You panic, I am greedy!4.5 billion funds swarmed into the venue through ETF ETF, science and technology 50, brokers were scanned by big hands, and the hottest chips and semiconductors were thrown wildly by institutions.

Author:Daily Economic News Time:2022.08.06

The major indexes of the market this week have permitted, off -site funds have begun to scan the goods. The total net inflow of the six index ETFs this week is about 4.5 billion yuan, of which the science and technology innovation 50ETF and the SSE 50ETF have net inflow of more than 1.7 billion yuan, respectively.

4.5 billion funds enter the market to sweep the goods

This week, the Shanghai and Shenzhen cities traded 5.19 trillion yuan, of which the Shanghai City transaction was 2.12 trillion yuan this week. As of the latest closing, the Shanghai Index received at 3227.03 points, down 0.81%throughout the week.

The main stock index and related ETF performance this week

This week's major stock indexes have permitted, science and technology innovation 50, science and technology entrepreneurship 50, and the entrepreneurial board index rose 6.28%, 2.03%, and 0.49%, respectively, while the Shanghai Stock Exchange 50, CSI 500 and CSI 300 fell 0.64%respectively, respectively. , 0.37%and 0.32%.

In terms of tracking the main index, 5 of the six main index ETFs this week have increased. , 175 million copies, 448 million, and 26 million copies; and the double innovation 50ETF decreased by 72 million copies.

On the whole, the major indexes of the market have permitted this week, and off -site funds have begun to scan the goods. The six index ETFs have a total net inflow of about 4.5 billion yuan this week. 100 million yuan.

Regarding the recent market trend, some brokers said that in the short term, the market adjustment pressure is high, and the probability of the medium term is still in the stage of adjustment. It is recommended to continue to focus on and layout of large -scale stocks and industry leaders with strong profitability and excellent defense capabilities and valuation repair space. In terms of operation, it is mainly based on low suction methods, identify new energy track stocks such as cars and photovoltaic, and fascinates the opportunity to rotate semiconductors, robotic sectors, and food and beauty sectors that have recently declined.

