The "stock god" also difficult to escape the decline in US stocks affects Buffett's losses in a single quarter of more than 350 billion yuan

Author:Cover news Time:2022.08.07

Cover Journalist Zhu Ning

Since the beginning of this year, as the Fed has opened up a radical tightening cycle, the market has caused the market's concerns about the decline in the US economy, and the three major US stock indexes have also performed bleak. The S & P 500 index has set the worst semi -annual line in 52 years; in such an investment environment, in this investment environment Below, even the "stock god" Buffett can hardly handle the answer to the market.

On the evening of August 6, Beijing time, Buffett Berkshire Hathaway announced the second quarter of the 2022 financial report. The loss of its investment portfolio in the second quarter was as high as US $ 53 billion (about RMB 358.4 billion). In the second quarter, the company's net loss belonged to shareholders was as high as US $ 43.755 billion (about RMB 295.9 billion), and the net profit was 28.094 billion US dollars in the same period last year.

Heavy warehouse stock drags the performance and causes losses

According to the financial report, in the second quarter of this year, Berkshire Hathaway's stock holders were concentrated in five companies: Apple (US $ 125.1 billion), Bank of America (US $ 32.2 billion), Coca -Cola Company ($ 25.2 billion), Chevron (237 (237) US dollars), American Express (US $ 21 billion), five companies hold about 69%of their positions.

Among them, Apple, Bank of America, American Express, and Chevron have encountered huge retracements in the second quarter, with the declines of 21.58%, 24%, 25.39%, and 10.35%. Coca -Cola rose 2.22%in the second quarter.

It should be noted that in addition to the profit or loss of normal stock investment, the reasons for the income and losses of investment and derivatives lead to the plunge in net profit. The financial report shows that its net loss in the second quarter of investment and derivatives was US $ 530.38 billion. However, this has also been vomited by Buffett many times, saying that the income and losses of investment and derivatives are not true for understanding and evaluating economic performance.

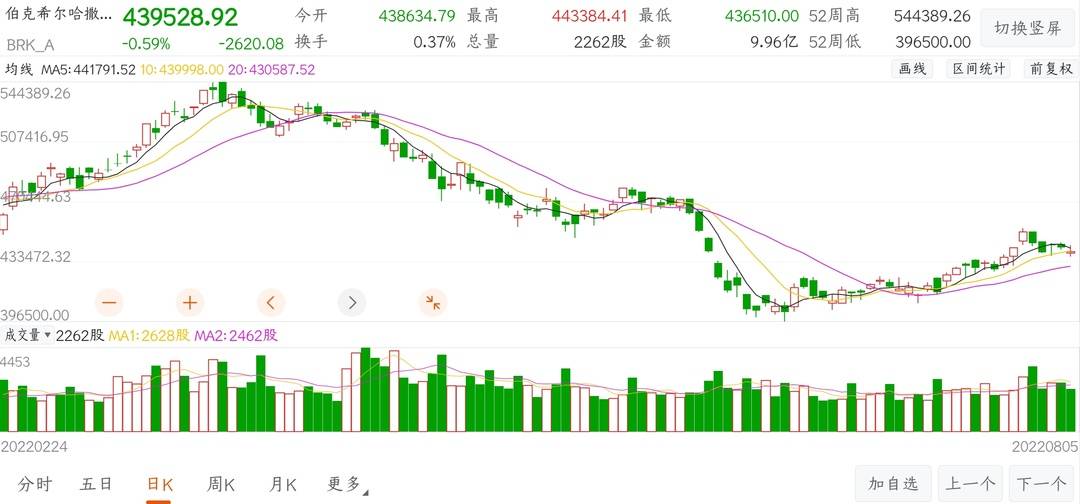

Berkshire's performance fluctuation also affects the performance of the stock price. Berkshire's Class A stocks fell more than 22%in the second quarter, down nearly 24%from the historical high set on March 28.

In this regard, Berkshire Hathawa once again called on investors to reduce the quarterly fluctuations of their equity investment: any given quarterly investment income (loss) amount is usually meaningless, and every provided The net income data may be very misleading for investors who have little knowledge of accounting rules or unknown.

