Four years of huge losses of 6.4 billion, Tencent "played with", does Huayi brothers still save?

Author:Kanjie Finance Time:2022.08.08

The Huayi brothers still moved to the edge of "danger".

In the 11 -year accompany, Tencent couldn't carry it anymore, and chose "abandon" Huayi brothers.

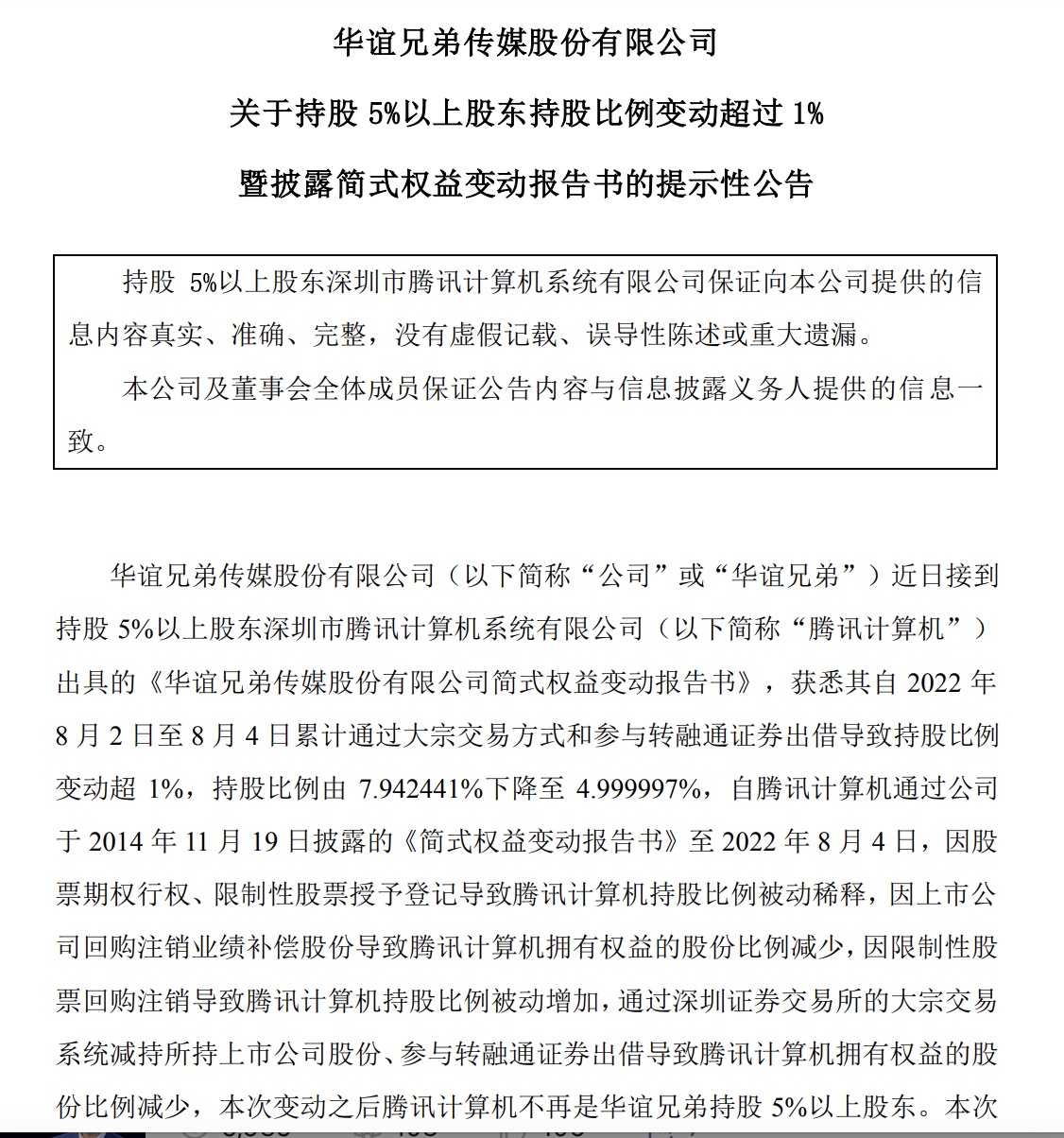

On August 5th, Huayi Brothers issued an announcement saying that Tencent Computer, a shareholder of more than 5%of the shares from August 2nd to August 4th, 2022, through a large transaction method and participation in the transaction of transferred securities. %, The shareholding ratio dropped from 7.942441%to 4.999997%.

