Brokerage stocks have been raised?"Bonding Mao" 1.5 billion main funds fled, and Nanjing Securities shareholders "not sold" rebounded the "brokerage list" against the market

Author:Huaxia Times Time:2022.08.07

China Times (chinatimes.net.cn) reporter Wang Zhaohuan Beijing report

A shares in early August opened a new cycle with adjustment. This week's (August 1st to August 5th), 4 days before (August 1st to August 5th), brokerage stocks fell into a "sense of existence". However, on the 5th, Nanjing Securities represented The violence of violence was full of popularity, helping the Shanghai index rising by more than 1%.

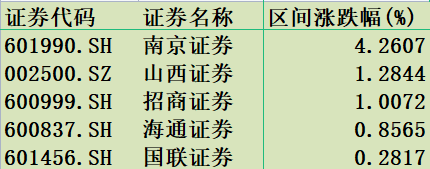

According to the statistics of the same flower Shunshun, only 5 securities firms have risen in a week, and Nanjing Securities rose 4.26%, ranking first; Shanxi Securities rose 1.28%, China Merchants Securities rose 1%, ranking second and third; Guilian Securities rose slightly by 0.85%and 0.28%, respectively.

On the list, Everbright Securities fell 6%, Hualin Securities fell 5.1%, Zhejiang Shang Securities fell 4.67%; Essence

Brokerage stocks have soared

On August 5, A shares ushered in a rebound. Especially in the afternoon, the collective performance of the brokerage stocks represented by Nanjing Securities in the afternoon was eye -catching, and the overall increase of the securities sector increased by 2.62%.

Among them, Nanjing Securities, Shanxi Securities, China Merchants Securities, Eastern Securities, and Guolian Securities ranked among the top five increases, with 10.05%, 5.54%, 4.08%, 3.73%, and 3.39%, respectively.

CICC, Guoxin Securities, Hualin Securities, Guotai Junan, and Hongta Securities ranked five after the list, with the increase of 1.30%, 1.46%, 1.54%, 1.57%, and 1.75%, respectively.

On August 5th, Nanjing Securities issued an announcement that the shareholders Nanjing Hi -Tech plans to reduce their holdings from May 5, 2022 to November 4, 2022 to reduce their holdings by concentrated bidding transactions. 0.8012%). On August 4, 2022, Nanjing Hi -Tech reported that the Nanjing Hi -Tech reduction shares planned by Nanjing Hi -Tech on August 4, 2022 had not reduced its holdings of the company's shares during this period. The reduction plan has not yet been implemented.

Some markets said in an interview with the reporter of the Huaxia Times that the collective rise of the securities sector is expected to start the second wave of the securities sector.

However, some investors are cautious that the securities sector has been highly controlled, and each rising is not ruled out that there is suspicion of shipment.

However, from the perspective of professionals, the reporting window of securities firms is gradual, and it is expected to improve the year -on -year pressure. The comprehensive registration system is about to be optimistic about the brokerage sector. Under the relatively loose liquidity and the dividend of the capital market reform policy, the brokerage sector has a strong valuation repair momentum.

Fully register

A few days ago, the CSRC convened a mid -year supervision work conference in the 2022 system, requiring solidly promoting the reform of stock issuance registration systems; reality and implementing all preparations for the implementation of stock issuance registration systems; strengthened the full chain of the issuance supervision Normalization, maintaining good issuance order. Taking the transformation of the distribution of supervision as a traction, accelerate the transformation of various lines such as institutions and listed companies, and improve the overall supervision efficiency; at the same time, deepen the reform of the company's bond registration system.

The chairman of the China Securities Regulatory Commission, Yi Hui Man, published an article in "Askish" a few days ago, mentioned that after nearly three years of pilot exploration, the registration system with information disclosure as the core has initially adopted the market test and fully implemented the stock issuance registration system. Conditions are basically available.

In the next step, the CSRC will scientifically grasp the audit and registration mechanism, the positioning of various sectors, and guide the healthy development of capital to standardize the healthy development of the capital, and prepare for the rules, business and technology of "embroidery" to ensure that this major reform is smoothly landing.

Zhang Jingwei, a non -banking analyst of Anxin Securities, pointed out that the comprehensive registration system is approximately promulgated to boost the valuation of the brokerage sector to facilitate the industry leaders. In the second quarter, the market recovery led the large -scale recovery of public offering funds. The securities company was leading the month -on -month. It is expected that brokerage channels are expected to make breakthroughs in fund investment consulting and private equity sales.

In the second half of the year, it has benefited from the improvement of market transaction emotions from the wide credit landing, which is still optimistic about the performance of short -term securities firms. However, from the perspective of the year, the pressure of performance still exists and the market differences are large. The growth rate surpassed the securities firms of the same industry.

Sun Ting, chief analyst of Haitong Securities Non -banking Research, believes that in the first half of 2022, the average daily basis transaction value of 1048.2 billion yuan, a year -on -year increase of 8%. The scale of IPO and bond issuance continued to grow. In the first half of the year, the net profit of the listed brokers fell 22%year -on -year.

At the same time, the concentration of investment banking business has increased significantly. Judging from the amount of underwriting projects in the first half of the year, the concentration of listed brokers still maintains a high level. Large -scale comprehensive brokerage firms have greatly ahead of peers with their own rich resources and team advantages.

Among them, the top five securities firms, CITIC Securities, CITIC Investment, CICC, Huatai Securities, and Guotai Junan completed a total of 3220.3 billion yuan, the industry accounts for 60%, which is significantly improved compared to 48%in 2021. Among them, IPO underwriting, with the continuous development of the science and technology board, brokerage companies with high -quality listing resources have completed the number and amount of IPO underwriting in the first half of the year.

Private equity development good brokerage securities firms

Recently, Fang Xinghai, vice chairman of the China Securities Regulatory Commission, said at the establishment of a private equity fund committee and the first work meeting under the third council of the China Foundation Association. The overseas market listing channels have maintained steady growth in the scale of domestic IPOs, and continued to launch policies that are conducive to the stable and healthy development of the private equity industry. Reports from Zhejiang Business Securities show that since 2015, the compound growth rate of private equity management in my country has reached 25%. The structure is mainly based on private equity funds (including entrepreneurial funds) and private equity funds. 67%and 29%. The number of private equity fund managers has remained relatively stable in recent years, and the number of management products has risen.

The report pointed out that the development of private equity funds is good for securities firms. First of all, the establishment of the registered system and the establishment of the science and technology board, and the establishment of the Beijing Stock Exchange to expand the exit channels for more small and medium -sized enterprises. Secondly, private equity funds are one of the most important trading rivals in the exchanges of off -site exchanges. The expansion of the scale of private equity funds and the increase in demand for risk aversion can push up the scale of derivatives and facilitate the strong derivatives business. The third is that when choosing a product agency channel, private equity funds are more inclined to choose a brokerage company with higher customer characteristics and high sales teams.

Editor: Editor Yan Hui: Xia Shencha

- END -

The National Medical Insurance Bureau intends to stipulate: guide the planting crown to form a reasonable price

China News Service, August 18th. On the 18th, the National Medical Security Bureau publicly solicited opinions on the Notice on the Development of Oral Planting Medical Service and Special Governance

Byte -by -line education business has been adjusted, and it is estimated to optimize about 3,000 people

According to the news of the Science and Technology Board Daily on the 18th, a number of independent letter sources said that the educational business of byte beating has been greatly adjusted. It is