"The first share of the artist's agent" Lehua finally passed the meeting. Can the "Wang Yibo" annual 300 million can support the valuation?

Author:Entertainment unicorn Time:2022.08.08

Author | Mingming

Edit | Yuan Jiaqi

The entertainment industry will welcome good news.

Following the official approval of the IPO application of Bona Pictures on the evening of July 28, Lehua also received the entry tickets for the Hong Kong stock market. In March of this year, Lehua Entertainment submitted a listing application to the Hong Kong Stock Exchange. On August 7th, he successfully passed the Hong Kong Stock Exchange listed hearing, and was about to officially land on Hong Kong stocks.

In addition, in January 2021, Ningmeng Film launched the A -share listing plan and ended the counseling plan at the end of June of the same year. After three months, Lingmeng Films submitted a prospectus to the Hong Kong Stock Exchange. On March 29, 2022, the prospectus was After 10 days, 10 days later, Ningmeng Pictures submitted the prospectus for the second time, the third impact IPO, and heard the Hong Kong Stock Exchange on July 19.

The head companies from the three major fields of film, artist agent, and TV series, which ushered in the good news of listing almost at the same time. The signal behind it is self -evident: After the long four -year cold winter, the IPO of the film and television industry finally ushered in loosening, and the overall heating. The financing pressure is eased and the business layout is expanded. What new stories will the film and television stocks tell after listing?

Can Wang Yibo and A-Soul support Lehua?

For seven or eight years, it has been launched four times, and Lehua's IPO journey is long and twisted.

In 2008, Du Hua founded Lehua Entertainment the following year since the resignation of Huayou Century, the largest domestic music content supplier in China, the following year. Han Geng, who returned to China from SJ, was once the most important signing artist of Lehua in the early days.

In September 2015, Lehua Entertainment was officially listed on the New Third Board, and securities were referred to as "Lehua Culture". After 2 months of listing, I tried to log in to A shares by mergers and acquisitions. The listed company reached a combination of electronic sounds to collect shares and pay cash to acquire spring fusion (valuation of 1.8 billion) and Lehua Culture (valuation 23.2 23.2 100 million). Due to the changes in the policy environment, in October of the following year, the electronic sound released a new reorganization plan to reduce Lehua's valuation to 1.887 billion yuan. In February 2017, the reorganization announcement was terminated. In March 2018, Lehua Culture terminated its listing on the New Third Board.

Later, Lehua started the long -distance running of the A -share independent listing. In April 2018, China Merchants Securities submitted the basic form of the first public offering of shares and listing on Lehua Entertainment. In May, the listing counseling report disclosed by China Merchants Securities showed that China Merchants Securities had implemented the first phase of counseling work on Lehua Culture. In June 2021, Lehua Entertainment terminated IPO counseling.

Until this year's Dao Dao Hong Kong stocks, his listing dream finally was in his wish. From the perspective of the equity structure, as most entertainment companies, Lehua Entertainment shareholders are mainly Internet capital, pointing to several in -depth binding businesses. Du Huawei, the founder and chairman of the founder, holds 50.18%of the shares. Youku and Lehua have a lot of cooperation, such as the former Ace Variety IP "This!" In the "Hip -hop" series, Han Geng, Wang Yibo and other Lehua artists have long been guests.

The quantum jump of the wholly-owned subsidiary of the byte is 4.74%, and the cooperation with Lehua mainly exists in the exploration of the virtual idol women's group A-Soul. According to external speculation, Lehua's members provide trainees to act as "people in the middle", and bytes are mainly responsible for technical support.

The prospectus shows that according to the data of Ferris Santa, the total revenue of the top five artist management companies in China in 2020 was RMB 3.2 billion, accounting for about 6.1%of the total market share in the same year. The income of Lehua Entertainment Management business ranks first among all Chinese artist management companies, with a market share of about 1.5%.

