人员 钜

Author:Jin Ziyan Time:2022.08.05

"Golden Syllabus" northern capital center Nanfeng/Author Xihai/Risk Control

In 2005, Xuanquan Optoelectronics Technology (Shanghai) Co., Ltd. (hereinafter referred to as "Zongquan Optoelectronics") was founded by Huang Zhijian. At that time, Huang Zhijian was the largest shareholder of indirect shares and implemented control. Later, Huang Zhijian controlled the Quanquan Optoelectronics with the other four. After 2013, Junquan Optoelectronics has since entered the state of non -actual control.

Behind this listing, as of the end of 2021, the interest liabilities of Yiquan Optoelectronics were only 1.1 million yuan. At the same time, the Quanquan Optoelectronics "on the account" was more than 100 million yuan in currency funds, anti -fundraising, and reasonable reason. In addition, from 2019 to 2021, the number of R & D personnel of the leaving of Quanquan Optoelectronics accounted for over 70 % of the total number of resign members, setting off a "wave of departure". Not only that, the core technicians of Junquan Optoelectronics have left for less than one year from their old owners, that is, participating in the research and development of a patent of Yiquan Optoelectronics. What is worse is that Li Qiumin is the director of the design director of the R & D department of the Quanquan Optoelectronics Technology, and has participated in the research and development of a core technology patent of Yiquan Optoelectronics. Implement?

1. Without long -term borrowing "hand holding" hundreds of millions of yuan in currency funds, the rationality of "blood replenishment" is suspected

If you want to know the straight, you must be accurate. If you want to know the square, you must be ruled. In recent years, the performance of a large number of funds raised by listed companies has changed a lot before and after the performance. Investors suggest that the regulatory authorities focus on the behavior of listed companies.

In this regard, Yiquan Optoelectronics is planned to raise funds for more than 100 million yuan to supplement liquidity.

1.1 The listing of 511 million yuan is planned to be raised, of which 100 million yuan is used for "blood replenishment"

According to the prospectus signed (hereinafter referred to as the "prospectus") signed on July 19, 2022), Huanquan Optoelectronics plans to raise 511 million yuan, which is used to build the "dual -core modular smart meter metering core research and development And industrialization projects "," management core research and development and industrialization projects of dual -core module -based smart meters "," smart grid dual -mode communication SOC chip research and development and industrialization projects "and" supplementary mobile funds ".

Among them, Jianquan Optoelectronics intends to use 100 million yuan of funds for "supplementing mobile funds".

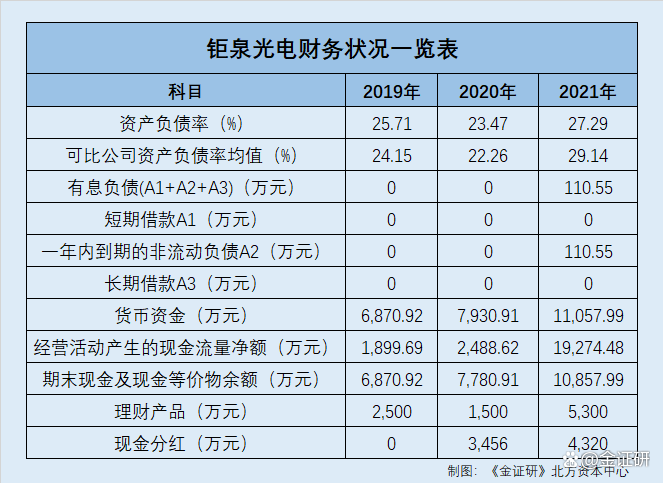

However, at the end of each issue of 2019-2021, there were no long-term borrowings and short-term borrowings in Yiquan Optoelectronics.

1.2 2019-2021 has no long and short-term borrowing. In 2021, the total liabilities were less than 1.5 million yuan.

