Northbound funds "drink and take medicine"!"China Buffett": Buying Moutai is better than cash more than cash.

Author:Federation Time:2022.08.07

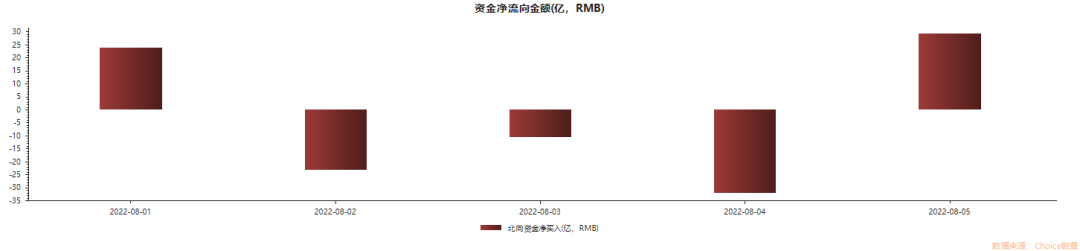

Following the small net purchase last week, the north -wing funds have shown a slightly net -selling trend this week.

Data show that the cumulative net sales of funds in the north this week sold 1.233 billion yuan. Among them, the net selling amount on Thursday was 3.205 billion yuan, which was the highest single -day net sales in the northbound funds this week. As the index rebounded due to the changes in the surrounding situation on Friday, the northern direction also had a net purchase on Friday, with a amount of 2.934 billion yuan.

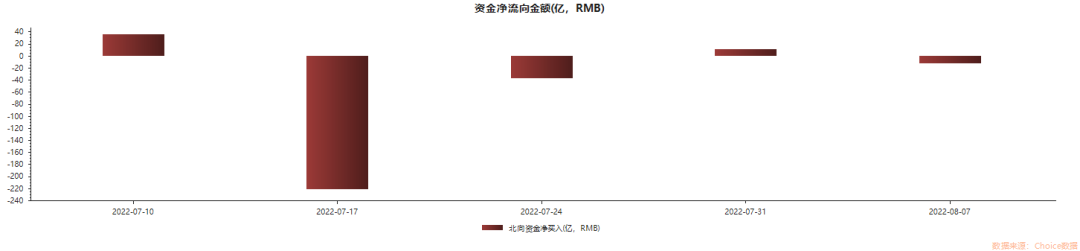

It should be noted that since the market in early July, after the index was short in the short term, the overall situation of the northern direction funds in the past month was 22.302 billion yuan, which was generally consistent with the fluctuation direction of the index. At present, there is still no clear sales direction in the north direction, and it is still appropriate to wait and see in the short term.

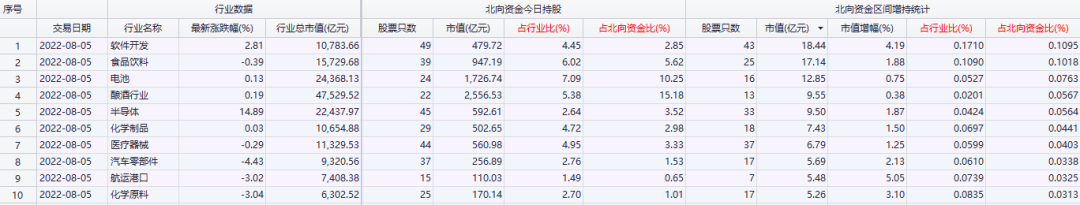

From the perspective of industry increases, the software development of nearly 5 trading days has been bought the most by the northbound capital, reaching 1.844 billion yuan. In addition, food, beverages and batteries are ranked second and third to the north -wing funds this week.

This week, the domestic software sector has set off a daily limit, mainly because the domestic software on the news has a large reasons for imported replacement space.

According to data from the Ministry of Industry and Information Technology, in 2021, there were more than 40,000 enterprises above designated size. The cumulative software business revenue was 9499.4 billion yuan, an increase of 17.7%year -on -year, and the compound growth rate of two years was 15.5%. In the past 10 years, China's software industry has increased from approximately 2.5 trillion yuan in 2012 to approximately 9.5 trillion yuan in 2021, an increase of nearly 3 times.

In addition, some people in the industry pointed out that the steady growth of the software industry has benefited from the rapid development of the digital economy. Software is a link between information technology and industry. On the one hand, the development of the home economy, online economy, and informatization of the epidemic has entered the fast lane, and the demand for the software industry has continued to grow; on the other hand, the pace of digital transformation of manufacturing has accelerated, key procedures in key areas, digital research and development design The penetration rate of the tools increased to 55%and 74.4%, respectively, and the advancement of industrial digitization also drove the rapid development of the software industry.

Haitong Securities believes that in the second quarter, the level of computer industry institutions (funds and fund management companies) continued to decline, refreshing the historical lowest point in the past ten years, reaching 2.0%. From the perspective of positioning or valuation, the computer industry is currently in the historical bottom, reaching a dual bottom, which also means that there will be a large upward space in the computer industry in the future.