Newly entered Western oil profitability

In fact, although Buffett's top three heavy positions have recovered, it still made a lot of profits from the stocks of newly added positions this year.

Since the first quarter of this year, Berkshire continued to buy Western oil stocks, making Berkshire's net expenditure in the first quarter of $ 41 billion. Since June, as Western oil stock prices have fallen, Berkshire has repeatedly increased its positions. In addition to the recent one, the total shareholding ratio of Berkshire has increased to 19.4%.

Benefiting from the soaring international oil prices, the performance of Western oil is very eye -catching. The second quarter's financial report showed that the company's total revenue reached US $ 10.735 billion, an increase of 78.6%year -on -year. As the profit base was low in the same period last year, the profit in the first half of this year was 36 times year -on -year.

At the same time, Berkshire will also get the benefits brought by the stock price. The stock rose all the way from nearly $ 29 at the beginning of the year, and rose to the annual high of $ 74 during the market on May 31, up as high as 140%. Subsequently, Western oil was repeatedly adjusted. As of Friday, Western oil increased by 103%during the year.

It should be pointed out that once Berkshire has more than 20%of ordinary stocks in Western oil, you can incorporate the performance of Western oil into its performance statement according to the shareholding ratio, which will boost Berkshire's performance; At present, the shareholding ratio that can be included in the report is only 0.6%. Analysts expect Western oil to earn about $ 10.7 billion this year. Therefore, if Berkshire eventually holds 20%of Western oil, the profits reported this year may increase by more than $ 2 billion.

The expectations of interest rate hikes make the trend of US stocks covering the shadow

In the second quarter of this year, the Fed started the violent interest rate hike anti -inflation model, and its economic prospects were also at stake. U.S. stocks once fell into a bear market. From the data point of view, the Nasda Index plummeted 22.44%in the second quarter, the S & P 500 index fell 16.45%, and the Dow fell 11.25%.

Faced with the high inflation that has not been seen for decades, the Fed's "Eagle" signal this year has become more and more obvious. After the 25 -basis points raised in March, the Federal Reserve kept raising 50 basis points in May. In June, it began to sacrifice 75 basis points of "violence" to raise interest rates, the largest since 1994.

Since the beginning of this week, Fed officials have frequently released the "Eagle" signal, breaking market expectations that ended interest rate hikes in advance. Among them, Chicago Fed Chairman Evans said that if the economy slows down as expected, 50 basis points will be supported at the September meeting. However, if economic data is hotter than expected, it is not impossible to raise 75 basis points for the third time.

Regarding the expectations of the Federal Reserve ’s interest rate hike, some market analysts told reporters that the original market believed that the latest employment data in the United States would decline sharply, and then it was able to force the Federal Reserve to slow down the pace of interest rate hikes at the September meeting, but now the latest data has broken this expectation. Essence

The analyst said: "If the Federal Reserve’ s interest rate hike slows down, the stock market will have expected support and can 'return to the blood.However, there has been a significant rise that exceeded expectations. "The reporter noticed that on Friday, local time, the United States released a non -agricultural employment report in July, and new jobs reached 528,000, which was more than twice the expected 250,000 times more than 250,000., Significantly increased from data last month.

"This shows that the current economic situation is not bad, and it provides sufficient confidence for the Fed's further interest rate hikes. There is no need to worry about the interest rate hikes leading to the economic decline, but the interest rate hike is a blow to the stock market."The probability of predicting the Federal Reserve ’s interest rate hike in September has exceeded the probability of interest rate hikes 50 basis points. At the same time, the reason for the rise of U.S. stocks during this period is that the Fed is expected to slow down the pace of interest rate hikes, but if the Fed has to continue to raise a sharp interest rate hike,Then U.S. stocks may further fall.

- END -

In the first July of this year, Chengdu express business volume of about 1 billion pieces of "Chengdu Metropolis Circle" won the top three in the province's express delivery business volume

Today, the reporter learned from the latest postal industry reported by the Provin...

Extremely review | Men take their girlfriends to eat seafood only to pay plastic bags, don't let the self -checkout of the "back door" to theft

Ji Mu News commentator Qu JingRecently, a man in Jiangsu took his girlfriend to He...