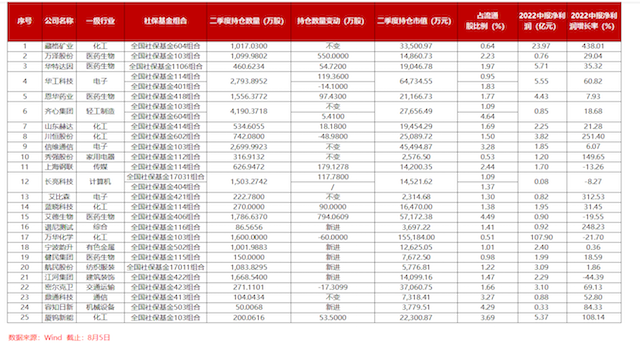

Recently, with the semi -annual report of the listed company, the social security fund adjustment dynamics in the second quarter also gradually surfaced. According to Wind data, as of August 5th, among the listed companies that have been disclosed at the current semi -annual report, there are 25 shareholders of the top ten shareholders of the social security funds in the list of 25 stocks. Weighing stocks, three of them have been combined by multiple social security funds.

So, what areas of social security funds are relatively optimistic? Which stocks were heavy in the second quarter? What inspiration can investors get from it?

6 new entry, increase holding 11

According to Wind data, as of August 5, among the listed companies that have been disclosed in the semi -annual report, the list of ten major circulation shareholders of the social security fund in the second quarter appeared in the second quarter. Yuan.

In the second quarter of the social security fund adjustment trend, 6 new stocks were newly entered, namely the testing, Ningbo Yunsheng, Jianmin Group, Xiangmin Group, Xiemin Group, Jianghe Group, and Rong Zhiri, all in different fields. From the perspective of increasing the number of holdings, the number of new holdings of Jianghe Group has the highest number of stocks, and the social security fund increased its holdings of 16.6854 million in the second quarter; the number of newly added stocks in the number of new stocks ranked second, and 10.838 million shares were added in the second quarter; Ningbo Ningbo; Ningbo; Ningbo Yunsheng has also increased over 10 million shares, which is 10.198 million shares.

In addition to the newly entered listed companies, 11 stocks have been increased in the second quarter. According to industry analysis, there are the most pharmaceuticals and chemicals, with 4 and 3 respectively. In terms of the number of holdings, Ed Bio has the largest number of shares, and 7.9406 million shares in the second quarter; Wanze shares, which are also pharmaceuticals, won the second place in the number of shareholders, which were 5.5 million shares; Shanghai Steel Union ranked ranked; Shanghai Steel Union ranked Third, the social security fund was increased by 1.791 million shares in the second quarter.

Of the 25 stocks, three are favored by many social security funds. Among the top ten shareholders of Huagong Technology, the National Social Security Fund 401 group and 114 groups of the National Social Security Fund appeared; among the top ten circulation shareholders of Qixin Group, the National Social Security Fund and the National Social Security Fund 604 were also appeared. In Changliang Technology, the National Social Security Fund 17031 and the National Social Security Fund 404 combination includes it.

From the perspective of the number of positions, the number of electronics and light industrial manufacturing in 25 individual stocks is the largest. Among them, in the second quarter, the number of social security funds held more than 20 million shares and ranked among the top three stocks were Qixin Group, Huagong Technology and Xinwei Communications, respectively.

From the perspective of the market value of holding positions, Wanhua's chemical market value is the highest, with 1.552 billion yuan; Huagong Technology holds the second place in market value to 647 million yuan; the third place is Ed Bio, and the market value of the social security fund in the second quarter is 572 million yuan. Yuan.

From the perspective of the industry, social security funds prefer chemical and pharmaceutical and biological fields. Data show that among the 25 listed companies, the chemical, pharmaceuticals and electronics industries are the largest, with 6, 5 and 4 respectively, accounting for 60 % of the total number of stocks.

Judging from the proportion of social security funds occupying the circulation stocks of listed companies, more than 4%of the listed companies are more than 4%. In the second quarter, the 604 group of the National Social Security Fund accounted for 4.64%of the circulation shares of Qixin Group; the 406 combination of the National Social Security Fund accounted for 4.49%of Edti Logistics Stocks; the 503 groups of the National Social Security Fund accounted for 4.29%.