In addition, the brewing industry, food, beverage and battery concepts have been listed in the top 5 industries in the first five industries for funds for funds. Judging from the second quarterly report that major public fundraising funds have disclosed, the largest increase in the stock market value of the fund is Moutai, Guizhou. In the second quarter, the market value of the shareholding increased by 28.452 billion yuan. Heavy positions.

Some securities firms believe that "after the first quarter, the current historical valuation of the food and beverage industry in the past two years is 12.62%, which can currently choose the best layout."

Based on the Fund's second quarterly report, the institution currently has 2 investment ideas:

First, in the post -epidemic era, the industry showed opportunities in the industry that showed "consumer advantages". The specific choices were the leading stocks of food and beverages such as Moutai, Wuliangye, Luzhou Laojiao, Shanxi Fenjiu; the second is to continue deep cultivation in the "manufacturing advantage" industry. Opportunities for the industrial chain, the specific selection is the leading stocks of the Ningde Times, Huayou Cobalt Industry, Yimei Lithium Energy, Longji Green Energy, BYD and other new energy industry chains and automotive industry chains.

Among the top ten net stocks in the top ten funds this week, Guizhou Maotai, Hengrui Pharmaceutical, and Northern Hua Chuang ranked among the top three. Among them, 4 stocks in the food and beverage sector have reached 4, which are Guizhou Maotai, Yili, Haitian Weiye, and Wuliangye. The pharmaceutical industry also has three pharmaceutical stocks in Hengrui Pharmaceutical, Mai Rui Medical, and Pharmaceutical Kant. medicine".

From the data point of view, the liquor leader in Guizhou Moutai ranked first among the net stocks in the north of the north this week for 2.971 billion yuan. According to public information, Guizhou Maotai's revenue in the first half of this year was about 57.617 billion yuan, an increase of 17.38%year -on -year; net profit attributable to shareholders of listed companies was about 29.794 billion yuan, an increase of 20.85%year -on -year. The total number of shareholders of Moutai in Guizhou was 146,000, a decrease of 11.57%from the 165,100 households at the end of the first quarter.

Recently, many institutions have released research reports from Moutai in Guizhou. Among them, 31 were bought and 1 were increased. One was strongly recommended. The average target price was 2326.82 yuan. Compared with the latest price of 1923.96 yuan, it was 402.86 yuan high, and the average target price increased by more than 20%.

In recent years, although the performance growth rate of Moutai in Guizhou has not been regarded as the best in A shares, its performance is stable, and occasional innovative stability can indeed be supported by value investors in the market.

Everbright Securities believes that although the domestic epidemic has been repeated since March and has caused certain disturbances on liquor sales, Moutai has benefited from the support of leading brand power and product finance preservation attributes. Q2 Total revenue and net profit in single -quarter increased by about 16%year -on -year, in line with the previous market expectations.

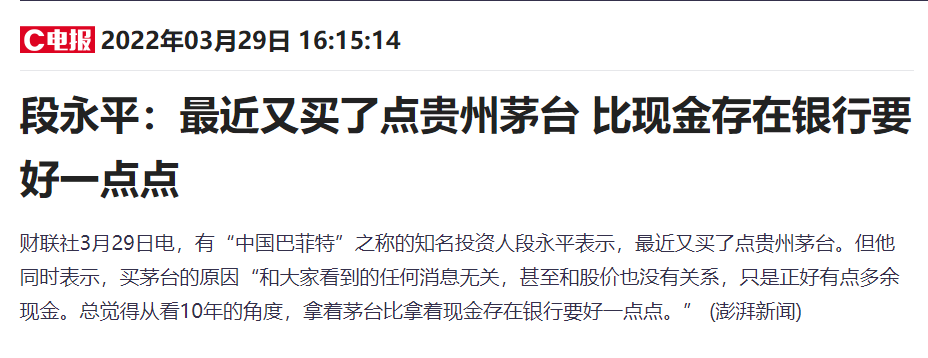

Duan Yongping, known as "Buffett, China", also stated: "From the perspective of 10 years, it is better to have a cash in cash."

In addition, Hengrui Pharmaceuticals received 1.9 billion yuan in northern -directional funds. The company has recently developed more blooms, and the innovative pharmaceutical pipeline ushered in dense harvest.

Soochow Securities believes that the innovative pharmaceutical sector has undergone a long time and large callback since 2021, and the valuation of many high -quality innovative drug standards has been in the bottom range.In the long run, the business ceiling of innovative medicines is high enough, and the maturity of the regulatory policy will also promote the healthy competition and development of the industry.In the short term, the impact of the epidemic has weakened.At the 2022 ASCO Annual Conference, domestic innovative drugs have excellent data, and the innovative pharmaceutical sector in the current position has the value of layout.understand more

- END -

ETF big waves, sandy sand, gold ETF is happy or worried?

Due to the characteristics of low thresholds, low fees, high liquidity, in recent ...

Luo Min, the founder of Qudian, sells prefabricated dishes.

Reporter Li HaoyueMiracles have been continuously staged in the field of live e -commerce, and gradually become a new landing point for many commercial elites.On June 15th, the founder of Qudian Luo M