US crude oil and gasoline invent

Author:Securities daily Time:2022.08.06

Reporter Zhu Baochen

Lear reporter Han Yu

On the evening of August 3, Beijing time, EIA (US Energy Information Agency) announced the latest data showing that the demand for gasoline consumption in the United States has weakened, while crude oil and gasoline inventory have increased exceeding expectations.

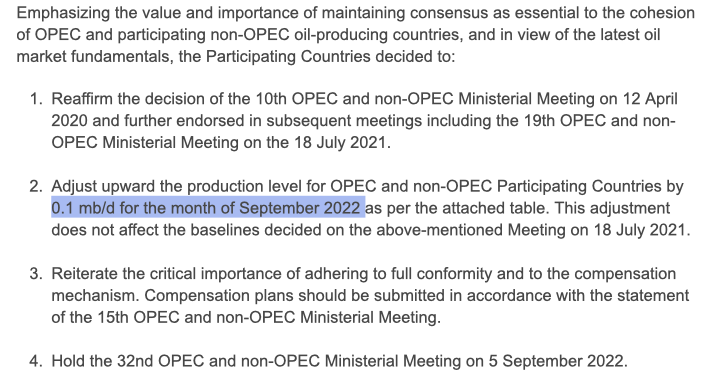

On the same day, the OPEC+meeting decided to increase the output quota of 100,000 barrels per day in September, far lower than the previous market's general expected 300,000 barrels/day to 400,000 barrels/day.

Caption: Slightly increased September output quota 100,000 barrels/day pictures Source: OPEC official website

Guotai Junan Futures stated that the results of the meeting were relatively neutral, and there was no expected supply reduction, and it was limited to boost oil prices. The current market has not yet reversed the overseas economic decline. Considering that the cross -macro indicators such as the recent CPI data and service industry data of overseas economies, the cross reflects the slowdown of economic momentum, the stacking cycle continues to advance, and the possibility of international oil prices in mid -term pressure is greater.

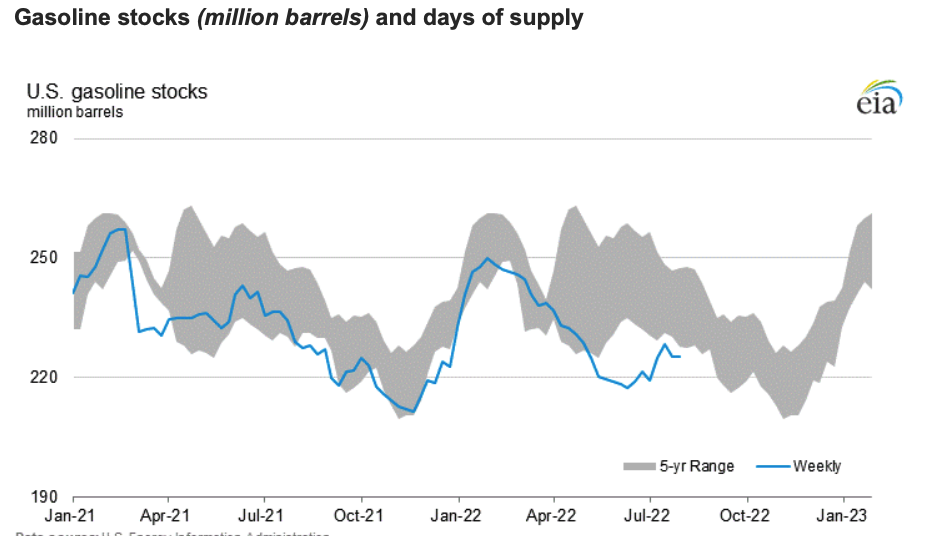

The latest data of EIA shows that on July 29, the demand for gasoline in the United States on the week of the week decreased by 12.6%compared with the same period last year, and a decrease of 700,000 barrels per day to 8.54 million barrels per day. %. At the same time, the increase in crude oil and gasoline inventory exceeded market expectations. Commercial crude oil inventory increased by 4.467 million barrels from the previous week, and gasoline inventory increased by 163,000 barrels.

"Summer in summer should be the peak season of gasoline consumption in summer, and the current phenomenon of accumulation is a very negative signal."

In the United States on July 29, gasoline inventory exceeded expectations to increase the picture source: eIA official website

At the same time, the slightly increasing production of OPEC+maintains the expectations of the crude oil supply side. The announcement stated that the main reason for restricting OPEC output is that the long -term investment in the crude oil field is insufficient. OPEC is actually effective in actual production capacity, not the issue of production. Industry insiders analyzed that OPEC is unwilling to overdraw the remaining remaining production capacity. On the one hand, it is to deal with the breakdown of possible sudden supply, and on the other hand, it is also because it will usher in the peak of the global refineries in September to October. At that time, seasonal declines will occur, and it will not be wise to increase production at this time.

CITIC Futures stated that with the fact that OPEC has not increased significantly, the key factors that affect international oil prices have shifted from the supply side to the demand side. Recently, due to the continued decline in overseas economic growth, the central bank of the United States and Europe has accelerated tightening, declined expectations or dragging oil prices. At the same time, due to the impact of the epidemic, the traffic flow of the United States and Europe has declined, and the demand for short -term traffic has also caused pressure. Slowness. The mid -term international oil prices still face large downward pressure.

It is worth noting that the US Markit service industry PMI data has continued to decline since March, and the latest published July data has also fallen below the glory line, recorded 47.3. According to the PMI report, the current consumption demand for American residents has declined significantly. Under the influence of high prices, there have been obvious inhibitory effects on travel, tourism and other activities, and also confirmed the above views from the side.

Under the influence of the above factors, international oil prices also fluctuated on August 3. Before EIA announced the data, the international oil prices rose by more than 2%, but after the US oil inventory exceeded the expected increase and demand decreased data, oil prices fell rapidly. Wind data shows that WTI crude oil futures received $ 90.66/barrel, a decrease of 3.98%. Brent crude oil futures received $ 96.78/barrel, a decrease of 3.74%.

(Edit Shangguan Monroe)

- END -

Establish a billion yuan industrial fund!Article eight support policies to accelerate the development of Baoding prefabricated vegetable industry development

At the Baoding Urban Agricultural Innovation Development Conference held from August 6th to 7th, the city issued eight support policies to accelerate the development of the prefabricated vegetable ind

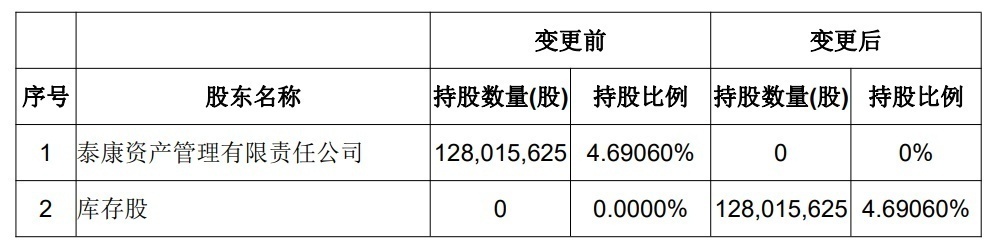

In the past three years, the dividend rate exceeds 10%, Taikang Insurance has completed the entire shares of the employee holding plan, and more than a thousand beneficiaries

On July 25, 2022, the official website of Taikang Insurance announced that Taikang...