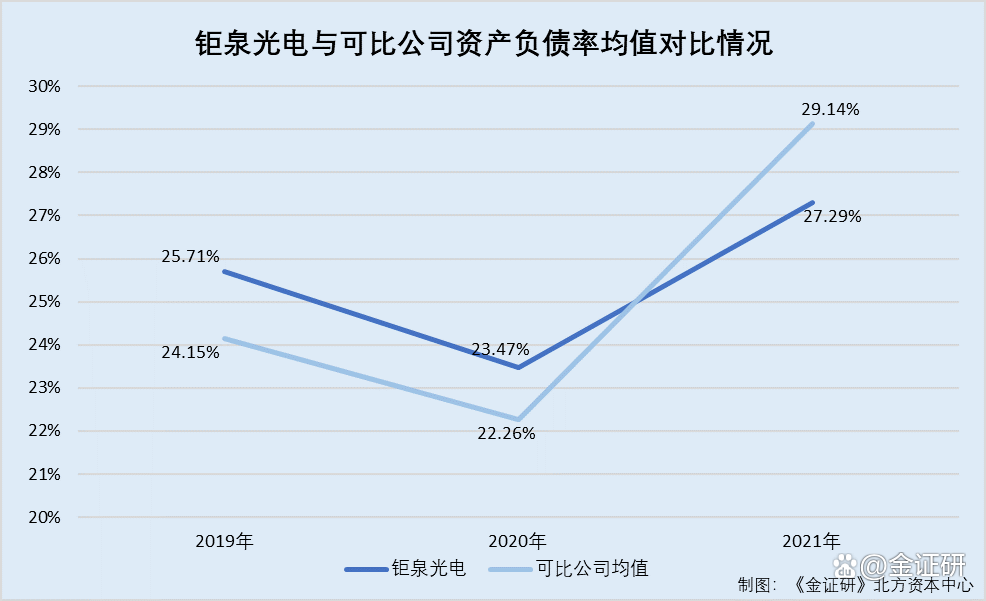

According to the prospectus, when the asset -liability ratio compared with the consolidated caliber, Wuquan Optoelectronics selected five comparison companies, namely Shanghai Beiling Co., Ltd. (hereinafter referred to as "Shanghai Beiling") and Qingdao Dongshuo Zaibo Technology Co., Ltd. ( The following is referred to as "East Soft Carry"), Shenzhen Liche Microelectronics Co., Ltd. (hereinafter referred to as "Lihewei"), Shanghai Fudan Microelectronics Group Co., Ltd. (hereinafter referred to as "Fudan Wei") and Chuangyao (Suzhou) communication Technology Co., Ltd. (hereinafter referred to as "Chuangyao Technology").

At the end of each issue of 2019-2021, the asset-liability ratio of Yiquan Optoelectronics was 25.71%, 23.47%, and 27.29%, respectively. During the same period, the average value of Yiquan Optoelectronics Compared with the company's asset -liability ratio was 24.15%, 22.26%, and 29.14%, respectively.

In addition, as of the end of 2021, the total liabilities of Quanquan Optoelectronics were 1.155 million yuan.

According to the prospectus, at the end of each issue of 2019-2021, the non-current liabilities expired within one year of Yiquan Optoelectronics were 0 yuan, 0 yuan, 0 yuan, and 11.055 million yuan, respectively. During the same period, there were no short -term borrowings and long -term loans in Yiquan Optoelectronics.

That is, at the end of each period of 2019-2021, the total amount of non-current liabilities, short-term borrowings and long-term loans (hereinafter referred to as "interest-liabilities") expired within one year (hereinafter referred to as "interest liabilities") were 0 yuan, 0 yuan, and 1.155 million yuan, respectively.

It can be seen that in 2021, the asset -liability ratio of Yiquan Optoelectronics has been lower than the same value. And at the end of each issue of 2019 to 2020, there was no interest liabilities in Quanquan Optoelectronics. At the end of 2021, the interest liabilities of Yiquan Optoelectronics had less than 1.5 million yuan.

And as of the end of 2021, the "lying" of more than 100 million yuan in currency funds on Yiquan Optoelectronics' accounts.

1.3 At the end of 2021, the balance of currency funds, cash and cash equivalent of hundreds of millions of yuan

According to the prospectus, at the end of each issue of 2019-2021, the monetary funds of Yiquan Optoelectronics were RMB 68.709 million, RMB 79.3091 million, and RMB 11.599 million.

From 2019 to 2021, the net cash flow generated by the operation activities of Yiquan Optoelectronics was 18.999 million yuan, RMB 24.8862 million, and 19,274,800 yuan; during the same period, the balance of the final cash and cash equivalents of Yiquan Optoelectronics was 68.709 million yuan and 77.809 million yuan, respectively. Yuan, 108.579 million yuan.

At the end of each issue of 2019-2021, the amount of Quanquan Optoelectronics Wealth Management products was 25 million yuan, 15 million yuan, and 53 million yuan, respectively.

More than that, from 2019 to 2021, the amount of cash dividends of Quanquan Optoelectronics exceeded 70 million yuan.

According to the prospectus, from 2019 to 2021, the amount of cash dividends of Yiquan Optoelectronics was 0 yuan, 34.56 million yuan, and 43.2 million yuan, respectively.

According to the research of the Northern Capital Center of "Jin Securities", from 2019 to 2021, the total cumulative cash dividend of Yiquan Optoelectronics was 77.76 million yuan. It can be seen from the above situation that in 2021, the asset -liability ratio of Jiquan Optoelectronics has been lower than the same value. At the end of each issue of 2019-2020, there was no interest liabilities in Quanquan Optoelectronics, and at the end of 2021, the total of more than 1.1 million yuan in interest liabilities of Quanquan Optoelectronics was only 1.1 million yuan. At the same time, as of the end of 2021, the "lying" of hundreds of millions of yuan in currency funds on the Yiquan Optical Express, and the cumulative dividend of over 70 million yuan in the past three years. At this point, the Quanquan Optoelectronics may not be "bad money", and its proposed fundraising "blood nourishing" rationality has doubts.