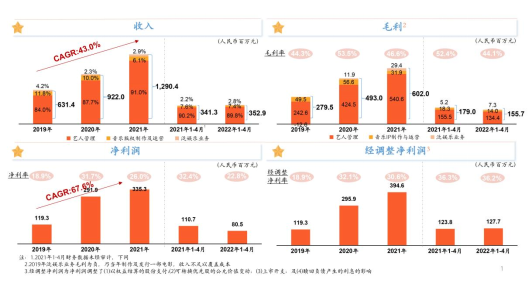

From 2019 to 2021, Lehua Entertainment's gross profit margin was 44.3%, 53.5%, and 46.6%, respectively, and net interest rates were 18.9%, 31.7%, and 26%, respectively. Its main business is artist management, music IP production and operation, and pan -entertainment business. Recently, Lehua Entertainment has 58 signed artists and 80 trainers participating in the training plan. The artist management business is Lehua Entertainment's revenue pillar. From 2019-2021, it brought 530 million yuan, 808 million yuan and 1.175 billion yuan in revenue, respectively. The total revenue accounted for 84%, 88%, and 91%, respectively.

The cost is mainly from the artist division. Among the top five suppliers, supplier B was the company's second largest supplier in 2019, and in 2020 and 2021 are the largest suppliers. During the reporting period, the company's purchasing amount from supplier B was 32.274 million yuan, 133 million yuan, and 302 million yuan, respectively, and the procurement accounted for 9.2%, 31.1%, and 43.9%, respectively.

In the past three years, the company's cumulative purchase amount to supplier B was 467 million yuan, and the dependence deepened. According to the period of business relationships and the degree of signing time, and the significant increase in procurement in 2020, and Wang Yibo and Wang Yibo were promoted to the top of the top of the "Chen Qing Order" in 2019, it is not difficult to infer that the supplier B is Wang Yibo.

In summary, 90 % of its income comes from the artist. The "one brother" Wang Yibo's whereabouts are essential for Lehua. Lehua Entertainment also reminded in risk disclosure, "Most of our income comes from artist management business. If we fail to maintain the relationship with artists and trainers or expand the number of artists and trainees signed by our contract, our business and finances, finance and finance The status and business performance may be affected by major adverseness. "Du Hua mentioned in an interview with Sina Finance that" most of the artists of Lehua's independent cultivation have been renewing the contract. " In the past few years, Lehua has caught up with the idol economy's air outlet, "Idol Trainee", "Creation 101" and other programs, and successfully created star NEXT, Wu Xuanyi, Meng Meiqi. To this day, the external environment has changed sharply. The draft show was suspended. The relevant departments reiterated the salary limit order, the impact of the epidemic, coupled with the frequent occurrence of the star collapse of the star, the regulatory red line tightened. For Lehua, it is necessary to prove that the model of the top flow can be copied, and the layout of upstream and downstream links such as film and television production, music production, and other industries must be further strengthened.

If the core artist leaves or encounters unexpected risks, the income has increased by 79.6%year-on-year A-Soul in the past year, and the "controllable, low-risk" virtual artist it represents is most likely to become the PLAN- B.

The wind of the Yuan universe is still blowing. After the landslide of Jiale's dormant house, the A-Soul continued to move in the form of a four-person combination, officially settled in the PICO platform, and recently ushered in the first virtual live broadcast VR night talk. Following A-Soul and "Quantum Boy", Lehua Entertainment launched its new virtual idol women's group "EOE group" on July 20, and opened the entire network on the Bilibili platform on July 24.

Bona, Lien Meng, and Lewa are listed. How does entertainment stocks prove long -term value after the "green light"?

In the past few years, Bona, Ling Meng, and Lehua have gone through bumps. Behind the entertainment industry, the entire entertainment industry has encountered the overall environment of "closed door closed" in front of the capital market.

