Buffett Buffett did not escape?Berkshire Hathaway Q2 investment portfolio is $ 53 billion

Author:Daily Economic News Time:2022.08.06

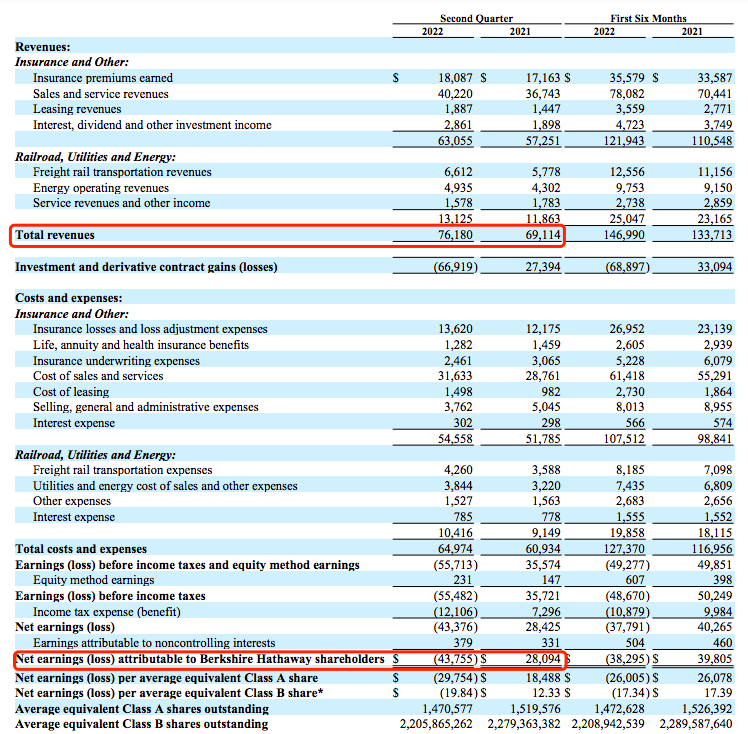

On the evening of August 6th, Beijing time, Buffeta, a "stock god" Buffett (BRK.A, a stock price of US $ 439528.92, a market value of US $ 646.492 billion) announced the second quarter of the 2022 financial report. During the reporting period, Berkshire Hathaway revenue was US $ 76.18 billion, with US $ 69.14 billion in the same period last year; operating profit of US $ 9.283 billion, US $ 6.686 billion in the same period last year.

However, the "stock god" failed to avoid significant fluctuations in the overall market.

"Daily Economic News" reporter noticed that Berkshire Hathaway's net loss attributable to shareholders in the second quarter was US $ 43.755 billion, and the same period last year was US $ 28.094 billion. Among them, the main reason is that its investment portfolio lost $ 53 billion in market plunge. In addition, the underwriting loss announced by the automobile insurance company Geico was US $ 487 million, due to the increase in the cost of repairing and replacement of damaged vehicles due to rising inflation and rising second -hand car prices.

Picture source: Berkshire Hathaway Financial Report

In the first half of this year, Berkshire's investment loss was US $ 54.6 billion, while the investment income of the second quarter of 2021 was US $ 21.4 billion, and the investment income of the first half of the year was US $ 26.1 billion.

Berkshire Hathaway stated in a statement that "the amount of investment profit and loss in any quarter is usually meaningless, and the net income data provided may be little or nothing to know about accounting rules or nothing. Knowing investors have a great misleading. "

Since the beginning of this year, as the Fed has opened up a radical tightening cycle, the market has triggered the market's concerns about the decline in the US economy, and US stocks have fallen into a bear market in the second quarter. The S & P 500 Index fell 16%in the second quarter, the largest single -quarter decline since March 2020. In the first half of this year, the global market also performed poorly, and the three major stock indexes of the US stocks also performed bleak. The S & P 500 Index achieved the worst semi -annual line in 52 years.