On the other hand, among the employees of the employee holding platforms of Yiquan Optoelectronics, there are more than 60 % of the number of resignation personnel.

2. More than 40 R & D personnel "ran away", and 60 % of the employee holding platform partners were leaving.

People are in Qi, Mount Tai moved. The purpose of the equity incentive plan is often to improve the corporate governance structure, attract and retain talents, thereby promoting the improvement of the overall performance of the enterprise and sustainable development.

However, among the partners of the employee holding platform of Yiquan Optoelectronics, the current employee accounts for more than 60 % of the vision.

2.1 Employees who are used for equity incentives have 39 people with a shareholding platform, and the number of resigns accounts for more than 60 %

According to the prospectus, as of July 19, 2022, Shanghai Wo Yu Investment Management Partnership (Limited Partnership) (hereinafter referred to as "Wo Yu Investment"), Shanghai Haichun Investment Management Partnership (Limited Partnership) "Haichun Investment") and Shanghai Fudu Investment Management Partnership (Limited Partnership) (hereinafter referred to as "Fulu Investment") are all employees of Yiquan Optoelectronics.

In addition, Yiquan Technology (Hong Kong) Co., Ltd. (hereinafter referred to as "Hong Kong Hong Kong") is the largest shareholder of Yiquan Optoelectronics, holding 22.24%of the shares of Yiquan Optoelectronics.

On February 1, 2013, Yiquan Hong Kong transferred its 450,000 shares, 878,200 shares, and 844,600 shares held by His Quan Optoelectronics, respectively. The employee holding platform of Jiquan Optoelectronics Wo Yu Investment, Hai Chun Investment, and Fudu Investment. The above -mentioned equity transfer of Quanquan Optoelectronics is based on incentives, and the equity transferee or its beneficiaries is employees of the Quanquan Optoelectronics when they are transferred.

In addition, the equity incentives made by Junquan Optoelectronics in February 2013 did not set the service period for the incentive object, nor did the incentive objects dispose of the shares held when the incentive object left the shares held by the Quanquan Optoelectronics. As of July 19, 2022, the signing of the prospectus, the partners of Wo Yu Investment, Hai Chun Investment and Fulu Investment Co., Ltd., the employee holding platform, were 31, 31, and 29.

As of July 19, 2022, Liu Rong, an investor in Wo Yu, had left.

At the same time, among the partners of Hai Chun Investment, Zhu Hao, Li Long, Yang Xiaohua, Zhang Zhiyong, Jin Zhijun, Hu Jin, Lang Jun, Zhang Binyang, Zhu Chuansen, Wang Wei, Yuan Huajie, Yuan Ying, Zhao Dongqin, Wu Lifeng, Chen Feng , Zhang Anshan, Fu Youwei, Li Baojun, Wang Yongshou, Miao Yue, Yongyong, He Qi, Xu Chenxi, and Hu Zhongyu, a total of 24 people have left.

At the same time, among the investors of Fudu Investment, Guo Jianqiu, Li Cailing, Xun Benpeng, Liu Fei, Chen Zhikai, Zhang Yeyong, Lou Jinlan, Ma Tao, Dong Haibo, Wang Yan, Chen Cheng, Li Chengzhi, Pan Bo, Han Shiying, a total of 14 people have left the job. Essence

According to the research of the Northern Capital Center of "Jin Securities", as of July 19, 2022, the signing of the prospectus, the total employees who held the Huanquan Optoelectronics Employee Wald Rain Investment, Hai Chun Investment and Fudu Investment Co., Ltd. totaled 63 Among them, the total number of resignated workers is 39, accounting for 61.9%of the total number of employees holding platforms.

It is worth noting that another company plans to be listed has resigned employees due to equity incentives and was asked by the regulatory authorities.

According to the second round of review and inquiry of the second round of review inquiries on the second round of review of the shares of Shengtaier's first public offering and listing application documents on the GEM on February 21, 2022 "The reply of the letter", Sheng Tel was asked why the employee had resigned employees in his equity incentive holding platform, and whether the shares processing method after the departure of the relevant employees complied with the terms of the "Partnership Agreement".

At the same time, Shengtaier was also required to combine equity incentives to incentive related shares handling clauses to explain whether its equity incentives set the waiting period, whether there are restricted conditions, and whether the relevant accounting treatment is reasonable.

It is worth noting that good equity incentive arrangements have incentive to enterprise employees.

According to public information, equity incentives are an institutional arrangement that optimizes the effects of incentive mechanisms. It combines shareholders' interests, corporate interests, and personal interests of operators, reducing short -term behavior of incentive objects, and an important mechanism for the long -term stable development of enterprises.

Among the partners of the Huanquan Optoelectronics employee holding platform, the number of employees has accounted for over 60 %, which is regrettable.