Around 2017-2018, at the content level, a series of relevant provisions of the State Administration of Radio, Film and Television increased uncertainty. In addition, the CSRC issued the difficulty of increasing the IPO of re-financing supervision. After the tax storm, the film and television industry ushered in the cold winter. After being favored, capital has retreated. During the four years, entertainment companies have "difficulty in listing".

In 2017, only Hengdian Film and Television, Jinyi Film and Television and Zhongguangtian selected three film and television companies realized IPOs. In 2018, China Television Entertainment, Xinli Media, Happy Twist, and Lichen Guanglu collectively suspended the IPO. Jiaxing Media is delisted from the New Third Board. After entering the IPO preliminary examination in 2012 to 2017, Xinli Media's three IPOs ended in failure, and finally chose to be acquired by the Reading Group to save the country.

In April 2020, the Hong Kong Stock Exchange announced the opening of the three types of companies such as "different rights of the same stock". The national SME shares transfer system company and the Hong Kong Stock Exchange signed a memorandum of understanding of cooperation. A number of policies have brought good favors to film and television companies landing in Hong Kong stocks. In the past a year, Hong Kong stocks have ushered in a wave of entertainment companies to go to listing. On July 18, the film and television company submitted an application to the Hong Kong Stock Exchange for the second time. Liu Shishi and Wu Qilong's strawling shadow industry was officially listed in Hong Kong stocks in January 2021.

What needs to be aware is that Bona, Lien Meng, and Lehua are all head companies in the field. The door of the capital market is loose, which does not mean that every company can be listed smoothly. Many entertainment companies still Continue to be bumpy.

The music entertainment company behind the Luhan and Black Panther Band Feng Huaqiu Shi, submitted to the Hong Kong Stock Exchange's listing application for the fourth time in April this year. In February of this year, the official website of the Shenzhen Stock Exchange showed that the start of Chanxing Culture (Starry Sky Chinese) did not meet the issuance conditions, listing conditions and information disclosure requirements, and did not pass the review meeting. This company, which has produced "Good Voice of China", submitted a prospectus to the GEM of the Shenzhen Stock Exchange for the second time, and folded again.

According to the analysis of relevant sources, the performance volatility caused by relying on explosive models and dependence on large platforms is the fatal injury of film and television entertainment companies, and also for supervision. In the past few years, hot money has flowed in, the industry has expanded, and the sequelae brought by it have gradually appeared. The main manifestations are that the performance commitments cannot be fulfilled, or the performance of the promise period is "diving" and huge amount of goodwill impairment.

Successful IPO does not mean Happy Ending. "Breaking" is almost the norm of entertainment stocks. Today, the straw bears will collect 1.98 Hong Kong dollars/share, and the listing of the listing is over a year and a half. The stock price has fallen below the issue price of HK $ 5.88/share. After listing, the key issues that entertainment stocks need to face is how to cope with the inherent flaws such as high risk, high instability, and great performance fluctuations, and prove their long -term value to the market.

Judging from the release of the first half of the year's performance, "loss" is still the main theme of Huayi Brothers and Wanda Films and other film companies. TV drama companies that are not affected by offline epidemics have relatively stable performance, especially the straw bears that deeply bind iQiyi, and the Ningmeng Film Industry, which deeply binds Tencent Video, etc. Huanrui Century has achieved a profit.

The external situation is becoming more and more complicated, and it is difficult to continue to produce explosive models. The diversification of business and avoiding risks will inevitably become an inevitable choice for each entertainment company.

After listing, can Lehua support the valuation? It is obviously not enough to rely on a Wang Yibo.

- END -

Donggang District has a good tea -quality tea -the heart of the "Rizhao Green" together

After more than half a century of development, Rizhao Green Tea, which is known as one of the three coastal green tea in the world, has become the gold signboard that Rizhao is extremely important

2 companies in Shangcheng are selected as a provincial platform!

Recently, the Provincial Department of Economic and Information Technology announc...