There are counts | Pension wealth management products

Author:Cover news Time:2022.08.08

As of July 25, 2022, five pilot financial management issues (including Belaide CCB Financial Management) issued a total of 31 pension wealth management products, and the other six new pilot institutions were also ready to go. Pension wealth management products have a variety of advantages such as long -term, low thresholds, inclusiveness and stability. At present, the market for the pension and wealth management products is smooth. The four pilot financial wealth management products first issued by the first four pilot institutions have also shown a stable income acquisition ability.

With the expansion of pilot agencies and regions, the number of pension wealth management products in the future will gradually increase, which will help further improve the construction of a multi -level pension system and meet the needs of residents' pension.

The increase in yields in the last two months of pension wealth management has increased obviously

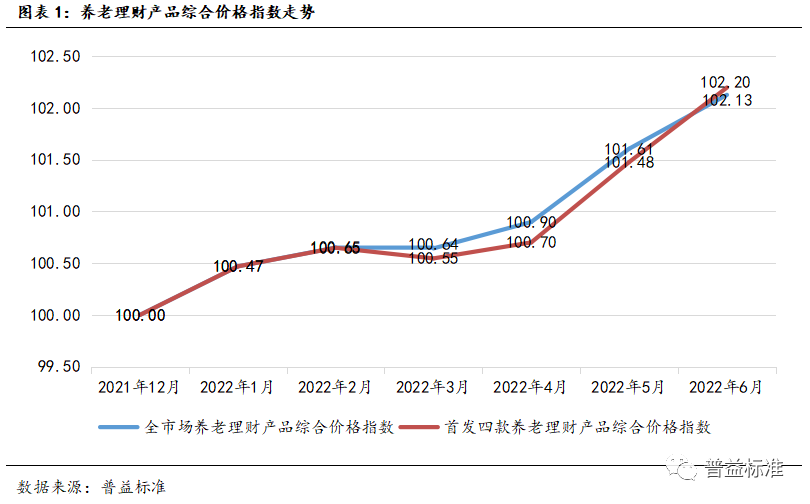

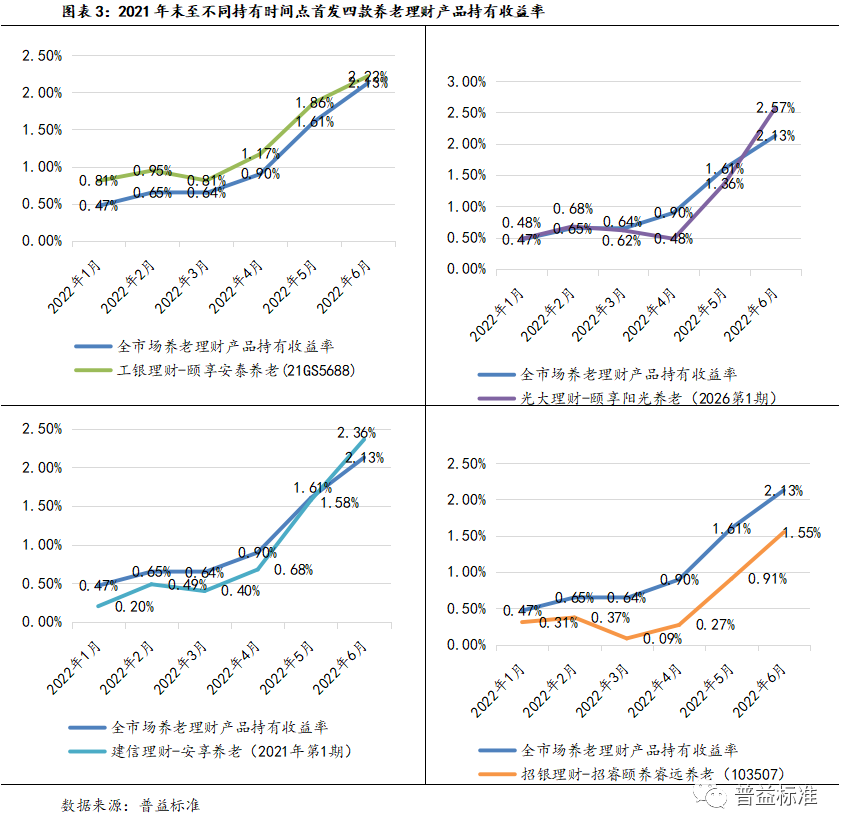

Since the beginning of this year, the market fluctuations have been greatly fluctuated, the net worth of the market's wealth management products has increased, and multiple wealth management products have broken nets. The market in May and June has begun to recover. A significant increase. In May and June 2022, the monthly holdings of pension wealth management products held a single monthly holding rate of 0.70%and 0.51%, respectively. In the past two months, the total yield of holding of 1.22%was 1.22%. In addition, it is assumed that investors began to hold pension wealth management products at the end of 2021. As of the end of May 2022, the holding rate of holding of 1.61%was higher than the first -issue four pension wealth management products. The yield of pension wealth management products reaches 2.20%, which is higher than the yield of the entire market for pension wealth management products.