As the shareholding ratio drops to less than 5%, this means that Tencent's reduction will no longer be restricted in the future. So, what signal does Tencent release this move?

As the first film and television company listed in A shares, the lineup of Huayi's shareholders was luxurious in the early days of listing. In order to coach his successful listing, Wang Chaoyong even pulled Li Jiacheng for Wang Zhongjun.

Ma Yun once asked Wang Zhongjun: "Do you want to be a company that make money, or do you want to be a Chinese Warner brother?"

At that time, Wang Zhongjun answered sincerely that he wanted to be China's Warner brothers.

The power of dreams is sometimes great, so Ma Yun turned around for Wang Zhongjun's dream. After becoming a shareholder of Huayi, Huayi also lived up to expectations and occupied half of the film and television industry at that time.

Two years after Huayi was listed, Tencent began to have an intersection with Huayi, and in May 2011, it cost 445 million at a price of 16 yuan/share to buy 27.8 million shares of Huayi.

Since then, as Huayi ’s reputation in the domestic film market has become greater and the linked connection between Huayi's Tencent has become closer. In November 2011, Tencent continued to increase and Huayi, and launched in -depth cooperation in operation, film and television content copyright, film and television drama shooting and other aspects.

In November 2014, Tencent once again subscribed to 51.55 million shares of Huayi Brothers for a price of 24.83 yuan/share, cost a total of nearly 1.3 billion yuan.

It is worth noting that at this time, Tencent held more than 8%of Huayi's shares, surpassing Ali and Ma Yun to become Huayi's second largest shareholder in one fell swoop, but the Tencent and Alibaba were basically the same. It will exceed 0.5%of the total share capital.

On the eve of the big bull market, maybe Wang Zhongjun forgot that Ma Yun had asked his question. When the stock price rose to the 100 billion market value all the way, Wang Zhongjun became a "hand shopkeeper" and gave the daily operation to Wang Zhonglei, and herself was herself. Going further and further on the road of art, investment and collection.

Ma Yun once publicly said to the outside world that Wang Zhongjun was the lazy CEO he had ever seen.

At that time, Wang Zhongjun had not noticed that the balance of fate had begun to tilt. In November 2015, the C -round C financing of Heroes Mutual Entertainment, Wang Zhongjun and Wang Zhonglei led the Huayi brothers to throw 1.9 billion yuan directly. When mentioning this investment, Wang Zhongjun was proud of it, and the money for investment was best.

After earning capital money, he was unwilling to do industry. This is a common problem for listed companies. In March 2016, Huayi Brothers Unite Tencent and Yunfeng Fund spent 547 million yuan to enter the main Hong Kong stock company "China No. 9 Health", which was later renamed "Huayi Tencent Entertainment". At that time, Huayi plans to build it into an international entertainment content integration platform.

In addition, the pits were dug on the road to Huayi's growth. It was also the two acquisitions, and finally pushed Huayi to the "abyss". In the four years from 2018 to 2021, the Huayi brothers lost more than 6.4 billion yuan. In addition, the brothers of Wang Zhongjun and Wang Zhonglei are still being included in the list of executors.

More importantly, the two brothers not only have a high proportion of pledge, but also have been constantly reducing their holdings since this year. In addition, due to the influence of the epidemic, Huayi's performance can not see signs of improvement.

As for why Tencent chooses to reduce its holdings at this node:

First, it may have something to do with the company's strategy, because this year they not only reduced their holdings, but also cleared New Oriental Online;

Second, the return on Huayi is far lower than expected. It is reported that from 2011 to 2017, Huayi only divided 700 million yuan, while Tencent's dividend was less than 100 million. In addition, Tencent did not have much profit in film cooperation.

In summary, the complexity of the capital market has brought Wang Zhongjun and Wang Zhonglei brothers on a wayless path. The diversified leverage when the bull market is diversified in the end. Choose "let go", so will Ali follow in the future?

- END -

In May 2022, local government bonds issuance and debt balance

1. The issuance of local government bonds in the country(1) The issuance of the mo...

Ruiyi Technology: Change the continuous supervision of the host brokers, from Soochow Securities to CITIC Investment

On August 9, 2022, Ruiyi Technology (836193.NQ) issued a change in the announcement of the continuous supervision of the host of the securities firm.The announcement shows that Soochow Securities Co.,