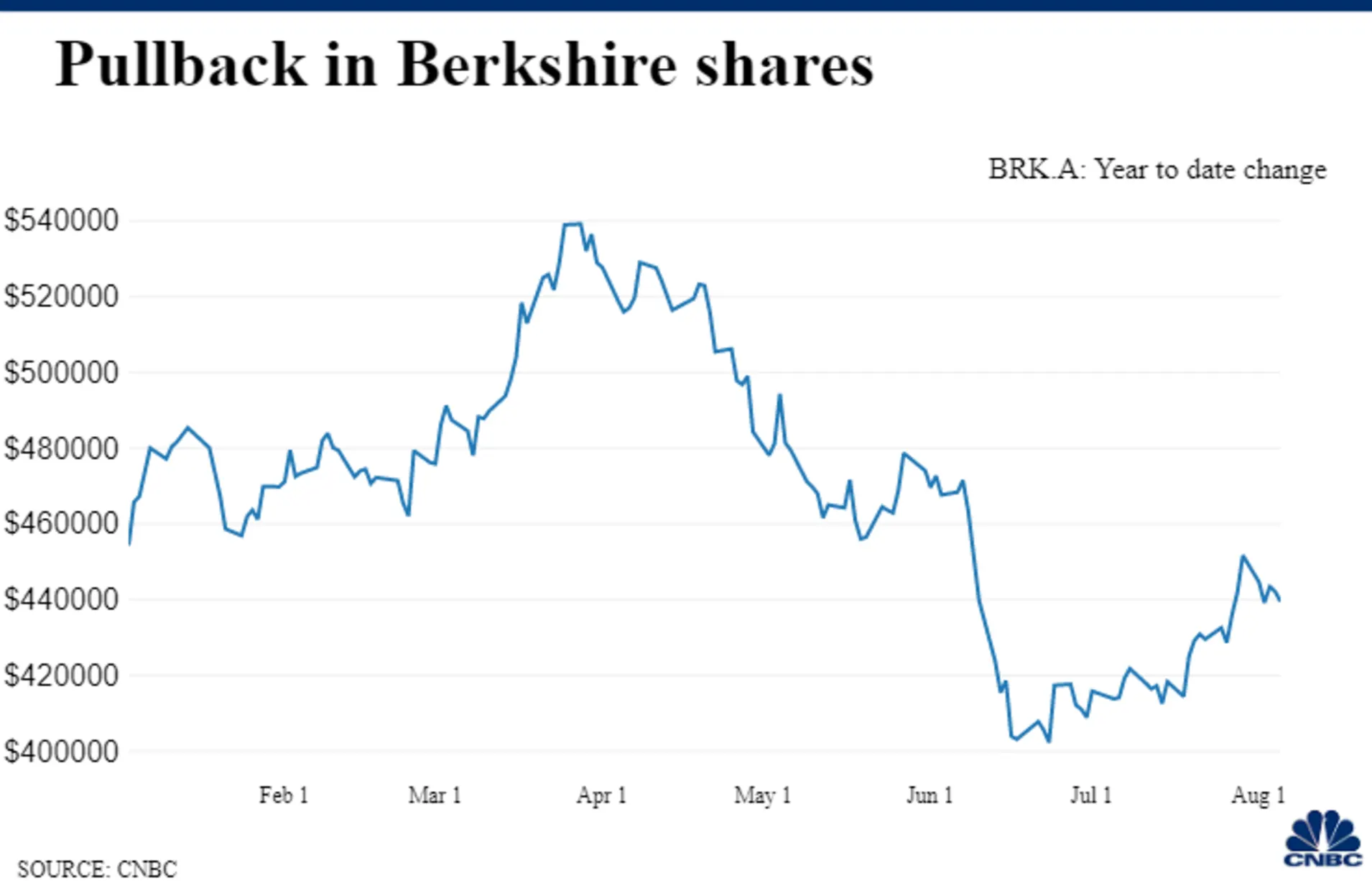

Berkshire Hathaway was also unavoidable -its stock price fell more than 22%in the second quarter, which was nearly 24%from the historical high hit on March 28 this year.

Berkshire Hathaway's stock price trend (picture source: CNBC)

As of June 30, about 69%of the company's total investment was concentrated in the United States Express (US $ 21 billion), Apple ($ 125.1 billion), Bank of America (US $ 32.2 billion), Coca -Cola Company ($ 25.2 billion) and Chevron and Chevron Dragon ($ 23.7 billion).

Specifically, the U.S. Express fell 15.3%in the second quarter, and the market value evaporated at US $ 19.77 billion; Apple fell 4.89%in the second quarter, and the market value evaporated for US $ 136.595 billion; the cumulative decline in the second quarter of the United States, and the market value evaporated at $ 48.93 billion; In the second quarter, a cumulative increased by 2.96%, a market value increased by 7.48 billion US dollars; Chevron dragon fell 4.81%in the second quarter, and the market value evaporated by 15.2 billion US dollars.

Berkshire Hathaway said that the company used in the second quarter for stock repurchase of about 1 billion US dollars, and the total repurchase in the first half of this year reached $ 4.2 billion. That is to say, Berkshire Hathaway's second quarter repurchase speed has slowed significantly compared to the first quarter. As of the end of June this year, Berkshire Hathaway's cash reserves were $ 105.4 billion.

CNBC reports that since March this year, Buffett has been increasing its holdings of Western oil (Oxy, a stock price of $ 59.01, a market value of $ 55 billion) stocks. The price calculation, these shares are worth about $ 10.9 billion. Western oil is also the best stock in this year's S & P 500 Index's ingredients, mainly due to the surge in global oil prices.

Western oil for nearly 6 months. Picture source: Ying is wealth love

Daily Economic News

- END -

Shijiazhuang Chang'an District: Vigorously carry out demonstration of small catering food safety

Great Wall Network · Jiyun Client August 5th (Reporter Zhu Haoming) This morning,...

"Keep the money bag to protect the happy home"

On June 15th, in order to thoroughly implement the Regulations on Preventing and D...