Everbright Financial Management and CCB Finance Financial Pension Financial Products have performed well. Compared with the earliest pension wealth management products each issued by the first batch of pilot institutions, the income performance of Everbright Financial Management and CCB Financial Pension Financial Products is better. It is assumed that investors began to hold pension wealth management products at the end of 2021. As of the end of June 2022 -The Yuxiang Sunshine Pension (2026 Phase 1) "and" Caixin Financial-Anxiang Pension (No. 1 2021) "holding yields are 2.57%and 2.36%, respectively, which are higher than the overall market 44bp and 23bp, and 23bp, and 23bp, and 23bp, and 23bp, and 23bp, and 23bp, and 23bp, and 23bp, and 23bp, and 23bp, and 23bp, and 23bp, and 23bp,, and 23bp, and 23BP, From April to June, the income rose significantly from April to June. In addition, we can also see "ICBC Financial-Yi Xiang Antai Pension (21GS5688)" is relatively stable, and the holdings of each time period are above the market average.

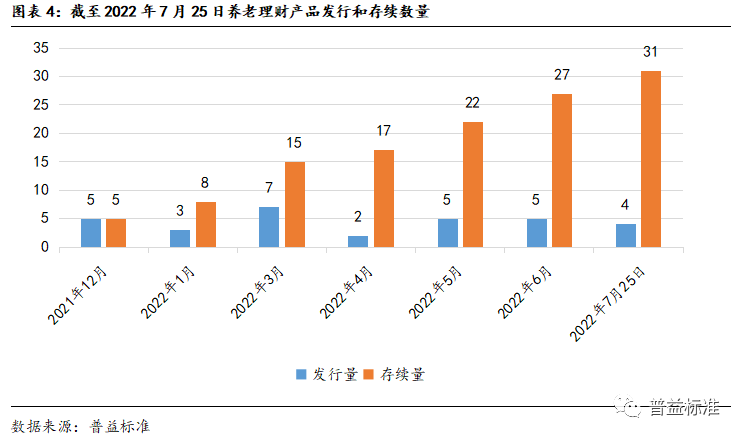

The number of pension wealth management products continues to rise steadily

After the pilot notification of the pension wealth management on September 15, 2021, the first four pilot agencies issued a pension wealth management product on December 6, 2021. Since then, the four pilot institutions have launched a variety of pension wealth management products. On the 25th, the joint venture wealth management company Belle Germany CCB Wealth Management also issued a pension wealth management product. As of July 25, 2022, there were 31 pension wealth management products in the market. The number of pension wealth management products will gradually increase.

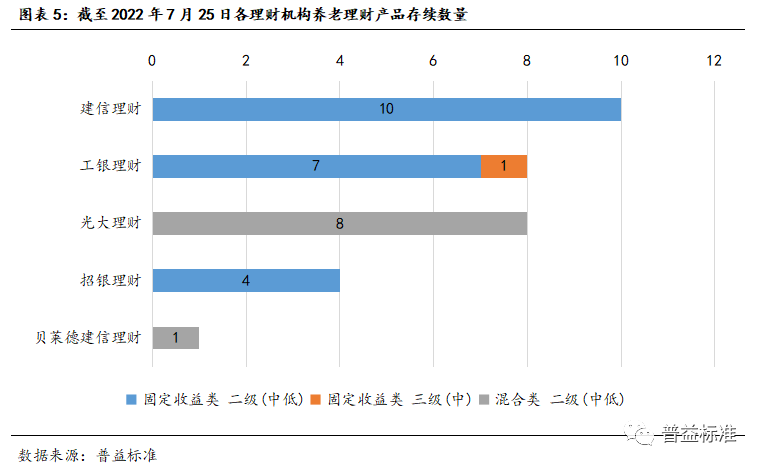

CCB financial management has the most old -age care financial products. As of July 25, 2022, of the five pension wealth management products issuance institutions, CCB's wealth management has the largest number, a total of 10 models, accounting for 32.26%. Land CCTV's wealth management is all mixed products, but the product risk level is a secondary risk level. At present, the six new institutions have not yet issued products after expanding the scope of the pilot range.

Pension wealth management products are mainly public offering products, and the investment threshold is low. At present, the 31 pension wealth management products are public -funded products, and their personal investment thresholds are low, all of which are 1.00 yuan, and inclusive features are obvious.

Pension wealth management products are mainly solid -income products, with low risk levels. Of the 31 pension wealth management products currently, there are 22 solid -income products, accounting for 70.97%. Although 9 products are mixed products, the product risk level is also secondary. The risk level of other three -level risk -level products, the risk levels of other duration products are all secondary, which reflects the operating style of obtaining stable benefits for pension wealth management products.

Pension wealth management products are mainly closed and long -term. Among the current pension wealth management products, there are 29 closed products, accounting for 93.55%, and only 2 open products; the overall pension wealth management products have a long period of time, and the investment cycle is more than 5 years. It guides investors to reasonably reasonable. Plan for pension wealth management investment and establish long -term investment concepts.

Cover reporter Dong Tiangang

- END -

Japanese media: The "independence" of the dollar becomes a world economic risk

The US dollar index continues to be strong and set a new high in nearly 20 years. On July 7, the US dollar index reached the highest point of 107.13 after the strong rise in the morning, and fell arou

Our city carried out inclusive financial activities to help rural revitalization

In order to strengthen the party building and leader to optimize the allocation of...