Not only that, from 2019 to 2021, the number of R & D personnel in Junquan Optoelectronics exceeded 40.

2.2 During the period of 2019-2021, the proportion of the R & D personnel who resigned accounted for over 70 % of the total number of departments

According to the prospectus, the industry of Yiquan Optoelectronics is the integrated circuit design, and the integrated circuit design, as a technology -intensive industry, depends on core technology, talent and innovation capabilities. request. As of December 31, 2021, the total number of employees of Quanquan Optoelectronics was 189. Among them, the number of R & D personnel was 136, accounting for 71.96%of the total number of employees of the Quanquan Optoelectronics.

According to the "reply report of the first public issuance of shares and the application documents for the listing of the listing of the science and technology board" signed on March 9, 2022 (hereinafter referred to as the "first round of reply letter"), from 2019-2021 The number of employees who resigned from Huanquan Optoelectronics were 58. Among them, R & D personnel are 46.

According to the research of the Northern Capital Center of "Jin Securities", from 2019-2021, the proportion of R & D personnel among the resignation staff of Yiquan Optoelectronics was 79.31%.

In addition, the R & D personnel who resigned include a number of core technology patent inventors.

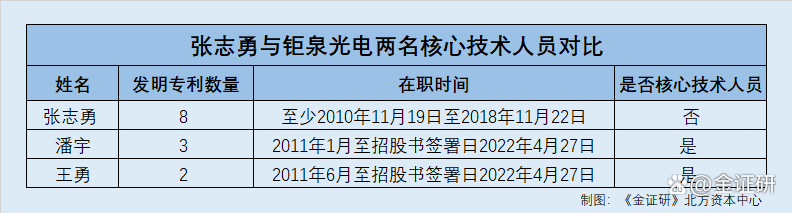

2.3 Zhang Zhiyong has participated in the research and development of nine core technology patents, and now he has left

According to the prospectus, as of December 31, 2021, Yiquan Optoelectronics has obtained a total of 61 invention patents, including the number of 12 practical new patents. As of July 19, 2022, Zhang Zhiyong was one of the partners of Hai Chun's investment platform Haichun Investment, and Zhang Zhiyong had left.

It should be noted that Zhang Zhiyong participated in the research and development of more than ten authorized patents in Yiquan Optoelectronics.

According to data from the State Intellectual Property Office, the patent number is the invention patent "Electric Energy Measurement and Analysis System, Methods and Model Conversion circuits" of 2010105546589. The application date is November 19, 2010, and the authorization date is April 23, 2014. The invention patent with the patent number of 2012100353540 "Method and Device of the Phase Election Error Phase Phase Phase Phase Introduction", the application date is February 16, 2012, and the authorization date is July 30, 2014.

The invention patent with the patent number of 2012100731027 "Method and its device for correction power meter power meter" is March 19, 2012, and the authorization date is July 30, 2014. The invention patent with the patent number of 2012101629740 "a method of reducing power pulse beating" is May 22, 2012, and the authorization date is August 20, 2014. The patent number is 2012102924202 invention patent "class joint accumulation combed filter and its implementation method". The application date is August 16, 2012, and the authorization date is April 22, 2015.

The invention patent with the patent number of 2014103266524 "a method of obtaining a single -frequency signal" is July 10, 2014, and the authorization date is July 6, 2018. The practical new patent of the patent number in 2016209821412 "Electric Energy Measurement Chip and Electric Energy Measurement Circle" with manganese copper disconnection function ", the application date is August 30, 2016, and the authorization date is March 22, 2017.

The invention patent with the patent number of 2017110821395 "A Correction Make Correction method", the application date is November 02, 2017, and the authorization date is October 23, 2020. The patent number 2018213847467 Practical new patent "one type of voltage voltage circuit parameter detection circuit and electrical energy measurement chip", the application date is August 27, 2018, and the authorization date is May 14, 2019.

The patent number of 2018214193959 Paradise patent "Electric Energy Measurement Device and Electric Energy Measurement Processing Module and Voltage Detection Circuit". The application date is August 31, 2018, and the authorization date is June 11, 2019. The patent number of 2018215938437 "a detection circuit and electric energy metering chip for a voltage measurement circuit parameter", the application date is September 28, 2018, and the authorization date is July 12, 2019.

The practical new patent of the patent number of 2018216043072 "Dual -benchmark Mutual Examination parameter detection circuit and electrical metering chip of the sampling circuit", September 29, 2018, and the authorization date is June 11, 2019. The patent number 2018216259128 Practical new patent "detection circuit of a voltage differential sampling circuit parameter" is September 30, 2018, and the authorization date is June 11, 2019.

The invention patent "mutual inspection circuit and method, current detection system, electrical metering system and chip" of the patent number of the patent number in 2018111852836. The application date is October 11, 2018, and the authorization date is November 6, 2020. The patent number 2018219364164 Practical new patent "a detection circuit and electrical metering chip and equipment based on this circuit", the application date is November 22, 2018, and the authorization date is September 13, 2019.