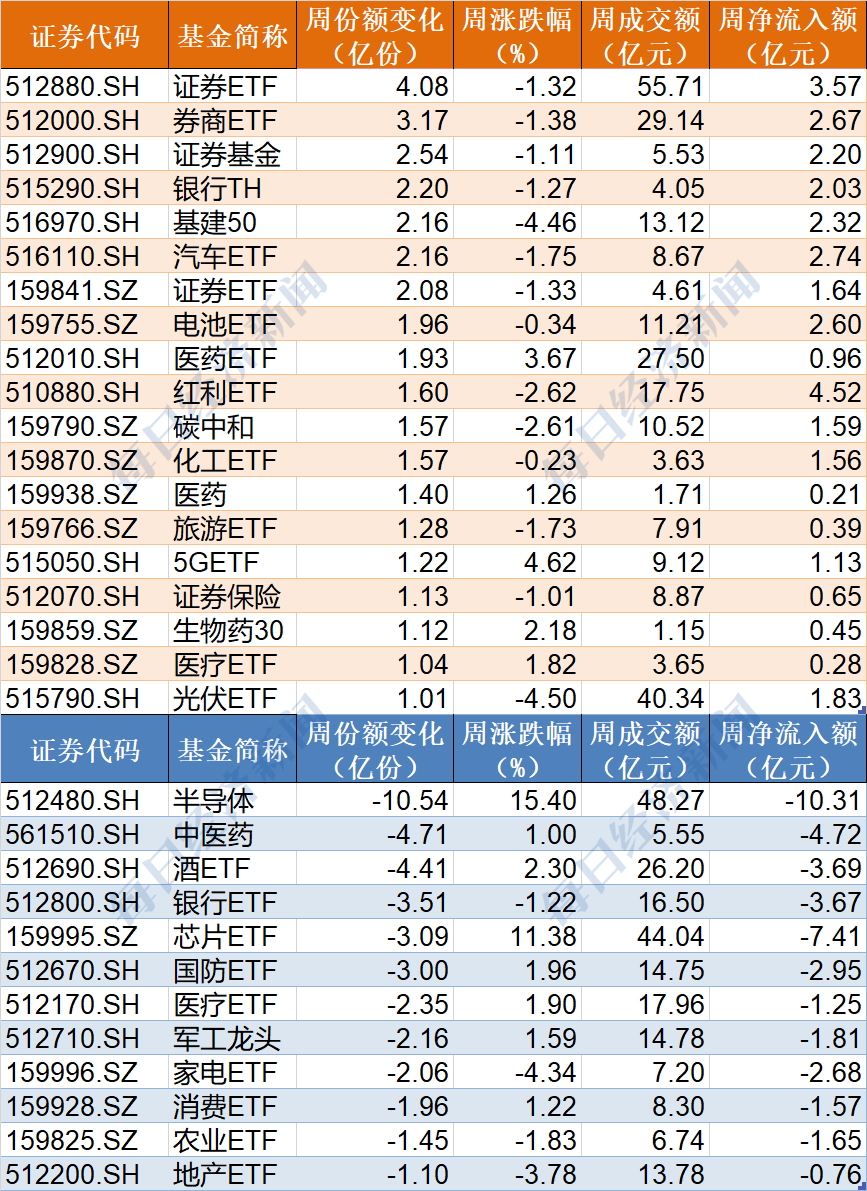

Fund plus warehouse securities, sell semiconductors

In terms of industry -themed ETF, there are 19 funds with a share of more than 100 million copies this week, of which Securities ETF (512880), brokerage ETF and securities fund shares have increased by 408 million, 317 million, and 254 million copies, respectively. Inlet funds of 357 million yuan, 267 million yuan and 220 million yuan.

In terms of capital outflows, 12 industry -themed ETF shares have decreased by more than 100 million copies this week, and the share of semiconductors, Chinese medicine and wine ETF has decreased by 1.054 billion, 471 million, and 441 million copies, respectively. Yuan, 472 million yuan and 369 million yuan.

It is worth noting that the securities sector has been optimistic about funds this week. Two securities ETFs, brokerage ETFs and securities funds have a total net inflow of more than 1 billion yuan.

Among them, the share of the brokerage company ETF once increased to 26.65 billion yuan. In addition, the share of securities funds and securities ETF (159841) also hit a new high this week.

Brokerage ETF share changes

In terms of capital outflows, semiconductors rose 15.4%this week, but were sold sharply by funds! The share has decreased by 1.054 billion copies, with net outflow funds of more than 1 billion yuan. In addition, the chip ETF share has decreased by 309 million copies this week, with a net outflow of 741 million yuan.

Semiconductor share changes

In general, in terms of 408 industry theme ETFs, this week's share increased by 257, and 151 were reduced, and more than half of the fund share increased.

Energy chemicals fell more than 4%

Most varieties of commodities ETF rose this week, of which soybean meal ETF rose more than 2%, gold -related ETFs rose more than 1%, while energy chemicals fell 4.19%.

There are 14 cross -border ETF turnover of more than 1 billion yuan this week, of which the Hang Seng Interconnection Week turnover exceeds 10 billion yuan.

In terms of market performance, most of the cross -border ETFs have risen this week, and the two NATF ETFs rose more than 3%.

The direction of passive fund allocation next week

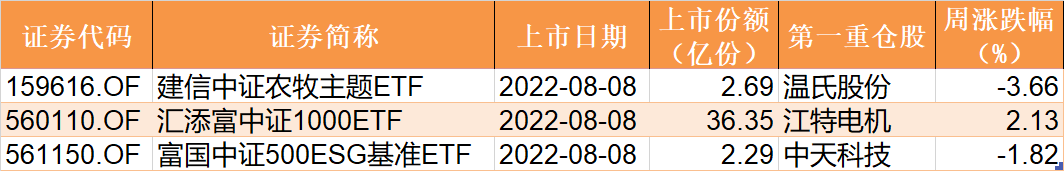

Fund heavy stock stocks have always been a hot spot for investors, but the heavy warehouse stocks of the active management fund have surfaced, usually with a certain lag, but the target of the ETF layout is very clear. By tracking the newly listed ETF, it is usually possible to track that newly listed ETFs, which can usually be possible It is found that the recent hotspot stocks, the incremental funds brought by the new ETF are also worthy of attention.

There are currently three ETF disclosure to be available next week. The tracking targets are the themes of CSI Agriculture and Animal Husbandry, CSI 100 and 500ESG.

In terms of distribution, there is currently no ETF disclosure to be released next week.

Daily Economic News

- END -

Sales reached 2 billion yuan!In 2022, Guangzhou Zengcheng Litchi sales doubled from last year compared to last year

With the enthusiastic August, the annual Zengcheng lychee season basically ended. ...

Phoenix Street: Promoting the application of \"place code\" to add \"safe locks\&

In order to strengthen the traceability and monitoring of the epidemic and ensure...