Optimistic about high performance and leading enterprise

From the perspective of heavy positions in the second quarter of the Social Security Fund, most of these companies have good profitability, and some are still corporate leaders.

From the perspective of the first half of the year, these 25 stocks have been profitable. Among them, 20 listed companies in the first half of 2022 have a positive growth rate in the same period, and the net profit of 6 companies in the first half of the year increased by more than 100%year -on -year.

Taking Tibet Ge Mining as an example, the National Social Security Fund 604 combination remained unchanged in the second quarter of this year. The number of stocks held 10.1703 million shares, ranking the eighth largest shareholder of circulation.

Photo source: Tibet Ge Mining Half -annual Report

According to the latest semi -annual report, Tibet Mining achieved revenue of 3.510 billion yuan in the first half of the year, a year -on -year increase of 218.53%; the net profit attributable to shareholders was 2.397 billion yuan, an increase of 438.01%year -on -year. Everbright Securities analyzed in the research report that potassium fertilizer and lithium salt continued to prosper. In the first half of the year, the company's performance increased greatly, the lithium salt resources reserved, and the industry layout industry was leading. Increase "rating.

Looking at Ebison, the number of national social security funds 421 combinations maintained the number of positions in the second quarter of this year, holding 2.2278 million shares, ranking the sixth largest shareholders of circulation.

The company's semi -annual report shows that Ebison's revenue in the first half of the year was 1.1 billion yuan, an increase of about 30%over the same period last year; the net profit attributable to shareholders was about 81 million yuan, an increase of about 313%over the same period last year. In the second quarter of this year, Penini Test received 865,600 shares of the 116 groups of the National Social Security Fund, becoming one of the new members and the company's ninth largest shareholder of circulating shareholders.

During the reporting period, the spectrum test realized operating income of 1.684 billion yuan, an increase of 127.97%over the same period last year; the net profit attributable to shareholders of listed companies was 90.688 million yuan, an increase of 243.94%over the same period last year. Soochow Securities commented in the research report. The performance in the first half of the year was bright. In the second half of the year, it is still expected to maintain high -speed growth, optimize the cost control ability, and have great potential for profit margins. Double -click to maintain the "increase of holdings" rating.

Liu Jixin, assistant to Rongzhi Investment Fund, a subsidiary of Rongzhi Investment Fund, told the reporter of the Huaxia Times that the National Social Security Fund is part of the funds of the state -owned enterprise employee's endowment insurance premiums to professional institutional management, so as to ensure asset security Under the premise of sex and liquidity, the value of fund assets is appreciated.

The Social Security Fund has the following characteristics. "First of all, the social security fund has strong investment research capabilities, and the investment style is also long -term value investment. In addition, the social security fund is one of the important participants in the A -share market. Favorite individual stocks can often become the focus of market attention; more, social security funds are more accurate to grasp the development direction of the industry. "Liu Jixin said.

Liu Cunxin said that the investment characteristics of the social security fund are the pursuit of long -term stable income, and the requirements for income are not high. Therefore, the social security fund will choose a company with a high degree of future performance growth or high -dividend characteristics in terms of investment preference. Among them, the industry leaders It is the "good heart" of the social security fund.

For ordinary investors, although the fund's heavy stocks and configuration trends have certain reference value, they cannot blindly copy the social security fund heavy stocks. "First of all, the news has a certain lag. When investors see the heavy warehouse targets, the stock may have accumulated a certain increase, and investors do not know the cost of social security funds and the current position; on the other hand,, on the other hand,, on the other hand,, on the other hand,, on the other hand The Social Security Fund constructs a package of stock portfolios, relying on investment portfolios to obtain income. Therefore, on a single company, even if the research institution is deepened, there will be a risk of stepping on thunder. "Liu Jixin pointed out.

Editor -in -chief: Xu Yunqian Editor: Gong Peijia

- END -

In the first half of the year's revenue increased slightly by 7%, Hang Luo Real Estate Chen Qizong: It is difficult to predict in the second half of the year. At this stage

China Times (chinatimes.net.cn) reporter Li Beibei Shanghai reportThe semi -annual...

"In the past, we all engaged in each, and now we will be united!" - Visit the only high -tech function platform in Sichuan -Chongqing adjacent areas

Green -oil high -standard farmland rolled up the layers of rice waves and sketched...