As of August 3, 2022, the case status of the above -mentioned patents was maintained in patent rights. The invention included Zhang Zhiyong, and the applicant was the Quanquan Optoelectronics.

It should be pointed out that in the authorized patent of the above -mentioned Zhang Zhiyong's participation in the development of Yiquan Optoelectronics, nine of them are patents corresponding to the core technology of Yiquan Optoelectronics. According to the prospectus, as of July 19, 2022, on July 19, 2022, the patent number of the invention patent "Electric Energy Measurement and Analysis System, Methods and Model Conversion circuits" with a patent number of 2010105546589, and a patent number of 2012100353540 The method of phase error and its device "and the invention patent of the patent number of 2012100731027" Method and its device "is the core technical patent of the Quanquan Optoelectronics.

At the same time, the invention patent with the patent number of 2012101629740 "a method of reducing the power pulse beating", the patent number of 2012102924202 invention patent "grade joint accumulation combed filter and its implementation method", the patent number of the invention patent with 2014103266524 " "A method of obtaining a single -frequency signal" is the core technical patent of the Quanquan Optoelectronics.

In addition, a practical new type of patent "Electric Energy Measurement Chip and Electric Energy Measurement Circuit with Manganese Copper Detection Function" with patent number in 2016209821412, and the invention patent "interoperability circuit and method, current detection system, electric energy metering system and electric energy metering system, and power measurement system and power measurement system of 2018111852836 The invention patent of the chip "and the patent number of 2018213847467" a type of voltage -voltage circuit parameter detection circuit and electrical metering chip "is also the core technology patent of Quanquan Optoelectronics.

According to the research of the Northern Capital Center of the "Jin Si Yan", as of July 19, 2022, Zhang Zhiyong's participation in R & D Quan Optoelectronics's authorization patent was 15, accounting for 24.59%of the total number of patents of the Quanquan Optoelectronics. Among them, the nine authorized patents involved in Zhang Zhiyong are the core technology patents of Quanquan Optoelectronics.

It is worth mentioning that Zhang Zhiyong participated in the number of Quanquan Optoelectronics's invention, more than two core technicians participating in the invention patent.

According to the prospectus, as of July 19, 2022, Pan Yu and Wang Yong were one of the core technicians of Pan Yu and Wang Yong. Among them, Pan Yu joined the Quanquan Optoelectronics in January 2011 and participated in the research and development of the three invention patents of Yiquan Optoelectronics. Wang Yong joined the Quanquan Optoelectronics in June 2011 and participated in the research and development of the two invention patents of Yiquan Optoelectronics.

It can be seen that Zhang Zhiyong participated in the development of more than a dozen items for the R & D Quan Optoelectronics Invention Patent, and all of the core technicians of Pan Yu and Wang Yong, the core technicians of the Quanquan Optoelectronics.

2.4 Wang Yong's departure from the old family has not been in office for one year, that is, participating in a patent research and development of Yiquan Optoelectronics

According to the prospectus, as of July 19, 2022, Wang Yong was one of the core technicians of Quanquan Optoelectronics, and served as the director of the digital research and development department of Yiquan Optoelectronics. From May 2008 to June 2011, Wang Yong served as a senior design engineer of Aisahua Technology (Shanghai) Co., Ltd. (hereinafter referred to as "Azahua"). From June 2011 to July 19, 2022, Wang Yong was the manager of the digital design department and senior manager of the digital design department, and the current director of the digital research and development department.

It shows that Wang Yong served as the senior design engineer of Aisahua during his tenure in "Old Eastern", and left in June 2011.

In addition, Wang Yong participated in the invention of a invention patent in Quanquan Optoelectronics, and the patent application time was less than one year before Wang Yong left Aisa Hua.

According to data from the State Intellectual Property Office, the patent number is the invention patent "multiplier" of 2012101093377. The application date is April 13, 2012, and the authorization date is December 16, 2015. As of August 3, 2022, the status of the case was maintained by patent rights, the inventor was Wang Yong, and the applicant was the Quanquan Optoelectronics.

And it is worth mentioning that the products distributed by Esarhua involved electronic devices and components.

据市场监督管理局数据,艾萨华成立于2001年1月17日,经营范围为研究、设计和开发通讯、网络、存储及电脑系统用的集成电路、电子器部件和系统及相关软件、其他Semiconductor products, etc.

According to the official website of Esarhua, as of August 3, 2022, Aisahua is a technology company that distributes electronic devices and components. Brand components. Texas Instruments (hereinafter referred to as "Texas Instrument") is one of the main suppliers of Aisa.

In addition, Yiquan Optoelectronics is also engaged in the design of integrated circuits.

According to the data of the Market Supervision and Administration Bureau, Yiquan Optoelectronics was established on May 19, 2005. The business scope includes the development, design and production of photoelectric technology products, selling self -produced products, the development and design of integrated circuits Technical Services.

According to the prospectus, the main business of Yiquan Optoelectronics is the research and development, design and sales of smart grid terminal equipment chips.

In the single and three -phase metering chip market, Quanquan Optoelectronics has gradually replaced chip manufacturers such as ADI, TDK, ATMEL and other brands during the development process. In terms of single-phase SOC chip market, from 2019-2021, Yiquan Optoelectronics continues to occupy the market space of Texas instruments. In terms of the smart meter MCU market, from 2019-2021, Yiquan Optoelectronics has entered the market with high computing 32-bit MCU products, seizing the market space that was originally occupied by ST brand. In addition, after export-based OFDM carrier chip markets, the chip that has complied with G3-PLC international standard chip has formed direct competition for ST brand manufacturers since its launch in 2020. In terms of carrier communication power amplifier chips, the PA chip launched by Jiquan Optoelectronics at the end of 2018 directly has an impact on international manufacturers such as Texas instruments.

It can be seen that Esahua distribute electronic devices and components, suppliers as ADI, ST, Texas instruments, etc. The business competitive enterprises with Yiquan Optoelectronics also include Texas Instruments and ST. The relationship between Quanquan Optoelectronics and Esahua or upstream and downstream.

The above situation may indicate that as of July 19, 2022, of the signing of the prospectus, among the partners of the employee holding platform of Yiquan Optoelectronics, over 60 % of employees have left. Not only that, the seventh of the leaving staff of the Quanquan Optoelectronics has become a research and development personnel, including Zhang Zhiyong, which participated in the nine core technology patents of Yiquan Optoelectronics. In addition, Wang Yong, the current director of the Digital R & D Department of Jiquan Optoelectronics, has served as a senior design engineer in Esarhua. He has left his post from Lao Dong's family for less than one year, that is, he participated in the patent invention of Yiquan Optoelectronics. Whether the patent is in the original unit is in The assignment task is related to? unknown.

The problem has not yet ended, and a core technology patent inventor of Jiquan Optoelectronics, or invests in the "peer" company outside.

3. Core technology patent inventor or invest in "peer" company, internal control or torture

Innovation ability is the inherent driving force for enterprise development, and one of the core factors to improve the competitiveness of the enterprise market.

However, one of the inventors of a core technology patent of Yiquan Optoelectronics, or the interbank enterprises who have invested in Quanquan Optoelectronics and are part -time.

3.1 As a smart meter chip research and development enterprise, products are widely used in smart homes, street light control, etc.

According to the prospectus, the MCU is a microcontroller, also known as a single -chip micro computer or single -chip microcomputer, which properly reduces the frequency and specifications of the central processor, and integrates the peripheral interfaces such as memory, counter, and other peripheral interfaces on a single chip to form a chip -level chip -level Computers do different combinations for different applications.

And Quanquan Optoelectronics is a smart meter chip research and development design enterprise. Its main business is the research and development, design and sales of smart grid terminal equipment chips, which can provide customers with chip products and supporting services. In addition, the main products of Quanquan Optoelectronics include electrical energy measurement chips, smart meter MCU chips, and carriers communication chips, which are integrated circuit design companies.

Among them, the electric energy metering chip is measured in the smart meter in the smart meter. The power data measurement based on the microelectronics circuit can automatically measure the voltage, current, and power power of the grid. It is the core component of the telecommunications interest metering system for smart grids. The smart meter MCU chip plays the role of various system control cores in the smart meter.

At the same time, the smart meter MCU chip can coordinate the operation of peripheral devices such as systems and monitors, keyboards, sensors. The power line carrier communication chip is mainly used in the power meter, collector, concentrator and other smart power grid collection system terminal devices with electric power meters, collectors, and concentrations. It is used to automatically read and transmit electrical energy data. Core components.

In addition, there is a technical barrier in the design industry of the smart grid terminal equipment chip design industry.

In this regard, the designer of the smart grid terminal device chip must not only master the knowledge of general integrated circuit design, but also learn to master the specifications of components around the integrated circuit, as well as related knowledge in the downstream application field. The smart grid terminal device chip needs to integrate multiple complex functional module IPs, especially the analog circuit, which is often combined with the actual environment. Only by relying on years of experience and product accumulation can we debug out effective solutions.

That is to say, Quanquan Optoelectronics is an enterprise engaged in the development, design and sales of smart grid terminal equipment chips. At the same time, Junquan Optoelectronics has certain experience requirements for chip testers.

On the other hand, from 2019 to 2021, the smart grid terminal device chip of Jiquan Optoelectronics contributed a total of more than 200 million yuan in income to the combination of Quanquan Optoelectronics.

According to the prospectus, from 2019 to 2021, the operating income of Yiquan Optoelectronics was 300 million yuan, 379 million yuan, and 499 million yuan, respectively. During the same period, the operating income of the Quanquan Optoelectronics Challenge chip was 153 million yuan, 193 million yuan, and 259 million yuan, respectively, accounting for 50.87%, 51.03%, and 51.78%of the current main business revenue, respectively.

From 2019 to 2021, the operating income of the Quanquan Optoelectronics MCU chip was 95 million yuan, 131 million yuan, and 140 million yuan, respectively, accounting for 31.79%, 34.52%, and 28%of the current main business revenue; The operating income of 50.9936 million yuan, 54.224 million yuan, and 900.931 million yuan, respectively, accounting for 16.99%, 14.31%, and 18.04%of the current main business income.

According to the research of the Northern Capital Center of "Golden Syllabus", from 2019 to 2021, the cumulative sales revenue of the Quanquan Optoelectronics Plane chip, MCU chip, and loading related chips was 299 million yuan, 378 million yuan, and 488 million yuan, respectively, accounting for its current period The proportion of operating income was 99.65%, 99.85%, and 97.83%, respectively.

According to the official website of the Quanquan Optoelectronics, as of August 3, 2022, the communication product IC of Yiquan Optoelectronics can be widely used in remote meters, smart homes, street light control, photovoltaic monitoring and other smart grid applications. At the same time, the work responsibilities of Jianquan Optoelectronics Recruitment of senior test engineers include responsible for chip BRING-UP test, FPGA platform debugging, simulation circuit functions and performance testing, chip mass production CP, FT assisted TE Review related designs and debugging cases.

In addition, the qualifications of Jianquan Optoelectronics Recruitment Senior Testing Engineers, including familiarity with simulation circuit design and related testing (such as PLL, ADC, DAC, OSC, DCDC, LDO, OSC, etc.) Instruments are used, it has more experience in CP and FT.

According to data from the State Intellectual Property Office, the invention patent of 201911437233 "a benchmark generation circuit", the application date is December 31, 2019. As of August 3, 2022, the status of the case was waiting for the substantial review. And the patent "a benchmarking circuit that suppresses overwhelming" involves the field of integrated circuit design, especially a benchmarking circuit that suppress overwhelming.

It can be seen that the main business of Yiquan Optoelectronics is the research and development and design of smart grid terminal equipment chips, and its communication products ICs are mainly used in smart homes and street light control. At the same time, the senior test engineer recruited by the Quanquan Optoelectronics requires familiarity with chip testing, and in the patent application of Yiquan Optoelectronics, one of which involves the circuit generated by the overwhelming benchmark in the field of circuit design.

It is worth mentioning that the director of the design director of the technical research and development department of Yiquan Optoelectronics contributed the two invention patents to the Quanquan Optoelectronics, and one of them was the core technology patent of Yiquan Optoelectronics.

3.2 Li Qiumin participated in the research and development of two invention patents of Yiquan Optoelectronics, one of which is the core technology patent

According to the prospectus, as of July 19, 2022, Li Qiumin held a 3.51%shares of Hai Chun, a shareholding platform holding a shareholding platform, and served as the director of the design director of the technical research and development department of Yiquan Optoelectronics.

According to data from the State Intellectual Property Office, the invention patent of the patent number of 201110411365X "chip with static protection function" and the invention patent "metal oxide semiconductor device" with the patent number of 2011104153905. On December 13th, the authorization date was January 20, 2016 and November 5, 2014, respectively. As of August 3, 2022, the case status was maintained by patent rights. One of the inventors was Li Qiumin, and the applicants were all the Quanquan Optoelectronics.

Among them, according to the prospectus, as of the date of signing the prospectus, on July 19, 2022, the invention patent of the patent number of 201110411365X "chip with electrostatic protection function" was a core technology patent for Yiquan Optoelectronics.

It shows that Li Qiumin, as the director of the design director of the R & D Department of the Quanquan Optoelectronics Technology, has also participated in the R & D of the Core Technology Core Technology Core Technology.

However, Li Qiumin invests in a company that overlaps with the Quanquan Optoelectronics business and serves as a director of the company.

3.3 Li Qiumin or investing in Aung Saiwei abroad, and both parties are integrated circuit design enterprises and the application fields may be stacked.

According to the data of the Market Supervision and Administration Bureau, Shanghai Yisili Electronic Technology Partnership (Limited Partnership) (hereinafter referred to as "Shanghai Yisili") was established on January 17, 2017. The business scope is technology development, transfer and consultation in the field of electronic technology Wait.

On March 22, 2017, investors invested in Shanghai Yisili changed. Before and after the change, "Li Qiumin" was one of the shareholders of Shanghai Yisili. On the same day, the proportion of capital contribution in Shanghai Yisili changed, and "Li Qiumin" changed its shareholding ratio of Shanghai Yisili from 90%to 66.67%. On May 13, 2020, the proportion of capital contributions in Shanghai Yisili changed, and the shareholding ratio of "Li Qiumin" changed from 66.67%to 81.82%. As of August 3, 2022, Shanghai Yisili had no other investors and investment proportion of "Li Qiumin".

It can be seen that from January 17, 2017 to August 3, 2022, "Li Qiumin" was the controlling shareholder of Shanghai Yicine, or the actual controller.

On the other hand, Shanghai Yisili controlled by "Li Qiumin", a company invested in the business or overlap of Quanquan Optoelectronics.

According to data from the Market Supervision and Administration Bureau, Ang Sai Microelectronics (Shanghai) Co., Ltd. (hereinafter referred to as "Ang Saiwei") was established on February 5, 2015, with a registered capital of 5.699 million yuan. Internal technology development.

As of August 3, 2022, Shanghai Yisili was one of the shareholders of Angsili. Since February 16, 2017, Shanghai Yisine has been one of the shareholders of Ang Saiwei. From July 15, 2015 to February 15, 2017, "Li Qiumin" is one of Ang Saiwei's shareholders. And from July 13, 2020 to August 3, 2022, "Li Qiumin" all served as Aon Saiwei's director.

According to the research of the Northern Capital Center of "Golden Syllabus", as of August 3, 2022, Shanghai Yisili's shareholding ratio of Angsiwei was 10.27%. Yisili's indirect shareholding of Ang Sai was 8.4%.

According to public information, according to public information, Shanghai Yici's actual controller "Li Qiumin" and Ang Saiwei director "Li Qiumin" also held the equity of Hai Chun Investment.

That is, "Li Qiumin" of Shanghai Yici, "Li Qiumin", the director of Ang Saiwei, or Li Qiumin, the director of the design director of the R & D department of the Quanquan Optoelectronics Technology Technology, is the same person.

According to the official website of Ang Sai, as of August 3, 2022, Ang Saiwei is an integrated circuit design enterprise with a magnetic sensor, high -performance simulation and hybrid signal. Wearable devices, smart homes and the Internet of Things, and intelligent monitoring security systems.

And Ang Sai Microelectronics uses high -performance deep sub -micron CMOS, dual -pole, BCD and other process technologies to combine its own patents to develop proprietary integrated circuit products, with magnetic sensors, smart terminals and intelligent wearable devices, smart home and smart home and smart home and smart home and smart home and smart home and smart home The Internet of Things, intelligent monitoring security systems, industrial control and automotive electronics are targeted.

In addition, the integrated circuit of Angsai Microelectronics focuses on solving the challenges in system equipment design. Products include magnetic sensors, switch chargers, LED drivers, DC-DC, LED intelligent lighting, speed and motion sensor, industrial control and automotive electronics Wait.

In addition, Ang Saiwei recruits the work responsibilities of simulation IC design engineers, including responsible for simulating the definition, development and verification of simulation of integrated circuit chips; cooperate with the marketing department to complete the initial definition of the project, lead the technical feasibility study and establishment of projects; The specific circuit architecture leads the project team members to complete the simulation circuit design, simulation, and verification work; the planning layout layout, guiding and assisting Layout engineers to complete the layout design to ensure that the layout meets the requirements of the circuit design, etc.

According to data from the State Intellectual Property Office, the patent number of 2021207569907 is a practical new patent "melting correction circuit". The application date is April 14, 2021, and the authorization date is April 8, 2022. As of August 3, 2022, the case status was maintained by patent rights. The inventor was Xiangchen, Zhang Liang, and Peng Qingsong, and the applicant was Ang Saiwei. The patent belongs to the field of electronic circuits and involves a kind of repair circuit.

It can be seen that Li Qiumin, the director of the technology research and development department of Jiquan Optoelectronics, or indirectly holds Angosai's 8.4%of the shares and serves as a director. In addition, Sai Angwei, as an integrated circuit design enterprise, is also a Spring Optoelectronics, which is also an integrated circuit design enterprise. The application areas of the main products include smart homes and smart lighting. Not only that, in the recruitment information of Quanquan Optoelectronics and Ang Saiwei, the applicants have chip test quality, and both companies are now involved in the patent of the electronic circuit field.

In other words, Li Qiumin, the director of the layout design of Yiquan Optoelectronics, is also an inventor of a core technology patent of Huanquan Optoelectronics. Or overlap. In this regard, can Li Qiumin, the engineer of the layout design, can perform his duties independently? Does the Quanquan Optoelectronics face the risk of potential technology leakage? Is there a lack of internal control? Or should "get a question mark".

The embankment of thousands of miles broke the ant hole. Focusing on the doubts of Quanquan Optoelectronics, will the truth of the capital market emerge in the future?

- END -

Social security information system switching period hotspot questions answers

1. How does the city's social security business apply for the city's social security business in June 2022?Answer: The province's social insurance information system is planned to implement system swi...

The first division of the Corps Alar City deepen the reform of the commercial system reform "nanny -style" service stimulates the vitality of the market subject

Tianshan News (Reporter Mi Ri Li Li report) This time it was inspected and inspired by the General Office of the State Council, and the results of the reform of the commercial system deepening the co